Decoding Your Earning Potential: A Guide to Salaries at JPMorgan Chase

JPMorgan Chase & Co. stands as a titan in the global financial landscape, offering a wide spectrum of career opportunities that attract top talent from around the world. For many ambitious professionals and recent graduates, a key question looms large: what can one expect to earn at such a prestigious firm? While the allure of a six-figure salary is strong, the reality is that compensation at JPMorgan Chase is a complex equation.

Salaries can range from approximately $40,000 per year for entry-level operational roles to well over $500,000 in total compensation for senior, revenue-generating positions. This guide will break down the numbers, explore the key factors that dictate your earning potential, and provide a clear picture of what a career at this financial giant can mean for your wallet.

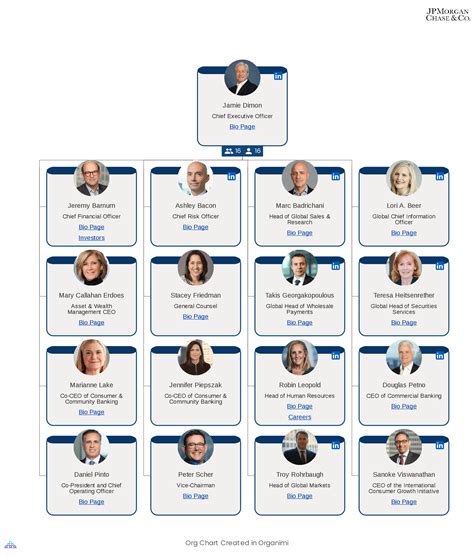

Understanding Roles and Responsibilities at JPMorgan Chase

Before diving into salary specifics, it's crucial to understand that "a job at JPMorgan Chase" is not a single role. The firm is a massive, diversified financial institution with distinct lines of business, each with its own set of roles, responsibilities, and corresponding pay scales.

Here are a few key areas:

- Corporate & Investment Bank (CIB): This is the division often associated with high finance. Professionals here work on large-scale, complex transactions. Roles include Investment Banking Analysts and Associates, who advise companies on mergers, acquisitions, and raising capital, and Markets Analysts (Sales & Trading), who buy and sell financial securities on behalf of clients.

- Asset & Wealth Management (AWM): This division manages investments for institutions and high-net-worth individuals. Private Bankers and Financial Advisors build relationships with wealthy clients to help them grow and preserve their fortunes.

- Consumer & Community Banking (CCB): This is the most visible part of the company, encompassing the Chase retail bank. Roles range from Bank Tellers and Relationship Bankers who serve everyday customers to Product Managers and Marketers who develop and promote banking products like credit cards and mortgages.

- Technology: Technology is the backbone of the entire firm. Software Engineers, Cybersecurity Analysts, and Data Scientists build and secure the platforms that power global finance, from mobile banking apps to sophisticated trading algorithms.

Average JPMorgan Chase Salary: A Look at the Numbers

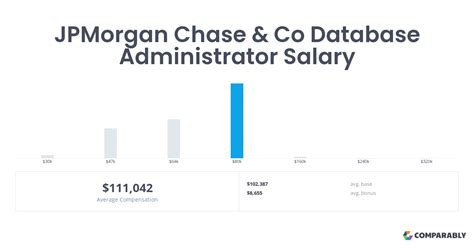

Salary at JPMorgan Chase is composed of two primary components: a base salary and a performance-based bonus. For front-office roles in the Investment Bank, the bonus can often equal or even exceed the base salary. The following data, compiled from reputable sources like Glassdoor, Levels.fyi, and industry reports, provides estimated salary ranges for several key positions.

*Note: Total Compensation is an estimate including base salary and potential annual bonus. These figures are subject to change based on market conditions, individual performance, and the factors discussed below.*

| Job Title | Level | Average Base Salary Range (USD) | Estimated Total Compensation (USD) |

| :--- | :--- | :--- | :--- |

| Investment Banking Analyst | First-Year | $100,000 - $125,000 | $175,000 - $225,000+ |

| Investment Banking Associate | Post-MBA | $175,000 - $225,000 | $275,000 - $400,000+ |

| Software Engineer | Entry-Level | $95,000 - $120,000 | $110,000 - $140,000 |

| Software Engineer | Senior | $140,000 - $180,000 | $170,000 - $250,000+ |

| Private Banker / Advisor | Associate | $90,000 - $130,000 | $120,000 - $200,000+ |

| Relationship Banker (Retail) | Entry-Level | $45,000 - $60,000 | $50,000 - $70,000 |

| Bank Teller | Entry-Level | $38,000 - $48,000 | $40,000 - $50,000 |

*Sources: Data synthesized from Glassdoor, Levels.fyi, and Payscale reports, updated for 2023/2024 market rates.*

Key Factors That Influence Salary

Your specific salary is determined by a combination of powerful factors. Understanding these levers is key to maximizing your earning potential.

### Level of Education

A bachelor's degree is the standard entry requirement for most professional roles at JPMorgan Chase. However, advanced degrees can significantly impact starting salary and career trajectory. For example, an MBA from a top-tier business school is the primary pipeline for Investment Banking Associate positions. These roles command a substantially higher starting base salary (around $175,000+) compared to undergraduate Analyst roles. Similarly, a Master's or Ph.D. in a quantitative field like Computer Science or Statistics can lead to higher-paying specialist roles in technology and quantitative finance.

### Years of Experience

Experience is arguably the most significant driver of compensation growth. The firm has a well-defined career progression, and each step comes with a major pay increase.

- Analyst to Associate: After two to three years as an Analyst, a high-performer is promoted to Associate, receiving a significant bump in both base pay and bonus potential.

- Associate to Vice President (VP): This is a critical promotion that happens after another three to four years. VPs take on more managerial responsibility and see their total compensation enter the $350,000 - $500,000+ range, according to data from Glassdoor and industry reports.

- VP to Executive Director (ED) and Managing Director (MD): These senior levels are reserved for top performers who drive significant revenue and lead large teams. Compensation at these levels can easily reach seven figures, driven primarily by performance-based bonuses.

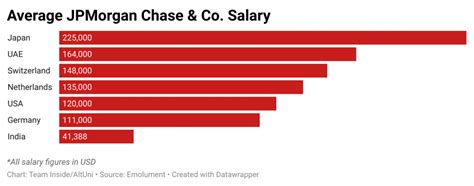

### Geographic Location

Where you work matters. JPMorgan Chase adjusts its salaries to reflect the local cost of living and the competitiveness of the talent market. Unsurprisingly, roles in high-cost-of-living (HCOL) financial hubs pay a premium.

- Top Tier: New York City, London, and Hong Kong offer the highest salaries to attract and retain talent in these expensive, competitive markets.

- Second Tier: Major cities like Chicago, San Francisco, and Singapore also offer strong compensation packages.

- Strategic Hubs: The firm has large operational and technology hubs in locations like Plano, Texas; Columbus, Ohio; and Wilmington, Delaware. While salaries here are still very competitive for the local market, they are generally lower than in HCOL financial centers. According to Salary.com's location-based calculator, a financial analyst role in New York City could pay up to 20% more than the same role in Columbus.

### Division or Line of Business

The division you work for is a primary determinant of your pay scale.

- Corporate & Investment Bank (CIB): This is the highest-paying division. Roles directly tied to revenue generation, like investment banking and sales & trading, have the highest bonus potential and overall compensation.

- Asset & Wealth Management (AWM): This division also offers high earning potential, with compensation often tied to the assets under management (AUM) that an advisor oversees.

- Consumer & Community Banking (CCB) and Corporate Functions: Roles in retail banking, HR, marketing, and internal operations are crucial to the firm's success but generally follow a more traditional corporate pay structure. While still competitive, the bonus potential is typically a smaller percentage of the base salary compared to front-office CIB roles.

### Area of Specialization

Within a division, specialization pays. In technology, an engineer specializing in a high-demand field like Artificial Intelligence/Machine Learning or Cloud Infrastructure will command a higher salary than a generalist developer. In the CIB, an investment banker specializing in a hot sector like technology or healthcare M&A may have a higher deal flow and, consequently, a larger bonus than someone in a slower-moving industrial sector.

Job Outlook

The career outlook for professions found at JPMorgan Chase remains robust. While the firm itself is highly competitive, the underlying fields are projected to grow.

According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook:

- Employment for Financial Analysts is projected to grow 8% from 2022 to 2032, faster than the average for all occupations.

- Employment for Software Developers is projected to grow by a staggering 25% over the same period, reflecting the immense demand for technology across all industries, especially finance.

- Employment for Financial Managers is projected to grow 16%, driven by the need for expert financial stewardship in an increasingly complex global economy.

Working at a top-tier firm like JPMorgan Chase positions you at the forefront of these growing and essential professions.

Conclusion

A career at JPMorgan Chase offers a pathway to exceptional earning potential, but your salary is not a predetermined number. It is a dynamic figure shaped by your role, performance, location, and expertise.

Here are the key takeaways for any prospective professional:

1. Compensation Varies Widely: Your role and division are the biggest factors. An Investment Banker in New York will earn vastly more than a Relationship Banker in a suburban branch.

2. Performance is Paramount: Especially in front-office roles, your annual bonus is a direct reflection of your contribution and can be the largest part of your pay.

3. Experience Drives Growth: A clear career path exists, with each promotion from Analyst to Managing Director unlocking a new level of compensation.

4. Location Matters: Expect higher pay—and higher costs—in major financial centers.

For those willing to meet the high demands of a career in global finance, JPMorgan Chase offers a challenging environment with the potential for immense professional and financial rewards. Focus on building the right skills, gaining relevant experience, and targeting the role that best aligns with your long-term ambitions.