Navigating the world of credit for the first time, or on a modest income, can feel like trying to solve a complex puzzle with missing pieces. You see offers for cards with tantalizing rewards and hear stories of financial freedom, but the big question looms: "What kind of credit card limit can I realistically get with a $30,000 salary?" It’s a question that’s not just about a number; it’s about access, opportunity, and the first crucial step toward building a strong financial future. The answer is more nuanced and empowering than you might think. While you may not start with a five-figure limit, a $30,000 annual income is absolutely a solid foundation for securing a credit card, building an excellent credit score, and steadily growing your credit line over time. The potential isn't just in the spending power, but in the power to shape your financial destiny. I'll never forget the first secured credit card I helped a young client apply for; the initial $300 limit felt small to them, but a year later, that card was the cornerstone of a credit score that allowed them to get a fair rate on their first car loan. That small limit wasn't a restriction; it was a launchpad.

This comprehensive guide is designed to be your launchpad. We will demystify the entire process, replacing uncertainty with clarity and confidence. We’ll dive deep into the specific credit limits you can expect, dissect the exact factors lenders scrutinize, and provide a step-by-step roadmap to not only getting approved but also strategically increasing your limit over time. By the end of this article, you will have the expert knowledge to confidently apply for the right credit card and use it as a powerful tool for financial growth.

### Table of Contents

- [Understanding Credit Card Limits: How Are They Determined?](#understanding-credit-card-limits-how-are-they-determined)

- [Expected Credit Card Limits for a $30,000 Salary: A Deep Dive](#expected-credit-card-limits-for-a-30000-salary-a-deep-dive)

- [Key Factors That Influence Your Credit Limit](#key-factors-that-influence-your-credit-limit)

- [Building Your Credit and Increasing Your Limit Over Time](#building-your-credit-and-increasing-your-limit-over-time)

- [How to Apply for a Credit Card with a $30,000 Salary: A Step-by-Step Guide](#how-to-apply-for-a-credit-card-with-a-30000-salary-a-step-by-step-guide)

- [Conclusion: Your Starting Limit is Not Your Final Destination](#conclusion-your-starting-limit-is-not-your-final-destination)

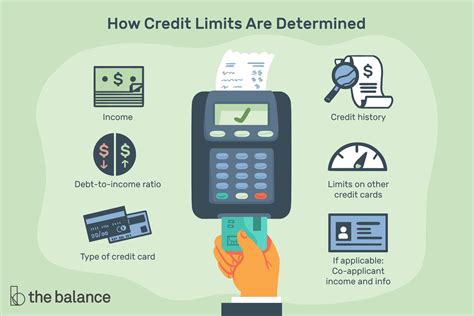

Understanding Credit Card Limits: How Are They Determined?

Before we can talk about specific numbers, it’s essential to understand what a credit limit is and the logic behind how it's assigned. A credit limit is the maximum amount of revolving credit a financial institution is willing to extend to you on a specific credit card. It's not free money; it's a loan that you can borrow from, repay, and borrow from again. For the lender, setting this limit is a calculated risk. They want to give you enough credit to make the card useful (and for them to earn money through interest and fees), but not so much that you're likely to get into financial trouble and be unable to pay it back.

The process of determining your limit is a sophisticated risk assessment. When you submit a credit card application, the issuer’s underwriting system—a complex algorithm combined, in some cases, with human oversight—goes to work. It pulls together various data points about your financial life to create a comprehensive risk profile. Think of it as a lender asking, "Based on this person's financial history and current situation, how confident are we that they will pay back what they borrow?"

The core responsibilities of this system are to:

1. Verify Your Identity and Income: Confirming you are who you say you are and that your stated income is plausible.

2. Assess Your Creditworthiness: Analyzing your credit report to understand your past behavior with debt.

3. Evaluate Your Capacity to Pay: Looking at your income relative to your existing debt obligations.

4. Assign a Risk Level: Quantifying the risk you pose as a borrower.

5. Determine an Appropriate Credit Line: Offering a limit that balances their risk with your needs.

### A Lender's Decision Process: A "Day in the Life" Example

To make this tangible, let's imagine the journey of an application from "Alex," who earns a $30,000 salary ($2,500/month).

- 9:00 AM: Alex submits an online application for a "cash back rewards" card. The application asks for their name, address, Social Security Number, and total annual income ($30,000).

- 9:01 AM: The bank's automated system instantly pings the three major credit bureaus (Experian, Equifax, and TransUnion) for Alex's credit report and score. The system receives a FICO score of 680 (considered "Good"), a report showing a 3-year-old student loan in good standing, and a car payment.

- 9:02 AM: The algorithm now calculates Alex's debt-to-income (DTI) ratio. It sees the monthly student loan payment ($150) and car payment ($250). Total monthly debt is $400. With a gross monthly income of $2,500, the DTI is ($400 / $2,500) = 16%. This is a very low and favorable DTI.

- 9:03 AM: The system's internal rules are reviewed. For a FICO score of 680, the bank's policy might be to offer a credit line equal to 5-10% of annual income. For a low DTI like Alex's, it might lean toward the higher end of that range.

- 9:04 AM: The system flags Alex as "Approved." It calculates the credit limit. 10% of $30,000 is $3,000. This is a reasonable starting limit for someone with a good score and low debt. The system generates an approval notice stating the credit limit is $3,000 and the Annual Percentage Rate (APR) is 21.99%.

- 9:05 AM: Alex receives an email: "Congratulations, you've been approved!"

In this scenario, every piece of information worked together to paint a picture of a responsible borrower, resulting in a solid starting limit. If Alex had no credit history or a lower score, the process and outcome would be very different, likely leading to a smaller limit or a recommendation for a different type of card.

Expected Credit Card Limits for a $30,000 Salary: A Deep Dive

This is the central question, but the honest answer from any financial expert is: it depends. There is no single, guaranteed credit limit for a $30,000 salary. Your income is just one ingredient in the recipe. The most significant other ingredient is your credit history and score.

However, we can provide data-driven, realistic ranges to help you set expectations. Most lenders have unwritten rules of thumb. A common starting point for an initial credit limit on a traditional, unsecured card is often between 5% and 20% of your annual income. Where you fall in that range—or if you fall in it at all—is determined by the other factors we will discuss.

Let's break down the probable outcomes based on your credit profile. For these examples, we will assume a stable annual income of $30,000 and a low to moderate amount of existing debt.

### Credit Limit Expectations by Credit Score Tier

Your credit score is a numerical summary of your credit risk, and it's one of the most powerful predictors of your initial credit limit. Here’s what you might expect based on standard FICO score ranges:

| Credit Score Tier | FICO Score Range | Typical Card Type | Plausible Limit Range (for $30k Salary) | Lender's Perspective |

| :--- | :--- | :--- | :--- | :--- |

| Excellent Credit | 800 - 850 | Rewards, Cash Back, Travel | $3,000 - $6,000+ | You are a very low-risk borrower. Lenders are confident in your ability to manage credit and will offer a generous starting limit (10-20% of income) to win your business. |

| Good Credit | 670 - 799 | Standard Unsecured, Rewards | $1,500 - $3,500 | You are a reliable borrower with a proven track record. Lenders see you as a safe bet and will offer a solid, functional limit (5-12% of income). |

| Fair Credit | 580 - 669 | Unsecured Cards for Fair Credit | $500 - $1,500 | Lenders see some risk. You may have a short credit history or minor blemishes. They'll offer a "starter" limit to see how you handle it, often with a higher APR. |

| Poor / No Credit | Below 580 / No Score | Secured Cards, Student Cards | $200 - $500 (Typically equals your security deposit) | You are a high-risk or unknown-risk applicant. Lenders will not extend unsecured credit. A secured card is your path to building or rebuilding your credit profile. |

*Sources: This table is a synthesized analysis based on general industry practices reported by financial authorities like the Consumer Financial Protection Bureau (CFPB) and leading consumer finance publications such as NerdWallet, Forbes Advisor, and Experian. Specific limits are not published by banks, but these ranges reflect the common experiences of applicants.*

### A Deeper Look at Compensation Components (Types of Cards)

The "compensation" you get from a credit card comes in the form of its features and limit. For a $30,000 income, the type of card you apply for dramatically impacts your likely limit.

- Secured Credit Cards: This is the most accessible option for those with poor or no credit. Your credit limit is almost always equal to the refundable security deposit you provide. If you deposit $300, your limit is $300. This eliminates the lender's risk entirely. While the limit is small, the "compensation" is huge: the ability to build a positive payment history that will be reported to all three credit bureaus, allowing you to qualify for better cards in the future.

- Student Credit Cards: Designed for college students with limited income and credit history. Lenders are more lenient in their approval criteria. Initial limits are typically modest, often in the $500 to $1,500 range. The goal is to build a relationship with a future high-earner.

- Unsecured Cards for Fair Credit: These cards are the next step up. They don't require a security deposit but come with higher interest rates and fewer rewards. For a $30,000 salary, expect a starting limit between $500 and $2,000. Issuers like Capital One (with its Platinum and QuicksilverOne cards) and Discover (with the Discover it® Secured and Chrome cards) specialize in this market.

- Standard Rewards Cards: These are the cards people often aspire to, offering cash back, points, or miles. To qualify with a $30,000 income, you will almost certainly need a "Good" to "Excellent" credit score (670+). If you meet that bar, a limit of $1,500 to $5,000 is a very reasonable expectation.

It's crucial to be realistic. Applying for a premium travel card like the Chase Sapphire Reserve® or The Platinum Card® from American Express with a $30,000 salary is highly unlikely to result in an approval, regardless of your credit score. These cards are designed for high-income, high-spending individuals, and their underwriting criteria reflect that. Stick to the card categories that align with your current financial profile.

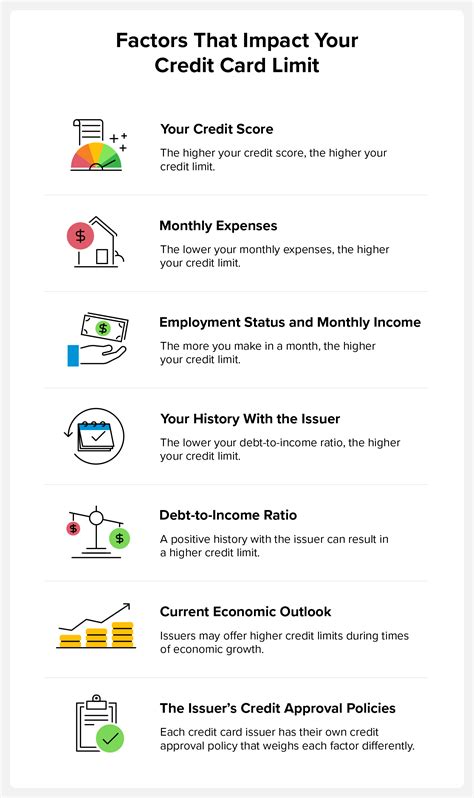

Key Factors That Influence Your Credit Limit

Your final credit limit is not an arbitrary number. It is the output of a complex calculation that weighs several key factors. Understanding these factors empowers you to present yourself as the strongest possible applicant and, eventually, to take actions that will lead to higher limits. Your $30,000 salary is the starting point, but these elements determine the final result.

###

Your Credit History and Score

This is, without a doubt, the most influential factor besides income. A credit score is a lender's shortcut to understanding your financial past and predicting your future behavior. A high score tells them you have a history of paying bills on time and managing debt responsibly. A low score signals risk.

- Payment History (35% of FICO Score): This is the single biggest component. A history of on-time payments is critical. Even one 30-day late payment can significantly drop your score and reduce the limit you’re offered. Lenders will be very hesitant to extend a large line of credit if you’ve been late paying other creditors.

- Credit Utilization Ratio (30% of FICO Score): This is the percentage of your available credit that you are currently using. High balances on existing cards suggest you might be financially stretched. To a new lender, this is a red flag. Ideally, you want to keep your overall utilization below 30%, and below 10% is even better. For an applicant with a $30,000 salary, having a low utilization on any existing accounts is paramount.

- Length of Credit History (15% of FICO Score): A longer history provides more data for lenders to assess. If you are young or new to credit, your history is short, which makes you a bit of an unknown quantity. This can result in a lower starting limit, as the lender wants to see how you handle your first card before extending more credit.

- New Credit (10% of FICO Score): Applying for a lot of credit in a short period (multiple "hard inquiries") can be a sign of financial distress. It signals to lenders that you might be desperate for credit. It's best to apply for one card at a time and wait at least 6 months between applications if possible.

- Credit Mix (10% of FICO Score): Lenders like to see that you can responsibly manage different types of credit, such as an installment loan (like a car or student loan) and revolving credit (credit cards). For someone with a $30,000 salary, having a student loan or a small car loan in good standing can actually *help* your application.

How to Leverage This: Before you apply, get a free copy of your credit report from AnnualCreditReport.com. Review it for errors and understand your score. If your score is in the "Fair" range (e.g., 650), your primary goal should be to find a card designed for that tier. Trying for a premium card will likely result in a denial and a useless hard inquiry on your report.

###

Your Existing Debt (Debt-to-Income Ratio)

Your Debt-to-Income (DTI) ratio is the second-most critical number in your application. It measures your capacity to take on new debt. Lenders use it to see how much of your monthly income is already committed to other debt payments.

How to Calculate DTI:

1. Sum Your Monthly Debt Payments: Include rent/mortgage, minimum credit card payments, car loans, student loans, personal loans, and any other regular debt obligations. (Note: Do not include utilities, groceries, or other living expenses).

2. Determine Your Gross Monthly Income: For a $30,000 salary, this is $30,000 / 12 = $2,500.

3. Divide and Multiply: (Total Monthly Debt / Gross Monthly Income) * 100 = DTI %

Example Scenarios for a $2,500 Monthly Income:

- Low DTI (Good): You live with family (rent-free) and have a $200 student loan payment.

- DTI = ($200 / $2,500) * 100 = 8%. This is excellent. A lender sees that you have significant disposable income to handle a new credit card payment. You are far more likely to get a higher limit.

- Moderate DTI (Acceptable): You have a $900 rent payment and a $250 car payment.

- DTI = ($1150 / $2,500) * 100 = 46%. This is high. While many lenders cap DTI around 43-50% for mortgages, for an unsecured credit card, this level might make them nervous. They may approve you, but for a very small limit ($300-$500) to minimize their risk. They see that a large portion of your income is already spoken for.

According to the CFPB, while there isn't a magic number, a DTI under 36% is generally viewed as favorable by lenders. With a $30,000 salary, managing your DTI is one of the most powerful things you can do to maximize your chances of approval and get a better limit.

###

Your Income and Employment Status

While we've anchored this discussion to a $30,000 salary, how that income is earned and its stability matters.

- Stability: An applicant who has been at the same job for two years earning $30,000 is a much better risk than someone who just started a new job a month ago, or whose income is variable (e.g., freelance work with fluctuating monthly earnings). Lenders value predictability.

- Total Household Income: The law (the CARD Act of 2009) allows individuals over 21 to include any income to which they have a reasonable expectation of access. This means if you have a spouse or partner whose income helps pay household bills, you can often include their income on your application. This can dramatically increase your stated income and, therefore, your potential credit limit. Be honest, but use the rules to your advantage. For example, if your partner makes $40,000, you could potentially apply with a total household income of $70,000, which completely changes the lending equation.

###

The Type of Credit Card and the Issuer

Different banks and different card products have different risk appetites.

- Issuer: Some banks, like credit unions or Discover, have a reputation for being more willing to work with applicants who have lower incomes or are new to credit. Others, like American Express, traditionally cater to a more affluent, established customer base. Researching the target audience of the card issuer can give you clues about your chances.

- Card Tier: As discussed, applying for the right *type* of card is critical. A premium travel card's algorithm might automatically decline any application with an income below $50,000. A "credit-builder" card's algorithm is specifically designed to approve them. Applying for a store credit card (e.g., from Target or Gap) can also be an easier entry point, as they often have more lenient approval criteria, though their limits might be lower and only usable at that specific retailer.

###

Your Relationship with the Lender

Having a pre-existing positive relationship with a bank can be a significant advantage. If you are applying for a credit card at the same bank where you have a checking or savings account, they have more data on you. They can see your average account balance, the consistency of your direct deposits, and whether you’ve ever overdrawn your account. A healthy checking account with a steady balance and regular deposits makes you a much more attractive candidate. This "internal score" can sometimes lead to a higher limit than you might get from a bank where you are a total stranger. It's often a wise strategy to apply for your first card at the bank you already use for your daily banking.

Building Your Credit and Increasing Your Limit Over Time

Your initial credit limit is not a permanent sentence; it's a starting line. For someone earning a $30,000 salary, the most important long-term financial goal is not a high initial limit, but rather the establishment of excellent credit habits. These habits are what will lead to significant credit limit increases, better loan rates, and greater financial opportunities down the road. The journey from a $500 limit to a $10,000 limit is a marathon, not a sprint, and it's paved with responsible behavior.

### The First 6-12 Months: The Proving Ground

Your first year with a new credit card is a probation period. The lender is watching. Your primary goal is to demonstrate that you are a low-risk, reliable customer.

1. Always Pay on Time: This is the golden rule. Set up automatic payments for at least the minimum amount due to ensure you are never late. A single late payment can set you back significantly.

2. Pay in Full if Possible: While you only have to pay the minimum, strive to pay your statement balance in full each month. This demonstrates that you are using the card as a convenience tool, not as a crutch for debt. It also saves you from paying high-interest charges.

3. Keep Utilization Low: Even if you have a $1,000 limit, try not to carry a balance of more than $300 (30% utilization). If you need to make a large purchase, say $800, try to pay off a chunk of it before the statement closing date. Lenders report your balance to the credit bureaus once a month. A consistently high reported balance, even if you pay it off, can negatively impact your score.

4. Use the Card Regularly: An inactive card does nothing to build your history. Use it for a small, recurring purchase like a streaming service or your weekly gas fill-up. This keeps the account active and generates a positive payment history each month.

### How and When to Ask for a Credit Limit Increase

After 6 to 12 months of perfect payment history, you are in a strong position to ask for a higher limit. A larger limit is beneficial not just for increased spending power, but because it can drastically improve your credit utilization ratio, which in turn boosts your credit score.

The Strategy:

- Check for Automatic Increases: Many issuers, particularly Capital One and Discover, are known for granting automatic credit line increases to customers who show responsible usage. These often occur around the 6-month or 1-year mark.

- Use the Issuer's Online Portal: Most banks allow you to request a credit limit increase directly through your online account or mobile app. This process is often automated and can give you an instant decision. Crucially, many of these requests (from issuers like Capital One, Discover, and American Express) are "soft pulls," meaning they won't affect your credit score. It's a risk-free way to ask.

- Be Prepared to Update Your Income: When you request an increase, you will be asked to update your annual income. If you've received a raise, even a small one, since you first applied, be sure to include it. This strengthens your case.

- Know When to Make a Phone Call: If the online request is a "hard pull" (which will be disclosed beforehand; issuers like Chase often do this), or if you get denied online, you can call the customer service number on the back of your card. A conversation with a credit analyst allows you to make your case personally, perhaps explaining that your income has increased or that you're planning a large purchase and would like to put it on their card.

### Emerging Trends and Staying Relevant

The world of credit is constantly evolving. Staying aware of these trends can give you an edge.

- Alternative Data: The credit industry is slowly incorporating alternative data into its scoring models. Programs like Experian Boost™ and UltraFICO™ Score allow you to voluntarily add positive payment history from utility bills, phone bills, and bank account management to your credit profile. For someone with a thin or new credit file, this can provide a tangible score boost and make you look like a better credit risk.

- Fintech and Credit-Builder Loans: Financial technology companies are offering innovative products. "Credit-builder loans" from companies like Self or SeedFi are a great example. You make small payments into a locked savings account for a set term. These payments are reported to the credit bureaus as a loan in good standing. At the end of the term, the account unlocks, and you get your money back. It's a forced savings plan that builds a strong credit history.

Advancing in the "field" of personal credit management means continuously learning and adapting. Your $30,000 salary is your starting capital. By investing it wisely through responsible credit use, you build the invaluable asset of a stellar credit score, which will pay dividends for the rest of your life.

How to Apply for a Credit Card with a $30,000 Salary: A Step-by-Step Guide

Approaching the application process with a clear, strategic plan dramatically increases your odds of success and helps ensure you get the best possible terms. Rushing in and applying for multiple cards at random is a recipe for denials and a damaged credit score. Follow this professional, step-by-step guide to navigate the process with confidence.

### Step 1: Check Your Credit Score & Full Credit Report

This is the non-negotiable first step. Applying for a credit card without knowing your credit score is like going on a road trip without a map.

- What to Do: Obtain your free credit score from multiple sources. Many banks (like Chase, Bank of America) offer it free to customers. Credit Karma and NerdWallet also provide free VantageScores, which are great for monitoring. For the most critical look, get your full credit reports from all three bureaus—Experian, Equifax, and TransUnion—via the federally mandated site AnnualCreditReport.com. You are entitled to one free report from each bureau per year.

- Why It's Important: Your score will immediately tell you which category of cards you should be looking at (e.g., for Fair Credit, Good Credit). Your full report will show you the "why" behind your score. Review it carefully for any errors that might be dragging your score down (and dispute them if you find any). You'll also see exactly what a lender will see, including the age of your accounts