Decoding Your Earning Potential: A Deep Dive into Quantitative Developer Salaries

In the high-stakes world where finance and technology collide, the role of a Quantitative Developer, or "Quant Developer," stands out as one of the most intellectually demanding and financially rewarding careers available. For those with a rare blend of expertise in mathematics, computer science, and finance, the compensation can be staggering. But what does a quantitative developer salary actually look like?

For talented professionals, six-figure starting salaries are the norm, with total compensation packages for experienced individuals frequently soaring well into the seven-figure range. This article breaks down the data to give you a clear picture of what you can expect to earn and the key factors that will shape your financial future in this elite field.

What Does a Quantitative Developer Do?

Before we dive into the numbers, let's clarify the role. A quantitative developer is the architect and engineer of modern automated finance. They don't just analyze financial markets; they build the sophisticated software that executes trading strategies.

Their primary responsibilities include:

- Developing and Implementing Trading Algorithms: Translating complex mathematical models (created by quant researchers) into robust, high-performance code.

- Building Trading Infrastructure: Creating the low-latency systems and platforms necessary for high-frequency and algorithmic trading.

- Data Analysis and Management: Designing systems to process and analyze massive datasets to find trading signals and manage risk.

- Backtesting Strategies: Running historical simulations to validate the effectiveness and risk profile of new trading models before they are deployed with real capital.

In essence, a quant developer is a highly specialized software engineer who operates at the bleeding edge of financial technology.

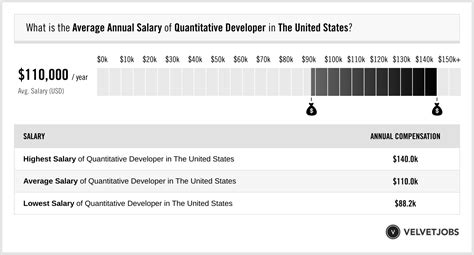

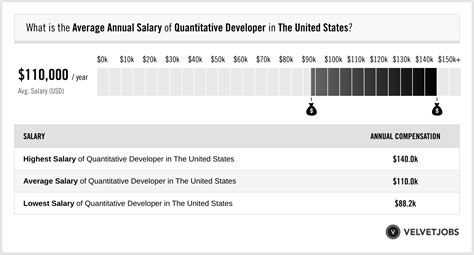

Average Quantitative Developer Salary

It's crucial to distinguish between *base salary* and *total compensation*. In quantitative finance, a significant portion of earnings comes from performance-based bonuses, which can often exceed the base salary.

- Average Base Salary: According to data from early 2024, the average base salary for a quantitative developer in the United States falls into a wide range.

- Salary.com reports an average base salary of approximately $155,836, with a typical range between $139,403 and $170,394.

- Glassdoor lists a higher average, suggesting a median total pay of $187,552 per year, with a likely range for total pay spanning from $141,000 to $257,000.

- Total Compensation by Experience Level: The real story is told through total compensation packages (base + bonus + other incentives).

- Entry-Level (0-2 years): Graduates, typically with a Master's or PhD, can expect a total compensation package in the range of $175,000 to $300,000+.

- Mid-Level (3-8 years): With a proven track record, professionals can see their total compensation grow to $300,000 to $600,000+.

- Senior/Lead (8+ years): Top-performing senior quants who directly contribute to a firm's profitability can earn $600,000 to well over $1,000,000 annually. For partners or those managing highly successful trading pods, multi-million dollar compensation is not uncommon.

Key Factors That Influence Salary

Your specific salary is not a single number but a function of several critical variables. Understanding these factors is key to maximizing your earning potential.

Level of Education

Education serves as a primary gatekeeper and salary determinant. While a bachelor's degree in a technical field is the minimum, advanced degrees are the standard.

- Master's Degree: A Master's in Financial Engineering (MFE), Computer Science, or a quantitative science is often the entry ticket. It demonstrates specialized knowledge and analytical maturity.

- Ph.D.: A doctorate in a highly quantitative field like Physics, Mathematics, Statistics, or Computer Science is the gold standard, especially at top-tier hedge funds and proprietary trading firms. A Ph.D. signals elite problem-solving ability and the capacity for original research, which commands the highest starting salaries.

Years of Experience

Experience is directly correlated with compensation, especially when that experience translates to a quantifiable impact on the firm's P&L (Profit and Loss).

- Junior (0-2 years): Focus is on learning the systems, coding standards, and financial domain. Compensation is high but more heavily weighted toward base salary.

- Mid-Career (3-8 years): Developers take on more ownership, leading projects and designing systems. Their ability to deliver profitable and stable trading systems is proven, leading to significantly larger performance bonuses.

- Senior (8+ years): These professionals are often leaders, architects, or specialists in a highly profitable niche. Their compensation is heavily tied to the performance of the strategies and systems they oversee. Their deep institutional knowledge and experience make them invaluable and extremely well-compensated.

Geographic Location

Quant finance is concentrated in global financial hubs, and salaries reflect the high cost of living and intense competition for talent in these cities.

- New York City & Chicago: As the epicenters of finance and trading in the U.S., these cities offer the highest salaries for quantitative developers. The concentration of hedge funds, prop shops, and investment banks creates fierce competition for top talent.

- Other U.S. Hubs: Cities like Boston, Houston, and the San Francisco Bay Area also have a growing number of quantitative roles, with competitive but sometimes slightly lower salaries than New York.

- Global Hubs: London, Hong Kong, and Singapore are major international centers for finance and offer compensation packages on par with, and sometimes exceeding, those in the United States, though they are subject to different tax structures.

Company Type

The type of firm you work for is arguably the biggest determinant of your potential earnings.

- Hedge Funds & Proprietary Trading Firms (e.g., Citadel, Jane Street, Two Sigma): These firms represent the pinnacle of compensation. Because their profits are directly tied to trading success, they offer enormous performance bonuses to quants who create profitable systems. The work is extremely demanding and the culture is highly competitive.

- Investment Banks (e.g., Goldman Sachs, JPMorgan Chase, Morgan Stanley): These institutions offer very competitive and lucrative salaries, with structured bonus pools. While total compensation is excellent, it may not reach the astronomical heights of the top hedge funds. They are often excellent places to receive formal training and build a strong professional network.

- Asset Management Firms & Fintech Companies: These firms also employ quant developers for portfolio management, risk analysis, and building financial products. Compensation is very strong but can be more variable, sometimes offering more stock options or equity in place of the massive cash bonuses seen at hedge funds.

Area of Specialization

Within the quant world, different specializations require different skills and can command different pay scales.

- High-Frequency Trading (HFT): Developers specializing in building ultra-low-latency systems, often using C++ and hardware acceleration, are in extremely high demand and can command top salaries due to the direct and immediate P&L impact.

- Statistical Arbitrage (StatArb): This involves deep knowledge of statistical modeling and languages like Python and R. The direct link to profitability also ensures high compensation.

- Derivatives Pricing and Modeling: This requires profound mathematical knowledge (e.g., stochastic calculus) and is critical for investment banks and firms dealing with complex options and exotic products.

- Quantitative Risk Management: While sometimes seen as a cost center rather than a profit center, these roles are critically important and command very high salaries, though perhaps a tier below alpha-generating roles.

Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) does not track "Quantitative Developer" as a distinct profession, the outlook for its component parts is exceptionally strong.

- The BLS projects that employment for Software Developers will grow by 25% from 2022 to 2032, much faster than the average for all occupations.

- Similarly, employment for Financial and Investment Analysts is projected to grow by 8%, also faster than average.

The increasing computerization of financial markets, the explosion of data, and the relentless search for a competitive edge mean that demand for skilled quantitative developers will remain incredibly high. This is not a career path that is likely to be automated away; rather, these are the professionals driving the automation.

Conclusion

Pursuing a career as a quantitative developer is a path for the ambitious and the brilliant. The journey requires an elite education, a passion for complex problem-solving, and resilience in a high-pressure environment.

However, the rewards are commensurate with the challenge. For those who succeed, this career offers not only some of the highest compensation packages in the professional world but also the opportunity to work on deeply stimulating intellectual challenges at the forefront of technology and finance.

Key Takeaways:

- Focus on total compensation, as bonuses are a massive part of your earnings.

- An advanced degree (Master's or PhD) in a quantitative field is your most valuable credential.

- Your earning potential will grow exponentially with proven experience that impacts the bottom line.

- The type of firm you join—hedge fund, investment bank, etc.—is the single largest factor influencing your salary ceiling.

If you have the talent and the drive, the field of quantitative development offers a career trajectory with nearly limitless potential.