Understanding the New Salary Overtime Law: What It Means for Your Career and Paycheck

A landmark change in federal labor law is on the horizon, poised to affect the paychecks and work hours of millions of American professionals. The U.S. Department of Labor has announced a new overtime rule that significantly raises the salary threshold for overtime pay eligibility. This change could mean that many salaried employees, previously considered "exempt" from overtime, will now be entitled to time-and-a-half pay for any hours worked beyond 40 in a week. This article breaks down what this new law is, who it affects, and how it could impact your career and compensation.

What Is the New Salary Overtime Rule?

The new regulation is an update to the Fair Labor Standards Act (FLSA), the federal law that establishes minimum wage, recordkeeping, and overtime pay standards. At its core, the FLSA requires that most employees be paid overtime at a rate of 1.5 times their regular pay rate for all hours worked over 40 in a workweek.

However, certain employees are "exempt" from this requirement. To be considered exempt, an employee must generally meet three criteria:

1. Be paid on a salary basis.

2. Be paid at least the minimum salary threshold set by the Department of Labor (DOL).

3. Perform job duties that are primarily executive, administrative, or professional (often called the "EAP" or "white-collar" exemption).

The new rule directly and substantially increases the second criterion: the minimum salary threshold. Its purpose is to extend overtime protections to a larger segment of the lower-salaried workforce who, despite their job titles, often work long hours for no additional pay.

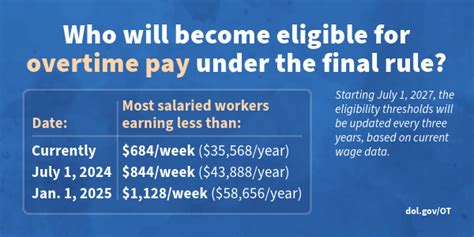

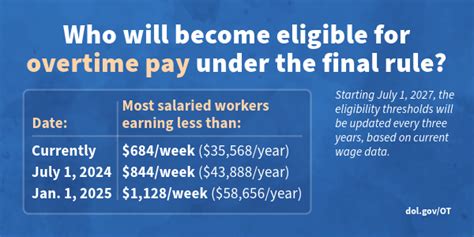

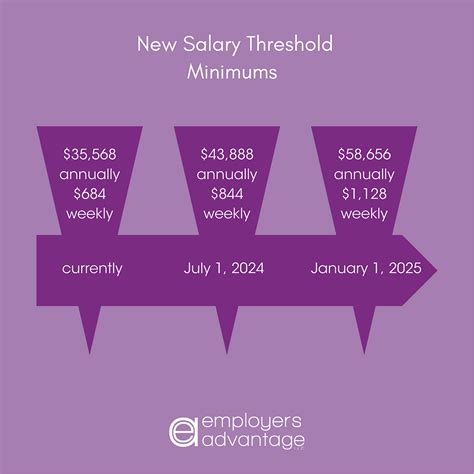

The New Salary Thresholds: Who is Eligible for Overtime?

This is the most critical component of the new rule. The DOL has implemented a phased increase to the standard salary threshold.

According to the U.S. Department of Labor's 2024 Final Rule, the new salary thresholds for exemption from overtime are:

- Effective July 1, 2024: The salary threshold will increase from the current $35,568 per year to $43,888 per year (or $844 per week).

- Effective January 1, 2025: The threshold will increase again to $58,656 per year (or $1,128 per week).

This means that, with few exceptions, any employee earning a salary below these amounts will become eligible for overtime pay on these dates.

Additionally, the rule raises the salary threshold for Highly Compensated Employees (HCEs), who are subject to a more lenient duties test. This threshold will rise to $132,964 on July 1, 2024, and to $151,164 on January 1, 2025.

Key Factors Determining Your Overtime Eligibility

While the new salary level is the main trigger, several factors interact to determine your final eligibility.

### The Duties Test: Beyond the Salary

Meeting the salary threshold is only one part of the equation. Your primary job responsibilities must still fit into the Executive, Administrative, or Professional exemption categories.

- Executive Exemption: Your primary duty is managing the enterprise, and you customarily direct the work of at least two other full-time employees.

- Administrative Exemption: Your primary duty involves office or non-manual work directly related to the management or general business operations of the employer or its customers.

- Professional Exemption: Your primary duty is work requiring advanced knowledge in a field of science or learning (a "Learned Professional") or work requiring invention, imagination, or originality in a recognized artistic or creative field (a "Creative Professional").

If your salary is above the new threshold but your job duties do not meet one of these tests, you are still entitled to overtime pay.

### Your Current Salary Level

This is the most straightforward factor. Compare your current annual salary to the new thresholds.

- Example: A retail store manager earns a salary of $52,000 per year and regularly works 50 hours a week. Under the old rule, they were exempt.

- On July 1, 2024, their salary is still above the $43,888 threshold, so they remain exempt.

- On January 1, 2025, their $52,000 salary will be *below* the new $58,656 threshold. At this point, their employer must either increase their salary to at least $58,656 or reclassify them as non-exempt and pay them overtime for all hours worked over 40.

### Geographic and State-Level Variations

It is crucial to remember that federal law sets a floor, not a ceiling. Many states have their own overtime laws that may provide greater protection for workers. For instance:

- California: As of 2024, the salary threshold for exemption is $66,560 per year for all employers, already higher than the new federal standard.

- New York: Has varying salary thresholds depending on location, with the highest in New York City ($68,250 per year or $1,300/week in 2024).

- Washington: The state threshold is calculated as a multiplier of the minimum wage and stands at $67,724.80 for 2024.

In cases where state and federal laws conflict, the law that is more generous to the employee always applies.

### Employer Response and Company Policy

Companies will be the ones to implement these changes, and they have several options. Understanding these can help you anticipate conversations with your manager or HR department. An employer can:

1. Raise Salaries: For employees whose salaries are close to the new threshold, employers may choose to increase their pay to keep them in the "exempt" category and avoid tracking hours.

2. Reclassify and Pay Overtime: Employers can reclassify newly eligible employees as non-exempt and pay them time-and-a-half for overtime hours. This may come with new requirements to meticulously track your work hours.

3. Manage Workloads: Companies might adjust workloads and schedules to ensure non-exempt employees do not exceed 40 hours per week, potentially hiring additional staff to cover the extra work.

What Is the Impact on the Job Market?

The job outlook for individual roles won't change because of this law, but the law's impact on the broader job market is significant. According to the Department of Labor, this rule is expected to extend overtime protections to approximately 4 million salaried workers.

The potential impacts include:

- Increased Take-Home Pay: The most direct effect for many will be higher earnings through overtime pay.

- Improved Work-Life Balance: Some employers may reduce workloads to keep employees at 40 hours per week, potentially leading to better work-life balance.

- Shift in Compensation Structures: The rule could slow salary growth for jobs hovering around the new threshold, as employers may budget for potential overtime costs instead of base pay increases.

- Re-evaluation of "Manager" Titles: Companies may be more judicious about awarding managerial titles if those roles do not meet the strict duties test for exemption.

Key Takeaways for Employees and Employers

The new overtime salary rule represents a major shift in the American workplace. For professionals looking to navigate this change, here are the key takeaways:

- Know the Numbers: Memorize the new thresholds: $43,888/year on July 1, 2024, and $58,656/year on January 1, 2025.

- Understand Your Role: Go beyond your job title. Review the official "duties tests" for the EAP exemptions to see if your role truly qualifies.

- Check Your State Laws: Your state may offer even greater protections. A quick search for "[Your State] overtime salary threshold" is a wise first step.

- Prepare for Conversation: Your status may change. Be prepared to discuss changes in compensation, duties, and hour-tracking with your employer.

This law is designed to ensure workers are compensated fairly for their time. By understanding its components, you can better advocate for yourself and make informed decisions about your career path.