A search for a document like "2025-benefits-and-comp-ll5-salary-plan-1.pdf" suggests a keen interest in the strategic world of employee rewards. This is the domain of the Compensation and Benefits Manager, a critical human resources role responsible for designing the very salary and benefits plans that attract, motivate, and retain top talent. If you're an analytical, strategic thinker fascinated by what makes a company a truly great place to work, this high-impact career path offers significant professional growth and impressive earning potential, with top professionals earning well over $180,000 annually.

What Does a Compensation and Benefits Manager Do?

While a file name like "2025-benefits-and-comp-ll5-salary-plan-1.pdf" points to a specific internal company document, the professionals who create, analyze, and manage such plans are Compensation and Benefits Managers or Analysts. The "LL5" likely refers to a specific job level within a company's grading structure, indicating a mid-to-senior level role.

These professionals are the architects of a company's total rewards strategy. Their key responsibilities include:

- Market Analysis: Researching and analyzing salary data and benefits trends to ensure the company’s offerings are competitive.

- Plan Design: Creating and structuring salary bands, bonus programs, and incentive plans (like the one in the searched PDF).

- Benefits Administration: Selecting and managing health insurance, retirement plans (401k), paid time off, wellness programs, and other perks.

- Legal Compliance: Ensuring all compensation and benefits practices comply with federal, state, and local regulations, such as the Fair Labor Standards Act (FLSA).

- Pay Equity Audits: Analyzing internal pay data to identify and resolve wage gaps based on gender, race, or other demographics.

- Communication: Explaining complex compensation and benefits information clearly to employees and executives.

Essentially, they use data to answer critical business questions: Are we paying our people enough? Are we paying them fairly? And are our benefits strong enough to beat the competition?

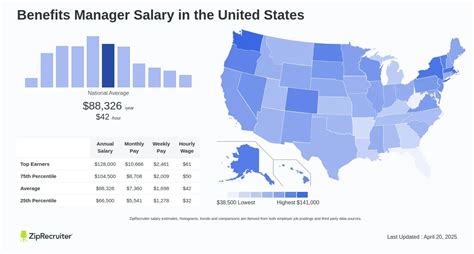

Average Compensation and Benefits Manager Salary

The earning potential in this field is strong and reflects the strategic importance of the role. While salaries vary, we can establish a clear picture by looking at data from several authoritative sources.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for Compensation and Benefits Managers was $131,280 as of May 2022. This means half of the professionals in the field earned more than this amount, and half earned less.

However, real-world salary aggregators often show an even higher range, reflecting more recent data and including bonuses.

- Salary.com reports that the median salary for a Compensation and Benefits Manager in the U.S. is approximately $142,525 as of late 2023, with a typical range falling between $126,450 and $160,210.

- Payscale notes that the average salary is around $103,000, but this figure includes a wider range of titles, including analysts. Their data shows that top earners in senior roles can exceed $150,000 in base salary alone.

- Glassdoor places the average total pay (including bonuses and profit sharing) for a Compensation and Benefits Manager at around $148,000 per year.

A typical career progression might look like this:

- Entry-Level (Compensation/Benefits Analyst): $65,000 - $85,000

- Mid-Career (Senior Analyst / Manager): $95,000 - $145,000

- Senior/Director Level: $150,000 - $220,000+

Key Factors That Influence Salary

Your specific salary will be determined by a combination of factors. Understanding these levers is key to maximizing your earning potential.

### Level of Education

A bachelor's degree is the standard entry point for this career, typically in Human Resources, Business Administration, Finance, or a related field. However, advanced education can significantly increase earning potential. Professionals holding a Master of Business Administration (MBA) or a master's degree in Human Resources often qualify for senior leadership positions and command higher salaries. Furthermore, professional certifications like the Certified Compensation Professional (CCP) or Certified Employee Benefit Specialist (CEBS) are highly valued by employers and can lead to a significant pay premium.

### Years of Experience

Experience is one of the most significant factors in this field. As you gain experience, you move from executing tasks to designing strategy.

- Analyst (0-4 years): Focuses on data gathering, market surveys, and supporting senior staff.

- Senior Analyst / Manager (5-10 years): Begins managing projects, designing new plans, overseeing benefits renewals, and conducting pay equity audits. This is where salaries often cross the six-figure mark.

- Director / VP (10+ years): Sets the entire total rewards strategy for the organization, manages a team, and presents to the executive board. These roles carry the highest salaries, often supplemented by significant long-term incentives and bonuses.

### Geographic Location

Where you work matters immensely. A Compensation and Benefits Manager in a high-cost-of-living metropolitan area with a competitive job market will earn substantially more than someone in a smaller city. Major tech and finance hubs lead the nation in compensation for this role.

According to Salary.com's location-based analysis, cities like San Francisco, San Jose, New York City, and Boston often pay 15-30% above the national average. Conversely, salaries in smaller cities in the Midwest and South may be below the national average, though the lower cost of living can offset this difference.

### Company Type

The size and industry of your employer play a huge role. A Fortune 500 technology or finance company will typically have more complex compensation structures (e.g., stock options, RSUs, global pay scales) and the resources to pay top dollar. In contrast, non-profits, government agencies, and smaller local businesses will generally offer lower base salaries, though they may provide other benefits like better work-life balance or pension plans.

### Area of Specialization

Within the broader field, certain niches are more lucrative. Professionals who specialize in Executive Compensation are among the highest earners. This specialty involves designing complex pay packages for C-suite executives, including stock awards, deferred compensation, and performance-based long-term incentives. Other high-demand specializations include Sales Compensation, which directly impacts revenue generation, and Global Compensation and Benefits, which requires navigating the complex laws and cultural norms of multiple countries.

Job Outlook

The future for Compensation and Benefits Managers is bright. The BLS projects that employment in this field will grow by 4% between 2022 and 2032, which is as fast as the average for all occupations.

This steady demand is driven by several factors:

- The ongoing "war for talent" requires companies to be strategic and competitive with their rewards.

- Growing focus on pay equity and transparency is making skilled compensation professionals essential.

- Healthcare and retirement plan regulations are constantly changing, requiring expert oversight.

- The rise of remote and hybrid work creates new complexities in geographic pay differentials that must be managed.

Conclusion

A career as a Compensation and Benefits Manager is far more than just processing payroll or benefits paperwork. It's a strategic, data-driven profession that sits at the heart of an organization's talent strategy. For those who possess strong analytical skills, a detail-oriented mindset, and an interest in human psychology and motivation, this career offers a clear path to a high-impact, well-compensated role. By investing in your education, gaining diverse experience, and potentially pursuing a specialization, you can build a rewarding career as a key architect of the modern workplace.