Introduction

Have you ever wondered who holds the financial keys to a kingdom, ensuring its stability, compliance, and strategic growth? In the corporate world, that person is the Comptroller. It’s a role of immense responsibility, blending the precision of an accountant with the foresight of a strategist. For those with a passion for numbers and a vision for leadership, the path to becoming a Comptroller is not just a career—it's a journey to the financial heart of an organization. If your search for "will compton salary" brought you here, you've landed in the right place to explore what is likely the intended query: the rewarding and high-stakes career of a Comptroller.

The allure of this role is undeniable. A successful Comptroller commands not only respect but also a significant income, with top professionals earning well into the six figures, often supplemented by substantial bonuses and equity. The median salary for Financial Managers, a category that includes Comptrollers, was $139,790 per year as of May 2022, according to the U.S. Bureau of Labor Statistics. But this figure is just the beginning. The journey from an entry-level accountant to a corporate comptroller is a testament to the power of dedication, strategic learning, and professional development.

I once had the privilege of working alongside a corporate comptroller during a major systems overhaul at a mid-sized tech company. Her name was Maria, and her calm demeanor amidst the chaos was legendary. While engineers panicked about code and marketers worried about messaging, Maria was the anchor, methodically ensuring that every financial transaction, every budget line, and every projection was flawless. It was a masterclass in seeing the big picture without ever losing sight of the smallest detail. That experience solidified for me that a great comptroller doesn't just count the money; they make the money count.

This guide is designed to be your definitive resource for understanding the Comptroller career path. We will dissect every component, from daily responsibilities and salary benchmarks to the critical factors that will shape your earning potential. We will explore the future of the profession and lay out a clear, step-by-step plan to help you embark on this challenging and highly rewarding journey.

### Table of Contents

- [What Does a Comptroller Do?](#what-does-a-comptroller-do)

- [Average Comptroller Salary: A Deep Dive](#average-comptroller-salary-a-deep-dive)

- [Key Factors That Influence a Comptroller's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in a Comptroller Career](#how-to-get-started-in-this-career)

- [Conclusion: Is a Comptroller Career Right for You?](#conclusion)

---

What Does a Comptroller Do?

The title "Comptroller" (often used interchangeably with "Controller") can sound formal and a bit mysterious. In essence, a Comptroller is the chief accounting officer of an organization. They are responsible for the integrity of all financial data and reporting. While a Chief Financial Officer (CFO) is typically focused on broader financial strategy, investment, and capital structure, the Comptroller is laser-focused on the accounting operations, internal controls, and the production of timely and accurate financial statements.

Think of the Comptroller as the master architect and guardian of a company's financial records. Their primary mandate is to ensure that the books are clean, compliant, and reflective of the company's true financial position. This is not merely a bookkeeping role; it's a high-level management position that requires a deep understanding of accounting principles, regulations, and business operations.

Core Responsibilities and Daily Tasks:

A Comptroller's duties are extensive and vary by the size and complexity of the organization, but they generally revolve around these key functions:

- Overseeing Accounting Operations: This includes managing the general ledger, accounts payable, accounts receivable, payroll, and fixed assets. They lead the teams responsible for these day-to-day transactions.

- Financial Reporting: The Comptroller is responsible for preparing all major financial statements, including the balance sheet, income statement, and statement of cash flows. This must be done in accordance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

- Internal Controls: A critical function is designing, implementing, and monitoring a system of internal controls to prevent fraud, waste, and error. This ensures the safeguarding of company assets.

- Budgeting and Forecasting: While the CFO may lead the overall strategic financial plan, the Comptroller is deeply involved in the creation of departmental and company-wide budgets, as well as variance analysis (comparing actual results to the budget).

- Compliance and Regulation: They ensure the company complies with all local, state, and federal government reporting requirements and tax filings. This includes staying up-to-date on ever-changing tax laws and accounting standards.

- Audits: The Comptroller is the primary point of contact for external auditors, managing the entire audit process to ensure a smooth and successful outcome.

- Technology and Systems: They often oversee the selection and implementation of financial and accounting software (ERP systems like SAP, Oracle NetSuite, or Microsoft Dynamics 365).

### A Day in the Life of a Comptroller

To make this tangible, let's imagine a typical Tuesday for "David," the Comptroller at a $100 million manufacturing company.

- 8:30 AM: David starts his day by reviewing the daily cash flow report prepared by the treasury analyst. He checks for any unusual activity and ensures the company has sufficient liquidity for its operational needs.

- 9:00 AM: He meets with his accounting team for their weekly huddle. The accounts payable manager discusses a new automated invoice processing system, and the senior accountant presents the preliminary close schedule for the end of the month. David provides guidance and sets priorities.

- 10:30 AM: David dives into reviewing the draft of the monthly financial reporting package for the executive team. He scrutinizes the variance analysis, noting a higher-than-budgeted cost in raw materials, and drafts a note to the COO to investigate the cause.

- 12:00 PM: Lunch meeting with the head of IT to discuss upcoming security enhancements for the company's ERP system to better protect sensitive financial data.

- 1:30 PM: A call with the company's external auditors to discuss the timeline and required documentation for the upcoming annual audit. David delegates the task of preparing the initial document request list to his assistant controller.

- 3:00 PM: David dedicates a block of time to strategic work. He analyzes the financial implications of a proposed new product line, building a preliminary financial model to assess its potential profitability and impact on cash flow.

- 4:30 PM: He reviews and approves a series of significant vendor payments and capital expenditure requests, ensuring they align with the approved budget and company policy.

- 5:30 PM: Before heading home, David responds to a few final emails and reviews his calendar for the next day, which includes a presentation to the board's audit committee.

This "day in the life" illustrates the constant blend of routine oversight, team management, strategic analysis, and regulatory compliance that defines the Comptroller's world.

---

Average Comptroller Salary: A Deep Dive

Now, let's address the central question that likely sparked your initial search: What does this demanding career pay? A Comptroller's salary is significant, reflecting the high level of expertise, responsibility, and risk associated with the role. However, the final figure is not a single number but a wide range influenced by numerous factors we will explore in the next section.

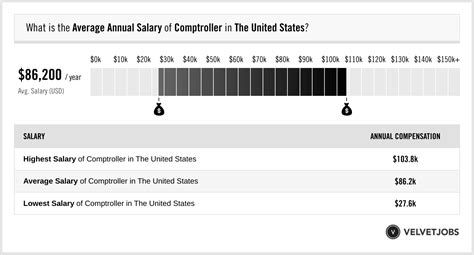

National Averages and Typical Salary Ranges

To establish a baseline, we'll consult several authoritative sources. It's important to cross-reference data, as methodologies can differ.

- U.S. Bureau of Labor Statistics (BLS): The BLS groups Comptrollers under the broader category of "Financial Managers." As of May 2022, the BLS reports the following data for this group:

- Median Annual Wage: $139,790

- Lowest 10%: Less than $77,530

- Highest 10%: More than $208,000 (note that BLS data is often capped at this amount, and actual top-end salaries can be much higher).

- This data provides a solid, government-backed overview but doesn't capture the full upper range for senior corporate comptrollers.

- Salary.com: This platform provides more granular data specifically for the "Controller" title. As of late 2023, Salary.com reports:

- Median Base Salary (Corporate Controller): Approximately $245,000

- Typical Salary Range: $208,000 to $288,000

- This data point is likely more representative of Comptrollers at mid-to-large sized companies and highlights how much higher the median can be for this specific role compared to the general "Financial Manager" category.

- Payscale: Payscale offers a broad range based on user-submitted data. As of late 2023, they report:

- Average Base Salary: Approximately $108,000

- Salary Range: $75,000 to $162,000

- This lower average likely includes data from smaller companies, non-profits, and professionals with the title but less experience, illustrating the wide spectrum of pay.

Synthesizing the Data: A realistic expectation is that a Comptroller role starts near the six-figure mark at smaller entities and can easily surpass $250,000 to $300,000 or more in base salary at large, complex corporations.

Salary Progression by Experience Level

A Comptroller is not an entry-level position. The salary reflects years of accumulated experience. Here’s a typical salary progression, combining data from various sources to paint a realistic picture:

| Career Stage | Typical Title(s) | Years of Experience | Typical Base Salary Range |

| :--- | :--- | :--- | :--- |

| Entry-Level (Path to Comptroller) | Staff Accountant, Junior Financial Analyst | 0-3 years | $60,000 - $85,000 |

| Early Career Professional | Senior Accountant, Financial Analyst II | 3-5 years | $80,000 - $110,000 |

| Mid-Career / Pre-Comptroller | Accounting Manager, Assistant Controller | 5-10 years | $110,000 - $160,000 |

| Comptroller (Mid-Sized Co.) | Controller / Comptroller | 10-15 years | $150,000 - $220,000 |

| Senior Comptroller (Large Corp.)| Corporate Controller, VP Controller | 15+ years | $220,000 - $350,000+ |

*(Note: These are national averages and can vary significantly based on factors discussed below.)*

This table clearly shows that the path is a marathon, not a sprint. Each step builds upon the last, with compensation growing in lockstep with increasing responsibility and expertise. The query "will compton salary" is best answered by understanding this progression; what a comptroller's salary will be is directly tied to their stage on this career ladder.

Beyond the Base Salary: Understanding Total Compensation

The base salary is only one piece of the puzzle. For senior roles like a Comptroller, total compensation is a much more important metric.

- Annual Bonuses: This is the most common form of variable pay. Bonuses are typically tied to company performance (e.g., hitting revenue or profit targets) and individual performance. A bonus can range from 15% to 50% or more of the base salary, especially at the Corporate Comptroller level.

- Profit Sharing: Some companies, particularly private ones, offer a profit-sharing plan where a portion of the company's profits is distributed to employees. As a key financial leader, the Comptroller would receive a significant share.

- Stock Options and Restricted Stock Units (RSUs): In publicly traded companies and high-growth startups, equity is a major component of compensation. Stock options give the right to buy company stock at a predetermined price, while RSUs are grants of company shares that vest over time. This can add immense value to a compensation package, potentially eclipsing the base salary in a successful company.

- Long-Term Incentive Plans (LTIPs): These are rewards designed to retain key executives over a multi-year period (typically 3-5 years). They are often paid in cash or equity and are tied to achieving long-term strategic goals.

- Comprehensive Benefits: A top-tier package is standard and includes high-quality health, dental, and vision insurance; a robust 401(k) or similar retirement plan with a generous company match; and significant paid time off.

- Perks: Executive-level perks can include a car allowance, club memberships, and executive coaching services.

When you factor in these additional components, the total compensation for a senior Comptroller at a large corporation can easily push into the $400,000 to $600,000+ range annually.

---

Key Factors That Influence a Comptroller's Salary

The wide salary bands discussed above exist for a reason. Two Comptrollers with the same title can have vastly different incomes. Understanding the variables that drive compensation is critical for maximizing your own earning potential. Let's break down the most influential factors in detail.

###

Level of Education & Professional Certifications

Your educational foundation and professional credentials are the bedrock of your career and a primary determinant of your starting salary and long-term trajectory.

- Bachelor's Degree: A bachelor's degree in Accounting is the non-negotiable starting point. A degree in Finance, Business Administration, or a related field is also acceptable, but it must include a heavy concentration of accounting coursework. This is the ticket to an entry-level role.

- Master's Degree: An advanced degree significantly enhances earning potential.

- Master of Business Administration (MBA): An MBA, particularly from a top-tier program, signals a mastery of broader business strategy, leadership, and finance, not just accounting. It's often a stepping stone for those aiming for a CFO role beyond the Comptrollership. An MBA can add a 15-25% premium to a salary.

- Master of Accountancy (MAcc) or Taxation (MTax): These specialized degrees provide deep technical expertise and are highly valued. They are also the most common path to meeting the 150-credit-hour requirement for the CPA license.

- Professional Certifications (The Game Changers):

- Certified Public Accountant (CPA): This is the gold standard in the accounting world. Period. Holding a CPA license is often a mandatory requirement for a Comptroller position, especially in publicly traded companies. It signifies a verified level of expertise, ethical commitment, and a deep understanding of GAAP, auditing, and tax law. The CPA designation can easily command a $10,000 to $20,000 salary premium from the start and is essential for reaching the highest echelons of pay.

- Certified Management Accountant (CMA): While the CPA focuses on public accounting, compliance, and auditing, the CMA focuses on corporate finance and management accounting. It validates skills in financial planning, analysis, control, and decision support. It is an excellent complement to the CPA or a powerful standalone credential for Comptrollers in the manufacturing or private sectors.

- Chartered Global Management Accountant (CGMA): This global designation is powered by the AICPA and CIMA and is designed for financial professionals who guide critical business decisions, combining financial and management accounting expertise.

Bottom Line: A Bachelor's gets you in the door. A Master's accelerates your path. A CPA license unlocks the executive suite and its associated compensation.

###

Years and Quality of Experience

Experience is arguably the single most important factor. However, it’s not just about the number of years; it’s about the *quality* and *progression* of that experience.

- The Foundational Years (0-5 Years): The most common and respected path begins in public accounting, particularly at one of the "Big Four" firms (Deloitte, PwC, EY, KPMG). Working in their audit/assurance practice provides unparalleled exposure to various industries, complex accounting issues, and rigorous methodologies. This experience is highly sought after by corporations looking to hire for their internal accounting teams. A Senior Accountant with 3-5 years of Big Four experience is a prime candidate for an Accounting Manager role in private industry.

- *Salary Impact:* This path builds the brand value that accelerates future earnings dramatically.

- The Managerial Leap (5-10 Years): This is where you transition from being a doer to a manager. As an Accounting Manager or Assistant Controller, you begin overseeing staff, managing the month-end close process, and taking ownership of specific areas of financial reporting. This is where you prove your leadership potential.

- *Salary Impact:* You'll see a significant jump into the low-to-mid six figures as you take on management responsibility. The salary for an Accounting Manager in a major city can range from $120,000 to $150,000.

- The Strategic Rise (10+ Years): To become a Comptroller, you must demonstrate strategic value beyond just closing the books. This involves leading major projects like an ERP implementation, playing a key role in M&A (Mergers & Acquisitions) due diligence, developing sophisticated financial models, and presenting to executive leadership.

- *Salary Impact:* This is where you break into the upper echelons. A Comptroller with 15 years of progressive experience, including public accounting and project leadership, is who commands the $200,000+ base salaries.

###

Geographic Location

Where you work matters—a lot. Salaries for financial roles are heavily influenced by the cost of living and the concentration of corporate headquarters in a given metropolitan area.

- Top-Tier Paying Metropolitan Areas: These cities are major financial hubs with a high cost of living and intense competition for top talent. Expect salaries here to be 20-40% above the national average.

- New York, NY: The epicenter of finance. According to the BLS, the annual mean wage for Financial Managers in the New York-Newark-Jersey City metro area was $217,540 in 2022.

- San Francisco-Oakland-Hayward, CA: The heart of the tech industry. The BLS reported an annual mean wage of $206,170.

- San Jose-Sunnyvale-Santa Clara, CA (Silicon Valley): Another tech giant, with an annual mean wage of $215,640.

- Other high-paying hubs include Boston, MA, Seattle, WA, and Washington, D.C.

- Mid-Tier Paying Metropolitan Areas: These are large cities with strong economies but a more moderate cost of living. Salaries will be at or slightly above the national average.

- Examples include Dallas, TX, Chicago, IL, Atlanta, GA, and Denver, CO.

- Lower-Tier Paying Areas: These are typically smaller cities and rural areas where the cost of living is lower and there are fewer large corporations. Salaries here may be 10-20% below the national average.

Key Takeaway: While a high salary in New York City is attractive, it must be weighed against the substantially higher cost of living. A Comptroller making $180,000 in Dallas may have a higher quality of life than one making $220,000 in San Francisco.

###

Company Type, Size, and Industry

The context of the company is a massive driver of compensation.

- Company Size:

- Startups/Small Businesses (<$50M Revenue): The "Controller" here might be the sole accounting professional, wearing many hats. The base salary will be lower (e.g., $100,000 - $140,000), but the role offers incredible hands-on experience and potentially valuable stock options.

- Mid-Sized Enterprises ($50M - $500M Revenue): This is a sweet spot for many. The company is established, processes are more mature, and the Comptroller leads a small team. Base salaries are strong (e.g., $150,000 - $220,000) with solid bonus potential.

- Large Corporations (>$500M Revenue / Fortune 500): These are the most complex and highest-paying roles. A Corporate Comptroller at a multi-billion dollar, publicly-traded company is managing a large, global team and dealing with immense regulatory scrutiny (e.g., SEC reporting, Sarbanes-Oxley). Base salaries regularly exceed $250,000, with total compensation reaching well into the mid-six figures.

- Company Type:

- Publicly Traded: These companies have the most rigorous reporting requirements and offer the highest salaries and equity packages to attract talent capable of managing that complexity.

- Private/Venture-Backed: Base salaries might be slightly lower than public counterparts, but the potential for a huge payday from equity upon an IPO or acquisition is a major draw.

- Non-Profit/Government: Compensation is significantly lower. A Comptroller at a large non-profit might earn $120,000 - $180,000. The trade-off is often better work-life balance, job security, and a mission-driven environment.

- Industry: Industry-specific knowledge is a valuable commodity.

- Financial Services & Technology (FinTech): These are consistently the highest-paying sectors due to the complexity, regulatory environment, and high profitability.

- Biotechnology & Pharmaceuticals: High salaries driven by long R&D cycles, complex accounting for clinical trials, and high potential for profit.

- Manufacturing: Requires deep expertise in cost accounting and inventory management (e.g., LIFO/FIFO, standard costing).

- Real Estate: Demands specialized knowledge of lease accounting and project-based financial reporting.

###

In-Demand Skills

Beyond credentials and experience, a specific set of modern skills can significantly increase your value and salary negotiation power.

- Technical Accounting Expertise: Mastery of complex topics like revenue recognition (ASC 606), lease accounting (ASC 842), and stock-based compensation is highly prized.

- ERP Systems Proficiency: Deep knowledge of a major ERP system (SAP, Oracle NetSuite, Microsoft Dynamics 365) is no longer optional. Experience leading an implementation or optimization project is a massive resume booster.

- Data Analytics & Business Intelligence (BI): The modern Comptroller doesn't just report the news; they analyze it. Skills in using tools like Tableau, Power BI, or Alteryx to visualize data and derive insights for the business are in high demand.

- Financial Planning & Analysis (FP&A): The line between the Comptroller and the head of FP&A is blurring. Strong skills in financial modeling, forecasting, and strategic analysis make you a true business partner, not just an accountant.

- Leadership and Communication: The ability to lead and develop a team, communicate complex financial information clearly to non-financial stakeholders (like the CEO or board), and act with unwavering ethical judgment are the soft skills that define top-tier Comptrollers.

By strategically developing these factors—earning a CPA, gaining Big Four experience, targeting high-paying locations and industries, and mastering modern skills—you can actively shape your career and ensure what *will* be your Comptroller salary reaches its maximum potential.

---

Job Outlook and Career Growth

Investing years of your life into a career path requires confidence in its future. For Comptrollers and the broader Financial Manager profession, the outlook is positive and stable, though evolving.

Job Growth Projections

The U.S. Bureau of Labor Statistics (BLS) provides the most authoritative long-term forecast. In its 2022-2032 projections for Financial Managers, the BLS forecasts a robust outlook:

- Projected Growth Rate: A remarkable 16% over the decade.

- Projected New Jobs: Approximately 126,600 new positions.

- Growth Driver: The BLS states, "This is much faster than the average for all occupations. The detailed financial data and analysis that financial managers provide is expected to be in demand over the decade."

This 16% growth rate is more than five times the average growth rate for all occupations (3%), signaling a profession with strong and sustained demand. This demand is fueled by several factors, including an increasingly complex global economy, heightened regulatory scrutiny, and the need for businesses of all sizes to manage their finances strategically to remain competitive. As companies grow and the economy expands, the need for competent managers to oversee financial operations and ensure compliance will continue to increase.