If you've ever set your sights on a career at the pinnacle of global finance, the title "Vice President at JPMorgan Chase" likely represents a significant milestone. It’s a role that signifies expertise, responsibility, and, of course, substantial financial reward. But what does that reward actually look like? The query "VP in JP Morgan salary" is one of the most common searches for aspiring and current finance professionals, and for good reason. It’s a benchmark of success in a highly competitive industry. This guide goes beyond the simple numbers, offering a comprehensive, 360-degree view of what it means to be a VP at one of the world's most influential financial institutions.

The potential is immense. While the numbers fluctuate based on a dozen factors we will explore in detail, a Vice President at JPMorgan can expect a total compensation package that often ventures deep into the six-figure range, frequently exceeding $300,000 to $500,000 or more annually when including bonuses. But this role is about more than just the paycheck; it's about becoming a linchpin in the machinery of global capital. I once coached a young Associate who was on the cusp of a promotion to VP. He was laser-focused on the salary bump, but the moment he got the title, his entire perspective shifted. He told me, "It's not about doing the work anymore; it's about *owning* the work and guiding the team that does it. The responsibility is a different weight entirely." That anecdote perfectly captures the transition and why understanding this career path is so critical.

This article is your definitive roadmap. We will dissect every component of a VP's compensation, explore the factors that can maximize your earnings, and lay out a clear, actionable plan to help you navigate the journey to this prestigious role.

### Table of Contents

- [What Does a Vice President at JPMorgan Chase Actually Do?](#what-does-a-vp-at-jpmorgan-chase-actually-do)

- [Average VP in JP Morgan Salary: A Deep Dive](#average-vp-in-jp-morgan-salary-a-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-your-salary)

- [Job Outlook and Career Growth for a Finance VP](#job-outlook-and-career-growth-for-a-finance-vp)

- [How to Become a Vice President at JPMorgan](#how-to-become-a-vice-president-at-jpmorgan)

- [Is a VP Role at JPMorgan the Right Goal for You?](#is-a-vp-role-at-jpmorgan-the-right-goal-for-you)

What Does a Vice President at JPMorgan Chase Actually Do?

Before we talk numbers, it's crucial to understand that the title "Vice President" in an investment bank like JPMorgan is fundamentally different from a VP role in a standard corporation. It is not an executive-level position but a mid-senior rank in the banking hierarchy. It sits squarely between the junior execution roles (Analyst, Associate) and the senior client-facing, business-generating roles (Executive Director, Managing Director).

The typical investment banking ladder looks like this:

1. Analyst (Typically 2-3 years, post-undergraduate)

2. Associate (Typically 3-4 years, post-MBA or promotion from Analyst)

3. Vice President (VP) (Typically 3-4 years, promotion from Associate)

4. Executive Director (ED) / Senior Vice President (SVP)

5. Managing Director (MD)

A VP is the engine of the deal team. They have moved beyond the pure number-crunching of an Analyst and the model-checking of an Associate. The VP's primary function is to manage the day-to-day execution of projects and transactions while starting to develop client relationships.

Core Responsibilities Include:

- Project Management: A VP is the primary manager of a deal's lifecycle. They coordinate the work of Analysts and Associates, ensuring financial models are accurate, marketing materials (like pitchbooks and Confidential Information Memorandums) are flawless, and due diligence processes are running smoothly.

- Mentorship and Team Leadership: They are the first line of management for junior bankers. They train Associates and Analysts, delegate tasks, review their work, and are responsible for their professional development on a deal-by-deal basis.

- Client Interaction: While senior bankers (EDs and MDs) own the primary client relationship, the VP is often the main point of contact for day-to-day communications. They handle client queries, present analytical findings, and build the trust necessary for a smooth transaction.

- Strategic Contribution: VPs are expected to think more critically and strategically than their junior counterparts. They contribute to the structuring of deals, identify potential issues, and help craft the narrative that will be presented to clients and potential buyers or investors.

### A "Day in the Life" of a JPMorgan Investment Banking VP

To make this tangible, let's walk through a hypothetical day for a VP in the Mergers & Acquisitions (M&A) group.

- 7:30 AM: Arrive at the office (or log on from home). Scan overnight emails from clients in different time zones and review the work an Analyst submitted late last night—a revised valuation model for a potential acquisition target.

- 8:30 AM: Team huddle with the Managing Director, an Associate, and two Analysts on the "Project Alpha" deal. The MD gives high-level direction based on a conversation with the client CEO. The VP translates this into a concrete to-do list, assigning the Associate to oversee updates to the pitchbook and an Analyst to run new sensitivity analyses on the model.

- 10:00 AM: Conference call with the client's CFO and corporate development team. The VP walks them through the updated valuation analysis, confidently answering detailed questions about the underlying assumptions.

- 12:00 PM: Quick lunch at their desk while reviewing a due diligence checklist provided by the legal team. They identify several open items and email the Associate with instructions on how to chase down the necessary information from the client.

- 2:00 PM: Spend two hours reviewing and marking up a 100-page pitchbook the junior team has prepared. The VP's focus is not just on typos but on the story. Does the strategic rationale flow logically? Are the graphs clear and compelling? They provide extensive comments for revision.

- 4:30 PM: A different deal, "Project Beta," is heating up. The VP joins a call with potential buyers, taking careful notes on their questions, which signal their key areas of concern and interest.

- 6:00 PM: The junior team for Project Alpha has sent back the revised pitchbook. The VP does a final review before sending it to the MD for approval.

- 7:30 PM: Formal meeting with an Associate to provide feedback on their performance over the past quarter, discussing strengths and areas for development. This mentorship is a key part of the VP role.

- 8:30 PM: Plan out the next day's priorities. Check in with the deal teams one last time before heading home, knowing they will likely still be working for several more hours.

This snapshot reveals a role defined by management, communication, and quality control. The VP is the crucial link ensuring the MD's vision is executed flawlessly by the junior team.

Average VP in JP Morgan Salary: A Deep Dive

This is the central question, and the answer is multifaceted. A VP's compensation at JPMorgan, like at all major investment banks, is not a single number but a package composed primarily of two parts: a base salary and an annual performance-based bonus. The total compensation is what truly matters.

It's important to approach this data with the understanding that it is dynamic and highly dependent on market conditions, firm performance, and individual contributions. The figures provided here are based on an aggregation of self-reported data from industry sources and should be considered representative estimates.

Authoritative Data Sources: For the most up-to-date figures, it's always best to consult real-time data from reputable salary aggregators. As of late 2023 and early 2024 reports from platforms like Glassdoor, Payscale, and Wall Street Oasis provide a strong consensus. For instance, Glassdoor data frequently shows the total compensation for a JPMorgan VP in New York ranging from $350,000 to over $550,000.

### Breakdown of Compensation Components

#### 1. Base Salary

The base salary is the fixed, predictable portion of the compensation. It is paid bi-weekly or monthly and is determined by rank, experience level within the rank (e.g., a first-year VP vs. a third-year VP), and location.

- For a first-year VP (VP1) at JPMorgan in a major financial hub like New York or London, the base salary typically starts at around $250,000 to $275,000.

- This base salary sees modest increases each year within the VP band. A third-year VP (VP3) might have a base salary closer to $275,000 - $325,000.

#### 2. Performance Bonus (The "Stub")

The bonus is the variable—and most significant—portion of a VP's earnings. It is paid out once a year (typically in January or February) and is highly dependent on a combination of factors:

- Firm Performance: The overall profitability of JPMorgan Chase.

- Group Performance: The success of the specific division and team (e.g., TMT M&A, Healthcare, Leveraged Finance).

- Individual Performance: The VP's personal contribution, deal flow, client feedback, and ratings from superiors and subordinates.

The bonus is where performance is truly rewarded. It can range dramatically, from 50% to over 150% of the base salary.

- In a mediocre year, a VP might receive a bonus of $150,000 - $200,000.

- In a strong year, that bonus could easily be $300,000 - $400,000+.

This variability is a core feature of investment banking compensation. It incentivizes high performance and aligns the employee's success with the firm's success.

### Total Compensation: The Full Picture

When you combine base and bonus, the total compensation paints a clearer picture.

JPMorgan VP Salary Brackets by Experience (Annual Total Compensation Estimate)

| Experience Level | Typical Time at Firm | Base Salary Range (Approx.) | Bonus Range (Approx.) | Total Compensation Range (Approx.) |

| :--- | :--- | :--- | :--- | :--- |

| First-Year VP | 6-7 years | $250,000 - $275,000 | $150,000 - $250,000 | $400,000 - $525,000 |

| Mid-Level VP | 7-8 years | $275,000 - $300,000 | $200,000 - $350,000 | $475,000 - $650,000 |

| Senior VP (pre-ED) | 8-10+ years | $300,000 - $325,000+ | $250,000 - $400,000+ | $550,000 - $725,000+ |

*Source: Aggregated data from Wall Street Oasis, Glassdoor, and industry reports (2023/2024). Figures are illustrative for front-office investment banking roles in New York City and can vary significantly.*

### 3. Other Benefits and Long-Term Incentives

Beyond base and bonus, the compensation package includes other valuable elements:

- Retirement Savings: A robust 401(k) plan with a generous company match. JPMorgan is known for having a strong matching program, which can add tens of thousands of dollars to an employee's retirement account annually.

- Health and Wellness Benefits: Top-tier health, dental, and vision insurance. Many programs also include wellness stipends, mental health support (EAP), and subsidized gym memberships.

- Deferred Compensation and Stock Awards: A portion of a high-performer's bonus may be paid in restricted stock units (RSUs) or other forms of deferred compensation. This serves as a "golden handcuff," incentivizing the VP to stay with the firm for the vesting period (typically 3-4 years). While not immediate cash, it is a critical component of long-term wealth building.

- Signing Bonus: For VPs hired laterally from another firm, a significant signing bonus (often $50,000+) is common to compensate for the forfeiture of their previous firm's year-end bonus.

In summary, the "VP in JP Morgan salary" is not just a salary; it's a comprehensive and highly lucrative compensation structure designed to attract, retain, and motivate top talent in a demanding field. The total package, especially in a good year, places these professionals firmly in the top echelon of earners globally.

Key Factors That Influence Your Salary

While the figures above provide a solid baseline, a VP's actual take-home pay can swing wildly based on several key variables. As a career analyst, this is where I urge professionals to focus their attention. Understanding and strategically navigating these factors is the difference between an average and a top-tier compensation package.

###

1. Division and Area of Specialization

Not all VPs at JPMorgan are created equal. The firm is a massive, diversified financial institution with distinct business lines. Compensation varies significantly depending on where you sit.

- The Gold Standard: Corporate & Investment Bank (CIB): This is the division most people think of when they hear "JPMorgan." VPs in front-office roles within the CIB command the highest salaries.

- Mergers & Acquisitions (M&A) and Industry Coverage Groups (e.g., Technology, Media & Telecom, Healthcare, Financial Institutions Group): These are traditionally the most lucrative. They are directly tied to revenue-generating transactions. A VP here is at the top of the pay scale.

- Capital Markets (ECM/DCM) and Leveraged Finance: These roles, focused on raising equity, debt, and financing for clients, are also highly compensated, sitting just alongside M&A.

- Strong Contenders: Asset & Wealth Management (AWM): VPs in this division, particularly in roles like portfolio management for the ultra-high-net-worth Private Bank or in strategic investment groups, also have very high earning potential, though bonuses might be slightly less volatile (and sometimes smaller) than in IBD.

- Corporate and Support Roles: A VP title also exists in functions like Technology, Marketing, Human Resources, Risk, and Compliance. While these are critical roles and pay very well compared to similar roles in other industries, their compensation structure is different. A VP in Technology, for instance, might have a base salary of $180,000 - $220,000 with a bonus of 20-40%, leading to a total compensation that is significantly lower than their investment banking counterparts. They are on a different pay scale entirely.

Key Takeaway: The closer your role is to the firm's direct revenue generation, the higher your variable compensation will be.

###

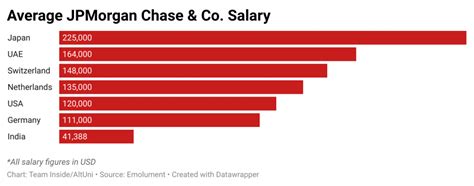

2. Geographic Location

Where you work matters immensely due to cost of living adjustments and the concentration of deal flow.

- Tier 1: New York City: As the firm's headquarters and the center of the financial universe, NYC commands the highest salaries. The figures cited in this article primarily reflect the New York market.

- Tier 1.5: London and Hong Kong: These major international financial hubs have compensation structures that are very similar to New York, though currency fluctuations and local tax laws can affect net pay.

- Tier 2: Major U.S. Hubs (San Francisco, Chicago, Boston): Salaries in these cities are still very strong but may be slightly discounted (perhaps 5-10%) from New York levels. San Francisco, with its focus on the tech industry, can sometimes rival NYC for top talent.

- Tier 3: Regional Hubs (Houston, Charlotte, Salt Lake City): JPMorgan has significant operations in these "middle-office" or regional hubs. A VP in Salt Lake City or Charlotte will earn an excellent living but will see a noticeable difference in both base and bonus compared to their New York colleagues. The base might be 15-25% lower, and the bonus potential will be scaled down accordingly. However, the lower cost of living can make these roles financially attractive on a relative basis.

Salary.com provides excellent tools for comparing salary data by location, and a quick search for "Financial Manager" salaries across these cities will confirm this tiered structure, even for roles outside of banking.

###

3. Level of Education

In investment banking, educational pedigree plays a significant role, particularly in gaining entry and accelerating your early career. By the VP level, performance is a much stronger driver, but your educational background still has an impact.

- MBA from a Top-Tier School (M7/T15): The traditional path to becoming an Associate (and subsequently a VP) is by attending a top MBA program like Harvard, Stanford, Wharton, Booth, or Columbia. Banks recruit heavily from these schools and often pay a premium. An MBA graduate who enters as an Associate has a clear, structured path to VP. Their network and the "stamp of approval" from their school can be invaluable.

- Undergraduate from a "Target School": A high-performing individual who joined as an Analyst directly from an elite undergraduate institution (e.g., an Ivy League school, MIT, Duke) and was promoted internally ("A-to-A") is on equal footing. They have the advantage of more years at the firm.

- Non-Target School / Other Advanced Degrees: It is certainly possible to reach the VP level from a non-target school or with other degrees (e.g., a PhD in a quantitative field for a "quant" role), but it often requires more aggressive networking, exceptional performance, or a lateral move.

- Certifications (CFA): The Chartered Financial Analyst (CFA) designation is highly respected, particularly in Asset Management and Equity Research. While it won't automatically lead to a higher salary at the VP level in M&A, it deepens expertise and can be a differentiator, especially for those without a traditional finance background. It signals a serious commitment to the profession.

###

4. Years of Experience and Performance

This is the most direct driver of salary growth within the VP band.

- VP1 vs. VP3: As illustrated in the table above, there is a clear and defined progression. A first-year VP is learning the role, while a third-year VP is expected to be operating with a high degree of autonomy and is on the cusp of being considered for promotion to Executive Director. This mastery is reflected in both base and bonus.

- Performance Buckets: At year-end, VPs are ranked against their peers. They are placed in "buckets"—top-tier, mid-tier, and bottom-tier. This ranking is the single most important determinant of their bonus. A top-bucket VP can earn a bonus that is 2x or more than a bottom-bucket peer, even if they have the same base salary and years of experience. This "eat what you kill" aspect of the culture is a powerful motivator.

###

5. In-Demand Skills

The modern financial world is evolving, and VPs who possess a blend of traditional and modern skills are compensated at a premium.

- Technical Proficiency: Flawless mastery of Excel (financial modeling, valuation) and PowerPoint (pitchbook creation) is table stakes. It's assumed.

- Sector Expertise: Developing a deep specialization in a high-growth sector like Technology (SaaS, FinTech, AI), Healthcare (Biotech, MedTech), or Renewable Energy makes a VP incredibly valuable. They can speak the language of the clients and provide more insightful advice.

- Data Science and Programming: While not a requirement for most IBD VPs, skills in Python, SQL, or data visualization tools like Tableau are becoming increasingly valuable. They allow for more sophisticated analysis of large datasets, which can provide a competitive edge in due diligence or market analysis. VPs in more quantitative or strategy roles who have these skills can command a premium.

- Client Relationship and Communication Skills: This is a soft skill with a hard impact on salary. A VP who can confidently lead a client meeting, de-escalate a tense situation, and articulate complex ideas simply is indispensable. As you move up, these skills become more important than technical abilities and are what get you promoted to ED and MD.

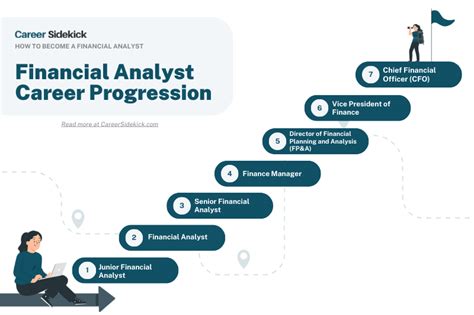

Job Outlook and Career Growth for a Finance VP

Attaining the VP title is a milestone, not a final destination. The role serves as a critical springboard for a long and lucrative career, both within and outside of JPMorgan. Understanding the future trajectory is key to long-term planning.

### Job Growth Projections

While the U.S. Bureau of Labor Statistics (BLS) doesn't track "Investment Banking VP" as a specific category, we can look at a closely related proxy: Financial Managers. The BLS projects that employment for financial managers will grow by 16 percent from 2022 to 2032, a rate that is much faster than the average for all occupations.

According to the BLS's Occupational Outlook Handbook, this robust growth is driven by several factors:

- The increasing complexity of the global financial landscape.

- A growing need for expert financial analysis to guide business decisions.

- The continued importance of cash management and risk analysis.

While this data applies broadly, the implications for elite institutions like JPMorgan are clear: the demand for highly skilled financial professionals who can navigate this complexity remains exceptionally high. However, the field is also cyclical. Hiring and bonuses are heavily tied to the health of the economy and capital markets. A recession may lead to hiring freezes and lower bonuses, while a bull market will fuel expansion and record-breaking compensation.

### The Path Forward: Promotion and Exit Opportunities

A VP at JPMorgan stands at a career crossroads with several attractive paths forward.

1. The Path to Managing Director (MD):

The primary goal for many VPs is to continue climbing the internal ladder. The next step is Executive Director (ED), a role that involves more client ownership and business generation. After a successful tenure as an ED, the ultimate prize is Managing Director (MD). An MD is a senior leader responsible for originating deals, managing major client relationships, and driving the group's revenue. The compensation for an MD is astronomical, often reaching well into the seven figures annually. This path requires not only exceptional technical and managerial skills but also a proven ability to bring in business.

2. Exit to Corporate Development:

One of the most common and prestigious exit opportunities is moving to a corporate development role at a major company (often a former client). In this role, the former VP uses their M&A expertise to help the company execute its own acquisitions, divestitures, and strategic investments. The work-life balance is significantly better, and while the cash compensation may be lower initially, it often includes substantial equity, providing a different kind of long-term upside.

3. The Move to the "Buy-Side": Private Equity and Hedge Funds:

This is often considered the holy grail of exit opportunities.

- Private Equity (PE): PE firms hire investment bankers for their rigorous valuation and deal execution skills. A VP from JPMorgan is a prime candidate for a Senior Associate or VP role at a PE fund. The work is even more demanding, but the long-term compensation potential, through a mechanism known as "carried interest," can dwarf even Managing Director pay over a full fund cycle.

- Hedge Funds: For VPs with a passion for public markets and deep analytical skills, moving to a hedge fund as a senior analyst or portfolio manager is a popular path. This career is focused on investment theses and generating returns, requiring a different but equally intense skillset.

4. Entrepreneurship and Startups:

The rigorous training, financial acumen, and network gained as a VP provide an excellent foundation for starting a business or joining a late-stage startup as a CFO or Head of Strategy. The ability to model financials, raise capital, and think strategically is directly transferable.

### Staying Relevant: Future-Proofing Your Career

To succeed and advance in the coming decade, a VP must be forward-thinking:

- Embrace Technology: Don't just delegate the tech work. Understand how AI, machine learning, and data analytics are changing the landscape of financial analysis. Be the VP who can speak intelligently about using AI to identify M&A targets or automate due diligence.

- Cultivate a Niche: Become the go-to expert in a specific sub-sector, whether it's vertical SaaS, gene therapy, or battery technology. Deep domain knowledge is a powerful differentiator.

- Focus on ESG: Environmental, Social, and Governance (ESG) factors are no longer a sideshow. They are integral to investment decisions and corporate strategy. Understanding how to advise clients on ESG issues and structure sustainable finance deals is a critical future skill.

- Build Your Network Relentlessly: Your career progression beyond VP will depend more on your relationships than your spreadsheet skills. Consistently nurture connections with clients, colleagues, and alumni.

The job outlook for a talented VP is exceptionally bright, but it requires continuous adaptation and a strategic approach to career management.

How to Become a Vice President at JPMorgan

The path to becoming a VP at a firm like JPMorgan is a marathon, not a sprint. It's a structured and intensely competitive journey that typically begins years before you even apply for your first job in finance. Here is a step-by-step guide for aspiring professionals.

Step 1: Build an Elite Educational Foundation (High School & University)

- Excel Academically: The process starts in high school. Achieving top grades, high standardized test scores (SAT/ACT), and a strong extracurricular profile are necessary to gain admission into a "target" or "semi-target" university.

- Choose a Target University: Banks like JPMorgan disproportionately recruit from a select group of universities known for their strong business, economics, and STEM programs. These include Ivy League schools (Harvard, Princeton, UPenn/Wharton), other top private schools (Stanford, MIT, Duke, UChicago), and strong public universities (UVA, Michigan, UC Berkeley).

- Select a Relevant Major: While banks are increasingly open to diverse majors, the most common paths are through Finance, Economics, Accounting, or a highly quantitative field like Mathematics, Engineering, or Computer Science. A high GPA (3.7+) is essential.

Step 2: The Pre-Career Gauntlet (University Years)

- Land a Prestigious Internship: The single most important step toward a full-time Analyst role is securing a "sophomore" and, critically, a "junior" summer internship at an investment bank or other top-tier financial firm. The junior year internship is effectively a 10-week interview for a full-time job offer.

- Network Aggressively: Your resume alone won't be enough. Attend information sessions, connect with alumni on LinkedIn who work at JPMorgan, and conduct informational interviews. You need advocates inside the firm before you even apply.

- Master the Technicals: You must master the fundamentals of accounting, financial modeling (DCF, LBO, comparable company analysis), and valuation before your interviews. Resources like Wall Street Prep, Breaking into Wall Street, and the Wall Street Oasis technical guides are indispensable.

Step 3: The Analyst and Associate Years (The Grind)

This is the most common route to VP.

- Path A: The Analyst to VP Track:

1. Secure an Analyst Offer: Perform exceptionally well in your junior internship to receive a full-time offer to join JPMorgan's Analyst program after graduation.

2. Survive and Thrive as an Analyst (2-3 years): This involves long hours, intense pressure, and a steep learning curve. The goal is to be