Introduction: The Myth of "No Overtime for Salaried Workers"

It's one of the most common assumptions in the professional world: if you earn a salary, you don't get paid for overtime. Many employees accept long weeks as a standard part of their salaried position, believing extra hours are simply part of the deal. However, this is a widespread and often costly misconception. The reality is that your eligibility for overtime pay depends not just on *how* you are paid (salary vs. hourly), but on your specific job duties and your salary level, as defined by federal and state law.

Understanding these rules is crucial for your financial well-being and career empowerment. Being misclassified could mean you are missing out on thousands of dollars in earned wages each year. This article will demystify the rules surrounding salaried employees and overtime, so you can understand your rights and ensure you are being compensated fairly.

Understanding Salaried Employment: Exempt vs. Non-Exempt

To answer the question of overtime pay, we must first understand the legal classifications defined by the U.S. Department of Labor (DOL) under the Fair Labor Standards Act (FLSA). The FLSA is the federal law that establishes minimum wage, overtime pay, recordkeeping, and youth employment standards.

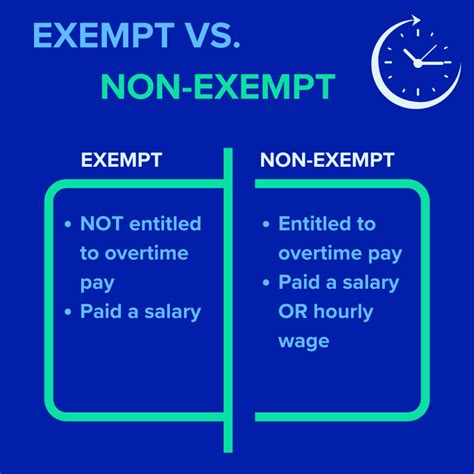

For salaried workers, the two most important classifications are Exempt and Non-Exempt:

- Non-Exempt Employees: These employees are covered by the FLSA's overtime provisions. They *must* be paid overtime, at a rate of at least 1.5 times their regular rate of pay, for any hours worked over 40 in a workweek. Both hourly and salaried employees can be non-exempt.

- Exempt Employees: These employees are *not* entitled to overtime pay under the FLSA. To be considered exempt, an employee must meet three specific tests:

1. Be paid on a salary basis (not hourly).

2. Be paid at least the federal minimum salary threshold.

3. Perform specific job duties that are classified as exempt (e.g., executive, administrative, or professional).

The key takeaway is this: Being paid a salary does not automatically make you exempt from overtime. If you are a salaried employee who does not meet all the exemption criteria, you are considered salaried non-exempt and are entitled to overtime pay.

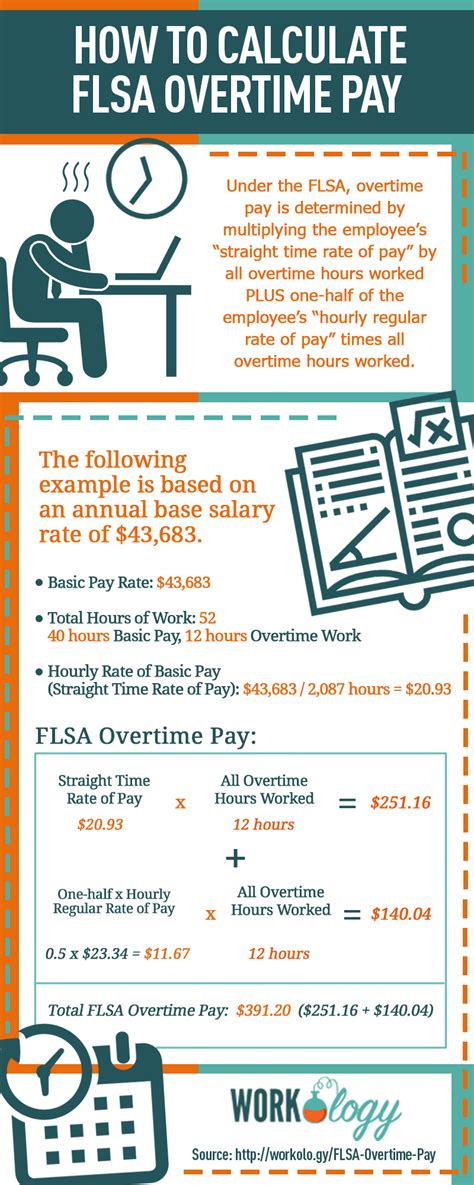

The Key to Overtime Pay: The FLSA Salary Threshold

The salary threshold is a critical, data-driven factor in determining overtime eligibility. If you are a salaried employee and your earnings are below this specific dollar amount set by the DOL, you are automatically considered non-exempt and eligible for overtime, regardless of your job duties.

The DOL has updated this threshold significantly. As of 2024, there are new rules being phased in:

- Effective July 1, 2024: The standard salary level threshold for exemption increases to $844 per week (equivalent to $43,888 per year).

- Effective January 1, 2025: The threshold will increase again to $1,128 per week (equivalent to $58,656 per year).

Additionally, there is a separate threshold for Highly Compensated Employees (HCEs), who are subject to a less stringent duties test.

- Effective July 1, 2024: The HCE total annual compensation threshold is $132,964 per year.

- Effective January 1, 2025: The HCE threshold will increase to $151,164 per year.

*(Source: U.S. Department of Labor, "Final Rule: Restoring and Extending Overtime Protections," 2024)*

If your salary falls below these figures, you are legally owed overtime for hours worked beyond 40 per week.

Key Factors That Determine Overtime Eligibility

If you are paid a salary *above* the threshold, your eligibility for overtime then depends on your specific job responsibilities. This is known as the "duties test." Your job title is irrelevant; what matters is what you actually do day-to-day. Here are the primary factors.

### The "Duties Test": Beyond the Paycheck

The FLSA outlines several categories of exempt duties. To be exempt, your primary job duty must fall into one of these categories.

- Executive Exemption: Your primary duty must be managing the enterprise or a recognized department. You must customarily and regularly direct the work of at least two other full-time employees, and you must have the authority to hire or fire other employees (or your suggestions on these matters must be given particular weight).

- Administrative Exemption: Your primary duty must be the performance of office or non-manual work directly related to the management or general business operations of the employer or the employer’s customers. Your role must include the exercise of discretion and independent judgment with respect to matters of significance. This is often the most complex and litigated exemption.

- Professional Exemption: This splits into two types:

- Learned Professional: Your primary duty requires advanced knowledge in a field of science or learning, customarily acquired by a prolonged course of specialized intellectual instruction (e.g., doctors, lawyers, engineers, accountants).

- Creative Professional: Your primary duty requires invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor (e.g., musicians, writers, actors, certain journalists).

- Computer Employee Exemption: You must be employed as a computer systems analyst, computer programmer, software engineer, or other similarly skilled worker in the computer field.

- Outside Sales Exemption: Your primary duty must be making sales or obtaining orders/contracts for services, and you must be customarily and regularly engaged away from the employer's place of business.

### Years of Experience and Level of Education

While experience and education are not direct tests, they are crucial indicators used to determine if you meet the duties tests. For instance, the Learned Professional exemption is inherently tied to a high level of education (e.g., a specific degree). Similarly, the experience required to exercise the "discretion and independent judgment" for the Administrative exemption often comes with seniority. An entry-level employee performing routine tasks under close supervision is far less likely to qualify as exempt than a senior manager, even if both are salaried.

### Geographic Location

While the FLSA sets the federal floor, many states have their own, more employee-friendly overtime laws. If state and federal laws conflict, the employer must follow the law that is more generous to the employee.

For example, states like California, New York, and Washington have significantly higher salary thresholds for exemption than the federal standard. In California, the 2024 minimum salary for exempt employees is $66,560 per year, regardless of the employer's size. It's critical to check your specific state and even local city laws, as they may provide greater overtime protections.

### Company Type and Industry

The type of company and industry you work in heavily influences the kinds of roles that are genuinely exempt. A tech startup will have many employees who fall under the Computer Employee exemption. A large manufacturing firm will have clear Executive roles on the plant floor. In contrast, roles in industries like retail or hospitality often face misclassification, where salaried "assistant managers" may spend the vast majority of their time performing non-exempt duties like running a cash register or stocking shelves.

Navigating Your Rights: What to Do If You're Owed Overtime

Understanding your classification is the first step. If you believe you have been misclassified as an exempt employee and are owed overtime, here’s a professional approach:

1. Document Everything: Keep a private, detailed log of the hours you work each day. Note the specific tasks you are performing, especially those that are routine and do not involve independent judgment.

2. Review the Law: Compare your salary and job duties against the federal FLSA standards and your specific state's labor laws.

3. Consult HR: Approach your Human Resources department professionally. Frame it as a query for clarification: "I've been reviewing my job duties and the FLSA guidelines, and I'd like to better understand how my role is classified as exempt."

4. Seek External Advice: If you are not satisfied with the response, you can file a complaint with the U.S. Department of Labor’s Wage and Hour Division (WHD) or your state's labor agency. You may also consult with an employment lawyer to understand your options.

Conclusion: Empowering Your Career with Knowledge

The question of whether salaried employees get overtime is not a simple yes or no. It's a nuanced issue based on a combination of your salary level, your specific job duties, and your location.

Key Takeaways for Your Career:

- Salary is not the only factor: Being paid a salary does not automatically disqualify you from overtime.

- Know the numbers: The FLSA salary thresholds ($43,888 starting July 1, 2024, and $58,656 starting Jan. 1, 2025) are your first checkpoint.

- Duties matter most: Your actual day-to-day responsibilities, not your job title, determine your status under the Executive, Administrative, and Professional duties tests.

- State laws can offer more protection: Always check your local regulations, as they may be more favorable.

By understanding these rules, you transform from a passive employee into an informed professional. This knowledge empowers you to advocate for fair compensation, protect your financial interests, and make strategic decisions throughout your career.