In the sprawling, dynamic economy of the Lone Star State, from the bustling energy corridors of Houston to the booming tech hubs of Austin, one profession stands as the bedrock of financial integrity and strategic growth: accounting. If you're considering a career that offers stability, intellectual challenge, and significant earning potential, understanding the nuances of an accountant salary in Texas is your first step toward a prosperous future. This isn't just a job; it's a vital role that underpins every successful enterprise in one of America's most powerful economic engines.

The demand for skilled accountants in Texas is robust, driven by a diverse industrial landscape that includes oil and gas, healthcare, technology, real estate, and international trade. This demand translates into competitive compensation, with the average accountant salary in Texas ranging impressively from approximately $85,000 to $95,000 annually, and top earners with specialized skills and experience commanding well over $150,000. As a career analyst, I've seen firsthand how a strategic approach to this profession can transform a standard salary into a life-changing income. I once guided a recent graduate who, within five years, leveraged a CPA license and a specialization in IT audit to triple their entry-level salary, a testament to the incredible growth trajectory available in the Texas market.

This guide is designed to be your definitive resource, moving beyond simple numbers to give you a comprehensive, 360-degree view of the accounting profession in Texas. We will dissect salary expectations, explore the factors that drive compensation, and lay out a clear, actionable roadmap for you to launch and advance your own accounting career.

### Table of Contents

- [What Does an Accountant in Texas Do?](#what-does-an-accountant-in-texas-do)

- [Average Accountant Salary Texas: A Deep Dive](#average-accountant-salary-texas-a-deep-dive)

- [Key Factors That Influence Your Accountant Salary in Texas](#key-factors-that-influence-your-accountant-salary-in-texas)

- [Job Outlook and Career Growth for Accountants in Texas](#job-outlook-and-career-growth-for-accountants-in-texas)

- [How to Become an Accountant in Texas: A Step-by-Step Guide](#how-to-become-an-accountant-in-texas-a-step-by-step-guide)

- [Conclusion: Is a Career in Accounting in Texas Right for You?](#conclusion-is-a-career-in-accounting-in-texas-right-for-you)

What Does an Accountant in Texas Do?

At its core, accounting is the language of business. An accountant is a professional fluent in this language, responsible for preparing, analyzing, and interpreting financial information that organizations need to make critical decisions. Their work ensures financial accuracy, regulatory compliance, and fiscal health. While stereotypes might paint a picture of a solitary number-cruncher, the modern accountant is often a dynamic, strategic partner integrated into the very fabric of an organization.

The responsibilities of an accountant in Texas are as diverse as the state's economy. Whether working for a Big Four firm in Dallas, an oil and gas giant in Houston, a tech startup in Austin, or a government agency in San Antonio, the fundamental duties revolve around managing the financial lifeblood of the entity.

Core Responsibilities and Daily Tasks:

- Financial Reporting: Preparing key financial statements, including the balance sheet, income statement, and cash flow statement. This provides a clear snapshot of the company's financial position.

- Bookkeeping and General Ledger Maintenance: Recording all financial transactions, reconciling accounts (like bank statements and credit cards), and ensuring the general ledger is accurate and up-to-date. This is the foundational work upon which all other financial analysis is built.

- Tax Preparation and Compliance: A major area for many accountants, this involves preparing federal, state, and local tax returns for individuals or businesses. It also includes strategizing to minimize tax liability legally and ensuring compliance with ever-changing tax laws.

- Auditing: Examining an organization's financial records to ensure accuracy and compliance with laws and regulations. Auditors can be internal (working for the company) or external (working for a public accounting firm).

- Budgeting and Forecasting: Working with management to develop budgets, monitor spending, and create financial forecasts to help guide future business strategy.

- Advisory Services: Providing strategic advice on matters such as mergers and acquisitions, capital investments, risk management, and business planning. This is where accountants transition from scorekeepers to strategic MVPs.

- Payroll and Accounts Payable/Receivable: Ensuring employees are paid correctly and on time, managing payments to vendors, and tracking money owed to the company by its customers.

### A Day in the Life of a Corporate Accountant in Houston

To make this tangible, let's imagine a day for "Maria," a Senior Accountant at a mid-sized energy logistics company in Houston.

- 8:30 AM - 9:30 AM: Morning Reconciliation & Review. Maria starts her day by reviewing the previous day's financial transactions. She reconciles key bank accounts and investigates any discrepancies found in the automated reporting from their ERP (Enterprise Resource Planning) system, like SAP or Oracle.

- 9:30 AM - 11:00 AM: Month-End Close Preparation. It’s the third week of the month, so Maria is deep in preparations for the month-end close. She works on accruing expenses for services that have been rendered but not yet invoiced and prepares complex journal entries for prepaid assets and depreciation schedules.

- 11:00 AM - 12:00 PM: Cross-Departmental Meeting. Maria joins a video call with the Operations team. They are planning a major new equipment purchase, and she is there to provide analysis on the financial implications, discussing depreciation impact, cash flow timing, and potential financing options.

- 12:00 PM - 1:00 PM: Lunch & Professional Development. During her lunch break, Maria spends 30 minutes watching a webinar from the Texas Society of CPAs (TXCPA) on new changes to sales tax regulations affecting the logistics industry.

- 1:00 PM - 3:30 PM: Financial Analysis & Reporting. Maria pulls data from their business intelligence software (like Tableau) to analyze budget vs. actual variances for the previous month. She identifies that fuel costs were 15% over budget and begins drafting a report for the CFO, including commentary on rising market prices and operational inefficiencies she discussed with the Ops team.

- 3:30 PM - 5:00 PM: Responding to Inquiries & Planning. Maria spends the last part of her day responding to emails from external auditors who have questions about last quarter's filings. She also blocks out time on her calendar for the next day to begin drafting the preliminary financial statements for the current month.

This example illustrates that the role is a blend of detailed, technical work, collaborative problem-solving, and strategic communication.

Average Accountant Salary Texas: A Deep Dive

Now for the central question: how much can you expect to earn? The accountant salary Texas offers is highly competitive, reflecting the state's strong economy and high demand for financial professionals. It's crucial to look at a range of data sources to get a complete and trustworthy picture.

According to the U.S. Bureau of Labor Statistics (BLS) Occupational Employment and Wage Statistics program (May 2022 data), the most recent comprehensive dataset available:

- National Average Salary for Accountants and Auditors: $86,740 per year.

- Texas State Average Salary for Accountants and Auditors: $91,480 per year, or $44.00 per hour.

This immediately highlights that Texas pays its accountants, on average, more than the national standard. But averages only tell part of the story. The salary range is vast, depending heavily on factors we'll explore in the next section.

Let's break down the compensation landscape further using data from reputable salary aggregators, which often reflect more real-time, user-submitted data.

- Salary.com (as of March 2024) reports the average Staff Accountant salary in Texas is around $66,501, but the typical range falls between $60,571 and $73,195. For a more senior role like an Accounting Manager, the average in Texas jumps to $124,198, with a range typically between $110,612 and $139,077.

- Payscale.com (as of March 2024) indicates the average salary for an Accountant in Texas is $65,845. However, it provides a detailed breakdown showing that salary increases significantly with experience.

- Glassdoor.com (as of March 2024), which aggregates self-reported data, shows the total pay for an Accountant in Texas is an average of $85,553 per year, which includes an estimated base pay of $70,064 and additional pay (bonuses, profit sharing) of $15,489.

These different figures highlight an important truth: your title, experience, and the inclusion of variable pay drastically alter your earning potential. A "Staff Accountant" is typically an entry-to-mid-level role, while the BLS "Accountant and Auditor" category encompasses a much broader range of experience levels.

### Salary Brackets by Experience Level in Texas

To provide a clearer picture of the career trajectory, let's synthesize the data into typical salary brackets for accountants in Texas. These are estimates and can vary based on city, company, and specialization.

| Experience Level | Typical Years of Experience | Typical Role Titles | Estimated Annual Base Salary Range in Texas |

| ----------------------- | --------------------------- | -------------------------------------------------- | ------------------------------------------- |

| Entry-Level | 0-2 Years | Staff Accountant, Junior Accountant, Audit Associate | $55,000 - $70,000 |

| Mid-Career | 3-7 Years | Senior Accountant, Financial Analyst, Senior Auditor | $70,000 - $95,000 |

| Senior Professional | 8-15 Years | Accounting Manager, Controller, Senior Tax Manager | $95,000 - $140,000+ |

| Executive Level | 15+ Years | Director of Finance, VP of Finance, CFO | $150,000 - $300,000+ |

*Source: Synthesized from data by BLS, Salary.com, and Payscale.com, 2024.*

### Beyond the Base Salary: Understanding Total Compensation

Your salary is just one piece of the puzzle. Total compensation is a more accurate measure of your financial earnings. In Texas, especially in corporate and public accounting roles, additional compensation can be substantial.

- Annual Bonuses: These are extremely common and are typically tied to individual performance, department goals, and overall company profitability. A performance bonus can range from 5% of your base salary at the junior level to over 30% at the manager and director levels. Big Four accounting firms are famous for their structured bonus systems.

- Profit Sharing: Some companies, particularly private ones, distribute a portion of their profits to employees. This can be a significant addition to your annual income, though it's variable and depends entirely on the company's success.

- Stock Options / Restricted Stock Units (RSUs): More common in publicly traded companies and tech startups, equity compensation gives you ownership in the company. This can be a massive wealth-building tool, especially if the company's stock performs well. Accountants in tech hubs like Austin are more likely to see this as a major part of their compensation package.

- Signing Bonuses: To attract top talent in a competitive market like Texas, companies often offer a one-time signing bonus, which can range from a few thousand dollars for entry-level roles to tens of thousands for highly sought-after senior professionals.

- Retirement Benefits: Look for strong 401(k) or 403(b) plans with a generous company match. A 100% match on the first 6% of your contribution is essentially an instant, guaranteed 6% return on your investment and a key part of your long-term financial health.

- Other Perks: Don't underestimate the value of other benefits, such as comprehensive health insurance (medical, dental, vision), paid time off (PTO), flexible work arrangements (remote/hybrid options), and funding for professional development, including CPA exam fees and continuing professional education (CPE) credits.

When evaluating a job offer in Texas, it's critical to look at the entire compensation package, not just the base salary figure.

Key Factors That Influence Your Accountant Salary in Texas

Your salary is not a fixed number; it's a dynamic figure influenced by a powerful combination of your qualifications, choices, and market forces. Understanding these levers is the key to maximizing your earning potential. This is the most critical section for anyone looking to build a high-income accounting career in Texas.

### 1. Level of Education & Professional Certifications

Your educational foundation and professional credentials are the most significant initial drivers of your salary.

- Bachelor's Degree: A Bachelor's degree in Accounting is the standard, non-negotiable entry ticket to the profession. It provides the fundamental knowledge of accounting principles, taxation, auditing, and business law.

- Master's Degree (M.Acc or MSA): A Master of Accountancy (M.Acc) or Master of Science in Accounting (MSA) can provide a starting salary advantage, often 5-10% higher than that of a candidate with only a bachelor's. More importantly, it is the most common path to meeting the 150-hour credit requirement to sit for the CPA exam in Texas.

- MBA with an Accounting Concentration: An MBA can also be highly valuable, particularly for those aspiring to executive leadership roles (Controller, CFO). It signals a broader understanding of business strategy, finance, marketing, and operations, which is highly prized in industry accounting roles.

The CPA: The Gold Standard and Salary Multiplier

The Certified Public Accountant (CPA) license is, without a doubt, the single most impactful credential an accountant can earn. It is a state-issued license that signifies the highest level of competence in the field.

- Salary Impact: Earning your CPA license typically results in an immediate salary premium of 10-15%. Over a lifetime, the total earnings difference between a CPA and a non-CPA accountant can exceed $1 million, according to the AICPA. A 2021 Robert Half Salary Guide noted that certifications like the CPA can boost salaries by 5% to 15%.

- Career Opportunities: The CPA is a mandatory requirement for many roles, especially in public accounting (you cannot sign an audit report without it) and for most senior management positions (Accounting Manager, Controller, CFO) in publicly traded companies. It opens doors that remain closed to non-licensed accountants.

- The Path in Texas: To become a CPA in Texas, you must meet the requirements of the Texas State Board of Public Accountancy (TSBPA), which includes completing 150 semester hours of education, passing all four sections of the rigorous CPA Exam, and obtaining relevant work experience.

Other Valuable Certifications:

While the CPA is paramount, other certifications can significantly boost your salary in specialized niches:

- Certified Management Accountant (CMA): Ideal for accountants in corporate finance and management roles. Focuses on financial planning, analysis, control, and decision support.

- Certified Internal Auditor (CIA): The global standard for those specializing in internal audit.

- Certified Information Systems Auditor (CISA): Highly lucrative for accountants working at the intersection of IT and finance, specializing in auditing information systems and cybersecurity controls.

- Certified Fraud Examiner (CFE): For those specializing in forensic accounting and fraud detection.

### 2. Years of Experience and Career Progression

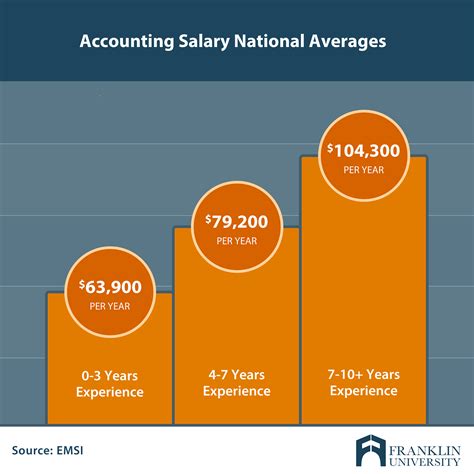

Experience is a powerful determinant of salary. Your value—and your paycheck—grows as you move from executing tasks to managing processes, and finally, to driving strategy.

- Entry-Level (0-2 Years): At this stage, you're learning the ropes. Your primary value is your academic knowledge, work ethic, and ability to learn quickly. Salaries in Texas for this group typically range from $55,000 to $70,000. Those starting at a Big Four firm in a major city like Dallas or Houston will be at the higher end of this range.

- Mid-Career (3-7 Years): You've proven your competence and now operate with more autonomy. You may be leading smaller projects or mentoring junior staff. Your salary sees a significant jump into the $70,000 to $95,000 range. This is often the period where accountants earn their CPA and make a strategic move from public accounting to a higher-paying industry role.

- Senior/Managerial Level (8-15 Years): You are now a manager of people and processes. You are responsible for the work of a team, signing off on financial reports, and interfacing with senior leadership. Your role is more strategic. A CPA is almost always required at this level. Salaries push well into six figures, from $95,000 to $140,000+. An Accounting Manager in a large Houston corporation could easily earn over $130,000 before bonuses.

- Executive Level (15+ Years): As a Director, VP of Finance, or Chief Financial Officer (CFO), you are part of the executive team. Your decisions shape the entire company's financial future. Compensation becomes heavily weighted toward bonuses and equity, with base salaries often starting at $150,000 and total compensation packages reaching $300,000 to $500,000 or more, depending on the size of the company.

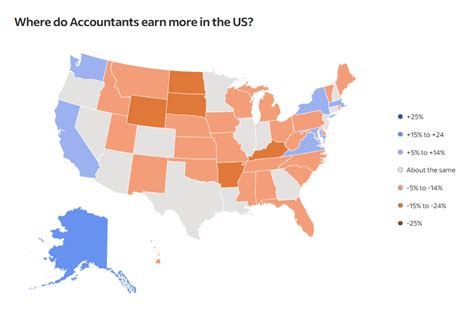

### 3. Geographic Location Within Texas

"Texas" is not a monolith. Where you work within the state has a profound impact on your salary, though it must be weighed against the cost of living.

| Metro Area | Average Accountant Salary (BLS, May 2022) | Key Industries | Notes on Cost of Living (vs. National Average) |

| ------------------- | ----------------------------------------- | --------------------------------------------- | ---------------------------------------------- |

| Houston-The Woodlands-Sugar Land | $97,970 | Oil & Gas, Healthcare, Logistics, Aerospace | Approximately 2% below national average. |

| Dallas-Fort Worth-Arlington | $92,020 | Financial Services, Tech, Defense, Real Estate | Approximately 3% above national average. |

| Austin-Round Rock | $90,140 | Technology, Startups, Government, Education | Approximately 18% above national average. |

| San Antonio-New Braunfels | $84,180 | Military/Defense, Healthcare, Tourism | Approximately 10% below national average. |

| Midland | $106,600 | Oil & Gas (Permian Basin) | Approximately 1% below national average (volatile).|

*Source: BLS MSA data (May 2022) and Payscale Cost of Living Calculator (2024).*

Analysis:

- Highest Paying: The Houston and Midland metro areas stand out as the highest-paying regions, largely driven by the high salaries in the lucrative oil and gas industry. An accountant working for an energy giant like ExxonMobil or a major oilfield services company in Midland can expect to earn a significant premium.

- Best Value: San Antonio offers a compelling value proposition. While salaries are lower than in Houston or Dallas, the cost of living is significantly lower, meaning your paycheck may stretch further.

- The Austin Conundrum: Austin's salaries are competitive but have not fully kept pace with its explosive rise in cost of living, particularly housing. The draw here is the vibrant tech scene and the potential for equity compensation in startups, which could lead to a massive payoff down the line.

- Dallas-Fort Worth: DFW is a balanced, mature market with a huge concentration of corporate headquarters (American Airlines, AT&T) and financial services firms, offering a vast number of diverse opportunities.

### 4. Company Type & Size

The type and size of your employer create different cultures, workloads, and compensation structures.

- Public Accounting (The Big Four): The four largest professional services firms (Deloitte, PwC, EY, KPMG) are known for paying top-tier starting salaries to attract the best talent from universities. They offer structured training and prestigious experience. The trade-off is notoriously long hours, especially during "busy season." A starting Audit or Tax Associate in their Dallas or Houston offices can expect a salary in the high $60s to low $70s.

- Public Accounting (Regional & Local Firms): Mid-sized and smaller firms may offer slightly lower starting salaries but often provide a better work-life balance and more direct client contact earlier in your career.

- Corporate/Industry Accounting (Fortune 500): Working in the accounting department of a large, publicly traded corporation (e.g., Dell in Austin, Valero Energy in San Antonio) offers high salaries, excellent benefits, and strong internal career paths. A Senior Accountant here could earn $90,000+.

- Corporate/Industry Accounting (Startups & Small Businesses): Salaries may be lower, and benefits less robust. The trade-off is often a more dynamic environment, broader responsibilities, and the potential for equity (stock options) that could be immensely valuable if the company succeeds.

- Government Accounting: Working for federal (e.g., IRS, FBI), state (e.g., Texas Comptroller's Office), or local agencies offers unparalleled job security and excellent benefits, including pensions. Salaries are typically lower than in the private sector but follow a transparent, structured pay scale (like the GS scale for federal jobs).

- Non-Profit Accounting: Driven by mission rather than profit, non-profits generally pay less than for-profit entities. The reward is often a strong sense of purpose and a good work-life balance.

### 5. Area of Specialization

Generalist accountants are always needed, but specialists command the highest salaries. Developing expertise in a high-demand niche is one of the fastest ways to increase your value.

High-Paying Specializations:

- Information Technology (IT) Audit: As businesses become more digital, the need for accountants who can audit complex IT systems, cybersecurity controls, and data integrity is exploding. A CISA-certified IT Auditor can earn a 15-20% premium over a traditional financial auditor.

- Forensic Accounting: These financial detectives investigate fraud, financial crimes, and litigation disputes. It's a high-stakes, high-reward field for those with an analytical and inquisitive mind. CFEs are in high demand.

- Mergers & Acquisitions (M&A) / Transaction Advisory: Accountants in this field perform due diligence on potential corporate acquisitions, helping to value companies and structure deals. It's a project-based, high-pressure environment with very lucrative compensation, often found within Big Four firms.

- International Tax: For multinational corporations operating in Texas, navigating the labyrinth of international tax law is critical. Accountants with expertise in transfer pricing, tax treaties, and foreign tax credits are immensely valuable.

- SEC Reporting: Accountants who specialize in preparing and filing reports with the Securities and Exchange Commission for publicly traded companies hold a critical compliance role. This requires deep technical knowledge and commands a high salary.

- Environmental, Social, and Governance (ESG) Accounting: An emerging but rapidly growing field. Companies are increasingly required to report on their sustainability and social impact, creating a need for accountants who can measure, verify, and report on these non-financial metrics.

### 6. In-Demand Skills

Beyond your formal credentials, a specific set of technical and soft skills can make you a more valuable—and higher-paid—candidate.

Technical Skills:

- Advanced Excel: This is non-negotiable. You must be a master of PivotTables, VLOOKUP/XLOOKUP, index-match, and complex formulas.

- **Enterprise Resource Planning (ERP)