In the world of professional development, understanding the fine print of a job offer is as critical as negotiating the salary itself. One of the most important yet frequently misunderstood terms you'll encounter is your employment classification. While you may have heard of "hourly" or "salaried" jobs, a third category—salaried non-exempt—offers a unique blend of stability and protection.

Understanding this classification is key to ensuring you are paid fairly for every hour you work. This article will demystify the salaried non-exempt definition, explain how it impacts your earnings, and clarify your rights as an employee under this important status.

What Is a Salaried Non-Exempt Employee?

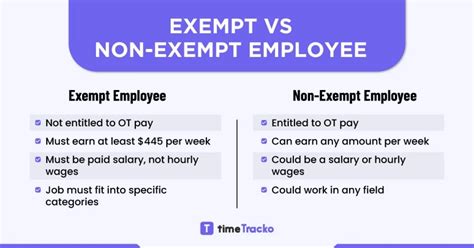

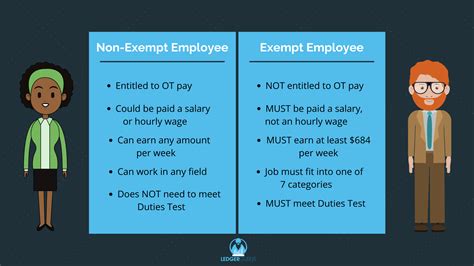

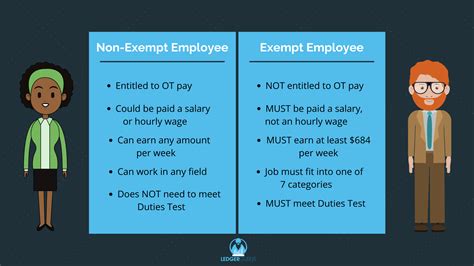

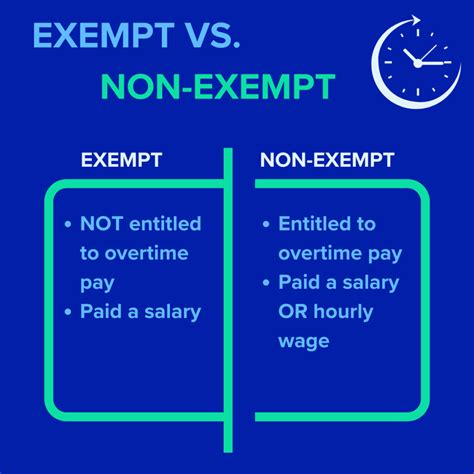

At its core, a Salaried Non-Exempt employee is a hybrid classification under the U.S. Fair Labor Standards Act (FLSA). Let's break down the two parts:

- Salaried: Like other salaried employees, you are paid a fixed, predetermined amount of money each pay period. This provides a stable, predictable base income, regardless of minor fluctuations in your weekly workload. Your salary is typically expressed as an annual figure (e.g., $55,000 per year).

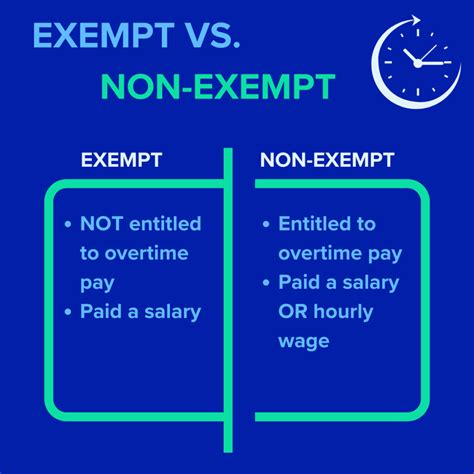

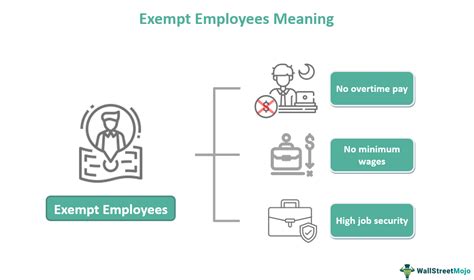

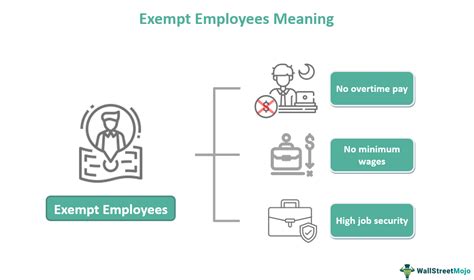

- Non-Exempt: This is the crucial part. "Non-Exempt" means you are *not exempt* from the overtime provisions of the FLSA. Therefore, you are legally entitled to overtime pay—typically calculated at 1.5 times your regular hourly rate—for all hours worked over 40 in a single workweek.

In short, a salaried non-exempt employee receives a consistent salary for a standard 40-hour workweek *and* gets paid extra for any overtime worked. This differs from a "salaried exempt" employee, who receives the same salary regardless of whether they work 35 or 55 hours in a week and is not eligible for overtime pay.

How Are Salaried Non-Exempt Employees Paid?

Since you receive a salary but are also eligible for overtime, calculating your pay can seem tricky. The process is straightforward:

1. Calculate Your Regular Hourly Rate: Your employer will convert your annual or weekly salary into an equivalent hourly rate. To do this, they divide your weekly salary by the number of hours that salary is intended to cover (usually 40).

- *Example:* If your annual salary is $52,000, your weekly salary is $1,000. Your regular hourly rate is $1,000 / 40 hours = $25 per hour.

2. Calculate Overtime Pay: Your overtime rate is 1.5 times your regular hourly rate.

- *Example:* $25/hour x 1.5 = $37.50 per hour of overtime.

3. Calculate Total Pay: In a week where you work overtime, your total pay is your base salary plus your total overtime earnings.

- *Example:* If you work 45 hours one week, your pay is:

- Your regular salary: $1,000 (for the first 40 hours)

- Overtime pay: 5 hours x $37.50/hour = $187.50

- Total weekly pay: $1,187.50

Key Factors That Influence the Salary of a Non-Exempt Position

While "salaried non-exempt" is a pay classification, not a job title, the base salary for roles that fall into this category is influenced by the same factors that affect any profession. Common salaried non-exempt roles include administrative assistants, paralegals, customer service team leads, IT help-desk staff, and some inside sales representatives.

###

Years of Experience

Experience is a primary driver of salary. An employee with a proven track record requires less training and can handle more complex tasks, making them more valuable to an employer.

- Entry-Level (0-2 years): An entry-level employee in a non-exempt role is learning the ropes. For example, an entry-level Administrative Assistant might earn a base salary between $38,000 and $45,000.

- Mid-Career (3-8 years): With several years of experience, you can expect a significant increase in your base salary. A mid-career Paralegal, a frequently non-exempt position, often earns between $55,000 and $70,000, according to Payscale.

- Senior/Experienced (8+ years): A senior-level professional, perhaps a Lead IT Support Technician, will command the highest salary, potentially ranging from $65,000 to over $80,000 before overtime.

###

Level of Education

Formal education and certifications can directly impact your starting salary and long-term earning potential. An associate's or bachelor's degree often sets a higher salary floor than a high school diploma alone.

- A candidate with a bachelor's degree in business administration will likely command a higher starting salary for an executive assistant role than a candidate without a degree.

- Specialized certifications, such as a Paralegal Certificate or a CompTIA A+ for IT support, can add thousands to your base salary, as they demonstrate proven expertise.

###

Geographic Location

Where you work matters immensely. Salaries are adjusted for the local cost of living and labor market demand. A higher cost of living in a major metropolitan area necessitates higher pay.

For example, let's look at the median salary for a Paralegal I, a role often classified as non-exempt. According to Salary.com data from late 2023:

- San Francisco, CA: ~$75,600

- New York, NY: ~$71,500

- Dallas, TX: ~$61,200

- Orlando, FL: ~$58,300

Furthermore, some states, like California and Alaska, have daily overtime laws that may apply in addition to federal weekly laws, offering even more protection for non-exempt workers.

###

Company Type and Industry

The size, prestige, and profitability of your employer play a significant role.

- Industry: A non-exempt IT support role at a high-growth technology or finance firm will almost always pay more than a similar role at a non-profit or in the public sector.

- Company Size: Large corporations (e.g., Fortune 500 companies) typically have more structured compensation plans and larger budgets, leading to higher base salaries and more robust benefits packages compared to small businesses.

###

Job Role and Responsibilities

Even within the non-exempt category, the complexity of the job dictates the pay. These roles are not "exempt" because their primary duties do not meet the specific "duties tests" for executive, administrative, or professional exemptions defined by the FLSA.

- Administrative/Clerical: Roles like office managers and executive assistants.

- Technical Support: IT help desk and network technicians.

- Creative/Marketing: Junior graphic designers or marketing coordinators.

- Legal Support: Paralegals and legal assistants.

An Executive Assistant supporting C-suite executives will have a higher base salary than a department-level administrative assistant due to the increased scope of responsibility and confidentiality required.

Why Do Companies Use This Classification?

Employers often use the salaried non-exempt classification for roles where they want to offer the stability and prestige of a salary but where work hours can fluctuate, often exceeding 40 hours per week.

- For the Employer: It provides predictable payroll costs for standard workweeks while ensuring legal compliance for overtime. It can also be an attractive classification for recruiting talent for roles that require frequent overtime.

- For the Employee: You get the best of both worlds—the security of a fixed salary and the legal right to be paid for every hour of overtime you work. This protects your work-life balance and ensures you are compensated for extra effort.

According to the U.S. Bureau of Labor Statistics (BLS), many of the occupations that fall under this category show stable or steady growth. For example, the outlook for Secretaries and Administrative Assistants is projected to be consistent over the next decade, ensuring continued demand for these vital non-exempt roles.

Conclusion: Know Your Worth and Your Rights

Understanding your employment classification is a fundamental part of managing your career. The salaried non-exempt status is a powerful and fair classification that provides both a stable income and protection against unpaid labor.

Here are the key takeaways:

- It’s a Hybrid: You receive a fixed salary for a standard week (usually 40 hours).

- Overtime is Mandatory: You are legally entitled to overtime pay (1.5x your regular rate) for hours worked beyond 40 in a week.

- Your Base Salary is Key: Factors like experience, location, and industry will determine your base salary, which is the foundation for your overtime earnings.

- Check Your Pay Stub: Always verify that you are being classified and paid correctly. If you are salaried non-exempt, your pay stub should reflect any overtime hours and pay.

By understanding this definition, you empower yourself to ensure you are compensated fairly, protect your time, and make informed decisions throughout your professional journey.