Introduction

Imagine a career where you are not bound by the four walls of an office, where your income is directly tied to your effort and expertise, and where you play a crucial role in helping people and communities recover from their most challenging moments. This is the reality of an independent insurance adjuster. For those with an entrepreneurial spirit, a sharp eye for detail, and a deep-seated desire to solve complex problems, this field offers a unique blend of autonomy, purpose, and significant financial reward. But the central question for anyone considering this demanding path is clear: what is the true earning potential? What does an independent adjuster salary actually look like?

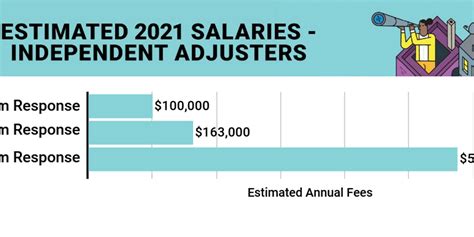

The answer is complex and compelling. While staff adjusters employed by a single insurance company earn a steady salary, independent adjusters operate as contractors, working for multiple insurance companies or third-party administration (TPA) firms. This model opens the door to substantially higher earnings, with seasoned professionals, particularly in catastrophe (CAT) adjusting, often earning well into the six figures annually. A typical range can span from $70,000 for those handling daily claims to over $200,000 for experienced catastrophe adjusters during a busy storm season.

I once found myself in the aftermath of a severe hailstorm that swept through my neighborhood. Amidst the chaos of contractors and concerned homeowners, the most composed person on the block was the independent adjuster. With a tablet in one hand and a specialized measuring tool in the other, she moved with a quiet competence, meticulously documenting damage, explaining the process to my anxious neighbors, and single-handedly bringing order and a path forward to a street in disarray. It was a powerful illustration of the adjuster's role not just as an investigator, but as a vital first responder in the economic recovery of a community.

This comprehensive guide will demystify the independent adjuster's career path and salary potential. We will dissect every factor that influences your income, explore the day-to-day realities of the job, and provide a step-by-step roadmap to get you started.

### Table of Contents

- [What Does an Independent Adjuster Do?](#what-does-an-independent-adjuster-do)

- [Average Independent Adjuster Salary: A Deep Dive](#average-independent-adjuster-salary-a-deep-dive)

- [Key Factors That Influence an Independent Adjuster's Salary](#key-factors-that-influence-an-independent-adjusters-salary)

- [Job Outlook and Career Growth for Independent Adjusters](#job-outlook-and-career-growth-for-independent-adjusters)

- [How to Become an Independent Adjuster: Your Step-by-Step Guide](#how-to-become-an-independent-adjuster-your-step-by-step-guide)

- [Conclusion: Is a Career as an Independent Adjuster Right for You?](#conclusion-is-a-career-as-an-independent-adjuster-right-for-you)

What Does an Independent Adjuster Do?

At its core, an independent adjuster is an investigative professional hired by insurance companies on a contract basis to determine the insurer's liability for a claim. When an insurance carrier faces a surge in claims—typically after a natural disaster like a hurricane, wildfire, or tornado, or simply due to high claim volume in a specific region—they deploy independent adjusters to handle the overflow. These professionals act as the eyes, ears, and analytical engine of the insurance company on the ground.

Their primary mission is to conduct a fair, timely, and impartial investigation of a loss. This involves evaluating the insurance policy to determine what is covered, assessing the extent of the damage or liability, and recommending a fair settlement amount. They are the critical link between the policyholder who has suffered a loss and the insurance carrier who has promised to make them whole.

The role is multifaceted and demands a unique combination of technical knowledge, investigative skills, and emotional intelligence.

### Core Responsibilities & Daily Tasks

While every day can be different, especially for a catastrophe adjuster, the workflow generally follows a structured process:

1. Receiving and Reviewing Claims: The process begins when an IA firm assigns the adjuster a batch of claims. The adjuster's first step is to review the claim file, which includes the policyholder's information, the policy details, and the initial report of the loss (known as the "First Notice of Loss").

2. Initial Contact and Scheduling: The adjuster must promptly contact the policyholder to introduce themselves, express empathy for their situation, explain the claims process, and schedule an on-site inspection. This first impression is critical for setting the tone for the entire claim.

3. On-Site Inspection (Scoping): This is the heart of the job for property adjusters. It involves a meticulous physical inspection of the damaged property. This could mean climbing on steep roofs to assess hail or wind damage, wading through a flooded basement, or carefully examining the char patterns in a fire-damaged home. The adjuster takes extensive photographs, detailed measurements, and copious notes on the scope of the damage. For liability claims, this may involve visiting an accident scene or interviewing witnesses.

4. Damage Estimation and Report Writing: After the inspection, the adjuster uses specialized software—most commonly Xactimate for property claims—to build a detailed, line-item estimate of the cost to repair or replace the damaged property. This report is a highly technical document that includes everything from the cost of drywall and paint to labor rates and building code requirements. This is often the most time-consuming part of the job, requiring hours of focused work at a desk.

5. Negotiation and Settlement: The adjuster submits their report and settlement recommendation to the insurance carrier. They may need to communicate their findings to the policyholder, answer questions, and sometimes negotiate the final settlement amount with the policyholder or their contractors. The goal is to reach an agreement that is fair to all parties and is fully supported by the policy and the evidence gathered.

### A Day in the Life of a Catastrophe Adjuster

To make this tangible, consider a day for an independent adjuster deployed to Florida after a hurricane:

- 5:30 AM: Wake up in a temporary rental or hotel room. Check emails and new claim assignments that came in overnight from the IA firm. Plan the day's inspection route using mapping software to be as efficient as possible.

- 7:00 AM: After grabbing a quick breakfast, head out to the first inspection. The car is a mobile office, equipped with a laptop, printer, tools (laser measure, pitch gauge, shingle gauge), ladder, and safety gear.

- 8:00 AM - 12:00 PM: Conduct two to three property inspections. This involves meeting with distressed homeowners, walking the property, climbing the roof to document wind damage, and taking hundreds of photos. Each inspection can take 1-2 hours.

- 12:00 PM: A quick lunch in the car while returning calls and scheduling inspections for the next day.

- 1:00 PM - 5:00 PM: Complete another three inspections in the afternoon sun and humidity. This work is physically demanding and requires constant focus.

- 6:00 PM: Head back to the temporary home office. The fieldwork is done, but the day is far from over.

- 7:00 PM - 11:00 PM (or later): This is "desk time." For every hour spent in the field, an adjuster might spend two hours writing reports. They meticulously build estimates in Xactimate, upload photos, write narrative reports explaining their findings, and submit the completed files to the insurance carrier. This requires immense concentration and attention to detail.

This cycle repeats, seven days a week, for weeks or even months on end during a major catastrophe deployment. It's a grueling but incredibly lucrative period that defines the high end of the independent adjuster salary.

Average Independent Adjuster Salary: A Deep Dive

Quantifying an independent adjuster's salary is different from analyzing a standard salaried position. Independent adjusters are business owners, and their income is revenue, not a wage. They are typically paid via a "fee schedule," which is a percentage of the final claim settlement amount, or a "daily rate" for certain assignments. After their gross earnings, they must deduct their own business expenses, including travel, lodging, tools, software subscriptions, licensing fees, and taxes.

Despite this variability, we can analyze data from various authoritative sources to build a clear picture of the earning potential.

### National Averages and Salary Ranges

It's important to distinguish between all claims adjusters and independent adjusters. The U.S. Bureau of Labor Statistics (BLS) groups all "Claims Adjusters, Appraisers, Examiners, and Investigators" together.

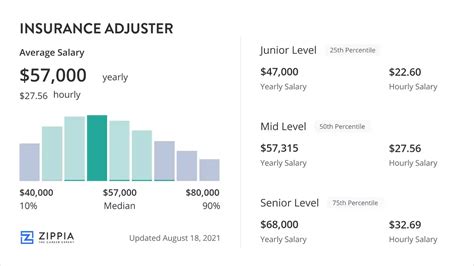

- According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for this broad category was $76,170 as of May 2023. The lowest 10 percent earned less than $51,690, and the highest 10 percent earned more than $111,720.

This BLS figure includes salaried staff adjusters, who make up a large portion of the workforce and typically have a lower, albeit more stable, income. Therefore, the true potential for an *independent* adjuster is often significantly higher than this median.

Reputable salary aggregators, which often gather self-reported data from professionals, provide a more targeted view:

- Payscale.com reports the average salary for an Independent Insurance Adjuster to be around $70,891 per year, but with a wide range from $48k to $124k. It notes that bonuses can add significantly to this figure.

- Salary.com places the average Independent Claims Adjuster salary in the United States at $74,186 as of May 2024, with the typical range falling between $64,887 and $85,027.

- Glassdoor.com estimates the total pay for an Independent Adjuster is around $95,338 per year in the United States, with an average salary of $73,197 and additional pay (bonuses, profit sharing) averaging $22,141.

The crucial takeaway from this data is the wide range. An adjuster working part-time on small daily claims might earn $50,000, while a top-tier catastrophe adjuster working two major storms in a year could easily clear $250,000 or more.

### Income Progression by Experience Level

An independent adjuster's income is directly correlated with their experience, reputation, and efficiency. Here’s a breakdown of what to expect at different career stages:

| Experience Level | Years in Field | Typical Role | Estimated Annual Gross Income Range | Key Characteristics |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level / Trainee | 0-2 Years | Handling small property claims; assisting senior adjusters; working non-catastrophe "daily" claims. | $50,000 - $80,000 | Focus is on learning the ropes, mastering Xactimate, and building a reputation for reliability with IA firms. Income is often inconsistent. |

| Mid-Career Adjuster | 3-9 Years | Handling moderately complex daily claims; first-time catastrophe deployments; some specialization. | $80,000 - $150,000 | Has a solid roster of IA firms. Works efficiently, closing more claims per day. Can handle larger, more complex residential and light commercial claims. |

| Senior / Elite Adjuster | 10+ Years | Top-tier catastrophe adjuster; specializes in large commercial loss, high-value homes, or complex liability. | $150,000 - $300,000+ | Is on the "first call" list for major IA firms when a disaster hits. Highly efficient, expert-level knowledge of policy and estimation. May mentor other adjusters. |

*Note: These are estimates of gross income before expenses and taxes. An adjuster's net income will be lower after accounting for business costs.*

### Understanding the Compensation Components

An independent adjuster's paycheck is not a simple salary. It’s a composite of several elements:

- Fee Schedules (Property Claims): This is the most common payment method for property claims. The adjuster earns a percentage of the total value of the claim they write. The percentage is on a sliding scale; for example, they might earn 65% on the first $5,000 of the claim, 55% on the next $5,000, and so on. The larger and more complex the claim, the higher the fee. A small $3,000 roofing claim might net a fee of a few hundred dollars, while a $150,000 fire loss could generate a fee of over $10,000 for a single claim.

- Daily Rates (Specific Assignments): For some assignments, especially in the early days of a catastrophe (when the goal is just to make initial contact and assess severity) or for specialized roles like large loss assisting, adjusters may be paid a flat daily rate. This can range from $400 to over $1,000 per day, depending on experience and the nature of the work.

- Mileage and Expenses: In some cases, particularly for daily claims, the IA firm may reimburse for mileage or specific expenses. However, for most catastrophe work, the adjuster is responsible for all of their own travel, lodging, and tool expenses, which must be factored into their financial planning.

- Bonuses: Some IA firms may offer performance bonuses for things like fast cycle times (closing claims quickly) or high policyholder satisfaction scores, but this is less common than the fee-based structure.

The beauty and the challenge of this model is its direct link between work and reward. The more efficiently and accurately you can close claims, the more money you will make.

Key Factors That Influence an Independent Adjuster's Salary

An independent adjuster's income is not a fixed number; it's a dynamic figure shaped by a multitude of variables. Two adjusters with the same years of experience can have vastly different annual earnings. Understanding these factors is the key to maximizing your own independent adjuster salary. As a career analyst, I've seen professionals strategically leverage these elements to build highly successful and lucrative careers.

### 1. Area of Specialization

This is arguably the most significant factor determining earning potential. Not all claims are created equal. The complexity, urgency, and value of the claims you handle will directly impact your income.

- Catastrophe (CAT) Adjusting: This is the highest-earning specialty. CAT adjusters deploy to areas hit by widespread disasters like hurricanes, tornadoes, wildfires, hailstorms, and floods. They handle a high volume of claims in a short, intense period. While the work is grueling (12-16 hour days, 7 days a week for months), the financial reward is immense. A single hurricane deployment can result in a six-figure income for an experienced adjuster. The demand is cyclical and depends entirely on weather events.

- Daily Claims Adjusting: This is the bread-and-butter of the industry. These are non-catastrophe claims that happen every day, such as a pipe leak, a kitchen fire, or a tree falling on a house. The volume is steadier and the work is less intense, allowing for a better work-life balance. The fee per claim is lower than in a CAT scenario, leading to a more moderate but consistent income. Many adjusters balance daily claims work with periodic CAT deployments.

- Large Loss / Commercial Adjusting: This is a highly specialized and lucrative niche. These adjusters handle claims for commercial properties like factories, apartment complexes, or shopping centers, where the claim values can run into the millions. This requires a deep understanding of commercial construction, business interruption insurance, and complex policy language. Earning potential is extremely high, but it takes many years of experience to enter this field.

- Liability & Casualty Adjusting: This specialty moves away from property and into investigating claims of bodily injury or property damage for which a policyholder is liable. This could be a slip-and-fall at a business or a complex auto accident. It's more investigative and less about physical measurement, requiring strong negotiation and interpersonal skills. Income can be very good and is less dependent on weather.

- Workers' Compensation: A highly regulated field focused on claims for employees injured on the job. It requires a deep knowledge of state-specific laws and medical terminology. It offers steady work but is a very distinct career path within adjusting.

Expert Advice: New adjusters should aim to get experience in daily claims to learn the fundamentals, with a long-term goal of becoming "CAT-ready" to seize high-income opportunities when they arise.

### 2. Geographic Location and Willingness to Travel

Where you live and where you are willing to work profoundly impacts your income.

- Storm-Prone States: Living in or being licensed in states frequently hit by natural disasters—such as Florida, Texas, Louisiana, Oklahoma, and California—provides a significant advantage. Proximity to catastrophes means you can be deployed faster and potentially incur lower travel costs. These regions provide the most frequent opportunities for high-volume, high-income CAT work.

- Cost of Living vs. Opportunity: An adjuster's "base" location matters less than their "deployment" location. An adjuster might live in a low-cost-of-living state like Tennessee but spend three months working in high-cost California after a wildfire. The key is holding licenses in the states with the most activity. Some states have higher prevailing labor and material costs, which can lead to larger claim values and, consequently, higher fees for the adjuster.

- Licensing Strategy: The most successful independent adjusters hold multiple state licenses. They often start with their home state license (or a "Designated Home State" license if their state doesn't require one) and then obtain reciprocal licenses for key states like Florida, Texas, and Louisiana. This allows them to be deployed anywhere in the country at a moment's notice, maximizing their availability and income potential.

### 3. In-Demand Skills and Certifications

In this field, specialized skills and credentials directly translate to higher pay and more consistent work. Simply having a license is not enough.

- Xactimate Proficiency: For property adjusters, this is non-negotiable. Xactimate is the industry-standard software for estimating property damage. Being a fast, accurate, and efficient Xactimate user is the single most important technical skill. IA firms will often choose an adjuster with proven Xactimate skills over one without. Investing in high-level Xactimate training (Levels 1, 2, and 3 certification) offers a massive return on investment.

- Rope and Harness / High-Steep Roof Certification: Safety is paramount. Having a certification that proves you are trained and comfortable inspecting steep and multi-story roofs makes you far more valuable to an IA firm. It opens you up to a wider range of claims that other adjusters cannot safely handle.

- Advanced Certifications (AIC, CPCU): While not mandatory, professional designations from organizations like The Institutes can significantly boost your credibility and earning potential, especially for those interested in complex claims or management roles.

- Associate in Claims (AIC): Demonstrates a comprehensive understanding of the claims process.

- Chartered Property Casualty Underwriter (CPCU): This is the premier designation in the property-casualty industry, signaling a high level of expertise and professionalism. It is more common among senior-level staff adjusters and IA firm managers but is highly respected for independent adjusters aiming for large loss work.

- Soft Skills: Do not underestimate the power of communication, empathy, and negotiation. An adjuster who can de-escalate a tense situation with an upset policyholder and clearly explain the process is invaluable. High customer satisfaction scores can lead to preferential treatment from IA firms.

### 4. Experience and Reputation

In the independent adjusting world, your reputation is your currency.

- The Rookie Penalty: In your first one to two years, you are an unknown quantity. IA firms will likely assign you smaller, less complex claims to test your abilities. Your income will be lower as you learn the systems, build speed, and prove your reliability. The key during this phase is to produce high-quality, error-free work, even if the pay isn't spectacular.

- Building a Track Record: As you successfully close claims, you build a reputation with the claims managers at IA firms. They will begin to trust you with larger, more complex, and more lucrative assignments. A manager who knows your work is clean and fast will actively seek you out for deployments.

- The "First Call" List: After several years of excellent performance on major CATs, you can earn a spot on the coveted "first call" list. This means when a major event happens, you are among the first group of adjusters the firm calls to deploy. These adjusters get the best claims and the longest deployments, leading to the highest earnings.

### 5. The IA Firm(s) You Work With

Independent adjusters are contractors, and they get their work from Independent Adjusting (IA) firms. The quality of the firm and your relationship with them is critical.

- Firm Size and Specialization: Large, national firms like Pilot Catastrophe Services, Crawford & Company, and Sedgwick have contracts with major insurance carriers and can provide a steady stream of work, especially during major CATs. Smaller, boutique firms might specialize in certain types of claims (e.g., large commercial loss, flood) and may offer higher fee schedules to attract top talent.

- Getting on Rosters: The first step for any new adjuster is to get on the rosters of as many reputable IA firms as possible. This is akin to applying for a job. Once you are on the roster, you are eligible to be deployed.

- Performance Metrics: IA firms track your performance closely. They measure things like your "cycle time" (how long it takes you to close a claim), the accuracy of your estimates, and the feedback from policyholders. Excelling in these areas ensures you get more work. Poor performance can get you removed from the roster.

By strategically developing these five areas—specializing in high-demand fields, being geographically flexible, acquiring critical skills, building an impeccable reputation, and aligning with quality IA firms—an independent adjuster can take control of their career trajectory and significantly elevate their salary.

Job Outlook and Career Growth for Independent Adjusters

When considering a long-term career, understanding the future landscape is just as important as the current salary. For independent adjusters, the outlook is a complex picture of evolving challenges and significant, enduring opportunities.

### Official Job Growth Projections

The U.S. Bureau of Labor Statistics (BLS) projects that overall employment for "Claims Adjusters, Appraisers, Examiners, and Investigators" is expected to decline 4 percent from 2022 to 2032. At first glance, this projection can seem discouraging, but it requires critical analysis from the perspective of an *independent* adjuster.

The primary driver of this projected decline is technology. Insurance companies are increasingly using automation and Artificial Intelligence (AI) to handle simple, low-value claims. For example, a minor auto-damage claim might be processed entirely through a mobile app, where the policyholder uploads photos and an AI system generates an estimate, eliminating the need for an adjuster. This trend will likely reduce the demand for staff adjusters who handle high volumes of simple, repetitive claims.

However, the story is very different for complex claims, which are the domain of the skilled independent adjuster. AI and automation are not yet capable of:

- Navigating the complexities of a major fire loss or water damage claim.

- Conducting the sensitive, in-person interviews required for a liability investigation.

- Making the nuanced judgment calls needed for large, multi-faceted claims.

- Climbing a roof to assess the subtle signs of hail damage.

Therefore, while the total number of adjusters may decrease, the demand for highly skilled, experienced, and technologically adept independent adjusters, especially for catastrophe and large loss work, is expected to remain strong and may even grow.

### Emerging Trends and Future Opportunities

Several powerful trends are shaping the future of this profession, creating new opportunities for those prepared to adapt.

1. **