Table of Contents

- [What Does a CPA in New York Actually Do?](#what-does-a-cpa-accountant-salary-new-york-do)

- [Average CPA Accountant Salary New York: A Deep Dive](#average-cpa-accountant-salary-new-york-salary-a-deep-dive)

- [Key Factors That Influence a New York CPA's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for CPAs in New York](#job-outlook-and-career-growth)

- [How to Become a CPA in New York: Your Step-by-Step Guide](#how-to-get-started-in-this-career)

- [Is a CPA Career in New York Right for You?](#conclusion)

---

New York City. The name alone conjures images of ambition, financial power, and towering skyscrapers that house the engines of the global economy. For those with a mind for numbers, a passion for order, and a drive to succeed, the role of a Certified Public Accountant (CPA) in this dynamic metropolis represents a pinnacle of professional achievement. You're likely here because you're asking a critical question: "What is a CPA accountant salary in New York?" The short answer is: it's substantial, and it's the gateway to a career of immense opportunity and influence. But the full answer is far more nuanced, exciting, and worth exploring in detail.

The allure of a New York CPA career extends far beyond a impressive paycheck. It's about being at the very heart of business. As a career analyst who has guided hundreds of professionals, I've seen firsthand how a CPA license can transform a standard accounting job into a strategic, high-impact career. I once worked with a young accountant who felt her work was repetitive and unfulfilling. After she earned her CPA, her entire perspective—and her employer's—shifted. She was no longer just reconciling accounts; she was advising on major financial decisions for a growing tech startup, directly shaping its future. That is the power of this credential in a city that never stops moving.

This guide is designed to be your definitive resource, moving beyond simple salary figures to give you a complete, 360-degree view of the CPA profession in New York. We will dissect compensation packages, explore the myriad factors that can increase your earning potential, and map out the exact steps you need to take to join this elite group of professionals. Whether you're a student weighing your options, an early-career accountant looking to level up, or a seasoned professional considering a move to the Empire State, this article will provide the clarity and data you need to make your next move with confidence.

---

What Does a CPA in New York Actually Do?

Before we dive into the numbers, it's essential to understand the substance behind the title. A CPA is not merely an accountant; they are a trusted financial advisor, a guardian of fiscal integrity, and a strategic partner to businesses and individuals. The CPA designation is a license that signifies a deep level of expertise, a commitment to a stringent code of ethics, and the authority to perform certain tasks that other accountants cannot, such as signing an audit report. In a complex financial hub like New York, their role is indispensable.

The responsibilities of a New York CPA are vast and varied, but they generally fall into three core domains:

1. Public Accounting (Assurance/Audit and Tax): This is the most traditional path. CPAs in public accounting firms—from the global "Big Four" (Deloitte, PwC, EY, KPMG) to large national firms and smaller local practices—serve multiple clients.

- Assurance/Audit: Here, CPAs examine a company's financial statements to ensure they are accurate, free of material misstatement, and compliant with Generally Accepted Accounting Principles (GAAP). They issue an audit opinion, a critical component for public companies that investors and regulators rely on.

- Tax: CPAs in tax help businesses and high-net-worth individuals navigate the labyrinthine world of federal, state, and local tax laws. This involves preparing complex tax returns, developing strategies to minimize tax liability legally, and representing clients before the IRS or state tax authorities.

2. Corporate Accounting (Industry): Many CPAs choose to work "in-house" for a single company. They are the backbone of the finance department in industries ranging from banking on Wall Street to fashion, media, technology, and real estate.

- Their roles can include Financial Controller, Director of Finance, Chief Financial Officer (CFO), internal auditor, or financial planning and analysis (FP&A) manager. They oversee financial reporting, budgeting, forecasting, and ensure the company's internal controls are robust.

3. Advisory and Specialized Services: This is one of the fastest-growing and often most lucrative areas. CPAs leverage their financial acumen to provide specialized consulting services.

- Forensic Accounting: Investigating financial fraud and white-collar crime.

- Mergers & Acquisitions (M&A): Performing due diligence on target companies.

- IT Audit: Assessing the risks and controls related to a company's information systems.

- Personal Financial Planning: Helping individuals manage their wealth and plan for retirement.

### A "Day in the Life" of a Senior Tax Associate in a NYC Public Accounting Firm

To make this more concrete, let's imagine a day for "Alex," a Senior Tax Associate at a mid-sized firm in Midtown Manhattan during the March "busy season."

- 7:30 AM: Alex grabs a coffee and bagel and is at their desk early. The first 30 minutes are spent triaging a flood of emails from clients and managers, flagging urgent requests regarding K-1s for a large partnership client.

- 8:00 AM: The morning is dedicated to a high-priority hedge fund client. Alex is reviewing the complex partnership tax return prepared by a junior associate, focusing on carried interest calculations and ensuring compliance with new international tax provisions. This requires deep technical knowledge and meticulous attention to detail.

- 11:00 AM: Alex jumps on a video call with the fund's controller to clarify some questions about specific investment transactions. Clear communication and client management skills are crucial here.

- 12:30 PM: A quick lunch eaten at the desk while reviewing industry news. Staying current on tax law changes is a non-negotiable part of the job.

- 1:00 PM: Alex switches gears to a real estate client, helping to model the tax implications of a potential property sale (a Section 1031 exchange). This is more advisory in nature, blending compliance with strategic planning.

- 4:00 PM: The partner on the hedge fund engagement stops by to review Alex's progress. They discuss a particularly gray area in the tax code and decide on the firm's position, which Alex will document in a technical memo.

- 6:30 PM: Alex spends the last part of the day providing feedback and training to the junior associate, reviewing their workpapers and explaining the more complex concepts.

- 8:00 PM: After logging billable hours for the day, Alex finally heads home, knowing another intense day awaits tomorrow.

This "busy season" day is demanding, but it highlights the blend of technical expertise, client interaction, problem-solving, and project management that defines the CPA role in New York. The off-season offers a better work-life balance with more time for training, business development, and strategic projects.

---

Average CPA Accountant Salary New York: A Deep Dive

Now for the central question: How much does this demanding but rewarding work pay? A CPA accountant salary in New York is significantly higher than the national average, reflecting the state's high cost of living and its status as a global financial center.

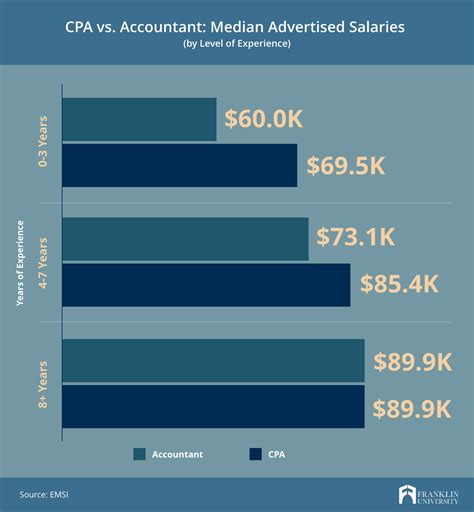

It's crucial to differentiate between a general accountant's salary and a CPA's salary. The CPA license acts as a powerful salary multiplier, often adding a 10-15% premium, or even more, to one's earning potential.

### National vs. New York Salary Benchmarks

Let's establish a baseline by looking at the broader data before narrowing it down to New York CPAs.

- National Average (Accountants & Auditors): According to the U.S. Bureau of Labor Statistics (BLS) May 2022 data (the most recent detailed report), the median annual wage for accountants and auditors in the United States was $78,000.

- New York State Average (Accountants & Auditors): The same BLS report shows that New York is one of the top-paying states for this profession, with an annual mean wage of $104,230.

- New York City Metro Area Average: Zeroing in further, the New York-Newark-Jersey City metropolitan area boasts an even higher annual mean wage of $107,350.

These figures from the BLS include all accountants, both CPAs and non-CPAs. When we isolate for the CPA credential, the numbers climb significantly. Reputable salary aggregators, which often factor in user-reported data including bonuses and specializations, provide a clearer picture for CPAs.

According to data from Salary.com (updated for 2024), the average CPA salary in New York, NY, is approximately $124,500, with a typical range falling between $110,900 and $140,200.

### Salary by Experience Level in New York

A CPA's salary growth trajectory is steep, especially in the first decade of their career. Here’s a typical breakdown of what you can expect for a CPA accountant salary in New York based on experience:

| Experience Level | Years of Experience | Typical Base Salary Range (NYC) | Potential Role |

| :--- | :--- | :--- | :--- |

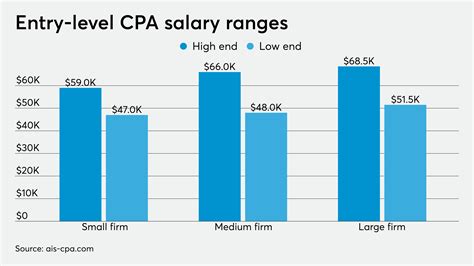

| Entry-Level / Associate | 0-2 Years | $75,000 - $95,000 | Audit or Tax Associate in Public Accounting |

| Mid-Career / Senior | 3-5 Years | $100,000 - $145,000 | Senior Associate, Supervising Senior |

| Experienced / Manager | 6-10 Years | $140,000 - $190,000+ | Manager in Public Accounting, Controller in Industry |

| Senior Leadership / Director| 10+ Years | $190,000 - $250,000+ | Senior Manager, Director, Partner |

| Executive / Partner | 15+ Years | $300,000 - $1,000,000+ | Partner in a CPA Firm, Chief Financial Officer (CFO) |

*Sources: Analysis compiled from Payscale, Salary.com, Glassdoor, and Robert Half Salary Guide data for the New York City market.*

As the table shows, crossing the manager threshold is a major inflection point. At this level, responsibilities shift from primarily execution to management, client relationship ownership, and business development, all of which command a significant salary premium. For those who make Partner at a large firm or become a CFO at a major corporation, the total compensation can easily reach seven figures.

### Beyond the Base Salary: Understanding Total Compensation

A focus solely on base salary is shortsighted. In a competitive market like New York, the total compensation package is a critical part of the financial picture. A CPA's earnings are often substantially boosted by a variety of other components.

- Annual Bonuses: This is the most significant addition to base pay. Bonuses are almost universal in public accounting and common in industry. They are typically tied to individual performance, firm/company performance, and billable hours. For a Senior Associate, a bonus might be 10-15% of their base salary. For Managers and above, this can jump to 20-40% or more.

- Signing Bonuses: To attract top talent, especially from universities or competing firms, New York firms frequently offer signing bonuses, which can range from $5,000 to $20,000 or more for experienced hires.

- Profit Sharing: At the partner level in CPA firms, compensation is directly tied to the firm's profits. In industry, senior leaders may participate in profit-sharing plans or receive equity (stock options, restricted stock units), which can be incredibly lucrative.

- Retirement Plans: A robust 401(k) plan with a generous company match (e.g., 50% match up to 6% of your salary) is standard. This is essentially free money that compounds over your career.

- Health and Wellness Benefits: Comprehensive health, dental, and vision insurance is a given. Many New York firms also offer wellness stipends for gym memberships, mental health apps, and other well-being initiatives to combat the stress of the profession.

- Paid Time Off (PTO): While "busy season" is intense, firms typically offer generous PTO packages (4-5 weeks is common for experienced staff) to be used during slower periods.

- Professional Development: Firms invest heavily in their CPAs. They will pay for CPA license renewal fees, memberships in professional organizations like the AICPA and NYSSCPA, and extensive continuing professional education (CPE) to keep skills sharp.

When you combine a base salary of, say, $130,000 with a 15% bonus ($19,500), a 401(k) match ($6,000), and other benefits, the total value of a mid-career CPA's compensation package in New York can easily exceed $160,000.

---

Key Factors That Influence a New York CPA's Salary

While the averages provide a great starting point, your individual salary is determined by a confluence of factors. Understanding these variables is the key to maximizing your earning potential. This is the most critical section for anyone looking to strategically build a high-earning CPA career in New York.

### ### Level of Education

While a bachelor's degree in accounting is the standard entry point, advanced education can provide a salary edge.

- The 150-Hour Requirement: To become a CPA in New York (and most states), you need 150 semester hours of college credit, which is 30 hours more than a typical bachelor's degree. Many candidates meet this by pursuing a Master of Science in Accountancy (MAcc) or Taxation (MST).

- The Master's Degree Premium: While the primary goal of the master's is to meet the 150-hour rule, it often comes with a starting salary premium of $5,000 to $10,000. Top MAcc programs have deep relationships with Big Four and national firms, providing a direct pipeline to high-paying jobs. The specialized knowledge gained in an MST, in particular, can lead to higher salaries in tax-focused roles.

- MBA with an Accounting Concentration: An MBA from a top-tier business school can be a powerful accelerator, especially for those looking to pivot from public accounting into high-finance roles in industry (e.g., corporate strategy, investment banking, private equity). A CPA with an MBA from a school like NYU Stern or Columbia is a formidable combination and can command salaries well above the typical accounting manager track.

### ### Years and Quality of Experience

This is, without a doubt, the single most significant driver of salary growth. However, not all experience is created equal.

- The Linear Trajectory (0-8 Years): As outlined in the salary table, the first 8 years of a CPA's career see predictable, substantial salary jumps with each promotion: Associate to Senior Associate (around year 2-3), and Senior to Manager (around year 5-6). Each step brings more complex work, supervisory responsibility, and a corresponding pay increase of 20-30%.

- The "Big Four" Experience Premium: Starting your career at one of the Big Four firms (PwC, Deloitte, EY, KPMG) in New York is like a boot camp that pays you. The training is world-class, the clients are large and complex (often Fortune 500 companies), and the brand name on your resume is a mark of quality. CPAs who spend 3-5 years at a Big Four firm are highly sought after in private industry and can often command a significant salary increase when they make the switch. An audit senior from a Big Four firm might leave for a Senior Financial Analyst or Accounting Manager role in industry and see their salary jump from $120,000 to $150,000 overnight.

- The Post-Manager Divergence: After reaching the manager level, the path becomes less linear. High performers who stay in public accounting can aim for Senior Manager and then Partner, where compensation grows exponentially. Those who move to industry might follow a path to Controller and then CFO, with salary tied to the size and success of the company.

### ### Geographic Location within New York

Even within New York State, where you work matters immensely. The "CPA accountant salary New York" query is heavily skewed by the New York City market.

| Location | Average CPA Salary (Estimated) | Cost of Living Index (vs. NYC) | Analysis |

| :--- | :--- | :--- | :--- |

| Manhattan (NYC) | $125,000 - $150,000+ | 100% | The epicenter. Highest salaries due to concentration of HQs, financial firms, and Big Four offices. Highest cost of living erodes some of this advantage. |

| Long Island (Nassau/Suffolk)| $110,000 - $130,000 | ~80% of NYC | Strong market with many mid-sized firms and corporate HQs. Lower salary than Manhattan but also a lower cost of living, offering a potentially better net financial position. |

| Westchester County | $115,000 - $135,000 | ~85% of NYC | Similar to Long Island, a wealthy suburban market with many corporations (PepsiCo, IBM, Mastercard) and high-net-worth individuals requiring tax services. |

| Albany (Capital Region)| $90,000 - $110,000 | ~60% of NYC | Dominated by government and healthcare accounting roles. Salaries are solid for the region but significantly lower than the downstate metro area. |

| Buffalo / Rochester | $85,000 - $105,000 | ~55% of NYC | Growing markets with a focus on manufacturing, tech, and healthcare. Offers an excellent quality of life for the salary but lacks the high-end opportunities of NYC. |

The takeaway is clear: if maximizing raw salary figures is your goal, Manhattan is the place to be. However, when factoring in cost of living, suburban markets like Long Island and Westchester can be financially attractive alternatives.

### ### Company Type & Size

The type of organization you work for has a profound impact on your salary, work-life balance, and career trajectory.

- The Big Four: Offer the highest starting salaries and most structured training. The trade-off is often the most demanding hours, especially during busy season. They are the best launchpad for a high-powered career.

- National & Regional Firms (e.g., Grant Thornton, BDO, RSM): These firms offer a competitive alternative to the Big Four. Salaries may be slightly lower, but the work-life balance can be better. They often serve middle-market clients, which can provide a broader range of experience.

- Small/Local CPA Firms: These firms offer the best work-life balance and a more personal work environment. Base salaries are generally lower, but a clear path to partnership might be more attainable. They are ideal for CPAs who want to serve small businesses and individuals in their community.

- Private Industry (Corporate Accounting): This is a vast category. A CPA working at a powerhouse like Goldman Sachs or JPMorgan Chase in a finance role will earn significantly more (with larger bonuses) than a CPA in a controller role at a mid-sized manufacturing company. A CPA at a pre-IPO tech startup might have a lower base salary but significant potential upside through stock options.

- Government & Non-Profit: These roles offer the lowest salaries but the best work-life balance and job security. A CPA working for the IRS, SEC, or a large non-profit organization like a hospital or university will have a stable, predictable career with strong benefits, but their peak earning potential will be lower than in public accounting or corporate finance.

### ### Area of Specialization

Once you have your CPA, specializing in a high-demand niche is one of the most effective ways to accelerate your salary. Generalists are valuable, but specialists are invaluable.

- Transaction Advisory Services (TAS/M&A): This is one of the most lucrative specializations. CPAs in this field perform financial due diligence for mergers and acquisitions. It's high-pressure, project-based work that commands premium billing rates and, consequently, high salaries and bonuses.

- Forensic Accounting: These financial detectives are hired to investigate fraud, resolve disputes, and provide expert testimony in court. Their specialized skills are in high demand and command high fees.

- IT Audit / Risk Assurance: In an increasingly digital world, CPAs who can bridge the gap between finance and technology are gold. They audit complex ERP systems (like SAP or Oracle), cybersecurity controls, and data integrity. Certifications like the CISA (Certified Information Systems Auditor) can add a significant salary premium.

- International Tax: For a global hub like New York, CPAs who understand the complexities of transfer pricing, tax treaties, and foreign tax credits are essential for multinational corporations. This is a highly complex and highly compensated field.

- Personal Financial Planning (PFP): CPAs who also earn the Personal Financial Specialist (PFS) credential can build lucrative practices advising high-net-worth individuals on everything from investments to estate planning.

### ### In-Demand Skills

Beyond your formal specialization, a portfolio of specific, high-value skills can make you a more attractive candidate and justify a higher salary.

- Hard Skills:

- Data Analytics and Visualization: Proficiency in tools like Alteryx, Tableau, or Power BI is no longer a "nice-to-have"; it's becoming a core competency. CPAs who can analyze large datasets to uncover insights are moving from a compliance role to a strategic one.

- Advanced Excel: Mastery of pivot tables, complex formulas, and modeling is the absolute baseline.

- ERP Systems Knowledge: Deep experience with a major system like SAP, Oracle NetSuite, or Microsoft Dynamics 365 is highly valuable for industry roles.

- Valuation: Skills in business and asset valuation are critical for M&A, financial reporting, and litigation support roles.

- Soft Skills:

- Communication and Presentation: The ability to distill complex financial information into a clear, concise narrative for non-financial stakeholders (like a CEO or a board of directors) is a key differentiator for senior roles.

- Business Acumen: Moving beyond the numbers to understand the business's strategy, competitive landscape, and operational drivers.

- Client Relationship Management: For those in public accounting, the ability to build trust and become a valued advisor to clients is what leads to promotions and partnership.

- Leadership and Mentoring: As you advance, your ability to train and develop junior staff becomes a critical part of your value to the firm.

---

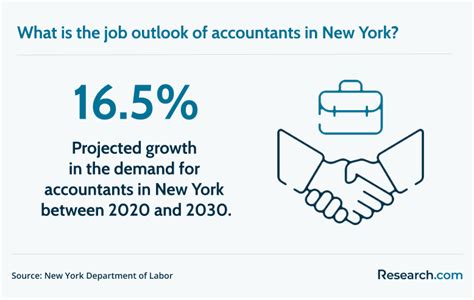

Job Outlook and Career Growth for CPAs in New York

A high salary is attractive, but career stability and growth potential are what make a profession truly valuable. For CPAs in New York, the future looks both stable and full of dynamic opportunities.

### Stable Demand and Projected Growth

The U.S. Bureau of Labor Statistics projects that employment for accountants and auditors will grow by 4 percent from 2022 to 2032, which is about as fast as the average for all occupations. This will result in about 126,500 openings each year, on average, over the decade. Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

Why the steady demand?

1. Globalization: As businesses expand internationally, they need CPAs skilled in international trade, M&A, and complex tax laws.

2. A Complex Regulatory Environment: Ever-changing tax laws and financial reporting standards (like new revenue recognition or lease accounting rules) mean that businesses constantly need expert guidance to remain compliant.

3. An Aging Workforce: A significant portion of current CPAs are baby boomers nearing retirement, creating a "succession gap" and opening up opportunities for the next generation of leaders.

4. Economic Health: As the economy grows, so does the need for accountants to prepare and examine financial records.

In New York, this demand is amplified. As the financial capital of the world, the concentration of public companies, financial institutions, and multinational headquarters ensures a deep and permanent market for top-tier accounting talent.

### Emerging Trends and Future Challenges: The Evolving CPA

The role of the CPA is not static; it's evolving. The accountant of the future will look very different from the "bean counter" of the past. Staying ahead of these trends is key to long-term career success.

- Trend: Automation and AI: Routine, rules-based tasks like data entry and basic reconciliation are being increasingly automated by sophisticated software and AI. This is not a threat, but an opportunity. It frees up CPAs to focus on higher-value, strategic work. The future CPA is an analyst, an advisor, and a technologist.

- Challenge: Accountants must become tech-savvy. They need to understand how these automation tools work, how to manage and analyze the data they produce, and how to use them to provide deeper insights.

- Trend: The Rise of ESG: Environmental, Social, and Governance (ESG) reporting is becoming a major focus for investors and regulators. Companies need CPAs to help them measure, report on, and get assurance