A role as a bank teller at a globally recognized institution like JPMorgan Chase is a popular and accessible entry point into the world of finance. It offers a unique opportunity to build foundational skills in customer service, cash handling, and banking operations. But what can you expect to earn? This article provides a data-driven look at the Chase Bank Teller salary, the factors that influence it, and the career's long-term potential.

While it is an entry-level position, a teller role at a major national bank like Chase often comes with a competitive hourly wage, typically ranging from $18 to $24 per hour, and a clear pathway for professional growth.

What Does a Chase Bank Teller Do?

A Chase Bank Teller is the frontline representative of the bank, responsible for delivering an excellent customer experience while handling essential financial transactions. The role has evolved beyond simple cash-in, cash-out duties and now requires a blend of operational precision and interpersonal skill.

Key responsibilities include:

- Processing Transactions: Accurately handling routine customer transactions such as deposits, withdrawals, loan payments, and check cashing.

- Customer Service: Greeting clients, answering inquiries about bank products and services, and resolving issues with accounts.

- Needs Assessment: Identifying customer needs and referring them to other banking professionals like personal bankers or mortgage specialists for more complex products (e.g., loans, credit cards, investment accounts).

- Cash Management: Balancing a cash drawer daily and ensuring all transactions are accounted for with precision.

- Compliance and Security: Adhering to all bank policies, procedures, and federal regulations to protect both the customer and the institution.

Average Chase Bank Teller Salary

Salaries for tellers at Chase are competitive and often slightly higher than the national median for all tellers, reflecting the scale and resources of the organization.

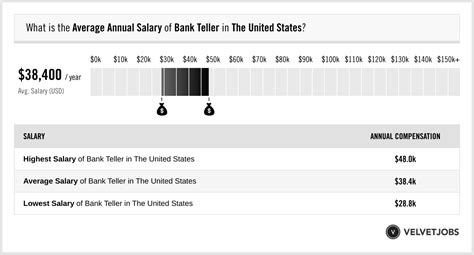

Based on recent data, the typical salary for a Bank Teller at Chase is as follows:

- Hourly Wage: Most Chase Teller positions are paid hourly, with a common range between $18.00 and $24.00 per hour.

- Annual Salary: This translates to an approximate annual salary of $37,440 to $49,920 for a full-time employee.

According to Salary.com, the median base salary for a Bank Teller at JPMorgan Chase & Co. is approximately $40,653 per year, with a typical range falling between $36,512 and $44,879. Similarly, Glassdoor reports an average total pay in a comparable range, aggregated from user-submitted data.

For context, the U.S. Bureau of Labor Statistics (BLS) reported the median annual wage for all tellers nationwide was $36,310 in May 2022. This indicates that Chase often pays at or above the national median, especially in competitive markets.

Key Factors That Influence Salary

Your exact earnings as a Chase Teller are not fixed. Several key factors can significantly impact your compensation package.

### Level of Education

For a bank teller position, a high school diploma or GED is typically the minimum requirement. While an associate's or bachelor's degree in fields like finance, business, or accounting is not usually necessary to secure the role, it can be a major asset for career advancement. A degree may not drastically increase your *starting* salary as a teller, but it significantly accelerates your eligibility for promotions to higher-paying positions like Lead Teller, Personal Banker, or Assistant Branch Manager.

### Years of Experience

Experience is one of the most direct influencers of a teller's wage.

- Entry-Level (0-2 years): New tellers can expect to start at the lower end of the pay scale, generally in the $18 to $20 per hour range.

- Mid-Career (2-5 years): With a few years of experience, proven performance, and a deep understanding of bank procedures, a teller can expect to earn closer to the median range, from $20 to $22 per hour.

- Senior/Lead Teller (5+ years): Tellers with extensive experience who take on mentorship or leadership responsibilities (often as a Lead or Head Teller) can command wages at the top of the range, potentially exceeding $24 per hour.

### Geographic Location

Where you work matters immensely. Banks, including Chase, adjust their pay scales to reflect the local cost of living and labor market competition. A teller in a high-cost-of-living metropolitan area will earn significantly more than a teller in a smaller, rural town.

For example, a teller position in New York, NY, or San Francisco, CA, will likely offer a starting wage 15-25% higher than the national average to remain competitive. Conversely, a position in a lower-cost state may align more closely with the lower end of the national salary range.

### Company Type

The prompt is specific to Chase, a large, multinational investment bank and financial services company. Compared to smaller institutions, large national banks like Chase often offer:

- Standardized Pay Structures: More formal and often more competitive pay bands.

- Comprehensive Benefits: Robust benefits packages that include health insurance, retirement savings plans (401k), and paid time off, which contribute to the overall compensation value.

- Structured Career Paths: Clear, defined opportunities for internal promotion.

In contrast, a community bank or credit union might offer a different work culture and may have more variable pay scales, though they often remain competitive to attract local talent.

### Area of Specialization

While the "teller" role is generalist, developing specific skills can lead to higher earnings through performance-based incentives or promotions. Tellers who excel in the following areas are highly valued:

- Sales and Referrals: Tellers who are effective at identifying customer needs and successfully referring them for new products (like credit cards, auto loans, or investment services) may be eligible for bonuses.

- Bilingual Skills: In diverse communities, bilingual tellers are in high demand and may command a higher starting wage.

- Business Banking: Tellers proficient in handling more complex transactions for small business clients demonstrate a higher level of competence and value.

Job Outlook

According to the U.S. Bureau of Labor Statistics (BLS), employment for tellers is projected to decline by 12 percent from 2022 to 2032. This decline is primarily attributed to the rise of online and mobile banking, which has automated many traditional transactions.

However, this statistic does not tell the whole story. The role of the teller is not disappearing; it is evolving. Banks are transforming tellers into "universal bankers" or "relationship bankers"—professionals who are less focused on routine transactions and more on building customer relationships, solving complex problems, and providing financial advice. For those who embrace these changes, the teller position remains a solid foundation for a long-term banking career.

Conclusion

A career as a Chase Bank Teller offers a stable and respectable entry into the financial services industry. With a competitive average salary that often surpasses the national median and is heavily influenced by location and experience, it is an accessible and rewarding starting point.

While the role is evolving due to technology, it provides an invaluable opportunity to develop critical skills in customer service, sales, and financial operations. For anyone looking to build a career in banking, the teller position at an esteemed institution like Chase is a strategic first step that opens doors to future growth and higher-earning potential.