In the intricate world of modern finance, data is the new currency. Behind every major investment decision, corporate merger, and market forecast lies a sea of numbers—and the individuals who can navigate this sea are the new titans of the industry. These are the Financial Data Analysts, the critical thinkers who translate raw data into strategic, profitable action. If you're drawn to the intersection of finance, technology, and strategy, and are wondering if the rewards match the challenge, you’ve come to the right place. This role isn't just a job; it's a launchpad to a lucrative and impactful career, with average salaries comfortably reaching the six-figure mark and beyond.

I once coached a brilliant history major who felt daunted by the prospect of breaking into the quantitative-heavy world of finance. He was convinced his "non-traditional" background was a career-ending liability. We worked together to reframe his skills—his ability to research, synthesize disparate information, and construct a compelling narrative was precisely what modern analysis required. A year after landing his first analyst role, he called to tell me he’d identified a subtle, negative trend in customer payment cycles that, once corrected, saved his company over a million dollars annually. He didn't just get a promotion; he earned a reputation as someone who could see the story that the numbers were trying to tell. His journey underscores a fundamental truth: success in this field is less about your starting point and more about your ability to derive meaning from data.

This guide is designed to be your definitive roadmap. We will dissect every component of a Financial Data Analyst's career, from the day-to-day responsibilities to the complex factors that dictate your earning potential. We will explore not just *what* you can earn, but *how* you can maximize that salary throughout your career.

### Table of Contents

- [What Does a Financial Data Analyst Do?](#what-does-a-financial-data-analyst-do)

- [Average Financial Data Analyst Salary: A Deep Dive](#average-financial-data-analyst-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Financial Data Analyst Do?

At its core, a Financial Data Analyst is a professional detective, an interpreter, and a storyteller. They are the bridge between the vast, chaotic world of financial data and the structured, actionable insights that executives need to make informed decisions. While the title might sound singular, the role is multifaceted, blending the skills of a statistician, a computer scientist, and a financial strategist. Their primary directive is to use data to answer critical business questions related to profitability, investment, risk, and operational efficiency.

The work begins with data itself. Analysts must first identify, gather, and cleanse data from a multitude of sources. This could involve pulling quarterly earnings reports from an SEC database, querying internal transaction logs using SQL, scraping market sentiment data from the web, or integrating information from third-party financial data providers like Bloomberg or Refinitiv. This "data wrangling" phase is often the most time-consuming part of the job, as ensuring data quality and accuracy is paramount. A conclusion drawn from flawed data isn't just wrong; it can be disastrously expensive.

Once the data is clean, the analysis begins. This is where the analyst's toolkit truly shines. They use statistical methods and financial modeling techniques to identify trends, patterns, and anomalies. Common tasks include:

- Financial Modeling: Building complex spreadsheets to forecast future revenue, expenses, and profits (FP&A - Financial Planning & Analysis).

- Variance Analysis: Comparing actual financial performance against budgets and forecasts to understand what went right and what went wrong.

- Investment Analysis: Evaluating the potential return and risk of stocks, bonds, or other investment opportunities.

- Risk Assessment: Using data to model potential financial risks, such as credit default, market volatility, or operational failures.

- Performance Reporting: Creating dashboards and reports that provide a clear, concise view of key performance indicators (KPIs) for stakeholders.

The final, and perhaps most crucial, responsibility is communication. A brilliant analysis is useless if it cannot be understood by non-technical decision-makers. Financial Data Analysts must be adept at data visualization, using tools like Tableau or Power BI to create compelling charts and graphs. They must then present their findings in a clear, persuasive narrative that explains not just *what* the data says, but *why* it matters and *what* the company should do next.

### A Day in the Life of a Financial Data Analyst

To make this more concrete, let's imagine a typical day for an analyst working in the FP&A department of a large retail corporation:

- 9:00 AM: The day starts with a quick team stand-up meeting. The manager discusses priorities for the week, and the analyst provides a quick update on their project: analyzing the profitability of a recent marketing campaign.

- 9:30 AM: Time to dive into the data. The analyst runs several SQL queries against the company's data warehouse to pull sales transaction data, customer data, and marketing spend data for the campaign period.

- 11:00 AM: The data is exported to a Python script using the Pandas library for cleaning. The analyst handles missing values, standardizes formats, and merges the different datasets into a single, cohesive master file.

- 1:00 PM: After a lunch break, the analyst opens up Excel and begins the core analysis. They build a pivot table to slice and dice sales by region, product category, and customer demographic. They calculate the return on investment (ROI) for the campaign and perform a variance analysis against the initial budget.

- 3:00 PM: The key insights are emerging. The campaign was highly successful in the Northeast but underperformed on the West Coast. The analyst begins building a dashboard in Tableau, creating maps and charts to visually highlight this regional disparity.

- 4:30 PM: The analyst drafts an email to the Marketing Director, attaching a preliminary summary of the findings and the interactive dashboard link. They schedule a meeting for later in the week to present the full analysis and recommend reallocating future marketing spend based on these results.

- 5:00 PM: The last hour is spent on professional development, completing a module in an online course on advanced financial modeling techniques, ensuring their skills remain sharp and relevant.

This "day in the life" illustrates the dynamic blend of technical prowess, financial acumen, and strategic communication that defines the role of a successful Financial Data Analyst.

Average Financial Data Analyst Salary: A Deep Dive

The compensation for a Financial Data Analyst is one of the most compelling aspects of the career path. It reflects the high demand for professionals who possess this unique combination of technical and financial expertise. Salaries are not only competitive but also have a significant potential for growth based on experience, location, and specialization.

It's important to note that salary data is dynamic. For this analysis, we will synthesize information from several authoritative sources to provide a comprehensive and reliable picture. These include government statistics, which are broad and stable, and real-time salary aggregators, which capture the latest market trends.

According to Salary.com, as of early 2024, the median Financial Data Analyst salary in the United States is $96,300. The typical salary range falls between $86,200 and $107,600. This "middle 50%" represents the bulk of practicing analysts.

However, this is just a single data point. Other sources provide slightly different but complementary views. Glassdoor, which incorporates user-submitted data, reports a total pay estimate of $95,591 per year, with a base salary average of around $82,419 and additional pay (bonuses, profit sharing) averaging $13,172. Payscale reports a slightly lower average base salary of $74,510, highlighting that the term "Financial Data Analyst" can sometimes encompass more junior or generalized data analyst roles within a finance department.

The U.S. Bureau of Labor Statistics (BLS) does not have a specific category for "Financial Data Analyst." However, we can look at closely related and often overlapping professions. For "Financial and Investment Analysts," the BLS reports a median annual wage of $96,220 as of May 2022. For "Data Scientists," a more technically advanced role that many senior analysts evolve into, the median wage was $131,490. This indicates a clear upward trajectory for those who continue to develop their technical skills.

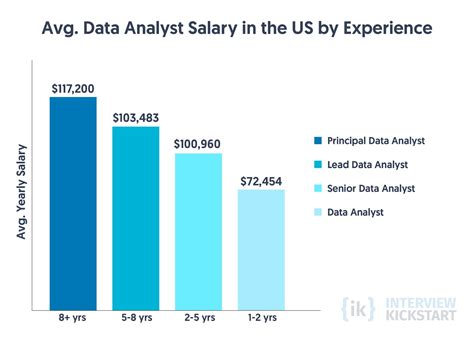

### Salary by Experience Level

One of the most significant drivers of salary is experience. As an analyst proves their ability to handle more complex projects, manage stakeholders, and drive tangible business value, their compensation increases accordingly.

Here is a typical salary progression, compiled from an analysis of data from Salary.com, Glassdoor, and Payscale:

| Experience Level | Years of Experience | Typical Base Salary Range (USD) | Role & Responsibilities |

| :--- | :--- | :--- | :--- |

| Entry-Level | 0-2 Years | $65,000 - $85,000 | Focuses on data gathering, cleaning, and preparing reports under supervision. Builds foundational skills in SQL, Excel, and BI tools. Often responsible for standard weekly/monthly reporting. |

| Mid-Career | 3-7 Years | $85,000 - $120,000 | Works more independently on complex projects. Develops sophisticated financial models, builds interactive dashboards, and begins presenting findings to mid-level management. May start to mentor junior analysts. |

| Senior | 8-15 Years | $120,000 - $165,000+ | Leads major analytical initiatives and sets project direction. Manages complex stakeholder relationships and presents directly to senior leadership. Acts as a subject matter expert and often has deep specialization in an area like risk, investment, or FP&A. |

| Lead / Manager | 10+ Years | $150,000 - $200,000+ | Moves into a formal leadership role, managing a team of analysts. Focuses on strategic planning, resource allocation, and developing the analytical capabilities of the department. Bridges the gap between the analytics team and executive leadership. |

*Note: These ranges are for base salary and can be significantly higher when factoring in bonuses and other compensation, especially in high-cost-of-living areas and certain industries like investment banking.*

### Understanding Total Compensation: Beyond the Base Salary

A savvy professional understands that base salary is only one piece of the compensation puzzle. Total compensation provides a much more accurate picture of a role's financial rewards. For a Financial Data Analyst, this package often includes several lucrative components:

- Annual Performance Bonus: This is the most common form of additional cash compensation. It is typically tied to both individual performance and company profitability. Bonuses can range from 5% to 20% of the base salary for mid-level roles, and can exceed 30-50% or more for senior analysts in high-performing sectors like hedge funds or investment banking.

- Signing Bonus: To attract top talent in a competitive market, many companies offer a one-time signing bonus. This can range from a few thousand dollars for entry-level roles to tens of thousands for experienced hires, helping to offset the loss of a bonus from their previous employer.

- Stock Options / Restricted Stock Units (RSUs): Particularly common in publicly traded companies and tech-focused startups (including FinTech), equity compensation can be a significant wealth-building tool. RSUs are grants of company stock that vest over time, while options give you the right to buy stock at a predetermined price.

- Profit Sharing: Some companies distribute a portion of their profits directly to employees. This is often contributed to a retirement account and aligns employee incentives with the company's overall success.

- Retirement Savings (401k/403b): A strong 401(k) plan with a generous company match is a crucial part of the package. A typical competitive match might be 50% or 100% of your contributions up to 4-6% of your salary. This is essentially free money and a key factor in long-term financial planning.

- Other Benefits: Don't underestimate the value of comprehensive health insurance (medical, dental, vision), life and disability insurance, paid time off, and professional development stipends. Many top companies will pay for certifications, online courses, and even Master's degrees, representing tens of thousands of dollars in value and directly contributing to your future earning potential.

When evaluating a job offer, it is essential to calculate the total value of the compensation package, not just the number on the salary line.

Key Factors That Influence Salary

While national averages and experience levels provide a useful baseline, a Financial Data Analyst's salary is ultimately determined by a complex interplay of several factors. Understanding these levers is the key to maximizing your earning potential throughout your career. This section provides an exhaustive breakdown of the variables that can add tens of thousands of dollars to your annual compensation.

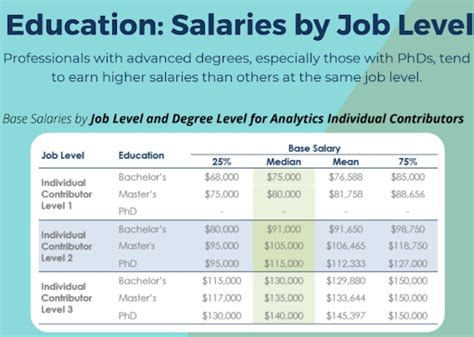

### ### Level of Education

Your educational background serves as the foundation upon which your career is built. While hands-on experience and skills are paramount, the right degree or certification can open doors and command a higher starting salary.

- Bachelor's Degree: This is the standard entry requirement. Degrees in Finance, Economics, Statistics, Mathematics, or Computer Science are most common and highly regarded. They provide the necessary quantitative and theoretical underpinning for the role. An analyst with a relevant bachelor's degree from a reputable university can expect to start in the standard entry-level range ($65k - $85k).

- Master's Degree: Pursuing a master's degree can provide a significant salary premium and accelerate career progression.

- Master of Science in Finance (MSF) / Business Analytics (MSBA): These specialized degrees offer a deep dive into advanced financial theory, statistical modeling, and data analysis techniques. Graduates can often bypass more junior roles and enter at a higher level, potentially commanding a starting salary $10,000 to $20,000 higher than their bachelor's-level counterparts.

- Master of Business Administration (MBA): An MBA, especially from a top-tier program, is a powerful asset for those aspiring to leadership. It complements technical skills with strategic, managerial, and communication training. While the immediate salary jump for a junior analyst might be modest, an MBA is often a prerequisite for senior management and executive roles (e.g., Director of FP&A, CFO), where salaries soar well into the high six figures.

- Professional Certifications: Certifications are a powerful way to signal specialized expertise and a commitment to the profession. They can directly translate to higher pay and more senior opportunities.

- Chartered Financial Analyst (CFA): The gold standard in the investment management industry. Earning the CFA charter is a rigorous process requiring passing three difficult exams. It demonstrates mastery of investment tools, asset valuation, portfolio management, and wealth management. A CFA charterholder can command a significant salary premium, often 15-20% or more, especially in roles related to asset management, equity research, and investment banking.

- Financial Risk Manager (FRM): The premier certification for risk management professionals, offered by the Global Association of Risk Professionals (GARP). As financial markets become more complex and regulated, demand for skilled risk analysts has surged. The FRM certification validates expertise in identifying, analyzing, and mitigating credit risk, market risk, and operational risk, making it highly valuable in banking and insurance.

- Technology-Specific Certifications: Certifications like the Microsoft Certified: Power BI Data Analyst Associate or the Tableau Desktop Specialist demonstrate proven expertise in the critical tools of the trade. While they may not provide the same broad salary bump as a CFA, they can be a deciding factor in hiring and can lead to specialized, higher-paying roles focused on business intelligence and data visualization.

### ### Years of Experience

As detailed in the previous section, experience is arguably the single most important factor in salary growth. However, the *quality* of that experience matters as much as the quantity. The salary trajectory is not linear; it's a series of plateaus and steep climbs corresponding to new levels of responsibility and impact.

- Analyst I (0-2 years): At this stage, you are learning the ropes. Your value is in your ability to execute tasks accurately and efficiently. Salary growth is steady but modest, primarily through annual cost-of-living adjustments and small performance-based raises. The key is to absorb as much knowledge as possible and master your core tools.

- Analyst II / Senior Analyst (3-7 years): This is where significant salary growth occurs. You are no longer just executing tasks; you are owning projects. You move from "what happened?" (descriptive analytics) to "why did it happen?" (diagnostic analytics) and "what will happen?" (predictive analytics). Your ability to provide independent, data-driven recommendations is what earns you substantial raises, promotions, and bonuses in the 20-40% range over this period.

- Lead Analyst / Manager (8+ years): At this level, your value shifts from individual contribution to leadership and strategic influence. You are now responsible for the output of a team and for shaping the analytical strategy of a department. Your salary reflects this immense responsibility. Compensation growth is driven by taking on larger teams, managing more critical business functions, and directly impacting the company's bottom line. This is where total compensation packages, including large bonuses and equity, can push earnings well into the $200,000+ territory.

### ### Geographic Location

Where you work has a dramatic impact on your paycheck. Salaries are closely tied to the cost of living and the concentration of high-paying industries in a specific metropolitan area. Major financial and tech hubs offer the highest salaries, but also come with a much higher cost of living.

Here's a comparative look at estimated median salaries for a mid-career Financial Data Analyst across various U.S. cities, based on data from Salary.com and Glassdoor, adjusted for 2024 trends:

| City | Estimated Median Base Salary | Cost of Living Index (US Avg = 100) | Commentary |

| :--- | :--- | :--- | :--- |

| San Francisco, CA | $145,000 | 191 | The epicenter of tech and venture capital. Highest salaries, but also the highest cost of living. FinTech roles are abundant. |

| New York, NY | $140,000 | 158 | The heart of Wall Street. Unparalleled opportunities in investment banking, hedge funds, and corporate finance. |

| San Jose, CA | $138,000 | 171 | Silicon Valley's core. Similar to SF, with a heavy focus on tech company FP&A and corporate finance roles. |

| Boston, MA | $125,000 | 134 | A major hub for asset management (Fidelity, Putnam) and a growing tech and biotech scene. |

| Seattle, WA | $122,000 | 141 | Home to tech giants like Amazon and Microsoft, both of which employ thousands of financial analysts. |

| Washington, D.C. | $118,000 | 136 | A unique market with high-paying roles in government contracting, defense, and large consulting firms. |

| Chicago, IL | $105,000 | 100 | A major financial center for derivatives, commodities, and large corporate headquarters. Offers high salaries with a more moderate cost of living. |

| Dallas, TX | $102,000 | 97 | A booming business hub with a low cost of living. Numerous Fortune 500 company headquarters provide strong opportunities. |

| Atlanta, GA | $98,000 | 95 | A growing FinTech hub with a very reasonable cost of living, offering excellent value. |

| Phoenix, AZ | $95,000 | 107 | A rapidly growing market with many back-office and operational finance centers for major banks. |

The Rise of Remote Work: The pandemic has reshaped the landscape. While many top-tier finance roles (especially in investment banking) are returning to the office, a significant number of corporate finance and analyst roles now offer remote or hybrid flexibility. This has led to two competing trends: some companies are adjusting salaries based on the employee's location (geo-arbitrage), while others are offering nationally competitive salaries to attract the best talent regardless of location. When considering a remote role, it's critical to clarify the company's compensation philosophy.

### ### Company Type & Size

The type and size of the company you work for is another massive determinant of your compensation structure and overall earning potential.

- Investment Banks & Hedge Funds (e.g., Goldman Sachs, JPMorgan Chase, Bridgewater Associates): This is the pinnacle of financial compensation. These firms demand long hours and intense pressure but offer exceptionally high salaries and astronomical bonus potential. An analyst at a top firm can see total compensation reaching well into the six figures even in their first few years. The work is highly specialized, focusing on M&A modeling, algorithmic trading strategies, and complex derivatives valuation.

- Large Corporations (Fortune 500): Working in the corporate finance (FP&A) department of a large, stable company like Apple, Ford, or Johnson & Johnson offers a fantastic balance. Salaries are very competitive, benefits are excellent, and work-life balance is generally better than in investment banking. Career paths are well-defined, leading from analyst to manager to director.

- Tech Companies & FinTech Startups: This dynamic sector offers a different kind of reward. Base salaries are high, competitive with large corporations. The major draw, however, is equity compensation (stock options or RSUs). A successful IPO or acquisition can lead to a life-changing windfall for early employees. The work is often fast-paced and innovative, focused on product profitability, user growth metrics, and securing venture capital funding.

- Consulting Firms (e.g., McKinsey, Bain, Deloitte, EY): Financial analysts within consulting firms often work on projects for other companies. The pay is excellent, and the experience is incredibly diverse, exposing you to multiple industries in a short time. However, the lifestyle is demanding, with long hours and frequent travel.

- Government & Non-Profit: These roles typically offer the lowest base salaries. However, they compensate with exceptional job security, robust government benefits (pensions), and a strong sense of public service. The work might involve budget analysis for a federal agency or financial planning for a large foundation.

### ### Area of Specialization

Within the broad field of financial data analysis, specializing in a high-demand niche can significantly increase your value.

- Quantitative Analysis ("Quants"): This is the most technically demanding and highest-paying specialization. Quants use advanced mathematics, statistics, and programming (often C++ and Python) to develop complex trading algorithms and pricing models. A PhD is often required.

- Investment Analysis / Equity Research: These analysts research public companies to make "buy," "sell," or "hold" recommendations. It requires deep industry knowledge and sophisticated valuation modeling. Success is directly tied to the accuracy of your predictions.

- Financial Planning & Analysis (FP&A): The backbone of corporate finance. These analysts are responsible for budgeting, forecasting, and explaining business performance to management. It's a stable and well-compensated path with a clear ladder to executive leadership (CFO).

- Risk Management: As mentioned with the FRM certification, this is a booming field. Analysts specialize in credit risk, market risk, or operational risk, using data to keep their firms safe from financial and regulatory threats.

- Treasury Analysis: These analysts manage a company's cash and liquidity, handling short-term investments, debt, and foreign exchange exposure. It's a critical function that ensures a company's financial health.

### ### In-Demand Skills

Finally, your specific skillset is what you bring to the negotiating table. The more high-value, in-demand skills you possess, the stronger your position.

- Technical Skills (The "What"):

- Advanced SQL: The ability to go beyond basic `SELECT` statements to write complex joins, subqueries, and window functions to manipulate massive datasets.