A career as a life insurance agent offers a unique combination of financial opportunity and the profound satisfaction of helping families secure their futures. But what does that opportunity look like in practical, monetary terms? While earning potential is high, an agent's salary is rarely a simple, fixed number. It's a dynamic figure influenced by performance, experience, and strategy.

For those considering this path, the financial landscape can be very promising. While entry-level agents build their client base, seasoned professionals often earn well into the six-figure range. This guide will break down the numbers, explore the key factors that drive income, and provide a clear picture of what you can expect to earn as a life insurance agent.

What Does a Life Insurance Agent Do?

At its core, a life insurance agent is a trusted advisor who helps individuals, families, and businesses prepare for the unexpected. They are the human connection to a complex financial product, translating needs into tangible security.

Their primary responsibilities include:

- Prospecting and Networking: Actively seeking out new clients through referrals, networking events, and marketing efforts.

- Needs Analysis: Conducting in-depth consultations with clients to understand their financial situation, long-term goals, and potential liabilities.

- Educating Clients: Explaining the different types of life insurance policies (e.g., term, whole, universal) in clear, understandable language.

- Customizing Solutions: Recommending and designing insurance plans that are tailored to each client's specific needs and budget.

- Closing Sales and Servicing Policies: Guiding clients through the application process and providing ongoing support, including policy reviews and updates as life circumstances change.

Success in this role hinges on strong communication skills, empathy, self-discipline, and a genuine desire to help others.

Average Life Insurance Salary

Unlike a traditional salaried job, a life insurance agent's income is heavily based on commissions—a percentage of the insurance premiums a client pays. This performance-based model means there is a wide range of potential earnings.

To understand the full picture, we must look at data from multiple authoritative sources:

- U.S. Bureau of Labor Statistics (BLS): The BLS provides a broad overview of the profession. As of May 2023, the median annual wage for Insurance Sales Agents was $60,350. The lowest 10 percent earned less than $31,510, while the top 10 percent earned more than $141,400. This data highlights the significant variance in income inherent in the role.

- Salary Aggregators: These sites often capture more real-time, commission-inclusive data from professionals in the field.

- Salary.com reports that the median salary for a Life Insurance Agent in the United States is approximately $79,890 as of May 2024, with a typical range falling between $72,135 and $89,207.

- Payscale emphasizes the compensation structure, showing an average base salary of around $51,000, with commissions ranging from $5,000 to over $53,000 annually. This illustrates how commissions can often equal or exceed an agent's base pay.

- Glassdoor reports a total average pay of $79,158 per year for Life Insurance Agents, factoring in both base salary and additional pay like commissions and bonuses.

Key Takeaway: While a starting agent might align more with the lower end of these ranges, an experienced, successful agent can easily surpass the $100,000 mark. Your income is directly tied to your ability to build a client book and sell policies.

Key Factors That Influence Salary

Your specific salary is not left to chance. Several key factors will determine your earning trajectory.

Level of Education

While a four-year college degree is not a strict requirement to become a life insurance agent, it is increasingly preferred by top-tier firms. A bachelor's degree in business, finance, economics, or marketing provides a strong foundational knowledge of financial principles and sales strategies. The minimum requirement is typically a high school diploma, followed by completing state-mandated licensing courses and passing a state exam.

More impactful than a degree are professional certifications, which demonstrate a higher level of expertise and can lead to higher earnings. Key designations include:

- Chartered Life Underwriter (CLU): An advanced designation for experts in life insurance and estate planning.

- Certified Financial Planner (CFP): A comprehensive certification for financial planning professionals.

Years of Experience

Experience is arguably the single most important factor in a life insurance agent's income. This is because income is cumulative, built on both new sales and renewals from existing policies.

- Entry-Level (0-2 Years): The primary focus is on learning the products, passing licensing exams, and building an initial client base. Income is typically at its lowest during this period as you establish yourself. Many firms offer a training salary or stipend to support agents during this ramp-up phase.

- Mid-Career (3-10 Years): By this stage, agents have a solid book of business that generates consistent renewal commissions. Their prospecting and sales skills are more refined, leading to larger and more frequent sales. Income grows substantially.

- Senior/Experienced (10+ Years): Top agents have a vast network and a large client portfolio that provides significant renewal income. They often handle more complex, high-value cases (like business succession or estate planning) which yield larger commissions. Their earnings are at their peak potential.

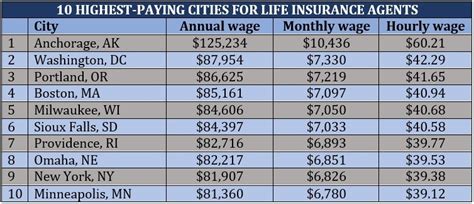

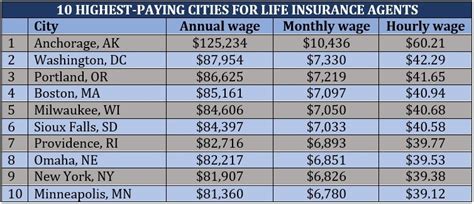

Geographic Location

Where you work matters. Salaries for life insurance agents are often higher in major metropolitan areas with a high cost of living and a greater concentration of high-net-worth individuals. Cities like New York, San Francisco, Boston, and Los Angeles may offer higher earning potential due to a larger client base with more complex insurance needs.

However, the need for life insurance is universal, and successful agents can thrive in any community by establishing themselves as a local, trusted expert.

Company Type

The structure of your employment will directly impact your compensation model. There are two primary paths:

- Captive Agents: These agents work exclusively for a single insurance company (e.g., New York Life, Northwestern Mutual, State Farm).

- Pros: Often receive a base salary or stipend, benefits, extensive training, and sometimes even a steady stream of leads from the company. This provides more stability, especially early in a career.

- Cons: Commission percentages are typically lower, and you can only sell products from that one company.

- Independent Agents (or Brokers): These agents are self-employed and work with multiple insurance carriers.

- Pros: They can offer clients a wider array of products to find the best fit, and they earn a much higher commission percentage on each sale. The earning ceiling is virtually unlimited.

- Cons: They are responsible for all their own business expenses, including marketing, office space, and generating leads. This path carries more risk and requires strong entrepreneurial skills.

Area of Specialization

Specializing in a niche market can dramatically increase your income. An agent who focuses on selling basic term life policies to young families will have a different income profile than one who specializes in high-net-worth estate planning.

Lucrative specializations include:

- High-Net-Worth Individuals: Crafting complex strategies for estate tax mitigation and wealth transfer.

- Business Insurance: Selling key person insurance, buy-sell agreement funding, and other policies to business owners.

- Annuities and Retirement Planning: Helping clients create guaranteed income streams for their retirement years.

Job Outlook

The future for life insurance agents is bright. According to the U.S. Bureau of Labor Statistics, employment of insurance sales agents is projected to grow 8 percent from 2022 to 2032, which is much faster than the average for all occupations.

While online tools and "insurtech" platforms offer consumers direct access to policies, the need for knowledgeable, empathetic agents remains strong. Many people still prefer a human advisor to help them navigate complex financial decisions, especially for significant life events. The agent's role is evolving from a simple salesperson to that of a holistic financial guide, ensuring its continued relevance and demand.

Conclusion

A career as a life insurance agent offers a direct correlation between effort and reward. While the median salary provides a solid benchmark, your ultimate earning potential is uncapped and rests firmly in your hands.

For the self-motivated individual who excels at building relationships and is driven to help others, this path is not just a job—it's an entrepreneurial venture with immense growth potential. By focusing on continuous learning, building a strong client base, and strategically choosing your company type and specialization, you can build a career that is both financially and personally fulfilling.