For many aspiring entrepreneurs, the idea of running your own business while backed by one of the most recognized brands in America is a powerful dream. The role of a State Farm agent represents more than just a job; it's a pathway to becoming a pillar in your community, a trusted advisor, and the master of your own financial destiny. But before embarking on this challenging yet rewarding journey, the most pressing question is often the most practical: what is the actual salary of a State Farm agent?

The answer is complex and far more exciting than a simple number. Unlike a traditional salaried employee, a State Farm agent's income is a direct reflection of their effort, business acumen, and dedication to their clients. While initial earnings might be modest, the long-term potential can be substantial, with many established agents earning well into the six-figure range and beyond. A typical income spectrum can range from approximately $45,000 in the initial, formative years to well over $250,000 annually for a high-performing, veteran agent with a large book of business.

I once had a minor fender bender, and the first person I called, even before my family, was my own insurance agent. The calm, professional guidance I received in that moment of stress was invaluable and perfectly illustrated that this role is not just about policies and premiums; it's about providing peace of mind. This article will serve as your definitive guide to understanding every facet of a State Farm agent's compensation, the factors that drive it, and the steps you need to take to build a successful and lucrative career with this industry titan.

### Table of Contents

- [What Does a State Farm Agent Do?](#what-does-a-state-farm-agent-do)

- [Average State Farm Agent Salary: A Deep Dive](#average-state-farm-agent-salary-a-deep-dive)

- [Key Factors That Influence an Agent's Salary](#key-factors-that-influence-an-agents-salary)

- [Job Outlook and Career Growth for Insurance Agents](#job-outlook-and-career-growth-for-insurance-agents)

- [How to Become a State Farm Agent: A Step-by-Step Guide](#how-to-become-a-state-farm-agent-a-step-by-step-guide)

- [Conclusion: Is a Career as a State Farm Agent Right for You?](#conclusion-is-a-career-as-a-state-farm-agent-right-for-you)

What Does a State Farm Agent Do?

To understand the salary, you must first understand the role. A State Farm agent is fundamentally a small business owner who partners with the State Farm brand. They are not merely salespeople; they are multifaceted professionals responsible for a wide array of activities that encompass sales, customer service, marketing, and business management. Their primary mission is to help individuals and families in their community manage the risks of everyday life, recover from the unexpected, and realize their dreams.

The core of the job revolves around building and maintaining a "book of business"—a portfolio of clients and their insurance policies. This involves a continuous cycle of prospecting for new clients and servicing existing ones to ensure their coverage remains adequate as their lives change.

Key Responsibilities and Daily Tasks:

- Sales and Consultation: This is the engine of an agent's income. Agents actively market and sell State Farm's diverse portfolio of products, including auto, home, renters, life, and health insurance, as well as financial services products like mutual funds and retirement plans. This isn't a hard-sell environment; it's about consultative selling—understanding a client's needs and recommending appropriate solutions.

- Client Relationship Management: A successful agent is a master of relationships. This includes conducting regular policy reviews, answering client questions, providing advice on coverage options, and being a reliable point of contact, especially during the stressful process of filing a claim.

- Marketing and Prospecting: Agents are responsible for their own marketing efforts. This can include networking at local community events, running social media campaigns, sending out direct mail, asking for referrals, and building relationships with other local professionals like real estate agents and mortgage brokers.

- Agency Operations and Management: As business owners, agents hire, train, and manage their own team of staff (such as customer service representatives and licensed sales producers). They are also responsible for all aspects of running a small office, including payroll, accounting, compliance, and managing overhead costs like rent and utilities.

- Continuous Learning and Compliance: The insurance industry is heavily regulated and constantly evolving. Agents must complete ongoing education to maintain their licenses and stay up-to-date on new products, industry regulations, and market trends.

### A Day in the Life of a State Farm Agent

To make this more tangible, here’s a glimpse into a typical day:

- 8:30 AM: Arrive at the office, grab coffee, and huddle with the team. Review daily goals, delegate tasks, and discuss any urgent client issues.

- 9:00 AM: Power hour of prospecting. Follow up on new leads from the website, make outbound calls to potential clients, and respond to email inquiries.

- 10:00 AM: Meet with a young couple who just bought their first home. Conduct a thorough needs analysis, explaining the importance of homeowners insurance and discussing life insurance options to protect their mortgage.

- 11:30 AM: Handle administrative tasks. Review underwriting requests, process policy changes for existing clients, and sign off on payroll.

- 12:30 PM: Lunch meeting with a local mortgage lender to strengthen referral partnerships.

- 2:00 PM: Conduct a virtual policy review with a long-time client who is nearing retirement. Discuss adjusting their auto coverage and rolling over their 401(k).

- 3:00 PM: Field an urgent call from a client who was just in a car accident. Calmly walk them through the initial steps of the claims process and assure them of support.

- 4:00 PM: Coach a new team member on how to effectively quote and present an auto policy.

- 5:00 PM: Plan social media posts for the week and review the agency's monthly performance metrics before heading home.

This blend of sales, service, and management highlights why the role is so demanding but also why the income potential is directly tied to the agent's ability to successfully juggle these diverse responsibilities.

Average State Farm Agent Salary: A Deep Dive

Analyzing the salary of a State Farm agent requires a shift in mindset from a traditional employee's fixed salary to a business owner's revenue-based income. An agent's total compensation is a combination of commissions, bonuses, and financial support, minus the expenses of running the agency.

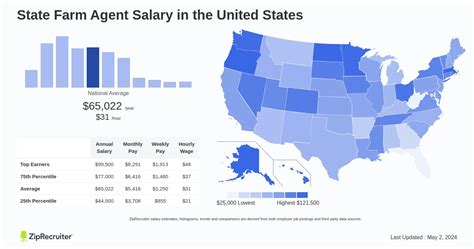

First, let's establish a baseline by looking at the broader industry. The U.S. Bureau of Labor Statistics (BLS) groups all "Insurance Sales Agents" together. According to the BLS's Occupational Outlook Handbook, the median pay for insurance sales agents was $57,860 per year or $27.82 per hour as of May 2022. The BLS notes a wide range, with the lowest 10 percent earning less than $31,120 and the top 10 percent earning more than $131,970. It's crucial to understand that the State Farm agent model, with its entrepreneurial structure and potential for renewal commissions, often allows for earnings that significantly exceed this median, especially for established agents.

More specific, self-reported data from salary aggregators provides a clearer picture for State Farm agents:

- Payscale.com reports the average income for a State Farm Insurance Agent is approximately $60,200 per year, with a typical range falling between $31,000 and $152,000. This data highlights the vast difference between new and veteran agents.

- Glassdoor.com estimates the total pay for a State Farm Agent to be around $118,500 per year in the United States, with an average base salary of about $69,000 and additional pay (bonuses, commission) of around $49,500. This "total pay" model is a more accurate representation of an agent's potential earnings.

- Salary.com provides a range for an "Insurance Agency Owner" that often falls between $86,000 and $135,000, acknowledging that top earners can far exceed this.

The key takeaway is that there is no single "salary." The income is dynamic and builds over time.

### Income Trajectory by Experience Level

The journey from a new agent to a seasoned veteran is marked by significant income growth. This growth is primarily fueled by the accumulation of renewal commissions.

| Experience Level | Typical Annual Income Range (Net) | Key Characteristics & Income Sources |

| :--- | :--- | :--- |

| Entry-Level (Years 1-3) | $40,000 - $75,000 | Heavy focus on new business sales. Income is primarily from first-year commissions and company bonuses. State Farm often provides financial support programs in the first few years to help offset startup costs. |

| Mid-Career (Years 4-9) | $75,000 - $150,000+ | Renewal commissions from the existing book of business provide a stable income base. New business commissions add significant growth. The agent has likely hired staff and refined their marketing and operational systems. |

| Senior/Veteran (Years 10+) | $150,000 - $300,000+ | A large, mature book of business generates substantial and predictable renewal income. The agent may focus more on high-value products (life insurance, financial services) and strategic management of the agency, with their team handling much of the day-to-day sales and service. |

*Note: These are net income estimates after typical business expenses. Actual income can vary significantly based on the factors discussed in the next section.*

### Deconstructing the Compensation Components

An agent's gross revenue is not a simple paycheck. It's a complex blend of several streams:

1. New Business Commissions: This is the commission earned on the first-year premium of a new policy sold. For example, if the commission rate for a new auto policy is 15% and the annual premium is $1,200, the agent earns $180. These commissions are the primary driver of income in the early years.

2. Renewal Commissions: This is the bedrock of long-term wealth for an agent. For every year a client keeps their policy, the agent earns a renewal commission. While the percentage is lower than the first-year commission (e.g., 7-10%), it's passive income generated from work done in previous years. Building a large book of business means creating a powerful, recurring revenue stream.

3. Financial Services Commissions: Selling products like mutual funds, variable annuities, and other investment vehicles carries its own commission structure and can be a highly lucrative part of the business for agents with the proper licensing (FINRA Series 6 & 63).

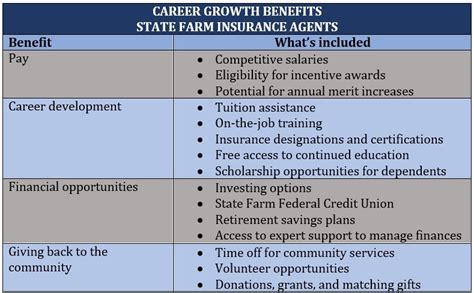

4. Performance Bonuses: State Farm offers numerous bonus programs tied to achieving specific goals. These can include awards for life insurance sales, profitability (writing good, low-risk business), client retention rates, and overall agency growth. These bonuses can add tens of thousands of dollars to an agent's annual income.

5. Initial Financial Support: Recognizing the challenge of starting a business from scratch, State Farm offers programs for new agents. The Term Independent Contractor Agent (TICA) program, for instance, provides significant financial support during the first five years, which supplements commissions and helps the new agent establish a solid foundation before transitioning to a fully commission-based structure.

It's this powerful combination of upfront earnings, long-term recurring revenue, and performance incentives that makes the State Farm agent career so financially compelling.

Key Factors That Influence an Agent's Salary

While the compensation structure provides the framework for an agent's income, a multitude of factors determine where an individual agent will fall on the earnings spectrum. Mastering these elements is the key to maximizing income and building a thriving agency. This is the most critical section for understanding the *why* behind the numbers.

### 1. Agency Acquisition vs. Starting from Scratch

This is arguably the single most significant factor in an agent's income trajectory.

- Starting a New Agency: When an agent starts a new agency (often through the TICA program), they begin with zero clients. Their initial years are a grind of intense prospecting and sales to build their book of business from the ground up. The income potential is theoretically unlimited, but the ramp-up period is longer, and early-year income is lower. State Farm's financial assistance is designed to bridge this gap.

- Purchasing an Existing Agency: Occasionally, an opportunity arises to purchase the book of business from a retiring agent. This is a massive head start. The new agent walks in the door with a pre-built stream of renewal commissions. While this requires a significant upfront investment (a loan to buy the book), the immediate income is much higher and more stable. The new agent's job is to retain those clients and grow the book further. An agent taking over a $2 million premium book of business will have a vastly different year-one income than an agent starting with $0 in premium.

### 2. Years of Experience and Client Retention

As detailed in the salary table, experience is paramount. But it's not just about time; it's about the *result* of that time: a large, loyal client base.

- The Power of Renewals: An agent with 15 years of experience might have thousands of policies on the books. If the average renewal commission per policy is $100, and they have 2,000 policies, that's $200,000 in baseline annual income *before* writing a single new policy. This stability allows veteran agents to focus on higher-margin activities.

- Client Retention Rate: An agent who provides exceptional service and builds strong relationships will have a high retention rate (e.g., 95%+). A low retention rate means the agent is constantly on a treadmill, trying to replace lost clients just to stay afloat. High retention is the key to compounding income growth.

### 3. Geographic Location

Where an agent sets up their office has a profound impact on their earnings potential. This works in several ways:

- Cost of Living and Premium Rates: In high-cost-of-living areas like California, New York, or major metropolitan centers (e.g., Chicago, Dallas), the assets being insured are more valuable. Higher home values and more expensive vehicles lead to higher insurance premiums. Since commissions are a percentage of the premium, higher premiums directly translate to higher commission dollars per policy.

- Population Density and Market Saturation: A dense urban or suburban area offers a larger pool of potential clients. However, it may also have more competition from other agents (both State Farm and competitors). A rural agent may have less competition but a smaller, more spread-out client base, requiring different marketing strategies.

- Economic Health: A local economy with a growing population and a thriving job market means more new families moving in, more new cars being bought, and more new businesses opening—all of which are opportunities for an agent.

Example Salary Variation by State (Based on aggregated data for insurance agents):

- High-Paying States: Massachusetts, New York, California, New Jersey, Colorado.

- Lower-Paying States: Mississippi, Arkansas, West Virginia, South Dakota.

An agent in a prime suburban territory outside a major city often hits the sweet spot of high-value assets and a large, accessible client base.

### 4. Product Mix and Area of Specialization

Not all policies are created equal in terms of commission. An agent's strategic focus can dramatically alter their income.

- Auto & Home Insurance: These are the "bread and butter" products. They are essential for building a large book of business and generating consistent renewal income. Most client relationships start here.

- Life Insurance: This is often the most lucrative line of business. Life insurance premiums are typically high, and so are the first-year commission rates (often 50% or more of the first year's premium). An agent who becomes proficient in selling life insurance can add a massive boost to their annual income.

- Financial Services: For agents who obtain their FINRA securities licenses (Series 6, 7, 63, 65, etc.), a whole new world of income opens up. They can offer mutual funds, retirement planning (IRAs, 401(k) rollovers), and other investment products. This not only deepens the client relationship but also adds a significant, high-margin revenue stream. A top-performing agent is almost always one who has integrated financial services into their practice.

- Commercial/Business Insurance: Some agents specialize in insuring small businesses in their community. Commercial policies often have large premiums and can be a stable source of income.

The most successful agents are those who master the art of cross-selling—turning a single auto policy client into a household with auto, home, life, and retirement accounts all under their management.

### 5. In-Demand Skills and Business Acumen

Since the agent is a business owner, their personal skills are a direct driver of revenue.

- Sales and Negotiation: The ability to connect with people, understand their needs, and persuasively present solutions is non-negotiable.

- Digital Marketing Savvy: In today's world, an agent who can effectively use social media marketing, SEO for their local agency website, email marketing, and online lead generation has a colossal advantage over one who relies solely on traditional methods.

- Leadership and Management: The ability to hire, train, and motivate a high-performing team is crucial for scaling the business. A well-run team frees up the agent to focus on high-value activities, rather than being bogged down in administrative tasks.

- Financial Management: Understanding a P&L statement, managing cash flow, and making smart decisions about business expenses (like marketing spend and staffing levels) are essential for profitability. An agent can generate high gross revenue but have low net income if they don't manage their expenses effectively.

### 6. Level of Education and Professional Designations

While a specific college degree is not always a strict requirement to become a State Farm agent, education and credentials play a vital role in an agent's credibility and capability, which in turn affects income.

- Baseline Education: A high school diploma is the minimum, but State Farm strongly prefers, and in many cases requires, candidates with a bachelor's degree, especially in fields like Business, Finance, Marketing, or Economics. This background provides a strong foundation in the principles needed to run a successful agency.

- State Licensing: This is the mandatory first step. Every agent must pass state-administered exams to become licensed to sell Property & Casualty (P&C) insurance and Life & Health (L&H) insurance. These are non-negotiable legal requirements.

- Advanced Professional Designations: This is where top agents separate themselves. Earning advanced designations signals a high level of expertise and commitment to the profession, building trust with clients, especially high-net-worth individuals. Key designations include:

- Chartered Life Underwriter (CLU®): The premier designation for life insurance professionals.

- Chartered Financial Consultant (ChFC®): A comprehensive designation covering a wide range of financial planning topics.

- Certified Financial Planner (CFP®): A highly respected mark for financial planning expertise.

- Chartered Property Casualty Underwriter (CPCU®): The top designation for P&C insurance professionals.

Agents with these designations can more confidently handle complex cases and attract more sophisticated clients, directly leading to higher income potential.

Job Outlook and Career Growth for Insurance Agents

For anyone considering this long-term career path, the future stability and growth potential of the profession are critical concerns. The outlook for insurance agents, including those with State Farm, is stable, but it's also undergoing significant transformation.

According to the U.S. Bureau of Labor Statistics (BLS), employment for insurance sales agents is projected to grow 6 percent from 2022 to 2032, which is faster than the average for all occupations. The BLS anticipates about 49,400 openings for insurance sales agents each year, on average, over the decade. Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

This steady growth is underpinned by a fundamental reality: insurance is a necessity in modern society. People will always need to insure their homes, cars, and lives. As the population grows, so does the pool of potential clients. However, the *way* insurance is sold and serviced is changing, and this presents both challenges and opportunities.

### Emerging Trends and Future Challenges

1. The Rise of Insurtech and Automation: Technology is the biggest disruptor. AI-powered quoting tools, automated underwriting, and digital claims processing are becoming more common. Some consumers, particularly for simple policies, are comfortable purchasing directly online from carriers (the "direct-to-consumer" model).

- The Challenge: Agents who cannot add value beyond what a website can offer will struggle.

- The Opportunity: Technology can also be an agent's best friend. A modern agent can leverage a sophisticated Customer Relationship Management (CRM) system to manage their client base, use data analytics to identify cross-selling opportunities, and use digital marketing tools to reach more prospects than ever before. The agent of the future is tech-enabled, not tech-replaced.

2. Changing Customer Expectations: Today's consumers expect seamless, omnichannel service. They want to be able to get a quote online, talk to an agent on the phone, sign documents electronically, and file a claim via a mobile app.

- The Challenge: Agents must adapt to this "phygital" (physical + digital) reality. An agent who only wants to do business face-to-face will miss out on a huge segment of the market.

- The Opportunity: The agent's role is shifting from a transactional salesperson to a holistic risk advisor. While a website can sell a policy, it cannot offer personalized, empathetic advice during a major life event like a house fire or the death of a spouse. The human touch remains the agent's ultimate competitive advantage. Agents who excel at building deep, trust-based relationships will thrive.

3. An Aging Agent Workforce: A significant portion of current insurance agents are baby boomers who are at or nearing retirement age.

- The Challenge: A potential knowledge gap as experienced agents leave the industry.

- The Opportunity: This "great retirement" creates a massive opportunity for the next generation of agents. There will be a significant number of agency ownership opportunities and books of business available for purchase in the coming decade, providing a potential fast-track to success for ambitious new agents.

### How to Stay Relevant and Advance in the Field

Career growth as a State Farm agent isn't about climbing a corporate ladder; it's about growing your business. Advancement means increasing your agency's size, profitability, and your personal net income.

- Embrace Lifelong Learning: The industry doesn't stand still, and neither should you. Continuously pursue education, whether it's earning advanced designations like the ChFC or CPCU, or taking courses on digital marketing and business management.

- Become a Tech-Forward Agency: Invest in and master the technology that State Farm provides and supplement it where necessary. Use social media not just to post, but to engage. Use a CRM to its full potential.

- Deepen Your Specialization: Become the go-to expert in your community for a specific niche, such as life insurance for new families, retirement planning for pre-retirees, or insurance for small business owners. Expertise breeds trust and referrals.

- Build a World-Class Team: Your growth is ultimately limited by your own time. The only way to scale is to build an excellent team that you can trust to handle day-to-day operations, allowing you to focus on strategy, high-value clients, and new business development.

The future for dedicated, adaptable, and client-focused State Farm agents remains incredibly bright. The role is evolving, but its core value proposition—expert advice and personal relationships—is more important than ever.

How to Become a State Farm Agent: A Step-by-Step Guide

Becoming a State Farm agent is a rigorous and competitive process. The company is selective, looking for individuals with a specific blend of entrepreneurial spirit, financial stability, and a genuine desire to help others. Here is a comprehensive guide to navigate the journey.

### Step 1: Self-Assessment and Initial Research

Before you even begin the application, conduct a serious self-assessment. This is not a typical 9-to-5 job; it's a commitment to building a business. Ask yourself:

- Am I a self-starter with a high degree of motivation and discipline?

- Do I have a strong aptitude for sales and an enjoyment of networking?

- Am I comfortable with an income that is based on my performance?

- Am I prepared for the long hours and hard work required in the first few years?

- Do I have a passion for helping people in my community?

Thoroughly explore the State Farm "Become an Agent" website. Understand the different agent pathways, such as the Term Independent