An $80,000 annual salary places you comfortably above the national median household income, opening the door to one of life's most significant financial milestones: homeownership. Yet, this exciting prospect is often clouded by a complex and daunting question: How much home can you *actually* afford? The answer isn't a simple number; it's a dynamic calculation shaped by interest rates, personal debt, credit scores, and the very ground on which you hope to build your future. This guide is designed to demystify that calculation, transforming ambiguity into a clear, actionable plan.

For years as a career and financial analyst, I’ve advised professionals on leveraging their income to achieve major life goals. I vividly remember the overwhelming mix of excitement and anxiety when my partner and I first sat down to figure out our own home buying budget. We ran the numbers a dozen times, each calculation revealing a new layer of complexity—property taxes, insurance, surprise repairs. It was that experience that solidified my belief that true financial empowerment doesn't come from just earning a good salary, but from understanding precisely what that salary can do for you.

This comprehensive article will serve as your definitive roadmap. We will dissect every variable, from the foundational rules of thumb used by lenders to the hidden costs that can derail an unprepared buyer. By the end, you will not only understand the factors that determine your home-buying power but will also have a strategic framework to confidently navigate the path to owning a home on an $80,000 salary.

### Table of Contents

- [The Foundational Rules of Home Affordability](#the-foundational-rules-of-home-affordability)

- [Calculating Your Home Buying Power with an $80k Salary: A Deep Dive](#calculating-your-home-buying-power-with-an-80k-salary-a-deep-dive)

- [Key Factors That Influence Your Home Affordability](#key-factors-that-influence-your-home-affordability)

- [Beyond the Sticker Price: The Hidden Costs of Homeownership](#beyond-the-sticker-price-the-hidden-costs-of-homeownership)

- [Action Plan: How to Prepare to Buy a Home on an $80k Salary](#action-plan-how-to-prepare-to-buy-a-home-on-an-80k-salary)

- [Conclusion](#conclusion)

---

The Foundational Rules of Home Affordability

Before you can plug numbers into a mortgage calculator, you must understand the core principles that lenders use to assess your financial capacity. These aren't arbitrary rules; they are risk-management formulas honed over decades to predict a borrower's ability to repay a loan consistently. Mastering these concepts is the first step toward speaking the same language as your mortgage broker.

The most critical concept is your Debt-to-Income (DTI) ratio, which compares your total monthly debt payments to your gross monthly income. Lenders look at two types of DTI.

1. The 28% Rule: The Front-End Ratio

The "front-end" ratio is the simpler of the two. It focuses solely on your proposed housing costs. Lenders traditionally recommend that your total monthly housing payment—known as PITI—should not exceed 28% of your gross monthly income.

- Principal: The portion of your payment that goes toward paying down the loan balance.

- Interest: The cost of borrowing the money, paid to the lender.

- Taxes: Your monthly share of the annual property taxes.

- Insurance: Your monthly share of the annual homeowners' insurance premium.

- *(Sometimes PITI adds an "A" for Homeowners Association (HOA) fees, becoming PITIA).*

For an $80,000 salary, your gross monthly income is $6,667.

$6,667 x 0.28 = $1,867

According to this rule, your maximum target for a total monthly housing payment should be around $1,867.

2. The 36% Rule: The Back-End Ratio

The "back-end" ratio is the one lenders prioritize because it provides a more holistic view of your financial obligations. It stipulates that your total monthly debts—including your new PITI payment—should not exceed 36% of your gross monthly income. This is the DTI figure you'll hear about most often.

These debts include:

- Your proposed PITI payment

- Minimum credit card payments

- Car loan payments

- Student loan payments

- Personal loans

- Child support or alimony payments

Again, with a gross monthly income of $6,667:

$6,667 x 0.36 = $2,400

This means the sum of all your monthly debt obligations, *including your new mortgage*, should ideally not surpass $2,400. Some lenders, particularly for government-backed loans like FHA or for borrowers with high credit scores, may allow a DTI as high as 43% or even 50%, but 36% remains the gold-standard benchmark for financial health.

### A "Day in the Life" of Your Housing Budget

To make this tangible, let's visualize it. Imagine your $6,667 gross monthly income arrives. Before you even see it, taxes are deducted, leaving you with (for example) a take-home pay of around $5,000, depending on your state and withholdings.

Now, let's apply the 36% rule. You have $2,400 allocated for all debts.

- You have a $400 monthly car payment.

- You have $250 in student loan payments.

- You have a minimum credit card payment of $50.

Your existing monthly debt is $400 + $250 + $50 = $700.

Now, we subtract this from your total allowed debt:

$2,400 (Max DTI) - $700 (Existing Debt) = $1,700.

In this realistic scenario, your maximum allowable PITI payment is no longer the $1,867 calculated with the front-end rule, but $1,700. This demonstrates why the back-end DTI is the more critical and restrictive figure. Your personal debt load has a direct, dollar-for-dollar impact on the size of the mortgage you can afford.

---

Calculating Your Home Buying Power with an $80k Salary: A Deep Dive

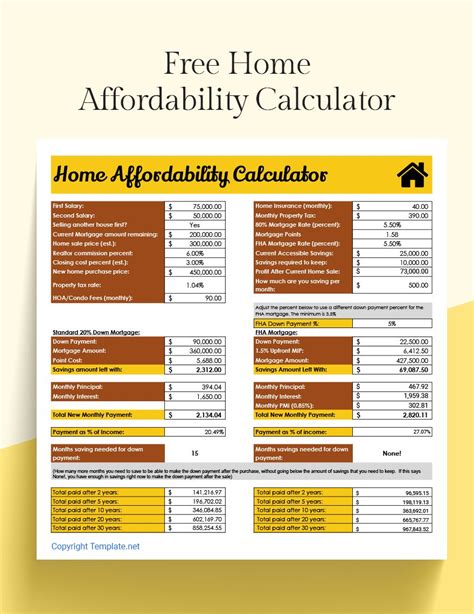

With the foundational rules established, we can now move to the exciting part: translating these monthly payment limits into an actual home price. This involves working backward from your maximum monthly payment, factoring in interest rates, and understanding the powerful role of your down payment.

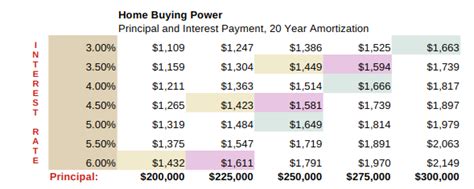

Let's use our $80,000 annual salary ($6,667/month) as the constant. The variables will be your existing debt load and, subsequently, your maximum affordable mortgage payment. We'll assume a 7.0% interest rate, a common figure in the 2023-2024 market according to Freddie Mac data, and an estimated $450/month for property taxes and homeowners insurance (a national average that can vary wildly).

Scenario 1: The "No Debt" Borrower

This is a rare but useful baseline. You have no car loans, student loans, or credit card debt.

- Gross Monthly Income: $6,667

- Max Back-End DTI (36%): $2,400

- Existing Monthly Debt: $0

- Maximum Allowable PITI: $2,400

From this, we subtract our estimated taxes and insurance:

$2,400 (PITI) - $450 (Taxes/Insurance) = $1,950 for Principal & Interest (P&I)

Using a mortgage calculator, a monthly P&I payment of $1,950 at a 7.0% interest rate over 30 years supports a total loan amount of approximately $293,000.

Scenario 2: The "Low Debt" Borrower

This is a more common profile. You have a modest car payment.

- Gross Monthly Income: $6,667

- Max Back-End DTI (36%): $2,400

- Existing Monthly Debt: $350 (car payment)

- Maximum Allowable PITI: $2,400 - $350 = $2,050

Subtracting taxes and insurance:

$2,050 (PITI) - $450 (T&I) = $1,600 for Principal & Interest (P&I)

A monthly P&I payment of $1,600 at 7.0% interest over 30 years supports a total loan amount of approximately $240,000. Notice how a small car payment reduced your borrowing power by over $50,000.

Scenario 3: The "Average Debt" Borrower

This profile reflects many young professionals with student debt.

- Gross Monthly Income: $6,667

- Max Back-End DTI (36%): $2,400

- Existing Monthly Debt: $400 (car payment) + $300 (student loans) = $700

- Maximum Allowable PITI: $2,400 - $700 = $1,700

Subtracting taxes and insurance:

$1,700 (PITI) - $450 (T&I) = $1,250 for Principal & Interest (P&I)

A monthly P&I payment of $1,250 at 7.0% interest over 30 years supports a total loan amount of approximately $188,000.

### The Power of the Down Payment

The loan amount is not your final home price. The final piece of the puzzle is your down payment. The home price you can afford is your Loan Amount + Down Payment.

Let's see how different down payment amounts affect the final purchase price for our "Average Debt" borrower with a max loan of $188,000.

| Down Payment Amount | Down Payment % (on final price) | Max Loan Amount | Affordable Home Price | Notes |

| :------------------ | :------------------------------ | :-------------- | :------------------------ | :------------------------------------------------------- |

| $15,000 | ~7.4% | $188,000 | $203,000 | Likely requires PMI. |

| $30,000 | ~13.8% | $188,000 | $218,000 | Likely requires PMI. |

| $47,000 | 20% | $188,000 | $235,000 | 20% down payment avoids PMI. |

| $62,000 | 25% | $188,000 | $250,000 | Stronger offer, no PMI. |

As the table clearly shows, your savings have a direct and powerful impact. A larger down payment not only increases your total purchasing power but can also help you avoid Private Mortgage Insurance (PMI), a costly extra fee we'll discuss later.

### What if we used a higher DTI?

As mentioned, some loan programs allow for higher DTIs. Let's re-run the numbers for our "Average Debt" borrower but with a more generous 43% DTI ratio, which is a common ceiling for conventional loans.

- Max Back-End DTI (43%): $6,667 x 0.43 = $2,867

- Existing Monthly Debt: $700

- Maximum Allowable PITI: $2,867 - $700 = $2,167

- P&I after Taxes/Insurance: $2,167 - $450 = $1,717

- New Max Loan Amount (at 7.0%): Approximately $258,000

This higher DTI limit increased the potential loan amount by $70,000. However, this comes with a major caveat: while the lender may approve this, it puts you in a much tighter financial position each month, leaving less room for savings, emergencies, or other life expenses. Being "house poor" is a real risk, and just because you *can* borrow that much doesn't always mean you *should*.

---

Key Factors That Influence Your Home Affordability

The calculations above provide a solid framework, but they are based on assumptions. In reality, your borrowing power is a fluid number influenced by a multitude of personal and market-driven factors. Understanding these variables is the key to maximizing what you can afford and securing the best possible loan terms.

### Your Debt-to-Income (DTI) Ratio

We've already established that DTI is king. On an $80k salary, every $100 in monthly debt (like a car payment or student loan) can reduce your borrowing power by roughly $15,000 to $20,000, depending on the interest rate. This makes debt management the single most powerful lever you can pull before applying for a mortgage.

- Student Loans: Lenders typically calculate a payment even if your loans are in deferment or forbearance. They often use 0.5% to 1% of the total loan balance as the estimated monthly payment. A $50,000 student loan balance could be calculated as a $250-$500 monthly payment, significantly impacting your DTI.

- Car Loans: A major culprit in high DTI. A $600/month payment for a new truck can be more damaging to a mortgage application than tens of thousands of dollars in student debt. If possible, paying off or refinancing a car loan before house hunting can dramatically boost your affordability.

- Credit Cards: Lenders use the *minimum* monthly payment reported to the credit bureaus, not your total balance. However, high balances can lower your credit score, which has its own negative effects.

### Your Credit Score

Your credit score is your financial report card, and for lenders, it's a primary indicator of your reliability as a borrower. A higher score proves you have a history of managing debt responsibly, which translates to lower risk for the lender and, most importantly, a lower interest rate for you.

According to FICO, a leading credit scoring model, even a small difference in score can have a massive impact on the interest rate you're offered.

Impact of Credit Score on a $300,000 Loan

| FICO Score Range | Example APR* | Monthly P&I Payment | Total Interest Paid (30 Yrs) |

| :--------------- | :----------- | :-------------------- | :----------------------------- |

| 760-850 | 6.6% | $1,916 | $389,765 |

| 700-759 | 6.8% | $1,956 | $404,024 |

| 660-679 | 7.3% | $2,056 | $440,240 |

| 620-639 | 8.2% | $2,245 | $508,242 |

*\*APRs are illustrative and based on national averages at a point in time. Source: myFICO.com Loan Savings Calculator.*

As the table shows, a borrower with an excellent 760 score pays $329 less per month than a borrower with a fair 630 score. Over the life of the loan, that adds up to a staggering $118,477 in extra interest payments. On your $80k salary, that lower payment means you could either afford a more expensive house or have hundreds of extra dollars each month for savings and other goals.

### Mortgage Interest Rates

While your credit score influences your *personal* rate, the *overall market* for interest rates is dictated by the economy, Federal Reserve policy, and global financial markets. You cannot control these, but you must be aware of them.

- Market Fluctuations: As seen from 2021 to 2024, rates can swing from historic lows (under 3%) to two-decade highs (over 7%). This has a monumental effect on affordability. A $300,000 loan at 3.0% has a P&I payment of $1,265. That same loan at 7.0% has a payment of $1,996. That $731 monthly difference is why the housing market is so sensitive to interest rate changes.

- Fixed vs. Adjustable-Rate Mortgages (ARM): A fixed-rate mortgage locks in your interest rate for the entire loan term (usually 15 or 30 years), providing predictable payments. An ARM typically offers a lower "teaser" rate for an initial period (e.g., 5, 7, or 10 years) before adjusting based on market conditions. An ARM can be a strategic choice if you plan to sell the home before the adjustment period ends, but it carries the risk of future payment shock if rates rise.

### Down Payment Amount

We've touched on this, but its importance cannot be overstated. Your down payment affects three key things: your loan size, your monthly payment, and whether you pay Private Mortgage Insurance (PMI).

- Avoiding PMI: PMI is insurance that protects the lender—not you—in case you default on the loan. It's typically required on conventional loans when your down payment is less than 20% of the home's purchase price. PMI can cost anywhere from 0.5% to 2% of the loan amount annually, broken into monthly payments. On a $300,000 loan, this could be an extra $125-$500 per month that does *not* go toward building your equity. Saving for a 20% down payment is the surest way to eliminate this cost and maximize your monthly cash flow.

- Loan Programs and Down Payments:

- FHA Loans: Backed by the Federal Housing Administration, these loans allow for down payments as low as 3.5% and are great for buyers with lower credit scores.

- VA Loans: For eligible veterans, service members, and surviving spouses, these loans often require 0% down.

- USDA Loans: For buyers in eligible rural areas, these also allow for 0% down.

- Conventional 97: A conventional loan option that allows for a 3% down payment.

### Geographic Location

This is perhaps the most dramatic variable. An $80,000 salary can afford a comfortable, spacious family home in one part of the country and a tiny studio apartment in another. The two main drivers are median home prices and property taxes.

Cost of Living and Home Price Comparison

| City | State | Median Home Price (Q4 2023)* | Estimated Affordable Home on $80k | Notes |

| :------------------------ | :---- | :--------------------------- | :---------------------------------- | :-------------------------------------------- |

| High Cost (HCOL) | | | | |

| San Jose | CA | $1,750,000 | N/A - Not Feasible | $80k salary is insufficient for this market. |

| Boston | MA | $715,000 | ~$220,000 | Affordability is extremely limited. |

| Denver | CO | $550,000 | ~$275,000 | Highly competitive; may afford a small condo. |

| Medium Cost (MCOL) | | | | |

| Austin | TX | $450,000 | ~$320,000 | Feasible, but high property taxes eat into PITI. |

| Phoenix | AZ | $430,000 | ~$350,000 | Achievable in many suburbs. |

| Atlanta | GA | $385,000 | ~$370,000 | $80k salary is very competitive here. |

| Low Cost (LCOL) | | | | |

| Cleveland | OH | $195,000 | >$400,000+ | $80k salary provides significant buying power. |

| St. Louis | MO | $210,000 | >$400,000+ | Homeownership is very accessible. |

| Birmingham | AL | $225,000 | >$400,000+ | Excellent affordability. |

*\*Median prices are illustrative, based on data from sources like the National Association of Realtors (NAR) or Redfin/Zillow research reports.*

*\*\*Affordable price is an estimate assuming low debt, good credit, and a 10% down payment, showing the relative buying power.*

Property taxes also vary immensely. States like New Jersey, Illinois, and Texas have some of the highest effective property tax rates in the country, while states like Hawaii, Alabama, and Colorado have some of the lowest. A 2.5% tax rate on a $300,000 home is $625/month in taxes, while a 0.5% rate is only $125/month. That $500 difference radically alters your PITI calculation and overall affordability.

### Loan Type and Term

The final piece is the structure of the loan itself.

- 30-Year vs. 15-Year Mortgage: A 30-year term is the most common because it spreads the loan over a longer period, resulting in the lowest possible monthly payment. This maximizes the home price you can afford upfront. A 15-year term has much higher monthly payments, but you pay significantly less interest over the life of the loan and build equity much faster. On an $80k salary, a 30-year mortgage is almost always the necessary choice to qualify for a reasonably priced home.

- Loan Type (FHA, VA, Conventional): As discussed, the type of loan can determine your down payment requirement and credit score thresholds. FHA loans come with their own mortgage insurance (MIP), which, unlike PMI, often lasts for the life of the loan. Choosing the right loan product for your financial situation is a key strategic decision you'll make with your lender.

---

Beyond the Sticker Price: The Hidden Costs of Homeownership

Qualifying for the loan and affording the PITI payment is only half the battle. True affordability means being able to comfortably handle the full financial responsibilities of owning a home. Many first-time buyers are blindsided by these "hidden" costs, which can turn a dream home into a financial strain. A responsible budget on an $80,000 salary must account for these from day one.

1. Closing Costs

These are the fees you pay to finalize the mortgage and transfer ownership of the property. They are paid in a lump sum at closing and typically range from 2% to 5% of the total loan amount. For a $300,000 loan, that's an additional $6,000 to $15,000 you need to have saved *on top of* your down payment.

Common closing costs include:

- Loan Origination Fee: A fee the lender charges for processing the loan application (often ~1% of the loan).

- Appraisal Fee: Cost to have a licensed appraiser determine the fair market value of the home.

- Title Insurance: Protects you and the lender from future claims against the property's title.

- Home Inspection Fee: The cost of hiring an inspector to check for structural issues, faulty wiring, etc. (Technically pre-closing, but part of the process).

- Prepaid Expenses: You may need to prepay several months of property taxes and homeowners insurance into an escrow account.

- Attorney Fees: In some states, a real estate attorney is required to oversee the closing.

2. Property Taxes and Homeowners Insurance**

While these are part of PITI, their potential for volatility deserves a separate mention. Your initial escrow calculation is based on the seller's tax history. After the sale, the county will reassess the property at its new, higher value, which can cause your property tax bill—and thus your monthly mortgage payment—to jump significantly in the second year of ownership. This is known as "escrow shock,"