In the intricate dance of career building, one of the most fundamental—and often misunderstood—elements is how you are paid. When you receive a job offer, the number you see is just the beginning of the story. The structure behind that number, whether it's a fixed annual salary or an hourly wage, dictates your daily work life, your financial planning, and your long-term earning potential. Understanding this distinction isn't just a matter of semantics; it's the bedrock of sound career management.

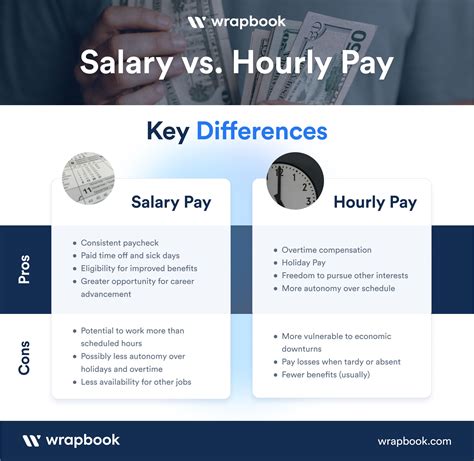

For many professionals, the path from an hourly job to a salaried position is seen as a major career milestone. It often signals a move into management, professional roles, or positions of greater responsibility. But is one inherently better than the other? The answer, as with most things in professional life, is complex. The optimal choice depends entirely on your industry, your personal financial goals, your desire for work-life balance, and the specific role you occupy.

In my years as a career analyst, I've counseled countless individuals who were fixated on a headline number without fully grasping the implications of its structure. I once worked with a graphic designer who was thrilled to leave a $35/hour freelance contract for a $70,000 salaried role, only to find himself working 60-hour weeks during product launches, effectively dropping his real hourly rate below what he previously earned, with no overtime compensation. This guide is designed to prevent that kind of surprise by giving you the expertise to look beyond the offer letter and truly understand the mechanics of your compensation.

This article is your definitive resource. We will dissect the legal definitions, explore the financial nuances, and analyze the real-world impact of both salaried and hourly pay structures. By the end, you will be equipped to evaluate job offers with confidence, negotiate more effectively, and make strategic decisions that align your compensation with your career aspirations.

### Table of Contents

1. [Defining the Core Concepts: What is a Salaried Employee vs. an Hourly Worker?](#defining-the-core-concepts)

2. [Compensation Breakdown: A Deep Dive into Salary vs. Hourly Earnings](#compensation-breakdown)

3. [Key Factors That Influence Your Pay Structure and Amount](#key-factors-that-influence-your-pay)

4. [Workforce Trends and Career Outlook](#workforce-trends-and-career-outlook)

5. [How to Choose and Negotiate Your Ideal Compensation Structure](#how-to-choose-and-negotiate)

6. [Conclusion: Making an Empowered Choice for Your Career](#conclusion)

1. Defining the Core Concepts: What is a Salaried Employee vs. an Hourly Worker?

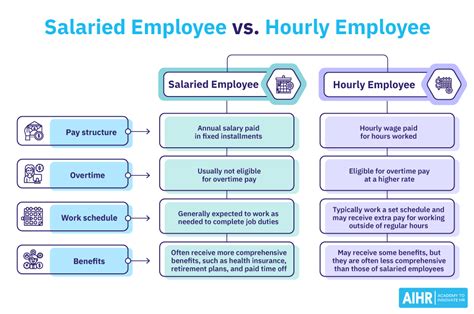

At first glance, the difference seems simple: one is a yearly sum, the other is a per-hour rate. However, the true distinction lies in legal classifications, expectations, and the nature of the work itself. These differences are primarily governed by a critical piece of U.S. legislation: the Fair Labor Standards Act (FLSA).

The FLSA establishes standards for minimum wage, overtime pay, recordkeeping, and youth employment. The key distinction it makes is between exempt and non-exempt employees.

### The Salaried (Exempt) Employee

A salaried employee receives a fixed, predetermined amount of compensation for each pay period (weekly, bi-weekly, monthly). This amount does not change based on the quantity or quality of work performed in that period, nor does it typically fluctuate if they work more or fewer hours than the standard 40-hour week.

Crucially, most salaried employees are classified as "exempt." This means they are *exempt* from the FLSA's overtime provisions. To be classified as exempt, an employee must meet three tests as defined by the Department of Labor:

1. The Salary Basis Test: The employee must be paid a predetermined, fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed.

2. The Salary Level Test: The employee must be paid a salary that meets a minimum specified amount. As of January 1, 2024, the standard salary level is $844 per week (or $43,888 per year). This threshold is scheduled to increase to $1,128 per week (or $58,656 per year) on July 1, 2024.

3. The Duties Test: The employee's primary job duties must involve executive, administrative, professional, computer, or outside sales tasks. These duties are defined in detail by the FLSA and generally involve the exercise of discretion and independent judgment with respect to matters of significance.

Because their pay is not tied to the clock, salaried employees are paid to get the job done, regardless of whether it takes 35 hours or 55 hours in a given week.

> A Day in the Life of a Salaried Employee: Sarah, the Marketing Manager

> Sarah arrives at the office around 8:45 AM. Her day is packed with meetings: a strategy session with her team, a budget review with the finance department, and a call with an external ad agency. A major campaign is launching next week, so she stays until 7:00 PM to finalize the press release and review analytics dashboards. She doesn't log her hours. Her paycheck at the end of the month will be the same as last month's, despite the extra 10-15 hours she put in this week. Her focus is on the successful launch, not the timecard.

### The Hourly (Non-Exempt) Worker

An hourly worker is paid a set wage for each hour they work. Their pay is directly tied to the time they spend on the job. Consequently, employers are legally required to track their hours worked meticulously.

Most hourly workers are classified as "non-exempt." This means they are *not exempt* from the FLSA's overtime provisions. They are entitled to overtime pay, calculated at 1.5 times their regular rate of pay, for all hours worked over 40 in a workweek.

This structure provides a direct reward for extra time spent on the job, but it also means that if an employee works fewer than 40 hours, their paycheck will be smaller. Their work life is governed by the clock.

> A Day in the Life of an Hourly Worker: Henry, the IT Support Specialist

> Henry clocks in electronically at exactly 9:00 AM. His day is spent resolving employee help desk tickets. He has a scheduled 30-minute unpaid lunch break, which he is required to take away from his desk. At 4:55 PM, a high-priority ticket comes in from the CEO's office. He works diligently to resolve it, finally finishing and clocking out at 5:20 PM. His timesheet automatically records these extra 20 minutes, and he will be paid for them. If he were asked to stay for three extra hours to assist with a server migration, those three hours would be paid at his overtime rate. His focus is on providing support during his scheduled, paid hours.

2. Compensation Breakdown: A Deep Dive into Salary vs. Hourly Earnings

Understanding your earning potential requires looking beyond the base number and considering the entire compensation structure, including overtime, benefits, and bonuses.

### National Averages and Earning Potential

Comparing salaries and hourly wages directly can be tricky, but we can look at national data from the U.S. Bureau of Labor Statistics (BLS) to get a clear picture.

- Salaried Workers: According to the BLS, the median weekly earnings for full-time wage and salary workers in the first quarter of 2024 were $1,139. This translates to an annual salary of $59,228.

- Hourly Workers: The BLS reports that the median hourly wage for all workers in May 2023 (the most recent comprehensive data available) was $23.11 per hour. For a full-time worker, this would be approximately $48,068 per year ($23.11 * 40 hours * 52 weeks).

This initial comparison suggests that salaried roles, on average, pay more. This is often because salaried positions typically require higher levels of education, experience, and responsibility. However, this doesn't account for a critical factor for hourly workers: overtime. An hourly worker in a high-demand field who consistently works 50 hours a week can easily out-earn a salaried peer.

Let's do the math: An hourly worker making $30/hour ($62,400/year base) who works 10 hours of overtime each week would earn an additional $450 per week ($30 * 1.5 * 10). Over a year, that's an extra $23,400, bringing their total earnings to $85,800.

### Comparison of Financial Components

To truly compare offers, you need to break them down into their core components.

| Feature | Salaried (Exempt) Employee | Hourly (Non-Exempt) Worker |

| :--- | :--- | :--- |

| Pay Structure | Fixed annual amount, paid in regular, predictable installments (e.g., bi-weekly). | Paid for hours worked. Paycheck amount can vary each period. |

| Predictability | High. Income is stable and predictable, making budgeting easier. | Lower. Income fluctuates with hours worked, overtime, and unpaid time off. |

| Overtime Pay | Not eligible for overtime pay. Compensation is for the job, not the hours. | Eligible for overtime at 1.5x the regular rate for hours worked over 40 in a week. |

| Paid Time Off (PTO) | Typically receive a set number of paid vacation, sick, and personal days. | Varies greatly. Many hourly roles do not offer paid leave, or it must be accrued based on hours worked. |

| Bonuses & Profit Sharing| More likely to be eligible for performance bonuses, annual bonuses, and profit-sharing plans. | Less common, though some companies offer production bonuses or small holiday bonuses. |

| Benefits Eligibility | Almost always eligible for a full benefits package (health insurance, 401(k), life insurance, etc.). | Eligibility varies. The Affordable Care Act requires employers with 50+ employees to offer coverage to those working 30+ hours/week. |

| Work-Life Balance | Can be challenging. "Salary creep" can occur, where expectations lead to consistently long hours. | More defined. The end of the shift is the end of paid work, creating a clearer boundary. |

### The Concept of "Total Compensation"

Expert professionals don't just look at salary or wages; they evaluate the total compensation package. This includes:

- Base Salary/Wage: The foundational number.

- Bonus Potential: Annual, performance-based, or sign-on bonuses.

- Retirement Savings: The value of any 401(k) or 403(b) matching contributions. A 100% match on the first 6% of your salary is effectively a 6% raise.

- Health Insurance: The value of the employer's contribution to health, dental, and vision insurance premiums.

- Paid Time Off: The value of vacation days, sick leave, and holidays.

- Other Perks: Stock options, equity, tuition reimbursement, wellness stipends, and professional development budgets.

When comparing a $75,000 salaried offer with a generous benefits package to a $40/hour role with no benefits, the salaried position is almost certainly the more valuable choice financially, even before considering the stability it offers.

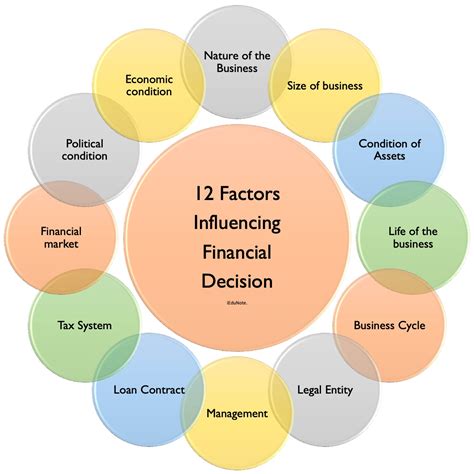

3. Key Factors That Influence Your Pay Structure and Amount

Your compensation isn't determined in a vacuum. A complex interplay of factors dictates not only the amount you earn but also whether you are offered a salaried or hourly position. Understanding these factors is key to maximizing your earning potential throughout your career.

### 1. The Legal Framework: FLSA Classification

This is the most rigid factor. As discussed, the FLSA's duties and salary-level tests are the primary determinants of whether a role *can* be salaried and exempt. Jobs that are routine, do not involve significant independent judgment, or fall outside the "EAP" (Executive, Administrative, Professional) categories are legally required to be non-exempt and paid hourly. This is why you see cashiers, assembly line workers, and call center representatives paid hourly—their roles do not meet the duties test for exemption. Conversely, a Director of Finance, who exercises significant discretion over company assets, will meet the duties test and be salaried.

### 2. Level of Education and Certifications

There is a strong, well-documented correlation between educational attainment and compensation type and level.

- High School Diploma/Associate's Degree: Jobs typically available at this level are often non-exempt and hourly. These include skilled trades, administrative support, and customer service roles. However, specialized associate's degrees (e.g., in nursing or radiologic technology) can lead to very high-paying hourly positions.

- Bachelor's Degree: This is often the entry point for professional, salaried careers in fields like business, marketing, engineering, and education. According to the BLS, workers with a bachelor's degree have median weekly earnings of $1,432, significantly higher than the $853 for those with only a high school diploma.

- Master's/Professional/Doctoral Degree: Advanced degrees are a near-guarantee of a salaried position. These roles (e.g., lawyer, doctor, university professor, senior scientist) come with the highest levels of responsibility and, consequently, the highest salaries. The BLS reports median weekly earnings of $1,732 for Master's degree holders and $2,083 for those with a professional or doctoral degree.

Certifications can dramatically increase hourly wages. A certified welder, for instance, earns a much higher hourly rate than an uncertified one. In the tech world, a cloud certification (like AWS Certified Solutions Architect) can elevate an hourly IT contractor's rate substantially or qualify them for a high-paying salaried role.

### 3. Years of Experience

Experience is a powerful driver of both salary growth and the transition from hourly to salaried work.

- Entry-Level (0-2 years): Many professional career paths begin with entry-level roles that may be hourly, even with a bachelor's degree. For example, a paralegal or a junior graphic designer might start as a non-exempt, hourly employee. This allows the company to manage costs while training new talent. An entry-level salaried professional might expect a salary in the 25th percentile for their field. According to Payscale, the average entry-level salary in the U.S. is around $53,000.

- Mid-Career (3-9 years): This is where many professionals transition from hourly to salaried roles or see significant jumps in their existing salaries. They have proven their value, can work more independently, and may begin managing projects or people. A mid-career professional can expect to earn near the median salary for their role. For example, a software engineer with 5 years of experience can command a salary well over $120,000, according to Glassdoor data.

- Senior/Late-Career (10+ years): At this stage, professionals are almost exclusively salaried. They occupy roles like Director, Vice President, or Senior Principal. Their compensation is heavily weighted toward salary, bonuses, and sometimes equity, reflecting their strategic impact on the organization. Senior-level salaries are often in the 75th to 90th percentile, with top executives earning multiples of the median.

### 4. Geographic Location

Where you work has a massive impact on your paycheck, whether salaried or hourly. This is driven by local cost of living, demand for labor, and state/city minimum wage laws.

High-Paying Metropolitan Areas:

Major tech and finance hubs offer the highest salaries in the nation to attract top talent in a high-cost environment. Data from Salary.com shows that a role like a Marketing Manager might have a median salary of:

- San Francisco, CA: $145,000

- New York, NY: $138,000

- Boston, MA: $129,000

Lower-Paying Regions:

In areas with a lower cost of living, the same role commands a lower salary:

- Des Moines, IA: $102,000

- Jackson, MS: $94,000

This effect is just as pronounced for hourly workers. The federal minimum wage is $7.25/hour, but many states and cities have set much higher floors. In Washington state, the minimum wage is $16.28/hour, while in parts of California, it's over $17/hour. This directly boosts the earnings of hourly workers in those regions compared to a state like Georgia or Wyoming, which adheres to the federal minimum.

The rise of remote work has complicated this, with many companies implementing location-based pay adjustments for their salaried remote employees.

### 5. Company Type & Size

The type and size of your employer create different compensation philosophies and capabilities.

- Large Corporations (Fortune 500): These companies have structured, well-defined salary bands for every role. They typically offer competitive base salaries and robust benefits packages (excellent health insurance, strong 401(k) matching) to attract and retain talent. Stability is a key selling point.

- Startups: Early-stage startups often can't compete with large corporations on base salary. They might offer a lower salary but compensate with potentially lucrative stock options or equity. The risk is higher, but so is the potential reward if the company succeeds. Benefits can be less comprehensive.

- Small & Medium-Sized Businesses (SMBs): Compensation can vary widely here. Pay might be less than at a large corporation, but there may be more flexibility for negotiation. Some SMBs offer profit-sharing plans to give employees a direct stake in the company's success.

- Government (Federal, State, Local): Government jobs are known for stability and excellent benefits, particularly pensions, which are rare in the private sector. Pay is determined by rigid scales (like the General Schedule or GS scale for federal employees). While the base salary may not reach the peaks of the private sector, the total compensation, when factoring in job security and benefits, is often very competitive.

- Non-Profits: Driven by a mission rather than profit, non-profits typically offer lower salaries than for-profit companies. They attract employees who are passionate about the cause. While pay is lower, the work can be highly rewarding, and the benefits packages are often reasonably competitive.

### 6. Industry and Area of Specialization

Industry is perhaps the single biggest determinant of pay scale. An accountant in the tech industry will almost certainly earn more than an accountant in the hospitality industry.

- High-Paying Industries: Technology, Finance, Pharmaceuticals, Law, and Management Consulting consistently offer the highest salaries and most lucrative bonus structures.

- Mid-Range Industries: Manufacturing, Construction, and Government offer solid, stable pay for both salaried and hourly workers. Skilled hourly trades in these sectors (e.g., electricians, plumbers) can be very well-compensated.

- Lower-Paying Industries: Retail, Hospitality, and Food Service are dominated by hourly positions with wages that are often at the lower end of the spectrum, though management roles will be salaried.

Within a single company, specialization matters. An AI/Machine Learning Engineer (a highly specialized, salaried role) will earn significantly more than a generalist Software Engineer. A corporate attorney specializing in mergers and acquisitions will command a higher salary than an in-house general counsel. For hourly workers, a CNC machinist (a specialized skill) will earn a much higher wage than a general warehouse associate.

### 7. In-Demand Skills

Regardless of your other qualifications, possessing specific, high-value skills can dramatically increase your compensation.

Skills Boosting Salaried Pay:

- Leadership & Management: The ability to lead teams and manage projects is the primary path to higher-salaried roles.

- Data Science & Analytics: Proficiency in Python, R, SQL, and data visualization tools is in high demand across all industries.

- Cloud Computing: Certifications in AWS, Azure, or Google Cloud are golden tickets to high six-figure salaries.

- Cybersecurity: As digital threats grow, so does the demand for cybersecurity professionals.

- Strategic Planning & Financial Modeling: Skills that directly impact a company's bottom line and future direction are always rewarded.

Skills Boosting Hourly Wages:

- Skilled Trades: Certifications in welding, electrical work, plumbing, and HVAC are always in demand.

- Medical Certifications: Nursing credentials (LPN, RN), sonography, and other medical technician certifications lead to high hourly rates.

- Bilingualism: In customer-facing roles, fluency in a second language (especially Spanish) can command a wage premium.

- Commercial Driver's License (CDL): Truck drivers are essential to the supply chain and are well-compensated for their time.

- Software Proficiency: Advanced knowledge of specific software (e.g., AutoCAD for drafters, Salesforce for admins) can increase your hourly rate.

4. Workforce Trends and Career Outlook

The landscape of work is constantly evolving, and these shifts have a direct impact on compensation structures and career trajectories. Staying ahead of these trends is crucial for long-term success.

### Overall Job Growth and Industry Shifts

The U.S. Bureau of Labor Statistics projects that total employment will grow by 4.7 million jobs from 2022 to 2032. However, this growth is not evenly distributed.

- High-Growth Sectors: The healthcare and social assistance sector is projected to add the most jobs, driven by an aging population and increased demand for care. Many of these roles, such as Registered Nurses and Therapists, are a mix of high-paying hourly and salaried positions. The professional, scientific, and technical services sector is also poised for strong growth, adding highly paid salaried jobs in fields like computer systems design and management consulting.

- Declining Sectors: Production and manufacturing roles are expected to see a decline due to automation and offshoring. While some highly skilled hourly roles will remain, many lower-skilled production jobs are at risk. Similarly, some administrative and office support roles are being automated by software, potentially reducing the number of available hourly positions in that domain.

This data suggests a long-term trend towards a more "K-shaped" economy, with strong growth in high-skill, high-knowledge salaried roles and certain high-skill hourly trades, while lower-skill roles face pressure.

### The Rise of the Gig Economy and Flexible Work

The "gig economy"—characterized by short-term contracts and freelance work—has fundamentally altered the traditional employer-employee relationship for millions. Workers on platforms like Upwork or Uber are classified as independent contractors, not employees. They are paid on a per-project or per-task basis, which is functionally similar to hourly work but without the legal protections of the FLSA. They are responsible for their own taxes, benefits, and retirement savings.

This trend offers unparalleled flexibility but comes with inherent instability. For some, it's an empowering way to control their career and earning potential. For others, it's a precarious existence without a safety net. Understanding the distinction between being a non-exempt hourly *employee* and an hourly *contractor* is critical.

### The Impact of Remote Work

The massive shift to remote work, accelerated by the pandemic, has primarily affected salaried, knowledge-based workers. This has had several effects on compensation:

1. Geographic Pay Disparities: As mentioned, companies are grappling with whether to pay a San Francisco salary to an employee who moves to a low-cost area like Omaha. This has led to the rise of location-based pay tiers.

2. Blurring Work-Life Boundaries: For salaried remote workers, the line between being "on" and "off" the clock can become dangerously blurred. Without the physical separation of an office, the risk of "salary creep"—working far more than 40 hours for the same pay—is heightened. This has led to renewed discussions about "right to disconnect" laws and a greater appreciation for the defined boundaries that hourly work provides.

### The Evolving Legal Landscape

The rules