A career in banking has long been synonymous with prestige, responsibility, and significant financial reward. Among the most sought-after titles in this competitive field is that of Vice President (VP). A position as a Bank VP signifies a high level of expertise and leadership, opening the door to a substantial six-figure salary and impressive bonuses.

But what does that translate to in actual numbers? A Bank VP's total compensation can range from $120,000 to well over $250,000 annually, depending on a variety of critical factors.

This guide will break down the salary expectations for a Bank VP, explore the key drivers behind your earning potential, and provide a clear outlook on this rewarding career path.

What Does a Bank VP Do?

Before diving into the numbers, it's essential to understand the role. Unlike in many other industries where "Vice President" is a C-suite or executive leadership position just below the President, the title of VP in banking is typically a mid-to-senior level management or senior individual contributor role. A large investment or commercial bank can have hundreds, if not thousands, of VPs.

The title indicates a significant level of seniority, experience, and trust. A Bank VP has moved beyond the entry-level Analyst and mid-level Associate ranks and is responsible for managing major client relationships, leading teams, and driving revenue.

Key responsibilities often include:

- Overseeing a specific department or team (e.g., commercial lending, wealth management, risk).

- Developing and maintaining relationships with high-value corporate or individual clients.

- Analyzing financial data to manage risk and guide strategic decisions.

- Structuring complex financial deals, such as mergers and acquisitions (M&A) or large-scale loans.

- Ensuring all activities comply with strict industry regulations.

- Mentoring and developing junior staff like analysts and associates.

Average Bank VP Salary

The compensation for a Bank VP is a combination of a strong base salary and, often, a significant performance-based bonus. It's crucial to look at both figures to understand the full picture.

According to recent data, the salary landscape looks like this:

- Average Base Salary: Salary.com reports the median base salary for a Banking Vice President in the United States is approximately $155,754 as of late 2023. The typical range falls between $137,882 and $176,143.

- Total Compensation: When including bonuses, profit sharing, and commissions, the figures increase significantly. Glassdoor places the estimated total pay for a Bank VP at an average of $203,500 per year, with a likely range between $155,000 and $269,000.

It’s important to note that these are national averages. A first-year VP will earn on the lower end of this scale, while a senior VP with a decade of experience will command a much higher salary.

Key Factors That Influence Salary

Your specific salary as a Bank VP is not a single number but a reflection of several key variables. Understanding these factors is crucial for maximizing your earning potential.

### Level of Education

While a bachelor's degree in finance, economics, or a related field is the standard entry requirement for a banking career, advanced education can dramatically impact your career trajectory and salary. A Master of Business Administration (MBA), particularly from a top-tier business school, is often a key accelerator. Graduates from elite MBA programs are frequently hired as Associates, putting them on a faster track to the VP title and a higher starting salary. Certifications like the Chartered Financial Analyst (CFA) designation can also increase earning potential and open doors to specialized, high-paying roles in asset management and investment analysis.

### Years of Experience

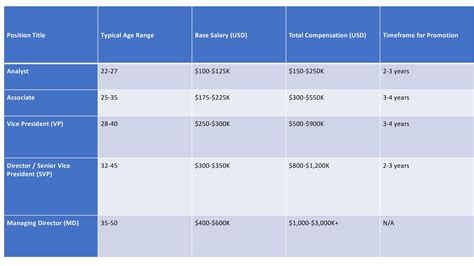

Experience is arguably the most significant factor. The path to VP in many banking sectors, especially investment banking, is highly structured:

- Analyst: 2-3 years post-undergraduate.

- Associate: 3-4 years, often post-MBA or promotion from Analyst.

- Vice President: Typically achieved after 5-8 years of total experience.

A newly promoted VP will have a base salary at the lower end of the VP range. As you gain more experience, manage larger teams, and close more significant deals, your salary and, most notably, your annual bonus will grow substantially.

### Geographic Location

Where you work matters immensely. Major financial hubs command the highest salaries due to a greater concentration of large banks and a higher cost of living.

- Top Tier Cities: New York City is the undisputed leader in banking compensation. Other high-paying metropolitan areas include San Francisco, Boston, Chicago, and Charlotte.

- Other Major Cities: Cities like Houston, Dallas, and Los Angeles also offer competitive salaries, though they may trail behind the top financial centers.

- Regional Markets: VPs at smaller regional or community banks will earn less but may benefit from a lower cost of living and a better work-life balance.

### Company Type

The type of institution you work for is a primary determinant of your salary.

- Investment Banks (Bulge Bracket & Elite Boutique): These institutions, like Goldman Sachs, J.P. Morgan, and Evercore, offer the highest earning potential. VPs here are heavily involved in high-stakes M&A, and their compensation is heavily weighted towards performance bonuses that can equal or exceed their base salary.

- Commercial Banks: Large commercial banks like Bank of America and Wells Fargo offer strong, competitive salaries for their VPs in areas like corporate or commercial lending. While total compensation is excellent, the bonus potential is typically more modest compared to investment banking.

- Community Banks & Credit Unions: VPs at these smaller institutions have salaries on the lower end of the spectrum. The roles often focus on local business lending and retail management, with a greater emphasis on work-life balance over maximum compensation.

### Area of Specialization

Within a bank, what you *do* is just as important as your title. Some specializations are far more lucrative than others.

- High-Earning Fields: Investment Banking (M&A, Leveraged Finance), Sales & Trading, and Private Wealth Management for ultra-high-net-worth clients are consistently the highest-paying areas.

- Core Banking Fields: Roles in Commercial Lending, Corporate Banking, Risk Management, and Compliance are also well-compensated and critical to the bank's function, though their bonus structures may be less astronomical. A VP of Risk Management will earn a strong, stable salary, but a VP in M&A has a higher ceiling for their annual bonus based on deal flow.

Job Outlook

The career outlook for senior banking professionals remains very strong. The U.S. Bureau of Labor Statistics (BLS) projects that employment for Financial Managers (the category that includes Bank VPs) will grow by 16% from 2022 to 2032. This rate is much faster than the average for all occupations.

The BLS cites a continued need for financial expertise to manage investments, mitigate risk, and provide services to an aging population as key drivers of this growth. However, it's crucial to remember that while the field is growing, competition for top-tier VP positions at elite firms remains incredibly fierce.

Conclusion

A career as a Bank Vice President is a challenging but exceptionally rewarding path. It demands long hours, a sharp analytical mind, and a deep commitment to the industry.

Here are the key takeaways for anyone considering this profession:

- Significant Earning Potential: Total compensation packages regularly exceed $200,000, driven by a strong base salary and performance-based bonuses.

- Experience is Key: The VP title is earned through years of dedicated work and a proven track record of success.

- Specialization and Location Matter: Your highest earnings will be found in investment banking roles located in major financial hubs like New York City.

- Strong Future Growth: The demand for skilled financial leaders is projected to grow significantly over the next decade.

For those with the ambition, education, and resilience to climb the banking ladder, the role of Vice President offers a powerful platform for a prosperous and impactful career at the center of the global economy.