Introduction

Have you ever received a job offer that felt like the best of both worlds? It promises the stability and predictability of a set annual salary, but also mentions that you'll be paid for any extra hours you put in. If so, you’ve likely encountered the "salaried non-exempt" classification. This unique and often misunderstood category is a cornerstone of the American workforce, yet it frequently leaves both new and experienced professionals scratching their heads. What does it actually mean for your paycheck, your work-life balance, and your long-term career trajectory?

This guide is designed to be your definitive resource, demystifying the salaried non-exempt role from every angle. While not a specific job title itself, this classification impacts millions of Americans in vital roles across every industry, from IT support specialists and paralegals to administrative coordinators and creative professionals. The compensation for these roles is competitive, with national averages for common non-exempt positions often falling between $45,000 and $75,000 per year, with significant potential for higher earnings through overtime and specialization.

As a career analyst, I once worked with a talented graphic designer who was thrilled to land her first "real" salaried job at a bustling agency. She was confused when her offer letter included details about time tracking and overtime pay. "I thought being salaried meant I just get paid the same no matter what?" she asked. Clarifying this for her was a lightbulb moment, empowering her to understand her true earning potential and protect her rights. This common confusion is precisely why a deep understanding of this classification is not just helpful—it’s critical for smart career management.

This article will serve as your comprehensive roadmap. We will dissect the legal framework, explore detailed salary data, analyze the factors that boost your earning potential, and chart a course for career growth. Whether you are considering an offer, currently in a salaried non-exempt position, or an employer aiming to classify your team correctly, this guide provides the expert insights you need.

### Table of Contents

- [What Does Being Salaried Non-Exempt Mean?](#what-does-being-salaried-non-exempt-mean)

- [Understanding Salaried Non-Exempt Compensation: A Deep Dive](#understanding-salaried-non-exempt-compensation-a-deep-dive)

- [Key Factors That Influence Salary in Non-Exempt Roles](#key-factors-that-influence-salary-in-non-exempt-roles)

- [Job Outlook and Career Growth from Non-Exempt Positions](#job-outlook-and-career-growth-from-non-exempt-positions)

- [How to Navigate and Thrive in a Salaried Non-Exempt Role](#how-to-navigate-and-thrive-in-a-salaried-non-exempt-role)

- [Conclusion: Your Launchpad for Professional Success](#conclusion-your-launchpad-for-professional-success)

---

What Does Being Salaried Non-Exempt Mean? Roles & Responsibilities

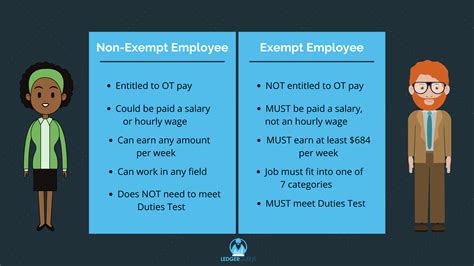

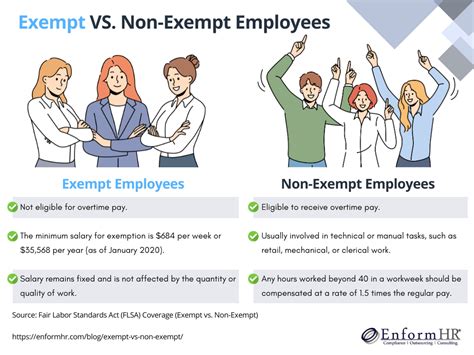

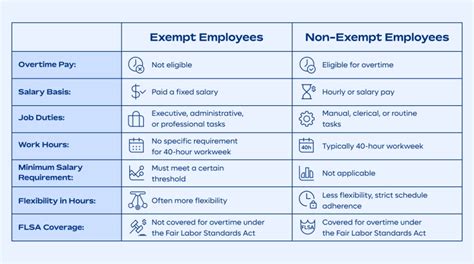

At its core, "salaried non-exempt" is not a job description but a legal classification under the Fair Labor Standards Act (FLSA), the federal law that establishes minimum wage, overtime pay, recordkeeping, and youth employment standards. To truly grasp what it means, we must first break down the two parts of the term: "salaried" and "non-exempt."

- Salaried: This refers to your basis of pay. Instead of being paid an hourly wage, you are paid a fixed, predetermined amount of money each pay period (e.g., weekly, bi-weekly). This amount constitutes your base pay for a standard workweek, which is typically 40 hours. This provides predictable and stable income, unlike hourly work where your paycheck can fluctuate significantly based on shifts.

- Non-Exempt: This is the crucial part that determines your eligibility for overtime. The FLSA mandates that "non-exempt" employees must be paid overtime for any hours worked beyond 40 in a workweek. The overtime rate is legally required to be at least one and a half times their "regular rate of pay." Being "exempt," by contrast, means an employee is *exempt* from these overtime requirements, typically because their job duties and salary level meet specific criteria (often managerial, professional, or administrative roles).

Therefore, a salaried non-exempt employee is a hybrid: they enjoy the stability of a fixed salary but are also legally entitled to, and must be paid for, all overtime hours they work. This classification is designed to protect workers whose job duties don't meet the specific tests for exemption, ensuring they are fairly compensated for all their time.

### Daily Tasks and Responsibilities

Since this isn't a single job, the daily tasks vary immensely. This classification can apply to an incredibly diverse range of professions. Common examples of roles often classified as salaried non-exempt include:

- Administrative and Executive Assistants: Managing calendars, coordinating meetings, preparing reports, and handling correspondence.

- Paralegals and Legal Assistants: Conducting legal research, drafting documents, organizing case files, and assisting attorneys.

- IT Support Specialists / Help Desk Technicians: Troubleshooting hardware and software issues, installing new systems, and providing technical assistance to colleagues.

- Junior Accountants or Bookkeepers: Processing invoices, reconciling accounts, preparing financial statements, and managing payroll.

- Customer Service Supervisors: Managing a team of representatives, handling escalated customer issues, and reporting on team performance.

- Inside Sales Representatives: Generating leads, qualifying prospects, and closing deals over the phone or email, often without the "outside sales" exemption.

- Lab Technicians: Running tests, recording data, maintaining lab equipment, and preparing samples.

The common thread is that the primary duties of these roles typically do not involve the level of independent judgment, discretion, or managerial authority required to be classified as exempt.

### A "Week in the Life" of a Salaried Non-Exempt Employee

To make this concrete, let's imagine a week in the life of "Maria," a Salaried Non-Exempt Communications Coordinator at a mid-sized tech company.

- Her Offer: Maria's annual salary is $52,000. Her workweek is Monday to Friday.

- Monday-Wednesday (24 hours worked): Maria has a standard week. She drafts social media posts, writes a draft for the internal newsletter, coordinates with the design team for a new product brochure, and attends team meetings. She logs her 8 hours each day in the company's timekeeping software.

- Thursday (11 hours worked): A major press release needs to go out by the end of the day. Unexpectedly, the legal team requests significant last-minute changes. Maria stays late to incorporate the edits, liaise with management for final approval, and schedule the wire distribution. She diligently tracks her extra 3 hours.

- Friday (9 hours worked): Following the press release, Maria spends the morning tracking media pickups and responding to journalist inquiries. The product brochure she was working on also has an urgent deadline, requiring an extra hour to finalize with the printers before the weekend.

- Total Week: Maria worked a total of 44 hours (40 regular hours + 4 overtime hours).

How is her pay calculated for this week?

1. Weekly Salary: $52,000 / 52 weeks = $1,000 per week.

2. Regular Rate of Pay: $1,000 / 40 hours = $25 per hour.

3. Overtime Rate: $25 x 1.5 = $37.50 per hour.

4. Overtime Pay: 4 overtime hours x $37.50 = $150.

5. Total Paycheck for the Week: $1,000 (base) + $150 (overtime) = $1,150.

This example powerfully illustrates the benefit of the classification: Maria gets the security of her $1,000 weekly base pay, but she is also fairly compensated for the extra work required to meet business deadlines.

---

Understanding Salaried Non-Exempt Compensation: A Deep Dive

Because "salaried non-exempt" applies to a wide array of jobs, there isn't a single national average salary. Instead, we must analyze the compensation for the *types* of roles that commonly fall under this classification. The pay for these positions is influenced by all the standard factors—experience, location, industry, and skill—but is uniquely augmented by the potential for significant overtime earnings.

### National Salary Averages for Common Non-Exempt Positions

To provide a clear picture, we've compiled data from the U.S. Bureau of Labor Statistics (BLS), Salary.com, and Glassdoor for several representative non-exempt professions. All data is as of late 2023/early 2024 to ensure accuracy.

- Administrative Assistants: The BLS reports a median annual wage of $45,760 as of May 2022. Salary.com shows a range typically falling between $43,264 and $54,345. Overtime in this role is common during peak periods like event planning or year-end reporting.

- Paralegals and Legal Assistants: The BLS states the median annual wage for this group was $59,200 in May 2022. Payscale.com indicates a typical range from $41,000 to $76,000, with top earners in specialized fields exceeding this. Overtime is a significant income component, especially when preparing for trial or major case filings.

- Computer User Support Specialists (IT Support): According to the BLS, the median annual wage was $59,660 in May 2022. Glassdoor reports a national average base pay around $55,200, with significant variation based on technical specialty. On-call duties and after-hours system upgrades can lead to substantial overtime.

- Bookkeeping, Accounting, and Auditing Clerks: The BLS cites a median annual wage of $47,440 in May 2022. Professionals in this role often work extensive overtime during tax season or quarterly/annual financial closes, which can dramatically increase their take-home pay.

It's crucial to remember that these figures represent *base salaries*. The true annual earnings for a salaried non-exempt employee can be 10-25% higher, or even more, depending on the frequency of overtime work.

### Salary Brackets by Experience Level

As with any profession, experience is a primary driver of base salary growth. An entry-level employee learns the ropes, while a senior non-exempt professional often acts as a subject-matter expert and mentor, justifying higher compensation even before overtime is considered.

| Job Title | Entry-Level (0-2 Years) | Mid-Career (3-8 Years) | Senior-Level (9+ Years) | Data Source(s) |

| :--- | :--- | :--- | :--- | :--- |

| Paralegal | $40,000 - $52,000 | $53,000 - $68,000 | $69,000 - $85,000+ | Payscale, BLS |

| IT Support Specialist | $42,000 - $55,000 | $56,000 - $72,000 | $73,000 - $90,000+ | Glassdoor, BLS |

| Executive Assistant | $48,000 - $60,000 | $61,000 - $80,000 | $81,000 - $110,000+ | Salary.com |

| Office Manager | $45,000 - $58,000 | $59,000 - $75,000 | $76,000 - $95,000+ | Payscale, Glassdoor |

*Note: These ranges represent typical base salaries and can be significantly higher in high-cost-of-living areas.*

### Breakdown of Compensation Components

The total compensation package for a salaried non-exempt employee is more than just their base salary and overtime. A competitive offer will include a variety of financial and non-financial benefits.

1. Base Salary: The fixed, guaranteed annual pay for a 40-hour workweek. This is the foundation of your compensation.

2. Overtime Pay: The most significant variable. It is calculated based on your "regular rate of pay." For a salaried non-exempt employee, this rate is typically determined by dividing your weekly salary by 40 hours. Any hours worked over 40 in a workweek must be paid at 1.5 times this rate. Some companies may offer double-time (2x the regular rate) for holidays or excessive hours, though this is not federally required.

3. Bonuses: Many salaried non-exempt employees are eligible for performance-based bonuses. These can be:

- Discretionary Bonuses: Given at the company's discretion for exceptional work or a successful year.

- Non-Discretionary Bonuses: Tied to specific, pre-set metrics (e.g., a bonus for achieving a certain customer satisfaction score or meeting a production target). Crucially, under FLSA rules, non-discretionary bonuses must be included in the calculation of the "regular rate of pay" for overtime purposes during the bonus period, which can retroactively increase the amount of overtime pay owed.

4. Profit Sharing: Some companies offer a profit-sharing plan, where a portion of the company's profits is distributed among employees. This is typically paid out annually or quarterly.

5. Health and Wellness Benefits: This is a major part of total compensation. It includes medical, dental, and vision insurance. Many employers also offer wellness stipends (e.g., for gym memberships), mental health support through Employee Assistance Programs (EAPs), and flexible spending accounts (FSAs) or health savings accounts (HSAs).

6. Retirement Savings: The 401(k) or 403(b) plan is standard. The key value here is the employer match. A common matching formula is 100% of your contribution up to the first 3-6% of your salary. This is essentially free money and a critical component of long-term wealth building.

7. Paid Time Off (PTO): This includes vacation days, sick leave, and personal days. The amount of PTO typically increases with seniority.

8. Other Perks: These can include tuition reimbursement, professional development stipends, commuter benefits, and stock options or grants (more common in tech companies and startups).

When evaluating a job offer for a salaried non-exempt role, it's vital to look beyond the base salary and consider the entire compensation package. The value of robust benefits and the potential for overtime earnings can make a seemingly lower base salary far more lucrative than a higher one with poor benefits and no overtime pay.

---

Key Factors That Influence Salary in Non-Exempt Roles

The salary ranges for non-exempt positions are wide for a reason. Numerous factors converge to determine the specific base salary an individual can command. Understanding these levers is essential for negotiating a better offer and strategically planning your career to maximize your income. This section provides a granular analysis of the most influential factors.

###

Level of Education

While many non-exempt roles are accessible with a high school diploma or an associate's degree, higher education consistently correlates with higher starting salaries and a steeper long-term earnings trajectory.

- High School Diploma vs. Associate's Degree: For a role like an Administrative Assistant, an individual with an Associate's degree in Business Administration may start at a salary that is 5-10% higher than someone with only a high school diploma. The degree signals a foundational knowledge of business principles, communication, and software proficiency.

- Bachelor's Degree: A bachelor's degree is often a prerequisite for more specialized and higher-paying non-exempt roles. For example, a Paralegal position at a top corporate law firm will almost certainly require a bachelor's degree, often in a related field like political science or history, in addition to a paralegal certificate. Similarly, an IT Support Specialist with a Bachelor's in Information Systems will command a significantly higher salary than one without, as they possess a deeper understanding of network architecture, security principles, and database management. According to the BLS, workers with a bachelor's degree have median weekly earnings that are over 60% higher than those with only a high school diploma.

- Certifications and Specialized Training: In the non-exempt world, targeted certifications can be as valuable, if not more so, than a general degree.

- For IT: Certifications like CompTIA A+, Network+, Security+, or Cisco's CCNA can directly lead to a salary increase of $5,000-$15,000.

- For Paralegals: An ABA-approved Paralegal Certificate is the industry gold standard and a gateway to higher-paying jobs.

- For Administrative Professionals: Becoming a Certified Administrative Professional (CAP) can enhance credibility and earning potential.

- For Bookkeepers: Becoming a Certified Bookkeeper (CB) demonstrates a high level of professional competence.

###

Years of Experience

Experience is arguably the single most powerful determinant of salary within a given role. Employers pay for proven expertise, efficiency, and the ability to handle complexity with minimal supervision. The salary growth trajectory reflects this reality.

- Entry-Level (0-2 years): At this stage, employees are learning the company's systems, policies, and the core functions of their job. The focus is on execution and reliability. For an IT help desk role, this means resolving basic tickets and escalating complex issues. A starting salary might be $45,000.

- Mid-Career (3-8 years): The professional is now fully proficient. They work independently, can troubleshoot complex problems, and may begin to mentor junior colleagues. They understand the nuances of the business and can anticipate needs. That IT professional may now be a Tier 2 Support Specialist, handling more advanced issues and earning $65,000. They are trusted to work on small projects independently.

- Senior-Level (9+ years): A senior non-exempt professional is often a subject-matter expert. They may not have formal management duties (which would make them exempt), but they are the go-to person for the most challenging tasks. They might be responsible for training new hires, improving departmental processes, or managing relationships with key vendors. Our senior IT specialist might now be an IT Support Lead or a specialist in a specific system (e.g., Salesforce administration), earning $85,000 or more in base salary, plus overtime for major system rollouts.

###

Geographic Location

Where you work has a dramatic impact on your salary, primarily due to vast differences in the cost of living and the demand for labor in local markets. A salary that feels like a fortune in one city might barely cover rent in another.

Companies use regional salary data to adjust their pay scales. Here's a comparative example for an Executive Assistant role, based on data from Salary.com:

| Metro Area | Average Base Salary Range | Notes on the Market |

| :--- | :--- | :--- |

| New York, NY | $75,000 - $115,000 | Extremely high cost of living and high demand from finance, media, and tech sectors drive salaries up. |

| San Francisco, CA | $80,000 - $120,000+ | The tech industry's hub, with the highest cost of living in the U.S., resulting in top-tier salaries for support roles. |

| Chicago, IL | $65,000 - $95,000 | A major business hub with a lower cost of living than the coasts, offering strong salaries. |

| Austin, TX | $60,000 - $90,000 | A rapidly growing tech and business center with rising salaries to attract talent. |

| Kansas City, MO | $55,000 - $80,000 | A more affordable metropolitan area, with salaries reflecting the lower cost of living but still offering solid wages. |

Key Takeaway: High-paying non-exempt jobs are concentrated in major metropolitan areas with strong economic engines (e.g., NYC, SF, Boston, DC, LA). However, the rise of remote work is beginning to change this dynamic. Some companies now pay a national rate regardless of location, while others are developing sophisticated "geo-based" pay models that adjust salary based on an employee's specific location.

###

Company Type & Size

The type and size of your employer create different environments with distinct compensation philosophies.

- Startups: Cash-strapped startups often offer lower base salaries for non-exempt roles. To compensate, they might offer equity (stock options), a more relaxed culture, and the opportunity to wear many hats and learn quickly. An Office Manager at a 15-person startup might earn $55,000 but also receive stock options that could be valuable if the company succeeds.

- Large Corporations (Fortune 500): These companies have structured, well-defined compensation bands. They typically offer higher base salaries, excellent benefits (robust health insurance, generous 401k match), and performance bonuses. The work environment is more formal and roles are more specialized. A Paralegal at a Fortune 500 legal department could earn a base salary of $75,000 with a 10% target bonus and a 6% 401k match.

- Non-Profits: Non-profits are mission-driven and often operate on tighter budgets. Salaries for non-exempt roles here are typically lower than in the for-profit sector. The compensation is often balanced by a strong sense of purpose, a collaborative culture, and sometimes more generous PTO or flexible work policies.

- Government: Government jobs at the federal, state, and local levels are known for their stability, excellent benefits (pensions are still common), and work-life balance. Pay is determined by rigid scales, like the federal General Schedule (GS) system. An IT Support Specialist might be a GS-7 to GS-9, with a salary range clearly defined by the government's public pay tables, varying by locality. While the base pay may not be the highest, the total compensation and job security are major draws.

###

Area of Specialization

Just as a surgeon earns more than a general practitioner, specialization within non-exempt fields dramatically boosts earning power. Gaining deep expertise in a high-demand niche makes you a more valuable and less replaceable asset.

- Paralegal Specializations:

- High-Paying: Corporate Law (mergers & acquisitions), Intellectual Property (patents & trademarks), Litigation (especially complex commercial litigation), and e-Discovery. A Senior IP Paralegal can command a base salary well over $90,000.

- Standard-Paying: Family Law, Real Estate, Personal Injury.

- IT Support Specializations:

- High-Paying: Cybersecurity Support, Cloud Infrastructure Support (AWS, Azure), Network Security, specialized enterprise software support (e.g., SAP or Salesforce). An IT tech with a Security+ certification focused on threat monitoring will earn far more than a general desktop support tech.

- Standard-Paying: General Help Desk (Tier 1), Hardware Repair, Basic Software Installation.

- Administrative Specializations:

- High-Paying: Executive Assistant to C-Suite executives (CEO, CFO), Legal Executive Assistant, Research Assistant in a scientific or financial field. These roles require immense discretion, industry knowledge, and project management skills, often pushing base salaries into the six-figure range in major markets.

###

In-Demand Skills

Beyond formal titles and specializations, possessing specific, high-value skills can directly translate to a higher salary. These are the practical abilities that make you more efficient and