In the intricate financial machinery of any successful company, there are certain roles that, while not always in the spotlight, are absolutely critical to survival and growth. The Accounts Receivable (AR) Manager is one of these unsung heroes. They are the guardians of a company's most vital asset: its incoming cash. If you're a detail-oriented, strategic-minded professional with a knack for finance and leadership, this career path offers not just stability but significant financial rewards and a direct impact on a company's bottom line. But what does that translate to in terms of compensation? The average Accounts Receivable Manager salary in the United States hovers around a robust $95,000 per year, with a typical range falling between $83,000 and $110,000. However, for top-tier professionals in high-demand markets, this figure can easily soar past $130,000 or more.

This article is more than just a list of numbers; it's a comprehensive roadmap. We will dissect every component of an AR Manager's salary, explore the factors that can maximize your earning potential, and lay out the precise steps you need to take to enter and excel in this rewarding field. I once worked with a rapidly expanding tech firm that was struggling with cash flow despite record sales. The issue wasn't the product; it was a disorganized collections process. By bringing in a sharp, experienced AR Manager, they reduced their average collection period by 25 days in just one quarter, fundamentally changing their financial stability and enabling their next phase of growth. That experience cemented for me that this role isn't just about collecting money; it's about enabling a company's future.

Whether you're a student planning your career, an accounting professional looking to specialize, or a current AR specialist aiming for the next level, this guide will provide the expert insights you need to navigate your journey and achieve your professional and financial goals.

### Table of Contents

- [What Does an Accounts Receivable Manager Do?](#what-does-an-accounts-receivable-manager-do)

- [Average Accounts Receivable Manager Salary: A Deep Dive](#average-accounts-receivable-manager-salary-a-deep-dive)

- [Key Factors That Influence an AR Manager's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for AR Managers](#job-outlook-and-career-growth)

- [How to Become an Accounts Receivable Manager](#how-to-get-started-in-this-career)

- [Is a Career as an AR Manager Right for You?](#conclusion)

---

What Does an Accounts Receivable Manager Do?

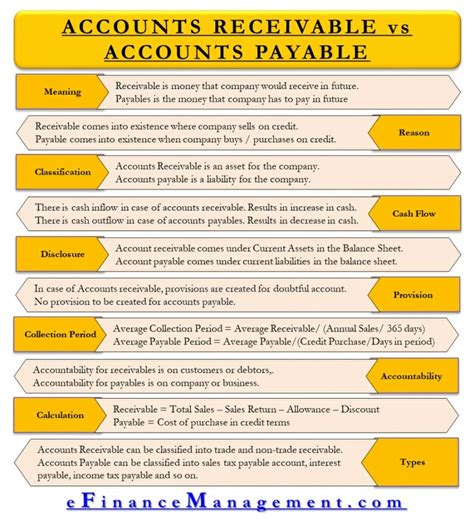

At its core, the Accounts Receivable Manager oversees the entire process of billing customers and collecting the money owed to the company. This function, often called the "order-to-cash" cycle, is the engine that converts sales revenue into actual cash in the bank. A well-run AR department ensures a healthy cash flow, minimizes financial risk from bad debt, and maintains positive relationships with customers.

This is not a simple bookkeeping role. It requires a sophisticated blend of financial acumen, leadership, negotiation skills, and technological proficiency. The AR Manager doesn't just chase late payments; they design and implement the systems and strategies that prevent them from happening in the first place.

Core Responsibilities and Daily Tasks:

An AR Manager's duties are diverse and strategically important. They typically include:

- Team Leadership and Management: Hiring, training, and supervising a team of AR clerks, specialists, and analysts. This includes setting performance goals, conducting reviews, and motivating the team to meet collection targets.

- Credit Policy Management: Establishing and maintaining the company's credit policy. This involves assessing the creditworthiness of new customers, setting credit limits, and periodically reviewing the credit terms for existing clients to mitigate risk.

- Oversight of Invoicing and Billing: Ensuring that all customer invoices are generated accurately, sent out on time, and comply with any specific client requirements or contractual terms.

- Collections Strategy: Developing and executing strategies for collecting outstanding payments. This ranges from setting up automated reminders for slightly overdue accounts to personally handling negotiations for large, delinquent accounts.

- Cash Application and Reconciliation: Overseeing the process of applying incoming payments to the correct customer accounts and invoices. This requires meticulous attention to detail to ensure the company's financial records are accurate.

- Reporting and Analysis: Preparing and analyzing key AR metrics and reports for senior management. This includes the Accounts Receivable Aging Report (which categorizes outstanding invoices by how long they've been due), Days Sales Outstanding (DSO), and collection forecasts.

- Process Improvement and System Implementation: Constantly seeking ways to make the order-to-cash cycle more efficient. This often involves leveraging technology, such as implementing new accounting software, automating invoicing, or using data analytics to predict payment behaviors.

- Customer Relationship Management: Acting as a point of escalation for complex billing disputes and payment issues, working to resolve problems while preserving the customer relationship.

### A Day in the Life of an AR Manager

To make this more concrete, let's walk through a typical day for an AR Manager at a mid-sized manufacturing company:

- 8:30 AM: The day begins with a quick team huddle. The manager reviews the previous day's collections, highlights key accounts that need immediate attention, and assigns specific tasks to the AR specialists. They discuss an issue with a new payment portal and delegate a team member to troubleshoot it.

- 9:15 AM: The manager dives into the AR Aging Report. They identify three major accounts that have just tipped into the "60 days past due" column. They review the history of communication for these accounts and formulate a strategy for the next contact.

- 10:30 AM: A meeting with the Sales Director. A large new customer wants to place a significant order but is requesting unusually long payment terms. The AR Manager presents their credit risk analysis of the new customer and negotiates a compromise: slightly extended terms in exchange for a partial upfront payment, balancing the desire for a sale with the need for financial prudence.

- 12:00 PM: Lunch, often taken while reviewing industry news or a report on economic indicators that could affect customer payment habits.

- 1:00 PM: A direct call to the Accounts Payable manager of one of the large, delinquent accounts identified earlier. Using a firm but professional tone, they discuss the overdue invoices, troubleshoot a potential invoicing discrepancy the client raises, and secure a firm commitment for payment by the end of the week.

- 2:30 PM: Time for strategic work. The manager analyzes the company's DSO for the last quarter, noticing a slight upward trend. They begin drafting a proposal for implementing an automated dunning (reminder) system to improve early-stage collections and reduce the team's manual workload.

- 4:00 PM: The manager reviews and approves credit limit applications for several new clients submitted by their team. They provide feedback on one application, requesting more financial information before approval.

- 4:45 PM: A final check-in with the team to see the day's progress, answer any last-minute questions, and prepare the daily cash receipts report for the CFO.

This snapshot illustrates the dynamic nature of the role—a constant mix of managing people, analyzing data, negotiating with stakeholders, and thinking strategically about the financial health of the business.

---

Average Accounts Receivable Manager Salary: A Deep Dive

Understanding the earning potential is a primary motivator for pursuing any career path. For Accounts Receivable Managers, the compensation is competitive and reflects the critical nature of the role. While a single "average" salary provides a useful benchmark, a deeper analysis reveals a wide range based on experience, location, and other factors.

### National Salary Benchmarks

To provide a comprehensive view, we'll synthesize data from several authoritative sources. It's important to note that different platforms use different data sets and methodologies, so we present a blended picture.

- Salary.com: As of late 2023 and early 2024, Salary.com reports the median salary for an Accounts Receivable Manager in the U.S. is approximately $95,280. The typical salary range falls between $83,573 (25th percentile) and $110,248 (75th percentile). The top 10% of earners in this role can exceed $124,600.

- Payscale.com: Payscale provides a similar figure, with an average base salary reported around $70,000. However, Payscale's data also highlights significant additional compensation. Their total pay estimate, including potential bonuses and profit sharing, ranges from $52,000 to $99,000, showing a wider variance that may include smaller companies or less experienced managers.

- Glassdoor.com: Based on user-submitted data, Glassdoor lists the total pay for an AR Manager in the U.S. at an average of $98,079 per year, with a likely range between $80,000 and $122,000. This figure combines an estimated base pay of around $79,000 with additional cash compensation (bonuses, commissions) of approximately $19,000.

Synthesized National Average:

Considering these sources, a realistic and well-supported national salary expectation for a competent, mid-career Accounts Receivable Manager is:

- Base Salary Range: $75,000 - $100,000

- Total Compensation (including bonuses): $85,000 - $120,000+

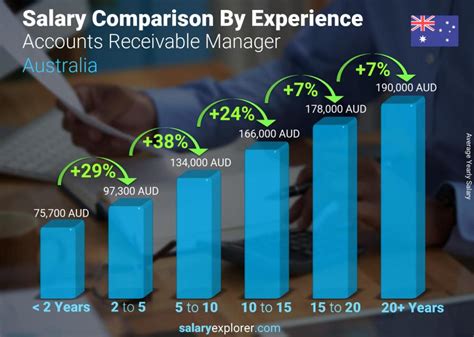

### Salary by Experience Level

Like most professions, compensation for AR Managers grows significantly with experience. The journey from an entry-level specialist to a senior leader is marked by substantial increases in both responsibility and pay.

| Experience Level | Typical Title(s) | Average Annual Base Salary Range | Key Responsibilities & Skills |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-3 Years) | AR Clerk, AR Specialist, Junior Accountant | $45,000 - $60,000 | Data entry, invoice generation, applying payments, initial customer contact for overdue bills, mastering accounting software. |

| Mid-Career (4-8 Years) | AR Supervisor, Senior AR Specialist, AR Team Lead, AR Manager (at smaller firms) | $65,000 - $90,000 | Supervising a small team, handling more complex reconciliations, analyzing aging reports, resolving escalated customer disputes, participating in credit decisions. |

| Experienced/Senior (8-15+ Years) | Accounts Receivable Manager, Senior AR Manager | $90,000 - $125,000+ | Managing the entire AR department, setting credit and collections policy, reporting to senior leadership (CFO, Controller), implementing process improvements, managing key client accounts. |

| Leadership/Executive (15+ Years) | Director of Credit, Director of Revenue Cycle, Controller | $130,000 - $200,000+ | Overseeing multiple financial functions including AR, setting high-level financial strategy, managing large and complex teams, significant influence on company's financial health and risk management. |

*Note: These are national averages and can be significantly influenced by the factors discussed in the next section.*

### Breaking Down the Compensation Package

The base salary is only one part of the equation. An AR Manager's total compensation package is often sweetened with variable pay and robust benefits, directly tying their performance to financial rewards.

- Annual Bonuses: This is the most common form of additional compensation. Bonuses for AR Managers are rarely discretionary; they are typically tied to specific, measurable Key Performance Indicators (KPIs). The most important KPI is Days Sales Outstanding (DSO), which measures the average number of days it takes for a company to collect payment after a sale has been made. Other metrics include collection effectiveness index (CEI), percentage of accounts past due, and bad debt write-offs. A successful manager who significantly lowers DSO can expect a bonus ranging from 5% to 20% of their base salary.

- Profit Sharing: Some companies, particularly privately held or smaller firms, offer profit-sharing plans. A portion of the company's annual profits is distributed among employees. As a key manager directly influencing profitability, the AR Manager's share can be substantial.

- Stock Options or Restricted Stock Units (RSUs): In publicly traded companies or high-growth startups, equity can be a significant part of the compensation package. This provides a long-term incentive and a stake in the company's overall success.

- Standard Benefits: In addition to direct compensation, the package will almost always include:

- Health, dental, and vision insurance

- 401(k) or other retirement plans, often with a company match

- Paid time off (vacation, sick leave, holidays)

- Life and disability insurance

- Opportunities for professional development, such as tuition reimbursement for an advanced degree or paying for certification exams.

When evaluating a job offer, it is crucial to look beyond the base salary and consider the total value of the compensation and benefits package. A role with a slightly lower base but a generous, achievable bonus structure and excellent benefits may ultimately be more lucrative.

---

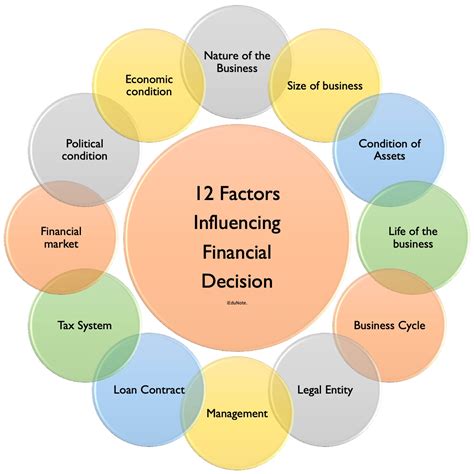

Key Factors That Influence an AR Manager's Salary

The difference between earning $80,000 and $130,000 as an Accounts Receivable Manager is not random. It's determined by a combination of your qualifications, where you work, and the specific value you bring to an organization. Mastering these factors is the key to maximizing your long-term earning potential.

###

Level of Education

Your educational background forms the foundation of your career and has a direct impact on your starting salary and long-term trajectory.

- Bachelor's Degree (The Standard): A bachelor's degree is considered the minimum educational requirement for an AR Manager role. The most relevant and sought-after majors are Accounting, Finance, and Business Administration. These programs provide the necessary grounding in financial principles, reporting, business law, and economic theory. A candidate with a relevant bachelor's degree can expect to meet the baseline salary expectations for the role.

- Master's Degree (The Accelerator): While not always required, a master's degree can significantly accelerate your career and boost your earning potential.

- Master of Business Administration (MBA): An MBA is particularly valuable as it signals a broader understanding of business strategy, leadership, and operations beyond just the accounting function. An AR Manager with an MBA is well-positioned to move into higher-level roles like Controller or Director of Finance. This can command a salary premium of 10-15% or more.

- Master's in Accounting (MAcc) or Finance (MSF): These specialized degrees provide deep technical expertise. They are highly valuable for roles in complex industries or very large corporations where intricate financial knowledge is paramount.

- Professional Certifications (The Differentiator): Certifications are a powerful way to validate your expertise and command a higher salary. They demonstrate a commitment to the profession and a mastery of specific skills.

- Certified Credit Executive (CCE): Offered by the National Association of Credit Management (NACM), this is arguably the gold-standard certification for credit and AR professionals. Earning the CCE requires significant experience, passing a rigorous exam, and demonstrates elite-level expertise in credit policy, financial analysis, and legal aspects of collections. Holding a CCE can significantly increase salary and open doors to senior leadership positions.

- Certified Public Accountant (CPA): While more common for public accountants or controllers, a CPA license is highly respected in any financial management role. It signals impeccable ethical standards and a deep understanding of Generally Accepted Accounting Principles (GAAP). An AR Manager who is also a CPA is a rare and valuable asset, especially in publicly traded companies that require strict financial controls and reporting.

- Other Relevant Certifications: Certifications like the Credit Business Associate (CBA) or Certified Collection Agency Manager (CCAM) can also add value, particularly earlier in one's career.

###

Years of Experience

Experience is perhaps the single most significant determinant of an AR Manager's salary. The role requires a level of seasoned judgment that can only be developed over time by navigating complex situations.

- Early Career (0-4 years): Professionals in this stage are typically in AR Specialist or Supervisor roles. They are building their core skills in billing, collections, and reconciliation. Their focus is on execution and learning the fundamentals.

- Mid-Career (5-10 years): This is the sweet spot for moving into a full-fledged AR Manager position. Professionals at this level have demonstrated their technical skills and are now developing their leadership and strategic capabilities. They have a proven track record of managing collections, dealing with difficult accounts, and likely have supervised junior staff. Their salary sees a significant jump as they take on full departmental responsibility. Salary growth during this period is rapid. An AR Supervisor earning $70,000 might see their salary jump to $90,000-$100,000 upon promotion to Manager.

- Senior/Expert (10+ years): A manager with over a decade of experience is valued for their deep strategic insight. They have likely managed teams through economic downturns, implemented new systems, and crafted credit policies from the ground up. They are not just managing a process; they are optimizing a critical business function. These individuals command the highest salaries, often in the $110,000 to $130,000+ range, and are prime candidates for Director-level roles.

###

Geographic Location

Where you work matters—a lot. Salaries for AR Managers can vary dramatically based on the cost of living and the concentration of corporate headquarters in a particular region.

| Metropolitan Area | Average AR Manager Salary (Source: Salary.com, Adjusted for 2024) | Comparison to National Average |

| :--- | :--- | :--- |

| High-Cost Cities | | |

| San Francisco, CA | $120,500+ | ~26% Higher |

| New York, NY | $114,800+ | ~20% Higher |

| Boston, MA | $109,200+ | ~15% Higher |

| Washington, D.C. | $105,700+ | ~11% Higher |

| Los Angeles, CA | $104,900+ | ~10% Higher |

| Mid-Range Cities | | |

| Chicago, IL | $100,200+ | ~5% Higher |

| Dallas, TX | $95,700+ | ~1% Higher |

| Atlanta, GA | $93,400+ | ~2% Lower |

| Lower-Cost Cities | | |

| Phoenix, AZ | $92,200+ | ~3% Lower |

| Orlando, FL | $89,100+ | ~6% Lower |

| Boise, ID | $85,500+ | ~10% Lower |

*This data illustrates a potential salary swing of over $35,000 based on location alone. The highest salaries are found in major metropolitan hubs with high costs of living and a high density of large corporations (e.g., finance in NYC, tech in San Francisco).*

The rise of remote work has slightly complicated this factor. Some companies now pay a national standard rate regardless of location, while others use a "location-based pay" model that adjusts salary based on the employee's home address. This is a critical point to clarify during job negotiations.

###

Company Type & Size

The type of organization you work for has a profound effect on your role and compensation.

- Large Corporations (Fortune 500): These companies typically offer the highest salaries and most comprehensive benefits packages. The AR function is often highly structured, with large teams and complex, high-volume transactions. The AR Manager here needs to be an expert in sophisticated Enterprise Resource Planning (ERP) systems (like SAP or Oracle) and navigating a complex corporate structure. The scale of responsibility is massive, and the pay reflects that.

- Startups and High-Growth Companies: Salaries at startups can be more variable. The base salary might be slightly lower than at a large corporation, but it's often supplemented with potentially lucrative stock options. The role is less structured; an AR Manager at a startup might also handle elements of accounts payable, payroll, or general accounting. This requires adaptability and a willingness to "wear many hats."

- Small to Mid-Sized Businesses (SMBs): These companies form the backbone of the economy and employ many AR Managers. Salaries are typically close to the national average. The role offers a good balance, providing significant responsibility and direct visibility to senior leadership without the bureaucracy of a massive corporation.

- Industry: The industry also plays a key role.

- Technology/SaaS: Tech companies, particularly those with recurring subscription revenue models, often pay a premium for skilled AR managers who understand subscription billing and churn management.

- Healthcare: This is a highly complex sector due to the intricacies of medical billing, insurance claims, and government payers (Medicare/Medicaid). AR Managers with expertise in healthcare revenue cycle management are in high demand and can command high salaries.

- Manufacturing & Construction: These industries often involve large, complex contracts with milestone-based billing. Expertise in project accounting and managing large B2B accounts is highly valued.

###

In-Demand Skills

Beyond your formal qualifications, the specific skills you possess can dramatically increase your value. The modern AR Manager is not just a collector; they are a technology-savvy financial analyst.

High-Value Hard Skills:

- ERP System Proficiency: Deep expertise in major ERP systems like SAP, Oracle NetSuite, Microsoft Dynamics 365, or Workday Financials is non-negotiable for top roles. Being a "super-user" who can help optimize these systems is a huge plus.

- Advanced Microsoft Excel: While it may seem basic, mastery of Excel (PivotTables, VLOOKUP/XLOOKUP, macros, data modeling) is essential for analysis and reporting.

- Data Analysis & Visualization Tools: The ability to use tools like Power BI, Tableau, or even SQL to query databases and create insightful dashboards is a major differentiator. This transforms the AR function from reactive to proactive, allowing a manager to identify trends and predict collection issues before they arise.

- Financial Modeling and Forecasting: The ability to build accurate cash flow forecasts based on AR data is a highly strategic skill that is invaluable to CFOs and corporate finance teams.

High-Impact Soft Skills:

- Negotiation and Conflict Resolution: The ability to negotiate payment plans with difficult but important customers without damaging the relationship is an art form. This skill directly preserves revenue and customer loyalty.

- Leadership and Team Development: A manager who can build, motivate, and retain a high-performing team is immensely valuable. This includes coaching junior staff and creating a positive, efficient work environment.

- Strategic Communication: The ability to clearly articulate the state of the company's receivables to senior leadership (C-suite) and explain the "why" behind the numbers is critical for gaining trust and resources.

- Process Improvement Mindset: A manager who is constantly asking "How can we do this better?" and has experience with methodologies like Six Sigma or Lean is highly sought after.

By consciously developing these specific skills, you can directly influence your salary negotiations and position yourself as a top-tier candidate in the job market.

---

Job Outlook and Career Growth

Choosing a career is not just