Introduction

In the world of professional careers, few paths offer the unique blend of entrepreneurial spirit, client advocacy, and significant income potential as that of a licensed insurance agent. If you're driven by the desire to help people protect their most valuable assets while building a financially rewarding career, you've likely wondered about the realities of a licensed insurance agent salary. It's a role that's often misunderstood—seen merely as sales, when in reality, it's a sophisticated advisory position demanding expertise, empathy, and strategic thinking. The earning potential isn't just a simple number; it's a dynamic equation influenced by your specialty, your drive, and your dedication to mastering the craft. While the U.S. Bureau of Labor Statistics reports a median salary of over $60,000, top-tier agents often earn well into the six figures, showcasing the vast opportunity this field holds.

I remember a conversation years ago with a family friend whose house had suffered a devastating fire. Amid the chaos and heartbreak, he told me, "The one person who brought clarity and calm was our insurance agent. She didn't just process a claim; she guided us, fought for us, and helped us piece our lives back together." That story has always stuck with me, crystallizing the profound impact a great agent can have. This isn't just about selling policies; it's about delivering peace of mind and being a steadfast ally in a client's moment of need.

This guide is designed to be your definitive resource, moving beyond simple salary figures to explore the intricate factors that shape your earnings and career trajectory as a licensed insurance agent. We will dissect compensation structures, analyze the job outlook, and provide a clear, actionable roadmap for getting started.

### Table of Contents

- [What Does a Licensed Insurance Agent Do?](#what-does-a-licensed-insurance-agent-do)

- [Average Licensed Insurance Agent Salary: A Deep Dive](#average-licensed-insurance-agent-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

---

What Does a Licensed Insurance Agent Do?

At its core, a licensed insurance agent is a professional advisor who helps individuals, families, and businesses identify their risks and find suitable insurance policies to mitigate potential financial losses. This role is far more consultative than a simple sales position. A great agent acts as a risk manager, an educator, and a long-term partner to their clients. Their responsibilities are multifaceted and require a blend of analytical, interpersonal, and organizational skills.

Core Responsibilities and Daily Tasks:

The work of an insurance agent can be broadly categorized into several key functions:

- Prospecting and Lead Generation: This is the lifeblood of an agent's business, especially in the early stages. It involves finding potential clients through various methods, including networking events, community involvement, cold calling, digital marketing, social media outreach, and purchasing qualified leads.

- Needs Analysis and Consultation: This is the most critical advisory part of the job. An agent sits down with a potential client to conduct a thorough analysis of their financial situation, assets, liabilities, and potential risks. For an individual, this might involve assessing their home, vehicles, and life insurance needs. For a business, it could be a complex evaluation of property, liability, workers' compensation, and cyber threats.

- Policy Quoting and Presentation: After identifying the client's needs, the agent researches various insurance products from the carriers they represent. They then prepare and present customized proposals that outline the coverage options, premiums, deductibles, and limits. The goal is to explain complex insurance jargon in simple, understandable terms.

- Closing Sales and Onboarding: Once a client decides to move forward, the agent facilitates the application process, collects necessary documentation, and ensures the policy is issued correctly by the insurance carrier. This is often referred to as "binding coverage."

- Client Servicing and Relationship Management: The job doesn't end after the sale. Agents are the primary point of contact for their clients. This includes answering questions about their policy, making changes (e.g., adding a new car), and processing billing. Building strong, long-term relationships is key to client retention and referrals.

- Claims Assistance: When a client suffers a loss (e.g., a car accident or property damage), the agent often acts as their first call and advocate. They help the client understand the claims process, assist with filing the necessary paperwork, and liaise with the insurance company's claims department to ensure a fair and timely settlement.

- Continuing Education and Compliance: The insurance industry is heavily regulated and constantly evolving. Agents are required to complete regular continuing education (CE) courses to maintain their licenses and stay up-to-date on new laws, products, and industry trends.

### A Day in the Life of a Licensed Insurance Agent

To make this more tangible, here’s what a typical day might look like for a successful property and casualty agent:

- 8:30 AM - 9:30 AM: Arrive at the office, grab coffee, and review the day's calendar. Respond to urgent emails from clients and underwriters. Check for any overnight claim notifications.

- 9:30 AM - 11:00 AM: Proactive Prospecting. Time-block for business development. This could involve following up on leads from the agency's website, making calls to potential clients, or crafting a targeted email campaign for a new commercial insurance product.

- 11:00 AM - 12:00 PM: Client Consultation. Meet with a young couple who just bought their first home. Conduct a detailed needs analysis, discussing not only the home itself but also their vehicles, potential liability risks, and the benefits of bundling policies for a discount.

- 12:00 PM - 1:00 PM: Lunch, often used for networking. Today, it's a lunch meeting with a local mortgage broker to strengthen a referral partnership.

- 1:00 PM - 2:30 PM: Quoting and Proposal Prep. Back at the desk, take the information from the morning meeting and enter it into the quoting software for multiple carriers. Analyze the different coverage options and premiums to build a clear, compelling proposal for the couple.

- 2:30 PM - 4:00 PM: Client Servicing. Field calls and emails. A long-time client needs to add their 16-year-old daughter to their auto policy. Another client calls in a panic about a minor fender-bender; the agent calms them down, explains the next steps, and helps them initiate the claim online.

- 4:00 PM - 5:00 PM: Follow-up and Closing. Call a business owner who received a proposal for workers' compensation insurance last week. Answer their final questions and successfully bind the policy.

- 5:00 PM - 5:30 PM: Planning. Review tomorrow's schedule and prepare any necessary materials. Make a list of key follow-ups to prioritize in the morning.

This snapshot illustrates the dynamic balance between sales, service, and administration that defines the role of a licensed insurance agent.

---

Average Licensed Insurance Agent Salary: A Deep Dive

Understanding the salary of a licensed insurance agent requires looking beyond a single national average. Compensation is heavily influenced by structure—primarily the mix of base salary and commission—and grows substantially with experience and specialization.

According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, the median annual wage for insurance agents was $60,340 in May 2023. This median figure means that half of all agents earned more than this amount, and half earned less. The BLS also provides a wider range, noting that the lowest 10 percent earned less than $31,510, while the highest 10 percent earned more than $131,990.

However, data from major salary aggregators, which often include commission and bonus data, paints an even more detailed picture.

- Salary.com reports that as of early 2024, the typical salary range for an Insurance Agent in the United States falls between $52,143 and $68,308, with a median of $59,183. This data often reflects agents in salaried or hybrid roles.

- Payscale.com provides a broader total pay spectrum, indicating a range from $37,000 to $107,000 when including base salary, bonuses, and commission. This highlights the significant upside potential.

- Glassdoor lists a national average base pay of around $58,951 per year, but with "additional pay" (commission, bonuses, etc.) averaging over $24,000, bringing the total potential compensation much higher.

The key takeaway is that while the median provides a solid benchmark, the real story lies in the vast range and the components that make up an agent's total earnings.

### Salary Brackets by Experience Level

An agent's income is not static; it's a journey. The first few years are about building a foundation—a client base, or "book of business"—which then generates recurring income through renewals.

| Experience Level | Typical Years of Experience | Typical Annual Salary Range (Total Compensation) | Key Focus |

| ----------------------- | --------------------------- | ------------------------------------------------ | --------------------------------------------------------------------------------- |

| Entry-Level Agent | 0-2 Years | $35,000 - $60,000 | Learning products, prospecting, writing new business, often with a higher base salary. |

| Mid-Career Agent | 3-9 Years | $60,000 - $110,000 | Managing and growing a book of business, generating renewal income, developing a specialty. |

| Senior/Veteran Agent| 10+ Years | $110,000+ | Deep specialization, managing large commercial accounts, mentoring, or agency ownership. |

*(Source: Synthesized data from BLS, Salary.com, and Payscale, reflecting total compensation including commission.)*

An entry-level agent, especially one in a "captive" environment (working for a single company like State Farm or Allstate), might start with a higher base salary and lower commission rate as they learn the ropes. As they gain experience and build their book of business, their income from commissions—especially on policy renewals—begins to grow exponentially, often far surpassing their initial base salary.

### Unpacking Compensation: Base, Commission, and Bonuses

It is impossible to discuss an insurance agent's salary without dissecting the components of their pay. This is one of the most variable aspects of the career.

- Base Salary: This is a fixed, predictable income paid regardless of sales. It's more common in captive agency roles, customer service-focused positions within an agency, or during an initial training period. It provides a safety net but may come with lower commission rates.

- Commission: This is the primary driver of income for most successful agents.

- New Business Commission: A percentage of the premium paid for a new policy sold. This is typically a higher percentage (e.g., 10-20% of the first year's premium) to incentivize growth.

- Renewal Commission: A percentage of the premium paid when a client renews their policy. While the percentage is lower (e.g., 2-15%), this creates a powerful stream of passive, recurring income. A large book of business with high retention can generate a substantial and stable income year after year.

- Bonuses: Many agencies and carriers offer bonuses for hitting specific sales targets, quality metrics, or profitability goals. These can be quarterly or annual and can significantly boost an agent's total earnings.

- Profit Sharing: Some agencies, particularly larger or well-established independent ones, may offer a share of the agency's overall profits to high-performing agents or long-term employees.

- Contingency/Contingent Commission: This is a backend bonus paid by an insurance carrier to an agency based on the overall performance of the book of business placed with them. Performance is typically measured by a combination of growth (premium volume) and profitability (low loss ratio). The agency may then share a portion of this with its agents.

A new agent might start in a role that is 70% base salary and 30% commission. A veteran independent agent, on the other hand, might operate on 100% commission, giving them unlimited earning potential tied directly to their efforts.

---

Key Factors That Influence Salary

The vast salary range reported by the BLS—from under $32,000 to over $130,000—is a direct result of several key variables. A prospective agent's career and income trajectory will be profoundly shaped by their choices and circumstances across these factors. As a career analyst, I advise aspiring professionals to strategically consider each of these elements when planning their path.

###

Level of Education and Professional Certifications

While a four-year college degree is not a strict requirement to become a licensed insurance agent (a high school diploma or equivalent is the typical minimum), higher education and advanced certifications can significantly impact earning potential and career opportunities.

- Education: A bachelor's degree in fields like Finance, Business, Marketing, or Risk Management provides a strong theoretical foundation and can be highly attractive to employers, especially for roles in commercial lines or financial services. It can signal a higher level of analytical and communication skills, potentially leading to a higher starting salary or a faster track to more complex, lucrative roles.

- Professional Designations: This is where agents truly differentiate themselves and unlock higher earnings. Earning prestigious industry designations demonstrates a deep commitment to the profession and a mastery of a specific area of insurance. They are a powerful signal of expertise to both clients and employers. Key designations include:

- Chartered Property Casualty Underwriter (CPCU): Considered the gold standard in the property and casualty insurance industry. It requires passing multiple rigorous exams on topics like risk management, insurance law, and commercial underwriting. Agents with a CPCU often move into high-level production, management, or specialist roles and command significantly higher salaries.

- Certified Insurance Counselor (CIC): A highly respected, practice-oriented designation focused on the practical application of insurance knowledge. Earning the CIC demonstrates expertise across all major lines of insurance and is a mark of a dedicated professional.

- Certified Financial Planner (CFP): For agents specializing in life insurance, annuities, and retirement products, the CFP designation is paramount. It allows them to provide comprehensive financial planning advice, opening up a much wider and more lucrative client relationship.

- Life Underwriter Training Council Fellow (LUTCF): A foundational designation for life insurance professionals, focusing on product knowledge and needs-based selling.

Agents who invest in these designations often see a direct return on investment through higher commissions on more complex accounts, access to management roles, and increased client trust.

###

Years of Experience and the Power of Renewals

Experience is arguably the single most important factor in an insurance agent's income. This is not just about gaining skills; it's about the fundamental business model of the industry: building a "book of business."

- Years 1-2 (The Foundation): As discussed, these years are about hustling. Income is primarily from new business commissions and any base salary. It can be a challenging period with a steep learning curve. The focus is on activity: calls, meetings, and quotes.

- Years 3-5 (The Growth Phase): By this stage, the agent has a small but growing book of business. Renewal commissions start to become a noticeable and stabilizing part of their income. Referrals from satisfied clients begin to supplement active prospecting, making lead generation more efficient. Salary data from Payscale shows a distinct jump in earnings during this phase.

- Years 6-10 (The Momentum Phase): The agent now has a significant book of business. Renewal commissions may constitute half or more of their total income, providing a strong financial floor. They have established a reputation and a strong referral network. They have the experience to handle more complex and larger accounts, which carry higher premiums and commissions.

- Years 10+ (The Expert/Veteran Phase): Veteran agents often have a six-figure income stream from renewals alone. Their new business comes almost entirely from referrals and their established reputation. They can be more selective about the clients they take on, focusing on high-value accounts. Many transition into agency management or ownership, leveraging their experience to mentor others and build a larger enterprise.

###

Geographic Location

Where an agent works has a significant impact on their income, driven by factors like population density, wealth concentration, cost of living, and the local business environment.

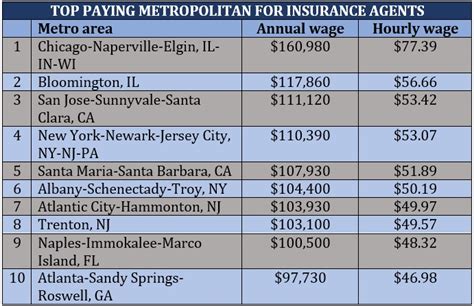

- High-Paying States and Metropolitan Areas: According to BLS data, some of the top-paying states for insurance agents include Massachusetts, New York, New Jersey, Colorado, and California. Metropolitan areas with robust financial sectors, high property values, and a concentration of large businesses tend to offer the highest potential. Cities like Boston, New York City, Denver, and San Jose are often cited as high-income locations for agents. Selling homeowners insurance in a high-cost-of-living area with expensive homes naturally leads to higher premiums and, thus, higher commissions than in a low-cost-of-living area.

- Average and Lower-Paying Areas: Conversely, rural areas and states with lower costs of living and less economic activity will typically have lower average salaries. While the income potential is lower, the reduced competition and lower overhead can still make it an attractive option for many agents.

- Regulatory Environment: State-specific insurance regulations can also play a role, influencing the types of products sold and the commission structures allowed.

###

Company Type & Size: Captive vs. Independent

The choice between being a captive agent or an independent agent is one of the most fundamental career decisions and directly impacts compensation structure and long-term potential.

- Captive Agents: These agents work exclusively for one insurance carrier (e.g., State Farm, Allstate, Farmers).

- Pros: Strong brand recognition, extensive training and support, often a base salary or subsidy program to start, and company-provided leads. This path offers more stability, especially early on.

- Cons: Limited to one company's products (which may not always be the best fit for the client), lower commission rates on average, and you do not own your book of business. If you leave, the clients stay with the company.

- Independent Agents (Brokers): These agents represent multiple insurance carriers. They own their own business or work for an independent agency.

- Pros: Ability to shop the market to find the best coverage and price for the client, higher commission rates, and ownership of your book of business. This ownership is a valuable asset that can be sold or passed down upon retirement. This path offers greater flexibility and unlimited earning potential.

- Cons: Higher risk, requires more entrepreneurial effort (you are responsible for your own leads, marketing, and overhead), and there is typically no base salary—it's often 100% commission.

- Agency Size: Working for a large national brokerage (like Marsh McLennan or Aon) offers access to massive resources, sophisticated training, and very large, complex accounts, leading to high-income potential. Working for a small, local "Main Street" agency provides a more intimate, community-focused environment, with potential for partnership or ownership down the line.

###

Area of Specialization

Just as doctors specialize, so do insurance agents. Specialization is a direct path to higher earnings because it allows an agent to develop deep expertise that is highly valued by specific client segments.

- Property & Casualty (P&C) vs. Life & Health (L&H): This is the first major split.

- P&C Agents sell policies like auto, home, and business insurance. Commission structures are renewal-based, building a stable long-term income.

- L&H Agents sell life insurance, health insurance, disability, and long-term care. Life insurance sales often involve very large, lump-sum commissions upfront, which can lead to very high-income years, but the renewal stream may be less consistent than P&C.

- Personal Lines vs. Commercial Lines (within P&C): This is another critical distinction.

- Personal Lines: Focuses on individuals and families (auto, home, renters, umbrella). It's a volume-based business.

- Commercial Lines: Focuses on businesses. This is often where the highest incomes are made. Policies are more complex (general liability, commercial property, workers' comp, professional liability), premiums are much larger, and the expertise required is significant. An agent who can expertly insure a large construction company or a tech startup will earn substantially more than an agent focused solely on personal auto policies.

- Niche Specializations: The highest-earning agents often carve out a niche. Examples include:

- High-Net-Worth Individuals: Providing customized insurance solutions for wealthy families.

- Specific Industries: Becoming the go-to expert for restaurants, contractors, or non-profits.

- Cyber Insurance: A rapidly growing and complex field with high demand for expert advisors.

- Employee Benefits: Working with companies to design and implement their health insurance and benefits packages.

###

In-Demand Skills

Beyond the license itself, certain skills directly correlate with higher income. Agencies and carriers are willing to pay a premium for agents who possess them.

- Financial Acumen & Analytical Skills: The ability to read a balance sheet, understand business finance, and perform complex risk analysis is critical for success in commercial lines.

- Advanced Client Relationship Management (CRM): Proficiency with CRM software (like Salesforce, Applied Epic, or Vertafore AMS360) to manage a large pipeline and book of business efficiently.

- Digital Marketing & Lead Generation: Agents who can generate their own high-quality leads through SEO, content marketing, social media, and paid ads have a massive advantage over those who rely solely on traditional methods.

- Bilingualism: In diverse communities, the ability to serve clients in their native language (e.g., Spanish) is an enormous asset and can unlock entire market segments.

- Public Speaking & Presentation Skills: The ability to confidently present complex proposals to business owners or conduct educational seminars for potential clients can set a top agent apart.

---

Job Outlook and Career Growth

For anyone considering a long-term career as a licensed insurance agent, the future viability of the profession is a critical concern. The good news is that the outlook is stable and projected to grow, though the role itself is undergoing a significant transformation.

According to the U.S. Bureau of Labor Statistics (BLS), employment of insurance agents is projected to grow 6 percent from 2022 to 2032, which is faster than the average for all occupations. The BLS anticipates about 52,100 openings for insurance sales agents each year, on average, over the decade. Most of these openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

Why is there still strong demand for insurance agents?

Even in an age of increasing automation and direct-to-consumer websites, the demand for knowledgeable human agents persists and, in some areas, is growing.

1. Complexity of Products: While buying a simple auto policy online is straightforward, most insurance needs are not. Life insurance, commercial liability, professional liability, and comprehensive financial planning involve complex products and significant financial consequences. Clients need and want an expert to help them navigate these decisions.

2. An Aging Population: As the large baby-boomer generation ages, demand for products like life insurance, long-term care insurance, and annuities will continue to increase. These are consultative sales that benefit greatly from a trusted advisor.

3. Evolving Risks: The world is becoming riskier in new ways. The rise of cybercrime has created a massive demand for cyber liability insurance. The increasing frequency of natural disasters due to climate change has made property insurance more complex and essential. Agents are needed to help businesses and individuals understand and insure against these emerging threats.

4. The Human Element: In a moment of crisis—a car crash, a house fire, a death in the family—people want to talk to a person, not a chatbot. An agent provides empathy, advocacy, and guidance when it is needed most.

### Emerging Trends and Future Challenges

The role of the agent is not static; it's evolving. Success in the next decade will require adapting to several key trends and overcoming new challenges.

- Trend: The Rise of Insurtech and AI: Technology is not replacing agents; it's augmenting them. Artificial intelligence can handle routine administrative tasks, analyze data to identify client needs, and streamline the quoting process. This frees up the agent to do what they do best: build relationships and provide high-level advice. The agent of the future will be a "bionic advisor," leveraging technology to be more efficient and effective.

- Challenge: Direct-to-Consumer (DTC) Competition: For simple, commoditized insurance products (like basic auto or renters insurance), competition from DTC websites is fierce. Agents must respond by emphasizing their value in more complex areas and providing a level of service and advice that an algorithm cannot replicate.

- Trend: Data-Driven Personalization: Carriers are using telematics (for auto insurance) and other data sources to create highly personalized insurance policies. Agents who