Decoding the Paycheck: How Much Does a JP Morgan Executive Director Make?

For ambitious professionals in the finance industry, ascending the corporate ladder at a titan like JPMorgan Chase & Co. represents a pinnacle of career achievement. One of the most coveted rungs on that ladder is the title of Executive Director (ED). This role signifies deep expertise, significant responsibility, and, consequently, substantial financial reward. If you're aiming for this senior position, understanding the compensation structure is a critical piece of your career planning.

So, what can you expect to earn? While the exact figure varies, total compensation for a JP Morgan Executive Director often ranges from $350,000 to well over $550,000 annually, with top performers in high-stakes divisions earning even more. This article will break down the components of that impressive figure, the factors that influence it, and what the future holds for this demanding yet rewarding career path.

What Does a JP Morgan Executive Director Do?

Before diving into the numbers, it's essential to understand the role. At JPMorgan Chase, the corporate title hierarchy is a well-defined progression, typically moving from Analyst to Associate, then to Vice President (VP), Executive Director (ED), and finally, Managing Director (MD).

An Executive Director is a senior-level professional, sitting just below the Managing Director. They are not typically board members, but rather high-impact leaders within their specific business area. Key responsibilities often include:

- Team and Project Leadership: Managing large teams of VPs, associates, and analysts to execute complex projects, whether it's an M&A deal, a software development lifecycle, or a wealth management strategy.

- Client Relationship Management: Serving as a primary point of contact for key institutional or high-net-worth clients, fostering trust and driving business development.

- Strategic Execution: Translating the high-level strategy set by Managing Directors into actionable plans and deliverables for their teams.

- Mentorship and Development: Playing a crucial role in developing the talent pipeline by mentoring junior and mid-level employees.

The day-to-day duties of an ED vary dramatically depending on their division, from investment banking and asset management to technology and corporate functions.

Average JP Morgan Executive Director Salary

Compensation for an Executive Director at JPMorgan Chase is not just a base salary; it's a package heavily weighted toward performance-based incentives.

- Average Base Salary: According to data from salary aggregators, the base salary for a JP Morgan Executive Director typically falls within the range of $225,000 to $275,000 per year. Data from Glassdoor, based on user-submitted reports as of early 2024, shows an average base pay of approximately $248,000.

- Additional Pay (Bonus & Stock): This is where compensation skyrockets. The annual bonus is a critical component and is directly tied to both individual and firm performance. Bonuses can range from $100,000 to over $300,000, and sometimes higher in a good year for a front-office, revenue-generating role.

- Total Compensation: When combining base salary and all additional pay, the total compensation package is highly competitive. Levels.fyi, a trusted source for compensation data in tech and finance, reports a median total compensation for a JPMC Executive Director at $430,000. The range is wide, with some reporting total packages approaching $600,000.

It is crucial to remember that these figures represent an average across various divisions and locations, and your personal earnings will be influenced by several key factors.

Key Factors That Influence Salary

Two Executive Directors at JP Morgan can have vastly different compensation packages. Here are the primary variables that determine earning potential.

### Years of Experience

The Executive Director title is not an entry-level or even mid-career position. It is a senior role that requires a significant track record of success. Professionals are typically promoted to ED after spending several years as a high-performing Vice President. Most individuals who reach this level have at least 10-15 years of relevant industry experience. Those with more extensive experience, a proven history of generating revenue, or managing larger, more complex teams can command salaries and bonuses at the top end of the scale.

### Area of Specialization

Your division within the firm is arguably the most significant factor influencing your pay. There is a distinct difference between "front-office" roles that directly generate revenue and "middle-office" or "back-office" roles that support the firm's operations.

- Front-Office (Highest Earning Potential): Roles in Investment Banking (M&A, capital markets), Sales & Trading, and Private Equity typically have the highest compensation due to their direct link to the firm's profits.

- Middle/Back-Office (Strong Earning Potential): Roles in areas like Technology, Risk Management, Compliance, and Corporate Strategy are also highly compensated, but their bonus structures may be less volatile and, on average, lower than their front-office counterparts. An ED in a crucial technology role, for instance, still earns an exceptional salary, but it might trail an ED who just closed a multi-billion dollar deal.

### Geographic Location

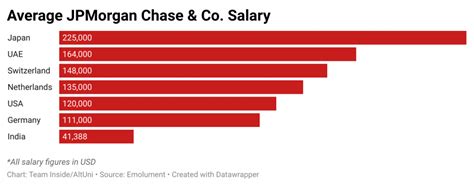

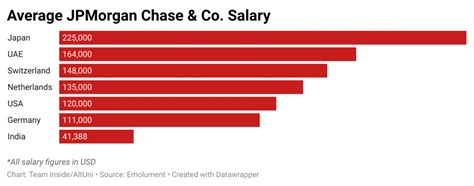

Where you work matters. Major financial hubs with a higher cost of living and a greater concentration of high-stakes business activity command a premium.

- Top Tier Locations: New York City, as the firm's headquarters and a global financial center, generally offers the highest compensation. London and Hong Kong follow closely behind.

- Other Major Hubs: Locations like Chicago, Houston, and San Francisco also offer very competitive salaries, though they may be slightly lower than in New York.

- Regional Offices: Offices in locations like Columbus, Ohio, or Plano, Texas, where JPMC has a massive corporate presence, will offer salaries that are excellent for the region but may be adjusted downward compared to the primary financial hubs.

### Level of Education

While experience trumps all at this level, education lays the foundation. A bachelor's degree in finance, economics, or a related field is the minimum requirement. However, a significant percentage of Executive Directors, especially in client-facing and strategic roles, hold a Master of Business Administration (MBA), often from a top-tier business school. An elite MBA can accelerate an individual's career trajectory toward the VP and ED ranks and enhance their negotiating power for compensation.

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) does not track data for a specific corporate title like "Executive Director." However, we can look at the broader category of "Financial Managers" for a directional outlook.

The BLS projects that employment for financial managers will grow by 16 percent from 2022 to 2032, which is much faster than the average for all occupations. This indicates a strong and sustained demand for experienced financial professionals. While the overall field is growing, competition for senior roles at elite institutions like JPMorgan Chase will always be incredibly fierce. Success requires not only a strong resume but also exceptional performance and networking skills.

Conclusion

Reaching the level of Executive Director at JPMorgan Chase is a testament to years of dedication, expertise, and high-level performance. The financial rewards reflect this achievement, with total compensation packages that place individuals firmly in the top tier of earners.

For those aspiring to this role, here are the key takeaways:

- Aim for Total Compensation: Focus on the full package, as the annual bonus is a significant part of your earnings.

- Experience is Paramount: Build a strong track record of success as you progress from Analyst to Associate and VP.

- Location and Division Matter: Your earning potential is highest in major financial hubs and in front-office, revenue-generating divisions.

- Education is Your Foundation: A strong educational background, potentially including an MBA, can provide a significant career advantage.

While the path is challenging, the role of an Executive Director at a firm like JP Morgan offers an unparalleled opportunity to lead at the highest levels of global finance and be compensated accordingly.