Are you meticulous, analytical, and fascinated by the financial heartbeat of a business? Do you find satisfaction in ensuring accuracy, optimizing processes, and safeguarding a company's most vital resource—its cash? If so, a career as an Accounts Payable (AP) Analyst might be the perfect fit for you. This role is far more than just processing invoices; it's a critical function that sits at the intersection of finance, vendor management, and data analysis.

But beyond the daily responsibilities, a crucial question for any aspiring professional is: what is the earning potential? The average accounts payable analyst salary in the United States typically falls between $55,000 and $75,000 per year, with top earners in high-demand locations and specialized roles commanding salaries well over $90,000. This guide will provide a comprehensive, data-backed exploration of that figure, breaking down every factor that influences your pay, from your education and location to the specific skills you bring to the table.

I remember early in my career, I witnessed an AP Analyst save a mid-sized tech company from a potential disaster. She flagged a series of invoices from a major vendor that looked almost identical to a set paid just weeks before. Instead of simply processing them, her analytical instincts kicked in. After a deep dive and a few calls, she uncovered a sophisticated duplicate billing scheme that would have cost the company over $85,000. That day, her value wasn't just in her efficiency—it was in her critical thinking and financial guardianship. That is the power of a great analyst.

This article is designed to be your definitive resource, whether you're just starting to consider this path or you're an experienced professional looking to maximize your earnings. We will delve into every aspect of this rewarding career.

### Table of Contents

- [What Does an Accounts Payable Analyst Do?](#what-they-do)

- [Average Accounts Payable Analyst Salary: A Deep Dive](#average-salary)

- [Key Factors That Influence Your Salary](#key-factors)

- [Job Outlook and Career Growth](#job-outlook)

- [How to Become an Accounts Payable Analyst](#how-to-start)

- [Conclusion: Is This Career Right for You?](#conclusion)

What Does an Accounts Payable Analyst Do?

An Accounts Payable Analyst is the financial gatekeeper of a company's outflow of cash. They are responsible for ensuring that all vendor invoices, employee expense reports, and other requests for payment are legitimate, accurate, and paid on time. While an "AP Clerk" might focus primarily on data entry, the "Analyst" designation implies a higher level of scrutiny, problem-solving, and process improvement.

Think of the AP department as a critical control point. Every dollar a company spends on goods, services, and overhead must pass through this team. The AP Analyst’s job is to manage this complex flow with precision and integrity. They don’t just pay the bills; they analyze spending patterns, manage relationships with suppliers, ensure compliance with company policies, and protect the organization from fraud and financial waste.

Their work directly impacts a company’s financial statements, cash flow, and supplier relationships. A missed payment can damage a company's credit and reputation, while a duplicate payment directly hurts the bottom line.

### Core Responsibilities and Daily Tasks

While the specifics can vary by company size and industry, the core duties of an AP Analyst generally include:

- Invoice Processing and Verification: Receiving, coding, and processing a high volume of vendor invoices. This involves matching invoices to purchase orders (POs) and receiving documents (a process known as the "three-way match") to verify the legitimacy of each charge.

- Vendor Management: Onboarding new vendors, maintaining accurate vendor files (including tax information like W-9 forms), and serving as the primary point of contact for payment-related inquiries.

- Payment Execution: Preparing and scheduling weekly or bi-weekly payment runs via check, ACH, wire transfer, or virtual card.

- Reconciliation and Reporting: Reconciling AP sub-ledgers to the general ledger, performing monthly accruals for unpaid invoices, and producing reports such as AP aging, cash disbursement forecasts, and key performance indicators (KPIs).

- Expense Report Auditing: Reviewing and auditing employee expense reports to ensure compliance with the company's travel and expense (T&E) policy.

- Problem Resolution: Investigating and resolving invoice discrepancies, payment issues, and vendor disputes in a timely and professional manner.

- Process Improvement and Analysis: Analyzing current AP processes to identify inefficiencies, bottlenecks, or control gaps. They often recommend and help implement new technologies (like automation software) or streamlined workflows.

- Compliance and Control: Ensuring adherence to financial regulations, tax laws (like 1099 reporting), and internal controls to prevent fraud.

### A Day in the Life of an AP Analyst

To make this more concrete, let's walk through a typical day for an analyst at a mid-sized manufacturing company.

- 8:30 AM - 9:30 AM: Morning Triage. The day begins by reviewing the AP department's shared inbox and the invoice processing queue. The analyst sorts incoming invoices, prioritizes urgent requests, and responds to initial inquiries from vendors asking about payment status. They might quickly resolve a simple issue, like a vendor who forgot to include a PO number on their invoice.

- 9:30 AM - 12:00 PM: High-Volume Processing and Three-Way Matching. This is a period of focused work. The analyst processes a batch of 50+ invoices for raw materials. For each one, they access the company's Enterprise Resource Planning (ERP) system (like SAP or Oracle NetSuite) to match the invoice details against the corresponding purchase order and the goods receipt note from the warehouse. A discrepancy is found: one invoice is for 120 units, but the warehouse only received 115. The analyst flags this, puts the invoice "on hold," and emails the procurement and warehouse managers to investigate.

- 12:00 PM - 1:00 PM: Lunch.

- 1:00 PM - 2:30 PM: Vendor Relations and Problem-Solving. The analyst spends time on the phone with a key supplier whose payment is late. By checking the system, the analyst sees the payment was scheduled correctly but the vendor's banking details were recently changed and not updated. The analyst works with the vendor to get the correct ACH information and re-schedules the payment for an emergency run. This proactive communication maintains a good relationship.

- 2:30 PM - 4:00 PM: Reporting and Analysis. It's nearing the end of the month. The analyst runs an "AP Aging Report," which shows all outstanding invoices and how long they've been unpaid. They analyze the report to identify any invoices nearing their due date that are still on hold and follow up with the relevant departments to get them resolved before they become overdue. They also start preparing the monthly accrual journal entry for invoices received but not yet processed.

- 4:00 PM - 5:00 PM: Preparing for Tomorrow. The analyst reviews the upcoming payment run scheduled for the next day, ensuring all necessary approvals have been obtained. They clear out their inbox, update their task list, and leave a note for the AP Manager about the resolved vendor payment issue.

This snapshot shows how the role blends routine processing with dynamic problem-solving, analytical work, and crucial communication skills.

Average Accounts Payable Analyst Salary: A Deep Dive

The salary for an Accounts Payable Analyst is a compelling aspect of the career, offering a stable income with significant growth potential. While the national average provides a good baseline, your actual earnings will be a composite of your experience, location, skills, and several other factors we'll explore in the next section.

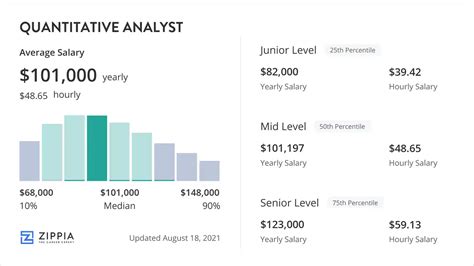

To provide the most accurate picture, we've synthesized data from several authoritative sources. It's important to note that different platforms use different data sets and methodologies, which accounts for the slight variations.

- According to Salary.com, as of late 2023, the median salary for an Accounts Payable Analyst in the United States is $61,847. The typical range falls between $55,593 and $69,328.

- Payscale.com reports a slightly lower average base salary of around $56,050 per year. Their data shows a range from approximately $44,000 to $71,000.

- Glassdoor, which incorporates user-submitted data, estimates the total pay (including bonuses and other compensation) for an AP Analyst to be around $64,300 per year, with a likely range between $54,000 and $77,000.

Synthesizing these sources, a realistic national average salary for a qualified Accounts Payable Analyst is approximately $60,000 to $65,000 per year.

### Salary by Experience Level

Your salary will grow significantly as you gain experience and take on more complex responsibilities. The progression from an entry-level position to a senior or lead role is often accompanied by substantial pay increases.

Here’s a typical salary progression, based on a compilation of industry data:

| Experience Level | Years of Experience | Typical Salary Range (Annual) | Key Responsibilities |

| :--- | :--- | :--- | :--- |

| Entry-Level AP Analyst | 0-2 Years | $48,000 - $58,000 | Core invoice processing, data entry, basic vendor communication, three-way matching, learning ERP systems. |

| Mid-Career AP Analyst | 3-7 Years | $59,000 - $72,000 | Handling complex invoices, resolving escalated vendor issues, month-end closing tasks (reconciliations, accruals), training junior staff, suggesting process improvements. |

| Senior / Lead AP Analyst | 8+ Years | $73,000 - $90,000+ | Overseeing the entire AP cycle, managing complex vendor accounts, leading process automation projects, developing reports for management, forecasting cash disbursements, mentoring the team. |

As a Senior AP Analyst, you are no longer just a processor; you are a strategic partner to the finance department. You might be the go-to expert for the company's ERP system, lead the implementation of a new e-invoicing platform, or perform detailed spend analysis that helps the procurement team negotiate better rates with vendors. This strategic value is what commands the higher salary.

### Beyond the Base Salary: Understanding Total Compensation

Your annual salary is only one part of your overall earnings. AP Analysts, especially in corporate environments, are often eligible for additional forms of compensation that can significantly boost their total take-home pay.

- Bonuses: Annual or quarterly performance bonuses are common. These are typically tied to individual goals (e.g., processing accuracy, project completion) and company performance (e.g., profitability targets). A bonus can range from 3% to 10% of your base salary, and sometimes more in high-performing companies.

- Profit Sharing: Some companies offer profit-sharing plans, where a portion of the company's profits is distributed among employees. This directly links your compensation to the organization's success.

- Benefits Package: While not direct cash, the value of a strong benefits package is immense. This includes:

- Health Insurance: Medical, dental, and vision insurance. A good employer plan can be worth thousands of dollars a year.

- Retirement Savings: 401(k) or 403(b) plans are standard. A key differentiator is the employer match. An employer matching 100% of your contributions up to 5% of your salary is essentially a 5% raise dedicated to your retirement.

- Paid Time Off (PTO): This includes vacation days, sick leave, and holidays. Generous PTO policies contribute to a better work-life balance.

- Tuition Reimbursement: Many companies will help pay for further education or professional certifications, a direct investment in your career growth.

- Stock Options/Equity: While more common in startups and publicly traded tech companies, receiving stock options can be a highly lucrative component of compensation if the company performs well.

When evaluating a job offer, it's crucial to look at the total compensation package, not just the base salary. An offer with a slightly lower base salary but a fantastic bonus structure, a high 401(k) match, and excellent health insurance could be far more valuable in the long run.

Key Factors That Influence an Accounts Payable Analyst Salary

Why does one AP Analyst earn $52,000 while another in a different company or city earns $82,000? The difference lies in a combination of several key factors. Understanding these variables is the first step toward strategically maximizing your own earning potential. This section provides a detailed breakdown of the most impactful drivers of an AP Analyst's salary.

### 1. Level of Education and Professional Certifications

Your educational background provides the foundation for your career and is often a primary screening tool for employers.

- High School Diploma / Associate's Degree: It is possible to enter the field, often as an AP Clerk or specialist, with a high school diploma and relevant office experience. An Associate's degree in Accounting or Business Administration can give you a significant edge and a higher starting salary, typically placing you at the lower end of the entry-level range ($48k - $52k).

- Bachelor's Degree: A Bachelor's degree in Accounting, Finance, or Business Administration is the most common and preferred qualification for an AP *Analyst* role. It signals a deeper understanding of accounting principles (like GAAP), financial controls, and analytical methods. Graduates with a bachelor's degree can expect to start higher in the salary range (often $55k+) and will find they have a much clearer path to advancement and senior roles.

- Professional Certifications: This is where you can truly differentiate yourself and justify a higher salary. Certifications demonstrate specialized expertise and a commitment to your profession. The most recognized certifications in the accounts payable field are offered by the Institute of Finance & Management (IOFM):

- Accredited Payables Specialist (APS): This certification is ideal for those in the first few years of their career. It covers the fundamentals of invoice handling, T&E, payments, and internal controls. Earning your APS can add 5-10% to your base salary and make you a more attractive candidate for mid-level roles.

- Accredited Payables Manager (APM): Aimed at experienced professionals and those aspiring to leadership, the APM certification covers higher-level topics like automation, fraud prevention, compliance, and departmental management. Holding an APM designation can significantly boost your earning potential, often pushing you into the senior analyst and manager salary brackets. It signals to employers that you have the skills to not just perform tasks, but to lead and optimize the entire AP function.

### 2. Years and Quality of Experience

As shown in the previous section, experience is arguably the single biggest driver of salary growth. However, it's not just about the number of years; it's about the *quality* and *complexity* of that experience.

- Entry-Level (0-2 Years): Your focus is on learning the ropes and demonstrating reliability. Your value is in your accuracy and efficiency in core processing tasks. Salary growth comes from mastering the fundamentals and the company's specific systems.

- Mid-Career (3-7 Years): You are now expected to be an independent problem-solver. Your salary increases because you can handle non-standard invoices, resolve complex vendor disputes without supervision, and assist with more analytical tasks like month-end close. Experience with a major ERP system implementation or a process improvement project during these years is a huge resume-builder.

- Senior/Lead (8+ Years): At this stage, your value is strategic. You are paid more because you can think beyond the invoice. You mentor junior staff, analyze departmental KPIs, generate cash flow forecasts, and identify opportunities for cost savings. An analyst who can say, "By analyzing our payment terms, I identified an opportunity to capture an additional $50,000 in early payment discounts annually," is invaluable and will be compensated accordingly.

### 3. Geographic Location

Where you work has a massive impact on your paycheck, largely due to variations in cost of living and the concentration of large corporate headquarters. A salary that feels comfortable in one city might be difficult to live on in another.

- High-Paying States and Metropolitan Areas: Salaries are typically highest in major economic hubs with a high cost of living.

- States: California, New York, Massachusetts, New Jersey, and Washington D.C. consistently offer the highest salaries for finance professionals.

- Cities: Expect to see the top salary figures in cities like San Jose, CA; San Francisco, CA; New York, NY; Boston, MA; and Seattle, WA. In these locations, a Senior AP Analyst can easily command a salary north of $85,000 - $95,000. However, this is balanced by significantly higher costs for housing, transportation, and daily living.

- Average-Paying Areas: Most of the country falls into this category, including major cities in Texas (Dallas, Houston), Illinois (Chicago), Georgia (Atlanta), and Colorado (Denver). Salaries here will hew closely to the national averages we've discussed.

- Lower-Paying Areas: Rural regions and states with a lower cost of living, particularly in the South and Midwest, will generally offer lower salaries. An AP Analyst position in a smaller city in Mississippi or Arkansas might pay closer to $45,000 - $55,000.

Note on Remote Work: The rise of remote work has slightly complicated this factor. Some companies now pay a single national rate regardless of location, while others use a "geo-arbitrage" model, adjusting your salary based on your location's cost of living. When considering remote roles, it is essential to clarify the company's compensation philosophy.

### 4. Company Type, Size, and Industry

The type of organization you work for plays a significant role in determining your salary and compensation structure.

- Large Corporations (Fortune 500): These companies typically offer the highest base salaries, structured bonus programs, and comprehensive benefits. They have large, complex AP departments, often using sophisticated ERP systems like SAP or Oracle. The work can be more specialized but also offers a clear corporate ladder for advancement.

- Startups and Tech Companies: Compensation here can be a mixed bag. The base salary might be slightly lower or on par with a large corporation, but it is often supplemented with potentially lucrative stock options. The environment is fast-paced, and your role might be broader, blending AP with general accounting or operations.

- Small and Medium-Sized Businesses (SMBs): Salaries at SMBs are often slightly below those at large corporations. However, you may have more visibility and a broader range of responsibilities, which can be excellent for skill development.

- Non-Profit Organizations: Non-profits and educational institutions typically pay less than for-profit companies. The tradeoff is often a better work-life balance, strong benefits, and the satisfaction of working for a mission-driven organization.

- Government: Government AP roles at the federal, state, or local level offer immense job security and excellent benefits (pensions, generous leave). The base salaries are often competitive with the private sector at the entry and mid-levels but may have lower ceilings for senior positions compared to top-tier corporations.

The industry also matters. An AP Analyst at a financial services firm or a high-tech company may earn more than one in the retail or hospitality sectors, reflecting the overall profitability and salary scales of those industries.

### 5. In-Demand Skills: The Ultimate Salary Booster

This is the area where you have the most direct control. Developing specific, high-value skills can dramatically increase your marketability and salary.

Technical & Hard Skills:

- ERP System Proficiency: Deep expertise in a major ERP system is non-negotiable for top earners. Experience with SAP, Oracle NetSuite, Microsoft Dynamics 365, or Workday is highly sought after. Being the "super-user" or go-to expert on these platforms is a direct path to higher pay.

- Advanced Microsoft Excel: Basic Excel is a given. High-paid analysts are masters of VLOOKUPs, INDEX/MATCH, Pivot Tables, and data modeling. The ability to manipulate and analyze large data sets in Excel to create reports and find insights is a critical skill.

- Data Analytics and Visualization: The future of AP is analytical. Skills in using tools like Tableau or Power BI to visualize spending trends, vendor performance, and departmental KPIs can set you apart and move you from an analyst role toward a finance business partner role.

- Automation Software Experience: Companies are rapidly adopting AP automation tools (e.g., Bill.com, Tipalti, AvidXchange). Experience implementing or working extensively with these platforms is a massive advantage, as you can help companies become more efficient.

- Understanding of Accounting Principles (GAAP): A strong grasp of Generally Accepted Accounting Principles, especially concerning accruals, expense recognition, and capitalization vs. expense, is crucial for accuracy and advancement.

Soft Skills:

- Problem-Solving and Critical Thinking: The ability to investigate a discrepancy, identify the root cause, and propose a solution is the core of the "analyst" function.

- Communication Skills: You must be able to communicate clearly and professionally with vendors, internal stakeholders (from procurement to department heads), and management.

- Negotiation Skills: While not a primary duty, the ability to negotiate payment terms with vendors or resolve disputes in a financially favorable way adds tangible value.

- Meticulous Attention to Detail: In a role where a misplaced decimal can cost thousands of dollars, an obsessive focus on accuracy is paramount.

- Time Management and Organization: Successfully juggling high-volume processing, month-end deadlines, and ad-hoc requests requires exceptional organizational skills.

By strategically developing these skills through experience, self-study, and certifications, you can actively steer your career toward the higher end of the salary spectrum.

Job Outlook and Career Growth

When considering a long-term career, salary is only one part of the equation. Job stability, future demand, and opportunities for advancement are equally important. For Accounts Payable Analysts, the future is a story of evolution, not extinction.

### The Official Outlook: A Story of Automation and Evolution

The U.S. Bureau of Labor Statistics (BLS) does not have a separate category for "Accounts Payable Analyst." Instead, it groups them within the broader category of "Bookkeeping, Accounting, and Auditing Clerks."

According to the latest BLS Occupational Outlook Handbook, employment in this category is projected to decline 5 percent from 2022 to 2032.

At first glance, this projection may seem alarming. However, it is crucial to understand the context. The decline is almost entirely attributed to technological advancements and automation software that are streamlining or eliminating the most routine, data-entry-focused tasks. The simple job of keying in invoice numbers and amounts is indeed becoming automated.

This is precisely why the "Analyst" role is becoming more important, not less.

The future of accounts payable belongs to professionals who can manage, interpret, and leverage the technology, not be replaced by it. Companies still need skilled individuals to:

- Manage and oversee the automation systems.

- Handle the exceptions that the software cannot.

- Analyze the data that these systems produce to provide strategic insights.

- Maintain vendor relationships and resolve complex disputes.

- Design and enforce internal controls to prevent fraud in an increasingly digital environment.

Therefore, while the number of purely clerical AP jobs may decrease, the demand for skilled AP Analysts with strong technical and analytical skills is expected to remain stable and may even grow within specific sectors. The key is to position yourself as the person who can think critically about the data, not just input it.

### Emerging Trends and Future Challenges

To thrive in the coming decade, AP Analysts must stay ahead of several key trends:

1. Hyper-Automation and AI: Artificial Intelligence (AI) and Machine Learning (ML) are moving beyond simple Optical Character Recognition (OCR) to perform intelligent invoice coding, fraud detection, and duplicate analysis. Future analysts will need to be comfortable working alongside these "digital assistants."

2. E-Invoicing and Supplier Portals: The push to eliminate paper is accelerating. Analysts will need to be proficient in managing electronic invoicing platforms