So, you searched for a "steve raleigh salary." It’s a specific query, and while you won't find "Steve Raleigh" listed as a standard job title in any official database, your search points to a powerful career aspiration. It suggests you're looking for a role that is professional, analytical, influential, and commands a significant salary—perhaps a position you overheard or a name you associated with a high-level strategic role, maybe even one based in a tech hub like Raleigh, North Carolina. You've landed in the right place. The career you're likely envisioning is that of a Strategic Analyst, a pivotal role that sits at the intersection of data, business, and forward-thinking decision-making.

This is the ultimate guide to that career. We will demystify the role, dive deep into its lucrative salary potential, and provide a clear roadmap for you to get there. We'll unpack the compensation packages that can reach well into the six figures, showing you not just *what* you can earn, but *how* to maximize it. I once worked with a young professional who was brilliant with numbers but stuck in a dead-end reporting job. By helping her reframe her skills and target Strategic Analyst roles, she didn't just double her salary; she found a career where her insights were actively shaping the future of her company. That is the power of this path, and this guide is designed to give you that same clarity and direction.

Let's break down everything you need to know about building a career as a Strategic Analyst.

### Table of Contents

- [What Does a Strategic Analyst Do?](#what-does-a-strategic-analyst-do)

- [Average Strategic Analyst Salary: A Deep Dive](#average-strategic-analyst-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion: Is a Strategic Analyst Career Right for You?](#conclusion)

What Does a Strategic Analyst Do? An In-Depth Overview

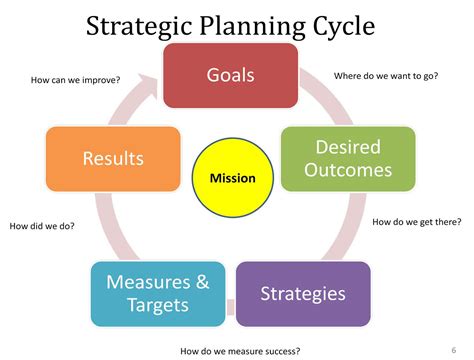

A Strategic Analyst is far more than a number cruncher; they are a business cartographer, a storyteller, and an agent of change. While a Data Analyst might tell you *what* happened and a Business Analyst might explain *how* it happened, the Strategic Analyst's core function is to determine *what's next* and *why* the company should go there. They operate at a higher altitude, using data-driven insights to guide long-term corporate strategy, competitive positioning, and major investment decisions.

Their primary responsibility is to answer the big, ambiguous questions that executives lose sleep over:

- Should we enter a new market?

- How do we respond to a disruptive new competitor?

- Which product line should we invest in for the next five years?

- Are there acquisition targets that align with our long-term vision?

To answer these questions, their work blends quantitative analysis with qualitative assessment. They are masters of synthesis, capable of taking disparate sources of information—market trends, financial reports, consumer behavior data, competitive intelligence, and internal performance metrics—and weaving them into a coherent, compelling narrative that recommends a specific course of action.

### Daily Tasks and Typical Projects

A Strategic Analyst's day is a dynamic mix of deep-focus analysis and high-level collaboration. No two days are exactly alike, but common activities include:

- Data Analysis & Modeling: Using tools like SQL, Python, R, and Excel to query databases, clean data, and build financial or market models to forecast potential outcomes.

- Market & Competitor Research: Scouring industry reports, news, and competitor filings (e.g., 10-K reports) to identify threats, opportunities, and strategic shifts in the landscape.

- Stakeholder Interviews: Talking to internal leaders from Sales, Marketing, Product, and Finance to understand business challenges and gather qualitative insights.

- Developing Frameworks: Creating and applying strategic frameworks (like SWOT analysis, Porter's Five Forces, or PESTLE analysis) to structure complex problems.

- Building Presentations & Reports: Crafting visually compelling and easy-to-understand slide decks and memos for an executive audience. The goal is not just to present data, but to sell a strategic vision.

- Cross-Functional Collaboration: Working on project teams to drive strategic initiatives, ensuring alignment across different departments.

### A Day in the Life of a Strategic Analyst

To make this more tangible, let's imagine a day for "Alex," a Senior Strategic Analyst at a mid-sized tech company.

- 9:00 AM - 9:30 AM: Alex starts the day reviewing overnight alerts for news on key competitors and the broader tech market. She flags an article about a rival's new pricing model and forwards it to the Head of Product with a few initial thoughts.

- 9:30 AM - 12:00 PM: Deep-work time. Alex is working on a major project: evaluating the feasibility of expanding into the Southeast Asian market. She spends this block in a Jupyter Notebook using Python and the Pandas library to analyze consumer spending data and internet penetration rates for several target countries.

- 12:00 PM - 1:00 PM: Lunch, often with a colleague from the finance team to informally discuss the Q3 financial results and their potential impact on her market expansion model.

- 1:00 PM - 2:00 PM: Alex joins a video call with the Director of Sales for the APAC region. She’s gathering on-the-ground intelligence about regional business practices and potential partnership opportunities, adding this qualitative color to her quantitative analysis.

- 2:00 PM - 4:00 PM: Alex switches gears to her presentation for next week's leadership offsite. She uses Tableau to create interactive charts visualizing the market opportunity. She then opens PowerPoint to build the narrative, focusing on telling a clear story: "Here's the size of the prize, here are the key risks, and here is our recommended phased-entry strategy."

- 4:00 PM - 5:00 PM: Alex meets with her manager, the Director of Corporate Strategy, to review her progress, bounce ideas around, and get feedback on her initial recommendations. They decide to add a more detailed competitive risk assessment, which Alex adds to her to-do list for tomorrow.

This example illustrates the role's blend of technical skill, business acumen, and communication prowess. It's a challenging, high-visibility position that directly influences a company's trajectory.

Average Strategic Analyst Salary: A Deep Dive

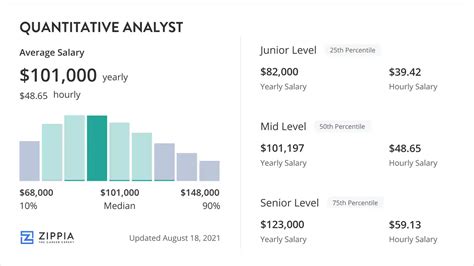

Now, let's get to the core of your query: the salary. The compensation for a Strategic Analyst is highly competitive, reflecting the significant value they bring to an organization. While the specific title can vary—"Corporate Strategy Analyst," "Strategy & Operations Analyst," "Strategic Planning Analyst"—the pay scales are consistently strong and show significant growth potential with experience.

It's important to note that salary data is dynamic. The figures presented here are based on an aggregation of recent data from authoritative sources to provide a comprehensive and reliable snapshot.

### National Averages and Typical Salary Ranges

Across the United States, the salary landscape for a Strategic Analyst is robust.

- Payscale reports the average base salary for a Strategic Analyst is approximately $83,000 per year, with a typical range falling between $59,000 and $119,000.

- Salary.com provides a more granular view, placing the median salary for a "Strategic Planning Analyst I" (entry-level) at $71,159, while a "Strategic Planning Analyst III" (senior-level) has a median salary of $123,023. Their data shows the top 10% of senior analysts can earn upwards of $147,000 in base salary alone.

- Glassdoor, which incorporates user-submitted data, reports an average total pay (including bonuses and other compensation) of $105,520 per year for a "Corporate Strategy Analyst."

Synthesizing this data, a reasonable expectation for a mid-level Strategic Analyst in the U.S. is a base salary in the $85,000 to $115,000 range, with total compensation often pushing well beyond that.

### Salary Brackets by Experience Level

One of the most attractive aspects of this career is its steep compensation growth curve. As you gain experience, your ability to tackle more complex problems and influence bigger decisions increases, and your salary reflects that directly.

| Experience Level | Typical Years of Experience | Typical Base Salary Range (USD) | Potential Total Compensation (with bonus, etc.) |

| :--- | :--- | :--- | :--- |

| Entry-Level Analyst | 0-2 years | $65,000 – $85,000 | $70,000 – $95,000 |

| Mid-Career Analyst | 2-5 years | $85,000 – $115,000 | $95,000 – $140,000 |

| Senior Analyst | 5-8 years | $110,000 – $145,000 | $125,000 – $180,000+ |

| Lead/Principal/Manager | 8+ years | $140,000 – $180,000+ | $160,000 – $250,000+ |

*Sources: Data synthesized from Payscale, Salary.com, and Glassdoor (as of late 2023/early 2024).*

As you can see, progressing from an entry-level position to a senior role can more than double your base salary. Moving into a management or principal-level position, where you lead a team or own a major strategic domain, pushes compensation even higher.

### Deconstructing the Compensation Package

The base salary is just one piece of the puzzle. For Strategic Analyst roles, especially in the corporate and tech sectors, total compensation is a much more important metric.

- Annual Bonuses: Performance-based annual bonuses are standard. These are typically calculated as a percentage of your base salary and can range from 10% for junior roles to 25% or more for senior positions. The bonus is often tied to both company performance (e.g., revenue or profit targets) and individual performance (e.g., successful project completion).

- Stock Options / Restricted Stock Units (RSUs): In publicly traded companies, particularly in the tech industry, equity is a significant component of compensation. RSUs are grants of company stock that vest over a period (usually 3-4 years). This can add tens of thousands of dollars to your annual compensation and aligns your financial interests with the company's long-term success. Startups will more commonly offer stock options.

- Profit Sharing: Some companies, particularly in finance or professional services, offer a profit-sharing plan, where a portion of the company's profits is distributed to employees.

- Signing Bonuses: For in-demand candidates, especially those with specialized skills or coming from a competitor, a one-time signing bonus is a common incentive to accept an offer.

- Comprehensive Benefits: Beyond direct compensation, a top-tier package includes excellent health, dental, and vision insurance; a strong 401(k) matching program (e.g., 50% or 100% match up to 6% of your salary); generous paid time off (PTO); and often, perks like wellness stipends, tuition reimbursement, and professional development budgets.

When evaluating a job offer, it's crucial to look at the entire package. A role with a slightly lower base salary but a massive RSU grant and a high-performance bonus target could be far more lucrative in the long run.

Key Factors That Influence Your Salary

Earning a top-tier Strategic Analyst salary isn't just about tenure; it's about a strategic combination of education, skills, location, and the type of company you work for. Understanding these levers is the key to maximizing your earning potential throughout your career. Let's dissect the five most critical factors.

### 1. Level of Education: The Foundation of Your Value

Your educational background serves as the entry ticket and can set your initial salary baseline. While a bachelor's degree is the minimum requirement, advanced degrees can significantly accelerate your career and compensation trajectory.

- Bachelor's Degree: A bachelor's degree in a quantitative field like Economics, Finance, Statistics, Computer Science, or Business Administration is the most common starting point. Graduates from top-tier universities with strong analytical programs can often command salaries at the higher end of the entry-level spectrum ($75,000 - $90,000). To be competitive, your coursework should include statistics, micro/macroeconomics, corporate finance, and ideally, some programming.

- Master of Business Administration (MBA): An MBA, particularly from a top-20 business school, is a powerful accelerator. Many companies, especially management consulting firms and Fortune 500 corporations, recruit heavily from these programs for their strategy roles. An MBA graduate often enters at a post-MBA associate or Senior Analyst level, bypassing the initial junior years.

- Salary Impact: An MBA can lead to starting salaries of $130,000 - $175,000+, not including substantial signing and performance bonuses. This is a primary pathway to the highest echelons of corporate strategy.

- Specialized Master's Degrees: Degrees like a Master's in Business Analytics, Data Science, or Finance are also highly valued. They provide deep technical expertise that is immediately applicable. While perhaps not carrying the same general management prestige as a top MBA, they make you an incredibly strong technical candidate for strategy roles within specific functions (e.g., Marketing Strategy, Financial Strategy).

- Certifications: While not a substitute for a degree, certifications can boost your resume and salary, especially if you lack a directly relevant academic background.

- Association for Strategic Planning (ASP): Offers the Strategic Planning Professional (SPP) and Strategic Management Professional (SMP) certifications. These demonstrate a formal understanding of strategic frameworks and processes.

- Data & Analytics Certifications: Certifications in specific tools like Tableau Desktop Certified Professional or technical skills like the Google Data Analytics Professional Certificate can validate your hands-on abilities and command a premium.

### 2. Years of Experience: The Proven Path to Higher Pay

Experience is the single most powerful determinant of your salary. Each career stage brings greater responsibility, autonomy, and, consequently, higher pay.

- Analyst (0-2 Years): At this stage, you are primarily an executor. You support senior team members, perform directed analysis, build slides, and learn the company's business model and data systems. Your focus is on technical proficiency and reliability.

- *Salary Range:* $65,000 – $85,000

- Mid-Level Analyst (2-5 Years): You begin to own smaller projects or significant workstreams within larger initiatives. You're expected to work more independently, proactively identify insights, and begin presenting findings to mid-level managers. Your analytical skills are sharp, and you're developing business acumen.

- *Salary Range:* $85,000 – $115,000

- Senior Analyst (5-8 Years): You are now a trusted advisor. You lead complex, cross-functional strategic projects from start to finish. You are the primary presenter to directors and VPs, and you are expected to not only analyze data but also formulate strong, defensible recommendations. You may begin to mentor junior analysts.

- *Salary Range:* $110,000 – $145,000

- Lead/Principal Analyst or Strategy Manager (8+ Years): At this level, you either become a deep subject matter expert (Principal) or move into people management (Manager). You are responsible for setting the strategic agenda for a business unit or a key corporate topic. You interface directly with C-suite executives and are responsible for the highest-impact decisions.

- *Salary Range:* $140,000 – $180,000+, with total compensation often exceeding $250,000 at top companies.

### 3. Geographic Location: Where You Work Matters

Your physical location plays a massive role in your salary due to variations in cost of living and the concentration of high-paying industries. The "Raleigh" in your original query is a perfect example of a high-growth, high-paying tech hub outside of the traditional top tier.

| City/Region | Typical Mid-Career Base Salary (USD) | Commentary |

| :--- | :--- | :--- |

| Tier 1: Major Tech & Finance Hubs (e.g., San Francisco Bay Area, New York City) | $120,000 – $150,000+ | Highest salaries in the country, but also the highest cost of living. Home to top tech HQs and Wall Street firms that pay a premium for strategy talent. |

| Tier 2: Major Metro Areas (e.g., Seattle, Boston, Los Angeles, Chicago) | $105,000 – $135,000 | Strong salaries driven by large corporate HQs and significant tech or finance presence. High, but slightly more manageable, cost of living. |

| Tier 3: High-Growth Tech Hubs (e.g., Austin, TX; Denver, CO; Raleigh, NC) | $95,000 – $125,000 | Excellent "sweet spot" cities. Offer strong tech and corporate salaries with a more favorable cost of living, leading to high disposable income. Raleigh's Research Triangle Park is a magnet for tech, biotech, and research companies seeking analytical talent. |

| Tier 4: Other Major U.S. Cities (e.g., Atlanta, Dallas, Minneapolis) | $85,000 – $110,000 | Solid salaries in line with the national average, often with a very affordable cost of living. Home to many Fortune 1000 companies. |

| Remote Work: | Varies Widely | The pandemic has shifted this landscape. Some companies pay based on a national standard, while others adjust pay based on the employee's location (geo-arbitrage). A role with a San Francisco-based company may pay a Bay Area salary even if you live in a lower-cost area, representing a massive financial advantage. |

### 4. Company Type & Size: The Ecosystem of Pay

The type and size of your employer create vastly different compensation philosophies and structures.

- Large Tech Companies (e.g., Google, Meta, Apple, Microsoft): These are often the highest-paying employers. They offer very competitive base salaries, but the real differentiator is the massive equity (RSU) grants, which can often equal or exceed the base salary over the vesting period. Total compensation packages of $200,000 - $300,000+ for mid-to-senior level analysts are common.

- Management Consulting (e.g., McKinsey, BCG, Bain): While the title might be "Consultant," the work is pure strategy. These firms are known for grueling hours but offer incredibly high starting salaries (post-MBA salaries often start near $175,000 base + bonus) and unparalleled career acceleration. Many corporate strategy leaders begin their careers in consulting.

- Fortune 500 Corporations (Non-Tech): Large, established companies in CPG, healthcare, automotive, or retail have mature corporate strategy teams. They offer strong, stable salaries, excellent benefits, and good work-life balance. Compensation is very competitive, perhaps with slightly less equity upside than big tech but often with robust bonus and profit-sharing plans.

- Startups (Venture-Backed): Compensation at startups is a high-risk, high-reward proposition. Base salaries may be lower than at established corporations to preserve cash. However, this is offset by potentially life-changing equity in the form of stock options. A Strategic Analyst at a successful startup that goes public or is acquired could see a massive financial windfall.

- Government & Non-Profit: These roles offer the lowest direct compensation. However, they provide immense non-monetary value, such as exceptional job security, excellent benefits (pensions), better work-life balance, and the opportunity to work on mission-driven strategic challenges.

### 5. Area of Specialization & In-Demand Skills

Within the Strategic Analyst umbrella, specialization can lead to higher pay. Furthermore, a specific toolkit of high-value skills will make you a more competitive and highly compensated candidate.

#### Top-Paying Specializations:

- Corporate Development / M&A Strategy: Analysts who focus on mergers and acquisitions are highly specialized. This requires deep financial modeling skills and an understanding of valuation. It's one of the most lucrative paths.

- Product Strategy: In tech companies, product strategists work closely with product managers to decide which features and products to build next. This requires a blend of market analysis, user research, and technical understanding.

- Pricing Strategy: A highly quantitative and impactful field. Pricing strategists use data to determine the optimal price for products and services to maximize revenue and profitability.

- Go-to-Market (GTM) Strategy: This specialization focuses on how to launch and grow products in the market, involving channel strategy, sales enablement, and marketing alignment.

#### High-Value Skills That Boost Your Salary:

1. Advanced SQL: The ability to go beyond simple `SELECT *` queries. You need to write complex, multi-table joins, use window functions, and optimize queries for performance on massive datasets.

2. Programming (Python or R): Proficiency in a scripting language is becoming non-negotiable. Python, with libraries like Pandas (data manipulation), NumPy (numerical analysis), and Matplotlib/Seaborn (visualization), is the industry standard for cleaning, analyzing, and modeling data that's too large or complex for Excel.

3. Data Visualization & Storytelling (Tableau/Power BI): It's not enough to find an insight; you must communicate it effectively. Mastery of a tool like Tableau or Power BI allows you to create interactive dashboards and compelling charts. The "storytelling" aspect is the ability to build a narrative around the data that leads your audience to a conclusion.

4. Financial Modeling: The ability to build a three-statement financial model, perform discounted cash flow (DCF) analysis, and model different scenarios in Excel. This is critical for M&A, investment analysis, and long-range planning.

5. Stakeholder Management & Executive Presence: A crucial soft skill. This is your ability to build relationships, gain trust, navigate corporate politics, and present with confidence and clarity to senior executives. This skill is what separates a good analyst from a future leader.

By strategically developing these skills and aligning your career choices with these influencing factors, you can actively steer your compensation from "average" to the top percentile of the profession.

Job Outlook and Career Growth: A Future-Proof Profession

A high salary is attractive, but long-term career viability is paramount. The great news is that the demand for Strategic Analysts is not only strong but also projected to grow significantly. In an increasingly complex and data-saturated world, the need for professionals who can translate raw information into actionable strategy has never been greater.

### A Robust Job Market with Strong Growth

The U.S. Bureau of Labor Statistics (BLS) provides a clear picture of this demand. While the BLS doesn't have a specific category for "Strategic Analyst," the most relevant proxy is "Management Analysts," a group that includes management consultants and corporate strategic planners.

According to the latest BLS Occupational Outlook Handbook (updated September 2023), employment for Management Analysts is projected to grow 10 percent from 2022 to 2032. This is much faster than the average for all occupations. The BLS projects about 99,400 openings for management analysts each year, on average, over the decade. This growth is driven by several key factors:

- The Data Deluge: Companies are collecting more data than ever before. They are desperate for professionals who can harness this data to find a competitive edge.

- Increased Complexity: Globalization, technological disruption, and shifting consumer behaviors make the business environment more volatile. Companies need strategists to help them navigate this uncertainty.

- Efficiency and Growth Mandates: In all economic climates, there is constant pressure to grow revenue and improve operational efficiency. Strategic Analysts are at the forefront of identifying opportunities for both.

This strong, sustained demand creates excellent job security and gives talented analysts significant leverage in negotiating compensation and choosing their career path.

### Emerging Trends and Future Challenges

The role of the Strategic Analyst is not static; it's evolving. To stay relevant and continue to advance, you must be aware of the trends shaping the profession.

1. The Rise of AI and Machine Learning:

- Trend: AI is not replacing the strategist; it's augmenting them. AI tools can automate routine data collection and analysis, run complex simulations, and identify patterns that a human might miss.

- Opportunity: The future-forward analyst will learn to leverage AI as a partner. This means understanding the basics of machine learning models, knowing how to frame strategic questions that AI can help answer, and critically evaluating AI-generated outputs. It frees up the analyst to focus on the uniquely human skills: nuanced interpretation, stakeholder empathy, ethical considerations, and persuasive storytelling.

- Challenge: Analysts who rely solely on basic data pulling and spreadsheet work will find their skills becoming commoditized. A refusal to adapt to new analytical technologies is a career-limiting move.

2. The Integration of ESG Strategy:

- Trend: Environmental, Social, and Governance (ESG) factors are no longer a niche concern; they are a core component of corporate strategy. Investors, customers, and employees now demand that companies operate sustainably and ethically.

- Opportunity: Strategic Analysts who develop expertise in ESG can carve out a valuable niche. This involves learning how to measure and model the financial impact of ESG initiatives, analyzing climate risk, and integrating sustainability goals into the long-range corporate plan.

- Challenge: This requires a new set of knowledge around regulations, reporting standards (like SASB or TCFD), and non-financial data sources.

3. The Need for Speed and Agility:

- Trend: The traditional five-year strategic plan is becoming less relevant in a fast-moving world. Companies are shifting towards more agile strategic planning cycles, with quarterly reviews and a "test and learn" approach.

- Opportunity: Analysts who can work quickly, iterate on their analysis, and provide "good enough" insights to inform rapid decisions will be highly valued. This is a shift from producing a single, perfect 100-page report to providing a continuous stream of strategic intelligence.

- Challenge: This requires a tolerance for ambiguity and the ability to balance analytical rigor with speed. Perfectionism can be an enemy of progress in an agile environment.

### How to Stay Relevant and Advance Your Career

Your career growth doesn't stop once you land the job. To move from a Senior Analyst to a Director of Strategy or a C-suite advisor, you need to be intentional about your development.

1. Become a Lifelong Learner: Dedicate time each week to learning. This could be taking an online course in Python, reading the latest HBR articles on strategy, or listening to podcasts about your industry.

2. Seek High-Visibility Projects: Don't just do the work assigned to you. Raise your hand for the messy, ambiguous, cross-functional projects that no one else wants. These are the projects that get you noticed by leadership and provide the richest learning experiences.

3. Build Your Internal Network: Your ability to get things done depends on your relationships. Have coffee with people in Product, Sales, Finance, and Engineering. Understand their challenges and goals. This network will be your source of information and support.

4. **