Considering a career as a Relationship Banker at a major financial institution like Bank of America? You're looking at a dynamic role that sits at the intersection of customer service, sales, and financial strategy. It's a career path with significant growth potential, but a key question for any prospective professional is: What can you realistically expect to earn?

This article provides a data-driven look into the salary of a Relationship Banker at Bank of America. We'll explore average compensation, the factors that can significantly increase your pay, and the long-term outlook for this profession.

What Does a Relationship Banker at Bank of America Do?

Before diving into the numbers, it's essential to understand the role. A Relationship Banker is the face of the bank for many customers. They are responsible for building and maintaining long-term relationships with clients to help them achieve their financial goals. This is not a teller position; it's a proactive, advisory role.

Key responsibilities typically include:

- Needs-Based Selling: Engaging with new and existing clients to understand their financial situation and life goals (e.g., buying a home, saving for college, retirement).

- Product & Service Expertise: Recommending and opening appropriate Bank of America products, including checking and savings accounts, credit cards, auto loans, and mortgages.

- Partnership & Referrals: Identifying clients who could benefit from specialized services and referring them to internal partners, such as a Financial Advisor at Merrill or a Small Business Banker.

- Problem Resolution: Handling complex customer service issues and ensuring a high level of client satisfaction.

- Achieving Goals: Meeting and exceeding specific sales and referral goals set by management.

In essence, a Relationship Banker acts as a financial primary care provider, guiding clients and connecting them with specialists when needed.

Average Bank of America Relationship Banker Salary

Compensation for a Relationship Banker is typically composed of two main parts: a base salary and variable pay (bonuses and/or commission). It's crucial to consider both when evaluating earning potential.

According to data from several authoritative sources, the average base salary for a Relationship Banker at Bank of America falls within the range of $51,000 to $59,000 per year.

- Salary.com reports a median base salary of approximately $58,500, with a typical range between $51,600 and $66,700 as of late 2023.

- Glassdoor data, based on thousands of employee-submitted reports, shows an estimated total pay (including bonuses and additional compensation) of around $65,000 per year, with a likely base salary range of $48,000 to $65,000.

It's the variable pay that can significantly elevate these figures. High-performing bankers who consistently meet or exceed their referral and sales goals can often add $5,000 to $15,000+ to their annual base salary, pushing their total compensation well into the $60,000 to $80,000+ range.

Key Factors That Influence Salary

Your salary isn't set in stone. Several key factors determine where you'll fall on the pay scale and how quickly you can advance.

### Years of Experience

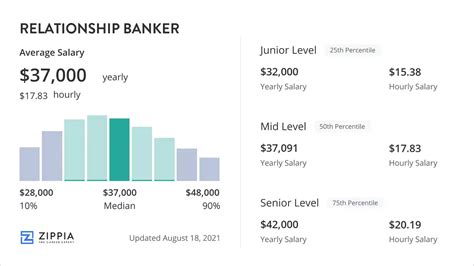

Experience is one of the most significant drivers of salary growth in this role. As you build a track record of success, your value to the company—and your compensation—increases.

- Entry-Level (0-2 years): New Relationship Bankers can expect to start at the lower end of the range, typically between $45,000 and $52,000 in base pay. The focus at this stage is on learning the products, processes, and building foundational client relationship skills.

- Mid-Career (2-5 years): With a few years of experience and a proven ability to meet goals, bankers can expect their base salary to rise to the $55,000 to $65,000 range. Their total compensation becomes more robust as they become more effective at earning bonuses.

- Senior/Experienced (5+ years): Senior Relationship Bankers or those who move into "Relationship Manager" roles for priority clients can command base salaries of $65,000+. At this level, total compensation can often approach or exceed six figures, especially for those in specialized or high-value markets.

### Geographic Location

Where you work matters. Bank of America, like all large corporations, adjusts its pay scales based on the cost of living and market competition in a specific geographic area.

- High Cost of Living (HCOL) Areas: In major metropolitan centers like New York City, San Francisco, or Boston, you can expect salaries to be 15-25% higher than the national average to account for the higher cost of living. A starting base salary could easily be in the high $50s or low $60s.

- Average Cost of Living Areas: In cities like Charlotte (Bank of America's headquarters), Phoenix, or Dallas, salaries will hew closely to the national averages cited above.

- Low Cost of Living (LCOL) Areas: In smaller cities and rural regions, salaries will be on the lower end of the spectrum, though the purchasing power of that income may be comparable to higher salaries in more expensive cities.

### Level of Education

While a specific degree is not always required, a Bachelor's degree in a relevant field like Finance, Business Administration, or Economics is highly preferred and can give you a competitive edge. It signals to employers that you have a foundational understanding of business principles.

More importantly, professional certifications can significantly impact your career trajectory. Bank of America often sponsors employees to obtain FINRA licenses like the Series 7 and Series 66. Holding these licenses not only increases your value but is essential for transitioning into higher-paying wealth management roles, such as a Financial Solutions Advisor at Merrill.

### Company Type

While this article focuses on Bank of America, it's helpful to understand how its compensation structure compares to other financial institutions.

- Large National Banks (e.g., Bank of America, JPMorgan Chase): These institutions typically offer structured career paths, robust training programs, and competitive benefits. The bonus potential can be very high, but it's often tied to rigorous performance metrics.

- Regional & Community Banks: These smaller banks may offer slightly lower base salaries but sometimes provide a better work-life balance and a strong sense of community.

- Credit Unions: As non-profits, credit unions may have lower salary and bonus potential but often offer excellent benefits and a highly member-focused culture.

For many, the brand recognition, training infrastructure, and upward mobility at a powerhouse like Bank of America make it an attractive place to build a career.

### Area of Specialization

Not all Relationship Bankers are the same. Within Bank of America, you can specialize in ways that directly impact your earnings. A standard banker in a retail financial center has a different earning potential than one in a specialized role. For example, moving into a position that serves Preferred or Affluent Clients (often part of the Merrill division) involves managing larger portfolios and more complex financial needs. These roles come with higher base salaries and significantly larger bonus potential, as they are tied to asset management and more sophisticated product sales.

Job Outlook

The future of banking is evolving, with a clear shift from transactional roles to advisory ones. While routine teller jobs may decline due to automation, the need for skilled relationship-builders is expected to grow.

The U.S. Bureau of Labor Statistics (BLS) projects that employment for Personal Financial Advisors—a role that shares many core responsibilities with modern Relationship Bankers—is projected to grow 13 percent from 2022 to 2032. This is much faster than the average for all occupations. This growth is driven by an aging population needing retirement planning and a general increase in demand for financial advice. This trend strongly suggests that the skills developed as a Relationship Banker are durable and will remain in high demand.

Conclusion

A career as a Relationship Banker at Bank of America offers a solid entry point into the financial services industry with a clear and rewarding path for advancement.

Here are the key takeaways:

- Solid Earning Potential: Expect a starting base salary in the $45k-$52k range, with a total average compensation of $60k-$70k when including typical bonuses.

- Variable Pay is Key: Your ability to meet sales and referral goals is the primary driver for pushing your total income higher.

- Growth is Multi-faceted: Your salary will grow significantly with experience, but specializing in affluent client services, obtaining FINRA licenses, and working in a major metropolitan market can accelerate your earning potential dramatically.

- Strong Career Outlook: The industry's shift toward relationship-based advising positions this role for strong future growth and job security.

For the motivated professional with strong interpersonal skills and a passion for finance, the Relationship Banker role at Bank of America is more than just a job—it's the first step on a lucrative and fulfilling career ladder.