Are you considering working in Colombia? Perhaps you're an employer looking to understand the local labor landscape, or an expat trying to grasp the cost of living. Or maybe you're a student of economics fascinated by how a single number can shape a nation's destiny. At the heart of all these queries lies one of the most debated, analyzed, and socially significant figures in the country: the `colombia salario minimo`, or the Colombian minimum wage.

This figure is far more than just a baseline for paychecks. It's a cornerstone of economic policy, a benchmark for social security contributions, a driver of national consumption, and the foundation upon which millions of Colombian families build their lives. Understanding its nuances is critical to understanding the modern Colombian economy and its workforce. As a career and economic analyst who has spent years dissecting labor market trends, I’ve observed firsthand how policy decisions like the annual minimum wage adjustment directly impact families' abilities to plan, save, and grow. It's not an abstract number; it's the financial bedrock for a vast segment of the population, with an average salary for those on it hovering around $1,300,000 Colombian Pesos (COP) per month in 2024, including mandatory subsidies.

This guide will demystify the `colombia salario minimo`. We will move beyond the headlines to provide a comprehensive, authoritative, and in-depth analysis. We will explore what this wage actually means in practice, dissect the factors that determine its real-world value, examine the economic outlook for low-wage sectors, and offer a strategic roadmap for career growth for those starting at this level. This is your ultimate resource for navigating the economic realities and opportunities tied to Colombia's minimum wage.

### Table of Contents

- [What Exactly Is Colombia's `Salario Mínimo`?](#what-is-it)

- [The `Salario Mínimo`: A Deep Dive into the Numbers](#the-numbers)

- [Key Factors That Influence the Real Value of the `Salario Mínimo`](#key-factors)

- [Economic Outlook and the Future of Low-Wage Work in Colombia](#outlook)

- [Navigating Your Career from a `Salario Mínimo` Position](#career-path)

- [Conclusion](#conclusion)

What Exactly Is Colombia's `Salario Mínimo`?

In Colombia, the minimum wage is officially known as the `Salario Mínimo Legal Mensual Vigente` (SMLMV), which translates to the "Current Legal Monthly Minimum Wage." It is the lowest monthly remuneration that employers are legally required to pay their formal employees for a standard full-time work schedule (typically 47 hours per week as of 2024).

However, the number you see in headlines is not the full picture. The take-home reality for a minimum wage worker is a composite figure. The core components are:

1. The Base Salary (SMLMV): This is the foundational amount set annually by the government.

2. The Transportation Subsidy (`Auxilio de Transporte`): This is a mandatory, additional payment for employees who earn up to two times the SMLMV. It is intended to help cover commuting costs and is a crucial part of the total compensation package for low-wage workers.

The process of setting the SMLMV is a major national event that takes place at the end of each year. It involves a tripartite negotiation body called the Permanent Commission for the Consultation of Labor and Wage Policies (`Comisión Permanente de Concertación de Políticas Salariales y Laborales`). This commission brings together three key parties:

- Government Representatives: Including the Ministry of Labor, Ministry of Finance, and the National Planning Department.

- Business Guilds: Major employer associations like the National Business Association of Colombia (ANDI) and the National Federation of Merchants (FENALCO).

- Labor Unions: The largest worker confederations, such as the Unitary Workers' Central (CUT) and the General Confederation of Labor (CGT).

These groups negotiate based on key economic indicators, primarily the previous year's inflation rate plus a productivity factor. The goal for unions is to secure a significant real-term increase in purchasing power for workers, while business guilds often caution against large hikes that they argue could stifle job creation or fuel inflation. If the parties cannot reach an agreement by a set deadline, the President of Colombia sets the new wage by decree.

### A "Budget on the Salario Mínimo": A Glimpse into Daily Reality

To make this tangible, let's imagine a day in the life, or rather a month in the budget, of "Ana," a single individual working as a retail assistant in Bogotá and earning the 2024 minimum wage.

Monthly Income (2024 Figures):

- Base Salary (SMLMV): $1,300,000 COP

- Transportation Subsidy: $162,000 COP

- Total Gross Income: $1,462,000 COP

Mandatory Deductions:

- Health Insurance (`Salud` - 4%): -$52,000 COP

- Pension Fund (`Pensión` - 4%): -$52,000 COP

- Total Deductions: -$104,000 COP

Net Monthly Income: $1,358,000 COP (Approximately $345 USD at an exchange rate of 3,950 COP/USD)

Hypothetical Monthly Budget in Bogotá:

- Rent: -$650,000 COP (Renting a room in a shared apartment in a working-class neighborhood like Kennedy or Suba).

- Utilities (Water, Electricity, Gas): -$120,000 COP

- Phone & Internet Plan: -$60,000 COP

- Groceries: -$400,000 COP (Careful shopping at discount markets like D1 or Ara).

- Transportation: The `auxilio de transporte` covers most daily TransMilenio commutes, but extra trips might cost an additional -$30,000 COP.

Remaining Discretionary Income: $98,000 COP (Approximately $25 USD)

This remaining amount must cover everything else: clothing, personal care items, emergencies, medicine not covered by basic insurance, and any form of leisure. As this stark example shows, while the `salario mínimo` provides a foundation for survival, it leaves virtually no room for savings, significant discretionary spending, or financial shocks, especially in a major metropolitan area.

The `Salario Mínimo`: A Deep Dive into the Numbers

Understanding the exact figures and their context is crucial for anyone employing, earning, or analyzing the `colombia salario minimo`. This section provides a detailed breakdown of the current wage, its historical trends, and the full compensation picture beyond the base salary.

For 2024, the Colombian government decreed the following official figures, as published by the Ministerio del Trabajo (Ministry of Labor):

- `Salario Mínimo Legal Mensual Vigente` (SMLMV): $1,300,000 COP per month.

- `Auxilio de Transporte` (Transportation Subsidy): $162,000 COP per month.

- Total Minimum Monthly Compensation: $1,462,000 COP per month.

This represented a 12.07% increase in the base salary and a 15.2% increase in the subsidy compared to 2023, a decision heavily influenced by the high inflation experienced in the preceding year.

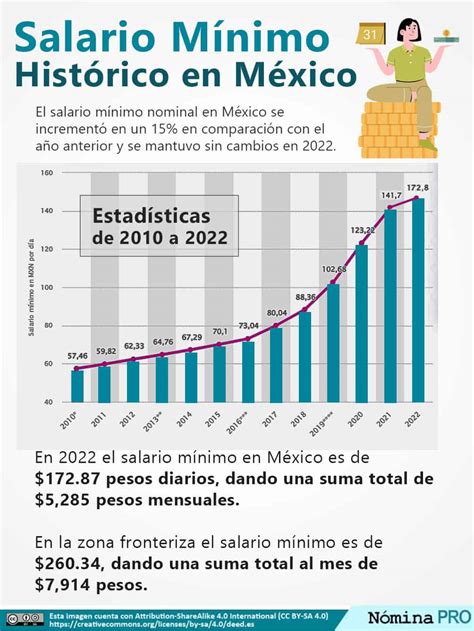

### Historical Context: The Last Decade of the SMLMV

To appreciate the current wage, it's vital to see its evolution. Exchange rate volatility means the USD equivalent can be misleading year-to-year, but the COP value shows the nominal progression within the local economy.

| Year | SMLMV (COP) | `Auxilio de Transporte` (COP) | Total Monthly (COP) | Approximate USD Value (at year-end) |

| :--- | :---------- | :----------------------------- | :------------------ | :---------------------------------- |

| 2024 | $1,300,000 | $162,000 | $1,462,000 | ~$370 |

| 2023 | $1,160,000 | $140,606 | $1,300,606 | ~$325 |

| 2022 | $1,000,000 | $117,172 | $1,117,172 | ~$280 |

| 2021 | $908,526 | $106,454 | $1,014,980 | ~$255 |

| 2020 | $877,803 | $102,854 | $980,657 | ~$245 |

| 2019 | $828,116 | $97,032 | $925,148 | ~$230 |

| 2018 | $781,242 | $88,211 | $869,453 | ~$220 |

| 2017 | $737,717 | $83,140 | $820,857 | ~$205 |

| 2016 | $689,455 | $77,700 | $767,155 | ~$190 |

| 2015 | $644,350 | $74,000 | $718,350 | ~$180 |

*Source: Historical data compiled from decrees issued by the Colombian Ministry of Labor. USD values are approximate and for illustrative purposes only, subject to exchange rate fluctuations.*

This table illustrates the steady nominal increase in the wage. However, the real story is its purchasing power when measured against inflation. The primary goal of the annual negotiations is to ensure the increase is higher than the previous year's Consumer Price Index (CPI), a goal that has been met in recent years, leading to modest but real gains for workers.

### Beyond the Paycheck: The Full Employer Cost and Employee Benefits

For an employer in the formal sector, the cost of hiring a minimum wage employee is significantly higher than the $1,462,000 COP the employee receives. This is due to mandatory social contributions known as `prestaciones sociales` and `parafiscales`. Understanding these is essential for any business operating in Colombia.

The approximate full monthly cost to an employer for one minimum wage worker is roughly 52-56% higher than the base salary.

Here is a breakdown of the additional employer-paid components:

- Pension Fund (`Pensión` - Employer's 12%): $156,000 COP

- Health Insurance (`Salud` - Employer's 8.5%): $110,500 COP

- Occupational Risk Insurance (`Riesgos Laborales` - ARL, avg. 0.522%): $6,786 COP

- Severance Pay (`Cesantías` - 8.33% of total compensation): $121,785 COP (This is paid into a fund for the employee annually).

- Interest on Severance (`Intereses sobre Cesantías` - 1% of Cesantías): $14,614 COP (Paid directly to the employee annually).

- Service Bonus (`Prima de Servicios` - 8.33%): $121,785 COP (Paid in two installments, June and December).

- Paid Vacation (`Vacaciones` - 4.17%): $54,210 COP (Accrued).

- Family Compensation Fund (`Caja de Compensación` - 4%): $52,000 COP

Total Approximate Monthly Cost to Employer ≈ $2,100,000 COP

This comprehensive system means that while an employee's net monthly income is $1,358,000 COP, their total package of benefits and accrued savings is much larger. The `cesantías` act as a form of unemployment insurance or can be used for housing and education, and the `prima` acts as a crucial mid-year and year-end bonus, making June and December vital months for household finances. This structure is a cornerstone of Colombia's formal labor code, designed to provide a robust safety net for workers.

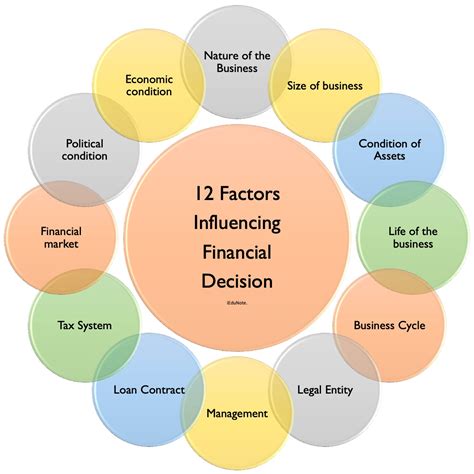

Key Factors That Influence the Real Value of the `Salario Mínimo`

The official value of the `salario mínimo` is a fixed number, but its real-world impact and purchasing power are anything but uniform. Numerous factors dramatically alter what this wage means for an individual or family. As an analyst, this is where we move from simple numbers to complex socioeconomic realities.

### ### Geographic Location: The Urban vs. Rural Divide

Location is arguably the single most important factor determining the adequacy of the minimum wage. The cost of living varies enormously across Colombia's diverse geography.

- High-Cost Cities (Bogotá, Cartagena, Medellín): In the capital and major tourist hubs, the `salario mínimo` is stretched to its absolute limit. According to DANE (Colombia's National Administrative Department of Statistics), Bogotá consistently has one of the highest consumer price indexes in the country. Rent is the biggest differentiator. A single room can consume over 50% of a person's net minimum wage income. In Cartagena, high prices are driven by tourism, affecting everything from food to transportation. Living on the minimum wage in these cities requires meticulous budgeting, reliance on public transportation, and often living in peripheral neighborhoods with long commute times.

- Mid-Tier Cities (Cali, Barranquilla, Bucaramanga): In these cities, the minimum wage offers slightly more breathing room. While still a modest income, lower rental prices and general living costs mean the wage can cover basic needs with a small amount left over. For example, renting a small apartment (not just a room) might become feasible for a dual-income couple earning minimum wage.

- Smaller Cities and Rural Areas (e.g., Tunja, Pasto, rural zones): Here, the `salario mínimo` can represent a relatively stable and decent income. The cost of housing and locally produced food is significantly lower. In many agricultural regions, a formal job paying the full SMLMV with all benefits is considered a high-quality, desirable position compared to the precariousness of informal agricultural labor.

### ### The Informal Economy: The Lawless Majority

The most significant and challenging factor in any discussion of the `colombia salario minimo` is the vast informal economy. According to DANE's 2023 data, the rate of labor informality in Colombia hovers around 55-58%. This means that well over half of the country's workforce operates outside the legal framework.

For these tens of millions of people—street vendors, small-scale farmers, domestic workers without contracts, gig economy workers—the `salario mínimo` is not a legally enforced floor but rather a distant reference point. Their characteristics include:

- No Guaranteed Wage: Earnings can fluctuate wildly day-to-day.

- No Benefits: They do not receive `cesantías`, `prima`, paid vacation, or employer contributions to health and pension.

- No Social Security: They are often not affiliated with the formal health system (relying on the subsidized regime) and are not saving for retirement.

Therefore, a formal job paying "only" the `salario mínimo` is a position of relative privilege and security compared to the majority of the workforce who face far greater precarity.

### ### Inflation: The Annual Race to Stay Afloat

Inflation, or the `costo de vida` (cost of living), is the arch-nemesis of the minimum wage. The annual increase in the SMLMV is fundamentally a race against the previous year's inflation. If the wage hike is 12% but inflation was 10%, the real gain in purchasing power is only 2%.

Food prices are particularly sensitive and disproportionately affect low-income households, as a larger percentage of their budget is spent on groceries. A spike in the price of potatoes, onions, or eggs, as has been seen in recent years, is felt immediately and acutely by minimum wage earners. This is why the inflation figure reported by DANE is the most critical number in the annual wage negotiations.

### ### Industry & Sector: Where Minimum Wage is the Norm

The `salario mínimo` is not evenly distributed across the economy. It is highly concentrated in specific sectors.

- Agriculture: A large portion of formal agricultural jobs are pegged to the minimum wage.

- Retail & Commerce: Positions like cashiers, shelf stockers, and cleaning staff in supermarkets and department stores are typically minimum wage roles.

- Hospitality & Food Service: Waitstaff, kitchen assistants, and hotel cleaning crews often start at or near the minimum wage (though tips can supplement income for some).

- Security & Cleaning Services: These outsourced services, common in residential buildings and offices, are almost entirely staffed by minimum wage workers.

- Manufacturing: Entry-level assembly line and manual labor positions in factories frequently pay the SMLMV.

Conversely, sectors like finance, technology, professional services, and mining have much higher average salaries, and the SMLMV is rarely seen except for ancillary staff.

### ### Education and Skills: The Bridge to Higher Earnings

While the `salario mínimo` is a wage floor, a person's educational attainment and skillset are the primary determinants of whether they remain at that floor.

- Basic Education: A significant portion of minimum wage earners have completed only primary or secondary school.

- Technical Training: This is the most powerful escape route. A certification from an institution like SENA (Servicio Nacional de Aprendizaje), Colombia's renowned public vocational training service, can be transformative. A certified welder, electrician, administrative assistant, or software development technician can command a salary significantly above the minimum, often starting at 1.5x to 2x the SMLMV.

- University Degree: A professional university degree is typically the entry ticket to salaried professional jobs that start well above the minimum wage and have a clear path for advancement.

The `salario mínimo` is therefore often a starting point for young people entering the workforce or a long-term reality for those without access to further education or specialized skills training.

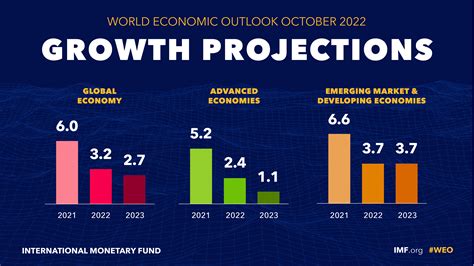

Economic Outlook and the Future of Low-Wage Work in Colombia

The future of the `colombia salario minimo` and the millions who depend on it is intertwined with broader economic trends, technological shifts, and government policy. Analyzing the outlook requires looking beyond the annual increase to the structural forces shaping the labor market.

### The Role of Minimum Wage in the National Economy

The debate around the `salario mínimo` in Colombia is a perennial one. Economists at institutions like Banco de la República (Colombia's central bank) and Fedesarrollo (a leading economic think tank) continuously study its effects. The key arguments are:

- Pro-Increase Argument: Labor unions and progressive economists argue that robust minimum wage increases are essential for reducing inequality and boosting aggregate demand. When low-income families have more money, they spend it immediately on essential goods and services, stimulating the local economy. They see it as a critical tool for social justice and poverty reduction.

- Cautionary Argument: Business guilds and more conservative economists warn that excessively high increases—especially those far above inflation and productivity gains—can have negative consequences. They argue it can (1) increase informality, as small businesses unable to afford the new wage and associated costs may opt to hire "off the books"; (2) create barriers to entry for young or unskilled workers, as companies become more selective; and (3) fuel inflation if businesses pass on the higher labor costs to consumers.

The reality, as with most complex economic issues, likely lies somewhere in between. Recent data from DANE has not shown a direct, causal link between recent wage hikes and a dramatic spike in unemployment, though the high rate of informality remains a persistent structural challenge.

### Emerging Trends and Future Challenges

Several key trends are set to reshape the landscape for low-wage workers in Colombia:

1. Automation and AI: Sectors with high concentrations of minimum wage labor, such as manufacturing, retail (e.g., automated checkouts), and administrative support (e.g., data entry), are susceptible to automation. While this may not eliminate all jobs, it will fundamentally change the skills required. Repetitive manual and cognitive tasks will be the first to be automated, placing a premium on skills that are harder to automate: critical thinking, creativity, and interpersonal communication.

2. The Gig Economy: The rise of platforms like Rappi (for delivery) and DiDi/Cabify (for transport) has created a new form of flexible work. However, these workers are typically classified as independent contractors, not employees. This means they are not protected by the `salario mínimo`, do not receive `prestaciones sociales`, and must cover their own social security costs. The legal and social debate over the rights and protections for gig economy workers is a major, ongoing issue that will define the future of low-skill urban work.

3. Formalization Efforts: The Colombian government, with support from international bodies like the World Bank, is actively pursuing policies to reduce labor informality. These include simplifying the process for small businesses to register their employees, offering incentives for formalization, and strengthening labor inspections. The success of these efforts will be crucial in extending the legal protections of the `salario mínimo` to a wider portion of the population.

### How to Stay Relevant and Advance

For an individual currently earning the minimum wage, proactive career management is not a luxury; it is a necessity. The key to future-proofing one's career is continuous learning and adaptation.

- Focus on Transferable Skills: Even in a basic retail or service job, one can focus on developing valuable soft skills: customer service, conflict resolution, teamwork, and reliability. These are transferable to any higher-paying job.

- Embrace Digital Literacy: Basic digital skills are no longer optional. Proficiency in common office software, communication platforms, and even social media for business is becoming a baseline expectation for many roles that pay above minimum wage.

- Leverage Vocational Training: The importance of SENA cannot be overstated. It offers free, high-quality technical and technological programs in fields with high demand, from software development and digital marketing to industrial mechanics and healthcare support. Completing a SENA program is one of the most effective and accessible pathways to tripling one's income potential.

Navigating Your Career from a `Salario Mínimo` Position

Starting your career at the `salario mínimo` is a reality for many, but it does not have to be a final destination. With a strategic approach, a commitment to personal development, and an understanding of the local labor market, it can be a stepping stone to a more prosperous future. This section provides a practical, step-by-step guide for growth.

### Step 1: Master