Considering a career that blends entrepreneurship, consultancy, and the satisfaction of helping others? The role of a Benefits Advisor, particularly with a well-known company like Aflac, offers a unique and potentially lucrative path. But what can you realistically expect to earn?

This article provides a data-driven look at the Aflac Benefits Advisor salary, exploring the core compensation structure, average earnings, and the key factors that can significantly boost your income. While the potential is high, with top performers earning well into six figures, total compensation is directly tied to performance, skill, and strategic effort.

What Does a Benefits Advisor at Aflac Do?

Before diving into the numbers, it's essential to understand the role. An Aflac Benefits Advisor (often referred to as an Insurance Sales Agent or Benefits Consultant) is not a typical salaried employee. Think of this position as being an independent business owner affiliated with the Aflac brand.

Their primary responsibilities include:

- Consulting with Businesses: Meeting with business owners and HR managers to understand their employee benefits needs.

- Presenting Solutions: Educating clients on Aflac's portfolio of voluntary/supplemental insurance products (e.g., disability, accident, cancer, life insurance).

- Enrolling Employees: Conducting one-on-one and group enrollment meetings to help employees select the policies that best fit their personal needs and budget.

- Building a Client Base: Prospecting, networking, and developing a "book of business" through relationship-building and providing excellent customer service.

The core of the job is sales and relationship management. It’s a performance-driven role where your effort directly correlates with your income.

Average Benefits Advisor Aflac Salary

The most critical point to understand about an Aflac Benefits Advisor's compensation is that it is primarily commission-based. While some offices may offer a small base salary or a training stipend for a limited time, the vast majority of your earnings will come from first-year commissions on new policies and renewal commissions on existing policies you manage.

This structure means there's a wide range of potential earnings.

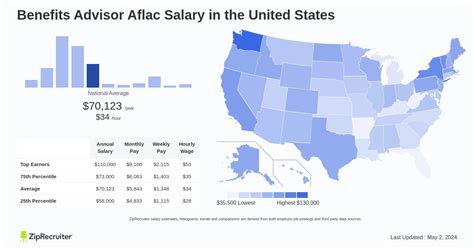

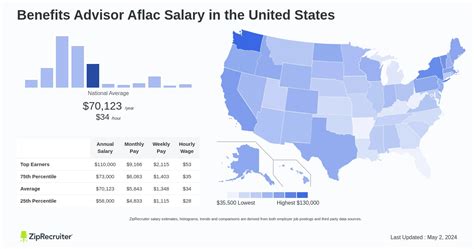

- Typical Total Compensation Range: According to data from major salary aggregators, the total annual pay for an Aflac Benefits Advisor in the United States typically falls between $38,000 to $95,000.

- Average Earnings: Glassdoor reports an estimated total pay of $70,054 per year, which includes an estimated base pay and additional pay from commissions and bonuses. Payscale reports a similar average of around $55,000, but notes that commissions can add an additional $2,000 to $50,000+ to that figure, highlighting the variability.

First-year advisors who are building their client base from scratch will likely earn at the lower end of this spectrum. In contrast, tenured advisors with a large and stable book of business can easily surpass $100,000 annually, as renewal commissions provide a steady stream of income.

Key Factors That Influence Salary

Your earnings are not set in stone. Several factors directly influence how much you can make as an Aflac Benefits Advisor.

### Years of Experience

This is arguably the most significant factor in a commission-based role.

- Entry-Level (0-2 Years): Earnings are almost entirely dependent on new sales. The focus is on prospecting, learning the products, and building relationships. Income can be modest and less predictable during this foundational phase.

- Mid-Career (3-8 Years): By this stage, an advisor has built a solid book of business. A significant portion of their income now comes from renewal commissions, providing a more stable financial base. This allows them to focus on both servicing existing clients and acquiring larger new accounts.

- Senior-Level (8+ Years): Highly experienced advisors have a mature book of business that generates substantial renewal income. Their reputation and network often bring in referrals, and they may take on leadership or mentorship roles within their Aflac office, further boosting their earnings.

### Geographic Location

While many remote jobs are location-agnostic, location matters for a Benefits Advisor because it dictates your market. Aflac advisors need access to a high concentration of small and medium-sized businesses (SMBs), which are their primary clientele.

- High-Opportunity Areas: Metropolitan areas with a vibrant and growing business community offer more opportunities for prospecting and sales. States with a high density of businesses, such as Texas, Florida, California, and New York, can be fertile ground for building a large client base.

- Lower-Opportunity Areas: Rural areas with fewer businesses may present more challenges in finding new clients, potentially capping earning potential.

### Level of Education

While a specific degree is not a strict requirement to become an Aflac Benefits Advisor, a relevant educational background can provide a significant advantage.

- State Licensing: The primary educational requirement is to pass your state's insurance licensing exam. Aflac provides support and training to help candidates achieve this.

- Advantageous Degrees: A bachelor's degree in Business, Marketing, Finance, or Communications can equip you with foundational knowledge in sales strategy, financial planning, and professional communication, which are all crucial for success. However, Aflac is known for its comprehensive training program, making drive and interpersonal skills more important than a specific diploma.

### Company Type

This section typically compares different employers, but for Aflac, it's more about contrasting the independent contractor model with a traditional salaried role.

- Aflac (Independent Contractor/Commission-Based): Offers unlimited earning potential, flexibility, and the ability to be your own boss. The trade-off is less income stability, especially in the beginning. Success is 100% on you.

- In-House Corporate Benefits Specialist (Salaried): Working directly for a large company to manage their internal benefits program provides a stable, predictable salary and a corporate benefits package. However, there is a clear ceiling on earning potential, with no direct commission from performance. According to Salary.com, a corporate Benefits Specialist typically earns between $65,000 and $83,000.

### Area of Specialization

Within the Aflac framework, specialization refers to the type of industries you target. An advisor who becomes an expert in the benefits needs of a specific sector can build a powerful reputation and a more efficient sales process. For example, you could specialize in:

- Manufacturing companies

- Tech startups

- Restaurants and hospitality

- Healthcare facilities (e.g., dental offices, clinics)

- Municipal and public-sector employers

Becoming the go-to Aflac consultant for a specific industry in your region can lead to a steady stream of referrals and higher closing rates.

Job Outlook

The career outlook for insurance professionals is stable and promising. The U.S. Bureau of Labor Statistics (BLS) projects that employment for Insurance Sales Agents will grow by 6 percent from 2022 to 2032, which is faster than the average for all occupations.

This growth is driven by several factors:

- An aging population requires more health-related insurance products.

- The complexity of healthcare and benefits packages leads both businesses and individuals to seek expert advice.

- Supplemental insurance is increasingly seen as a vital part of a comprehensive financial safety net.

Conclusion

A career as an Aflac Benefits Advisor offers a direct path to financial success for the right individual. While the term "salary" can be misleading, the total compensation potential is high, with top performers building highly profitable businesses for themselves.

Here are the key takeaways:

- It's an Entrepreneurial Role: Your income is directly tied to your sales performance, networking skills, and ability to build lasting client relationships.

- Experience is King: Earnings grow substantially as you build a book of business and begin earning renewal commissions.

- The Outlook is Positive: The need for benefits expertise is growing, ensuring long-term demand for skilled advisors.

If you are a self-motivated, resilient, and service-oriented individual who thrives on performance-based rewards, the Aflac Benefits Advisor career path offers an exceptional opportunity to control your schedule, your work, and your earning potential.