Ever wondered what it takes to lead a global empire like The Coca-Cola Company? The allure is undeniable: shaping culture, steering a multi-billion dollar ship, and, of course, the compensation that reflects that monumental responsibility. When people search for the "Coca-Cola CEO salary," they're not just looking for a number; they're glimpsing the absolute peak of the corporate world. They're asking, "What does the summit look like, and is there a path for me to get there?"

The answer is yes, a path exists—it's a long, arduous, and incredibly rewarding marathon, not a sprint. While the headline-grabbing multi-million dollar compensation packages are reserved for a select few, the journey to becoming a top executive is built on a series of achievable steps, strategic decisions, and relentless professional development. The median salary for a Chief Executive in the United States hovers around $246,440 per year according to the U.S. Bureau of Labor Statistics, but for the leader of a company like Coca-Cola, that figure is merely a starting point for a much larger compensation structure.

I once had the opportunity to attend a company-wide town hall led by a new CEO at a large organization. Watching him field incredibly tough questions about the company's future, I wasn't just struck by his intelligence, but by the sheer weight of accountability on his shoulders. Every word he said could move markets and impact the livelihoods of thousands of employees, a profound responsibility that frames the true nature of the job far beyond any salary figure.

This guide will demystify that journey. We will start by examining the specific compensation of the Coca-Cola CEO to set the stage, but we will quickly pivot to the broader, more practical questions you need answered. We will explore what a top executive actually does, dissect the complex layers of their salary, analyze the factors that dictate earning potential, and provide a concrete, step-by-step roadmap for anyone aspiring to reach the highest echelons of corporate leadership.

### Table of Contents

- [What Does a Top Executive Like the Coca-Cola CEO Do?](#what-does-a-coca-cola-ceo-do)

- [CEO & Top Executive Salary: A Deep Dive](#average-coca-cola-ceo-salary-a-deep-dive)

- [Key Factors That Influence an Executive's Salary](#key-factors-that-influence-salary)

- [Job Outlook and the Future of Executive Leadership](#job-outlook-and-career-growth)

- [How to Start Your Journey to the C-Suite](#how-to-get-started-in-this-career)

- [Is the Path to Executive Leadership Right for You?](#conclusion)

---

What Does a Top Executive Like the Coca-Cola CEO Do?

While the title "Chief Executive Officer" is singular, the role is a multifaceted amalgamation of strategist, visionary, financial steward, and chief cultural officer. It's a position less about managing day-to-day operations—that's the role of other C-suite executives and senior leaders—and more about setting the long-term course and ensuring the entire organization is aligned to navigate it successfully.

The core responsibilities of a CEO at a major corporation can be broken down into four key pillars:

1. Setting the Vision and Strategy: This is the CEO's most critical function. They are responsible for defining the company's mission, vision, and long-term strategic goals. This involves analyzing market trends, competitive landscapes, technological shifts, and global economic factors to decide where the company will play and how it will win. For a company like Coca-Cola, this means answering questions like: How do we adapt to changing consumer tastes towards healthier beverages? How do we innovate in packaging to meet sustainability goals? In which emerging markets should we invest billions of dollars? The CEO doesn't just create this vision; they must passionately communicate it to employees, investors, and the public to inspire confidence and action.

2. Capital Allocation and Financial Stewardship: A corporation is an economic engine, and the CEO is the chief operator. They hold final accountability for the company's financial performance. This involves making high-stakes decisions on how to allocate capital: funding new product lines, greenlighting acquisitions and mergers, authorizing major marketing campaigns, and deciding on the level of dividends paid to shareholders. They work closely with the Chief Financial Officer (CFO) to oversee budgets, manage risk, and ensure the company meets its financial targets and maintains the trust of Wall Street and other investors.

3. Building and Leading the Senior Team: No CEO succeeds alone. A huge part of their job is to recruit, develop, and retain a world-class executive team (the C-suite). They must ensure that the right leaders are in the right seats—from the COO managing operations to the CMO driving brand growth. The CEO's role is to empower these leaders, hold them accountable for their respective domains, and foster a collaborative environment where the team can challenge ideas and execute the company's strategy effectively.

4. Managing Key Stakeholders and Being the Public Face: The CEO is the primary liaison between the company and its most important external stakeholders. This includes the Board of Directors, to whom the CEO reports. It involves engaging with major investors and analysts to communicate the company's strategy and performance. It also means acting as the public face of the brand, speaking with the media, engaging with government officials and regulators, and representing the company's values in the public square.

### A "Day in the Life" of a Fictional Major-Brand CEO

To make this tangible, let's imagine a typical day for "Alex," the CEO of a global consumer goods company similar to Coca-Cola.

- 6:00 AM - 7:30 AM: Wake up, exercise, and review overnight market reports from Asia and Europe, along with a curated summary of global news and industry updates prepared by their team.

- 7:30 AM - 8:30 AM: Breakfast meeting with the CFO to review the previous day's sales figures and discuss a forthcoming earnings call with investors.

- 9:00 AM - 11:00 AM: Lead the weekly Executive Leadership Team meeting. The agenda includes a deep dive on a competitor's new product launch, a final decision on the Q4 marketing budget, and a review of the company's progress on its sustainability initiatives.

- 11:00 AM - 12:00 PM: One-on-one meeting with the Chief Human Resources Officer to discuss succession planning for key leadership roles and review employee engagement survey results.

- 12:30 PM - 2:00 PM: Lunch with the CEO of a major retail partner to discuss joint business plans and strengthen the strategic relationship.

- 2:30 PM - 3:30 PM: Media interview with a major financial news outlet about the company's innovation pipeline.

- 4:00 PM - 5:30 PM: Strategic planning session with the head of a new ventures division, exploring potential acquisitions of smaller, high-growth beverage startups.

- 6:00 PM - 7:00 PM: Conference call with the Chairperson of the Board of Directors for a pre-briefing on next week's board meeting.

- 7:30 PM onwards: Attend a charity gala where the company is a major sponsor, representing the brand and networking with other city leaders. Afterward, time for family and reading briefing documents for the next day.

This schedule highlights that a CEO's day is not about doing the work, but about making decisions, building relationships, and steering the ship at the highest possible level.

---

CEO & Top Executive Salary: A Deep Dive

The compensation for a top executive, particularly the CEO of a publicly traded behemoth like The Coca-Cola Company, is a complex package designed to reward performance, retain talent, and align the leader's financial interests with those of the shareholders. It's far more than just a simple salary.

Let's begin with the specific and then broaden our scope.

### The Coca-Cola CEO Salary: A Case Study

For the fiscal year 2023, the total compensation for James Quincey, Chairman and CEO of The Coca-Cola Company, was reported as $24,678,638, according to the company's 2024 Proxy Statement filed with the U.S. Securities and Exchange Commission (SEC).

It's crucial to understand how this figure is constructed, as only a small fraction is a guaranteed base salary:

- Base Salary: $1.6 million. This is the fixed, guaranteed portion of his pay.

- Stock Awards: $11.7 million. This is the largest component and is granted in the form of company stock (often Restricted Stock Units or RSUs) that vests over several years. Its ultimate value depends on the company's stock price, directly linking his wealth to shareholder returns.

- Option Awards: $4.0 million. These give the CEO the right to buy company stock at a predetermined price in the future. They are only valuable if the stock price rises above that price, creating a powerful incentive to grow the company's value.

- Non-Equity Incentive Plan Compensation: $6.4 million. This is his annual cash bonus, which is paid based on the company's performance against specific, pre-set financial and strategic goals for the year (e.g., revenue growth, operating income, etc.).

- All Other Compensation: ~$960,000. This includes perks such as contributions to retirement plans, life insurance premiums, and personal use of the company aircraft for security purposes.

This breakdown reveals a critical principle of executive pay: the vast majority is "at-risk" and performance-based. If the company and its stock perform poorly, the CEO's total take-home pay can be significantly lower than the reported target.

### National Averages for Top Executives

While the Coca-Cola figure represents the pinnacle, it's essential to look at the broader landscape for C-suite and executive roles.

According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, the median annual wage for "Top Executives" was $246,440 in May 2023. This is a solid starting point, but it encompasses a vast range of company sizes and roles, from the head of a regional non-profit to senior VPs at large corporations.

For a more granular view, salary aggregators provide data that better reflects the corporate C-suite. As of late 2023/early 2024 data:

- Salary.com reports the median total compensation for a Chief Executive Officer in the U.S. is $843,845, with a typical range falling between $636,929 and $1,100,530. This figure includes base salary, bonuses, and other incentives.

- Payscale.com shows a median base salary for a CEO around $180,000, but this climbs dramatically with the addition of bonuses (median $49,000) and profit-sharing (median $60,000), again emphasizing the importance of variable pay.

- Glassdoor reports a total pay average of around $201,000 for CEOs, but this is heavily influenced by a high volume of data from smaller companies and startups. For large public companies, the figures are exponentially higher.

### Executive Salary by Experience Level

The journey to a CEO-level salary is a long one, marked by significant increases at each stage of leadership. While a CEO title is the end goal, the path is paved with roles like Director and Vice President, each with its own substantial compensation structure.

| Career Stage | Typical Title(s) | Typical Total Compensation Range (U.S. Average) | Source & Notes |

| :--- | :--- | :--- | :--- |

| Early Leadership | Manager, Senior Manager | $90,000 - $160,000+ | Payscale/Glassdoor. Highly dependent on function (e.g., engineering vs. HR) and industry. |

| Mid-Career | Director | $150,000 - $275,000+ | Salary.com. At this level, annual bonuses become a significant part of compensation. |

| Senior Leadership | Vice President (VP) | $220,000 - $450,000+ | Salary.com/Glassdoor. Equity (stock options or RSUs) often becomes a standard component of pay. |

| Executive | C-Suite (CFO, COO, etc.) | $350,000 - $1,000,000+ | Based on public company proxy filings and Salary.com. Highly variable by company size. |

| Chief Executive | CEO (Large Corporation) | $1,000,000 - $25,000,000+ | Based on SEC filings. As seen with Coca-Cola, total compensation is heavily weighted towards equity. |

This table illustrates a clear and steep trajectory. Moving from a manager to a director, and then from a director to a vice president, represents major inflection points in earning potential, long before one even reaches the C-suite.

---

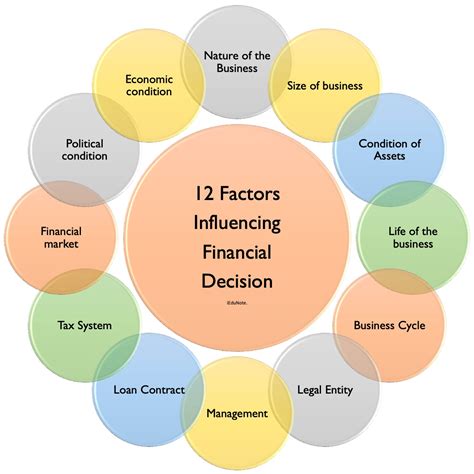

Key Factors That Influence an Executive's Salary

An executive's compensation isn't determined by a single variable. It's a complex equation with multiple inputs. Understanding these factors is crucial for anyone aspiring to maximize their earning potential on the long road to the top. This section will provide an in-depth analysis of the most significant drivers of executive pay.

###

Level of Education: The Foundational Ticket

While a specific degree isn't a legal requirement to be a CEO, educational attainment is a powerful signaling mechanism that opens doors and boosts earning potential from the very first job.

- The Bachelor's Degree: This is the non-negotiable starting point. Degrees in Business Administration, Finance, Economics, or Accounting are the most traditional and direct pathways. They provide the fundamental language and analytical tools of business. Increasingly, degrees in STEM fields (Science, Technology, Engineering, and Math) are also common launching pads, particularly in tech-focused industries, as they demonstrate rigorous analytical and problem-solving skills.

- The Master of Business Administration (MBA): The Great Accelerator: For aspiring executives, the MBA remains the single most impactful educational credential. However, not all MBAs are created equal. An MBA from a top-tier, globally recognized business school (e.g., Harvard, Stanford, Wharton, INSEAD, London Business School) acts as a powerful career accelerator.

- Direct Salary Impact: Graduates from top MBA programs often see their pre-MBA salaries double or even triple. According to *U.S. News & World Report*, the average salary and bonus for 2023 graduates of the top 15 U.S. business schools was over $200,000. This is the starting salary, which sets a much higher base for future growth.

- Network Access: The alumni network of a top business school is arguably its most valuable asset. It provides unparalleled access to leaders across every industry, creating opportunities for mentorship, partnerships, and career moves that would otherwise be impossible.

- Credibility and Skillset: A top MBA program provides advanced training in leadership, strategy, finance, and operations, bestowing a level of credibility that fast-tracks graduates into leadership development programs and high-visibility roles.

- Other Advanced Degrees & Certifications: While the MBA is king, other credentials can be valuable. A Juris Doctor (JD) is common for CEOs who rise through the legal or corporate governance ranks. A CFA (Chartered Financial Analyst) charter is highly respected for those on a finance track towards a CFO or CEO role. Executive Education programs from top universities also allow senior leaders to continuously update their skills in areas like digital transformation or global leadership without committing to a full-time degree.

###

Years of Experience: The Compounding of Value

Experience is perhaps the most significant determinant of salary. However, it's not just about the number of years worked; it's about the *quality* and *trajectory* of that experience. Salary growth is not linear; it accelerates at key transition points.

- 0-5 Years (Analyst/Associate): The primary goal here is learning and performing. Young professionals in finance, consulting, or brand management might start in the $70,000 to $120,000 range (higher in high-cost-of-living cities). The focus is on mastering technical skills and demonstrating reliability and intelligence.

- 5-10 Years (Manager/Senior Manager): This is the crucial first step into leadership. You move from "doing" to "leading others who do." Compensation typically moves into the $120,000 to $180,000+ range. Here, you gain experience with budgeting, project management, and hiring. Your success is now measured by your team's output.

- 10-15 Years (Director): As a Director, you begin to manage managers and often have P&L (Profit and Loss) responsibility for a specific product line, region, or department. This is a major inflection point. You are now accountable for business outcomes, not just team performance. Total compensation often breaks the $200,000 - $275,000 barrier, with a significant portion coming from annual performance bonuses.

- 15-20+ Years (Vice President): The VP level signals entry into senior leadership. VPs are responsible for entire functions within a business unit or region. They are deeply involved in strategy. Compensation packages regularly exceed $300,000 - $450,000+, and long-term incentives like stock options or RSUs become a standard, significant component of pay. This is where personal net worth can begin to build substantially.

- 20-25+ Years (C-Suite/CEO): Reaching this level requires a proven, multi-decade track record of delivering results, leading large teams, and successfully managing a major P&L. As we've seen, compensation becomes a complex mix of salary, bonuses, and equity awards that can range from $500,000 at a smaller public company to tens of millions at a global giant like Coca-Cola.

###

Geographic Location: The Cost of Business

Where you work has a direct and significant impact on your paycheck, particularly in the earlier stages of a career. This is driven by the cost of living and the concentration of corporate headquarters.

- Top-Tier Cities: Metropolitan areas like New York City, the San Francisco Bay Area, and Boston command the highest salaries in the nation. These cities are major hubs for finance, technology, and biotechnology, with a high concentration of large corporate HQs and a very high cost of living. A VP in New York might earn 20-30% more in base salary than a VP with the same role in a smaller Midwestern city. According to Salary.com, a Director-level role in NYC pays approximately 25% above the national average.

- Major Business Hubs: Cities like Chicago, Los Angeles, Dallas, and Atlanta (the home of Coca-Cola) also offer highly competitive salaries, often just a tier below the absolute top. They host numerous Fortune 500 companies and offer a slightly lower cost of living, making them attractive economic centers.

- Mid-Sized and Lower-Cost Regions: Salaries in smaller cities and rural areas will be demonstrably lower, reflecting a lower cost of living and less competition for top-tier executive talent. However, the purchasing power of that salary may be equivalent or even greater.

It's important to note that for the absolute highest levels (C-suite and CEO of major public companies), the geographic variance becomes less pronounced. The talent pool is global, and compensation is benchmarked against national and industry peers, not just local market rates. However, the path *to* that role is often built in these high-cost, high-opportunity cities.

###

Company Type & Size: The Scale of Responsibility

The size and nature of the organization you lead is a massive determinant of compensation. The responsibility of running a 100-person startup is vastly different from running a 100,000-person global corporation.

- Large Public Corporations (e.g., Fortune 500): This is the domain of multi-million dollar pay packages. Compensation is high because the scale, complexity, and public scrutiny are immense. CEOs are managing billions in revenue, thousands of employees, and global supply chains. Their pay is disclosed publicly in SEC filings and is set by a compensation committee of the Board of Directors, who often use third-party consultants to benchmark against peer companies. As seen with Coca-Cola, equity is the largest component.

- Private Companies & Private Equity-Owned Firms: CEOs of large private companies also command very high salaries, often comparable to their public-company peers. However, their compensation structure may be different, with more emphasis on long-term value creation and a potential equity stake that can be monetized upon a sale or IPO. Pay is not publicly disclosed, leading to less public scrutiny.

- Startups (Venture-Backed): In the startup world, cash is king and must be preserved for growth. Therefore, a startup CEO's salary is often significantly lower than that of a corporate executive, perhaps in the $150,000 to $250,000 range. The real prize is equity. A founding or early-stage CEO might own a substantial percentage of the company, which could be worth nothing if the company fails, or worth tens or hundreds of millions of dollars in a successful exit (acquisition or IPO). The compensation model is high-risk, high-reward.

- Non-Profit Organizations: Leaders in the non-profit sector are mission-driven. While the CEO of a very large non-profit (like a major hospital system or foundation) can earn a substantial six-figure or even seven-figure salary, it is generally far less than in the for-profit world. Compensation is governed by a board and is often scrutinized to ensure it is reasonable and that the maximum amount of funds are going toward the organization's programmatic work.

###

Area of Specialization: The Paths to the Top

CEOs are rarely generalists from day one. They typically rise through the ranks by achieving excellence in a specific functional area. The most common "feeder roles" into the CEO position are:

- Finance (The CFO Path): A background in finance provides a deep understanding of capital allocation, M&A, and investor relations. Former CFOs are often seen as safe, disciplined, and financially astute leaders. This path is common across all industries. A top CFO at a large public company can earn $1 million to $10 million+ in total compensation, making it a lucrative executive role in its own right.

- Operations (The COO Path): Chief Operating Officers are masters of execution. They are responsible for the company's day-to-day operations, supply chain, and efficiency. This experience is invaluable for running a complex organization. Former COOs are often chosen as CEOs when a company needs to improve its performance and execution. A COO's pay is typically in the same range as a CFO's.

- Marketing/Sales (The CCO/CMO Path): In consumer-facing industries like CPG (Coca-Cola), retail, and media, the brand is paramount. Leaders who rise through marketing and sales have a deep understanding of the customer, brand building, and revenue generation. James Quincey of Coca-Cola, for example, built his career in marketing and operational roles across various global markets.

- Technology/Product (The CTO/CPO Path): In the tech industry, it is very common for CEOs to have a background in engineering or product development. They understand the core technology that drives the business, which is essential for innovation. The path to CEO at a company like Microsoft or Google is often paved with a history of successful product launches.

The most likely path to CEO often depends on the industry and the specific challenges the company is facing.

###

In-Demand Skills: The Tools That Command a Premium

Beyond degrees and titles, a specific set of high-value skills can dramatically increase an executive's value and, therefore, their salary.

High-Value Hard Skills:

- P&L Management: Direct experience managing a Profit and Loss statement is non-negotiable for senior leadership. It demonstrates you can run a business, not just a department.

- Financial Acumen & Modeling: The ability to read and interpret financial statements, understand valuation, and model business cases is critical for making sound investment decisions.

- Data Analysis & Digital Literacy: In the modern economy, leaders must be comfortable using data to drive decisions and