Introduction

Have you ever seen a headline announcing a multi-million dollar executive compensation package and wondered, "How is that even possible?" The role of a Chief Executive Officer, particularly at a globally recognized, disruptive tech giant like Uber, represents the absolute pinnacle of corporate achievement. The journey to this position is one of relentless ambition, strategic acumen, and profound responsibility. The compensation, often reaching staggering figures, reflects not just a salary for a job, but a reward for creating immense shareholder value, navigating complex global markets, and leading tens of thousands of employees. For an aspiring leader, understanding the mechanics of a role like the Uber CEO and its compensation is not just an exercise in curiosity—it's a blueprint for ultimate career success.

While the headline-grabbing numbers are astronomical, the path to the C-suite is built on a series of incremental steps and strategic decisions. For a role of this magnitude, the total compensation is a complex mix of base salary, performance bonuses, and, most significantly, equity awards. For context, the median total compensation for a CEO at a large-cap U.S. company often falls in the $15 million to $25 million range annually, according to industry reports. However, this figure is the summit of a very steep mountain, and the journey begins with roles earning a fraction of that.

I once had the privilege of sitting in a boardroom as a junior analyst, observing a CEO navigate a make-or-break negotiation. The immense pressure, the strategic foresight required to see ten moves ahead, and the calm authority they exuded left a permanent mark on me. It was then I realized that the top job isn't about the perks; it's about being the final backstop for every major decision, a responsibility that commands a premium. This guide is designed to demystify that premium, break down the path to earning it, and provide you with a comprehensive roadmap, whether your ambition is to lead a small startup or a global behemoth like Uber.

### Table of Contents

- [What Does a CEO Do?](#what-does-a-ceo-do)

- [Average CEO Salary: A Deep Dive](#average-ceo-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a CEO Do?

The title "Chief Executive Officer" often conjures images of high-stakes meetings, private jets, and front-page interviews. While these can be elements of the job, the reality is far more demanding and multifaceted. The CEO is the ultimate steward of an organization, the individual singularly responsible for its success or failure. Their core mandate is to maximize long-term shareholder value, a goal that requires them to wear many hats and master several domains simultaneously.

At its heart, the CEO's role can be broken down into five primary functions:

1. Setting the Vision and Strategy: The CEO is the chief architect of the company's future. They are responsible for defining the organization's mission, vision, and long-term strategic goals. This involves analyzing market trends, identifying competitive threats and opportunities, and deciding which markets to enter, which products to build, and where to allocate the company's precious resources. For a company like Uber, this means deciding whether to invest more in ride-sharing, food delivery (Uber Eats), freight, or new ventures like autonomous driving.

2. Capital Allocation: This is arguably the most critical and least understood function of a CEO. They are the chief capital allocator, deciding how to deploy the company's financial resources to generate the best possible return. This includes approving annual budgets, green-lighting major capital expenditures (like building a new data center), deciding on acquisitions and divestitures, and determining the company's capital structure (e.g., issuing debt vs. equity, paying dividends, or buying back shares).

3. Building and Leading the Senior Team: A CEO cannot run a company alone. A huge part of their job is to recruit, develop, and retain a world-class executive team (the C-suite: CFO, COO, CTO, etc.). They must ensure the right leaders are in the right seats, hold them accountable for performance, and foster a collaborative and high-performing leadership culture.

4. Shaping Corporate Culture: The CEO is the ultimate role model for the company's culture. Their actions, communications, and values set the tone for the entire organization. They are responsible for creating an environment that attracts and retains top talent, promotes innovation, and aligns with the company's strategic objectives. This involves everything from how the company handles failure to how it prioritizes ethics and diversity.

5. Managing Stakeholders: The CEO is the public face of the company to a wide range of stakeholders. This includes investors and the board of directors, to whom they report, as well as employees, customers, partners, government regulators, and the media. They must be able to communicate the company's strategy and performance clearly and persuasively to each of these audiences.

### A Day in the Life of a Major Tech CEO

To make this more concrete, here’s a fictionalized but realistic "Day in the Life" for a CEO of a large, public tech company:

- 6:00 AM - 7:30 AM: Wake up, workout, review overnight market news from Asia and Europe, and scan a dashboard of the company's key performance indicators (KPIs). Read a pre-brief for the day's meetings.

- 7:30 AM - 9:00 AM: Breakfast meeting with a key institutional investor to discuss quarterly performance and long-term strategy.

- 9:00 AM - 11:00 AM: Weekly Executive Leadership Team meeting. The agenda includes a review of financials with the CFO, a product roadmap update from the CPO, and a discussion about a competitive threat with the head of strategy.

- 11:00 AM - 12:00 PM: One-on-one meeting with the Chief Technology Officer to discuss the budget for a major AI research initiative.

- 12:00 PM - 1:00 PM: "Lunch and Learn" with a group of high-potential junior employees. This is a critical culture-building and talent-spotting activity.

- 1:00 PM - 2:30 PM: Prep session with the legal and PR teams for an upcoming congressional hearing on industry regulations.

- 2:30 PM - 4:00 PM: Board committee call (e.g., Compensation Committee) to review executive pay structures and succession planning.

- 4:00 PM - 5:00 PM: Call with the CEO of a potential acquisition target to continue exploratory discussions.

- 5:00 PM - 6:30 PM: All-hands company meeting (virtual) to announce a new strategic initiative and answer employee questions in a live Q&A.

- 6:30 PM - 8:00 PM: Dinner with a key government official or industry partner.

- 8:00 PM - 10:00 PM: Reading time. Reviewing detailed strategy documents, legal briefs, or M&A proposals. Responding to the most critical emails flagged by their executive assistant.

This schedule illustrates the intense demands on a CEO's time, requiring them to switch contexts rapidly and operate at a high level across finance, strategy, technology, and people management. The compensation reflects the complexity and relentless pressure of this 24/7 role.

Average CEO Salary: A Deep Dive

Analyzing CEO compensation requires looking far beyond a simple base salary. For top executives at public companies, the vast majority of their pay is "at-risk," meaning it's tied directly to the performance of the company, primarily through stock awards. This structure is designed to align the CEO's financial interests with those of the shareholders.

### The Uber CEO: A Case Study in Executive Compensation

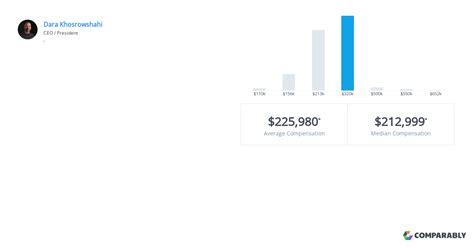

To understand the pinnacle of CEO pay, let's look at a real-world example. According to Uber's 2023 proxy statement filed with the U.S. Securities and Exchange Commission (SEC), CEO Dara Khosrowshahi's total compensation for the 2022 fiscal year was $24,297,746.

This figure is not a simple paycheck. It was composed of:

- Base Salary: $1,000,000

- Stock Awards: $19,970,085

- Non-Equity Incentive Plan Compensation (Bonus): $3,040,000

- All Other Compensation: $287,661 (primarily for personal security costs)

This breakdown is crucial. It shows that over 82% of his total compensation was in the form of stock awards, the value of which is directly tied to Uber's stock price performance over several years. His cash bonus was also dependent on hitting specific company performance targets. This structure is typical for CEOs of large, publicly traded companies. His $1 million base salary, while substantial, represents only about 4% of his total potential earnings.

### General CEO Salary Benchmarks

While the Uber example represents the top end of the scale, it's helpful to look at broader market data for a more complete picture. The compensation for a CEO varies dramatically based on company size, industry, and location.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for Top Executives was $191,340 as of May 2023. However, this category is very broad and includes executives at companies of all sizes, from small non-profits to mid-sized regional businesses. The BLS data also notes that the lowest 10 percent earned less than $78,570, and the highest 10 percent earned more than $239,200—though this top figure from the BLS often represents a floor for true C-suite compensation at larger enterprises, as it primarily captures salaries and short-term bonuses, not the massive impact of stock awards.

For a more precise look at CEO-specific roles, we turn to salary aggregators that incorporate data from larger companies.

- Salary.com: As of late 2023, the median total compensation for a Chief Executive Officer in the United States is $847,975. The salary range is vast, typically falling between $641,365 and $1,105,920. This includes base salary, bonuses, and other short-term incentives but may not fully capture the multi-year value of large stock grants.

- Payscale: Reports the average CEO salary at around $181,190 in base pay, but emphasizes that bonuses can exceed $100,000 and profit-sharing can add another significant layer. This data likely skews toward smaller and mid-sized companies.

- Glassdoor: Shows a total pay average around $212,000, with a likely range between $143,000 and $327,000, again reflecting a mix of company sizes.

### Salary by Experience Level

The journey to a seven or eight-figure compensation package is a long one. Here is a typical, albeit simplified, progression in a corporate environment leading to a CEO role, with salary bands that reflect the increasing scope of responsibility.

| Career Stage | Typical Title(s) | Years of Experience | Typical Total Compensation Range (Salary + Bonus) | Notes |

| :--- | :--- | :--- | :--- | :--- |

| Early Career | Analyst, Associate, Specialist | 0-5 | $70,000 - $150,000 | Focus on individual contribution and mastering a specific domain (finance, marketing, engineering). |

| Mid-Career | Manager, Senior Manager | 5-10 | $120,000 - $250,000 | First-time people management. Responsible for a team's output and small budgets. |

| Senior Leader | Director, Senior Director | 10-15 | $200,000 - $400,000 | Manages multiple teams or a large department. Responsible for a significant business function. |

| Executive | Vice President (VP), General Manager (GM) | 15-20 | $350,000 - $800,000+ | Responsible for a major business unit or entire corporate function. May include significant stock options. |

| C-Suite (Non-CEO) | CFO, COO, CTO | 20+ | $700,000 - $5,000,000+ | Leads a core pillar of the entire enterprise. Compensation is heavily tied to company performance via stock. |

| Chief Executive Officer | CEO (Small/Mid-Size Co.) | 20+ | $500,000 - $3,000,000+ | Ultimate responsibility for a smaller organization. Compensation is significant but smaller scale than large public firms. |

| Chief Executive Officer | CEO (Large Public Co.) | 25+ | $10,000,000 - $50,000,000+ | Ultimate responsibility for a major public corporation. Compensation is dominated by performance-based equity. |

*(Note: These are estimates based on aggregated market data and can vary widely. Source: Author's analysis combining data from BLS, Salary.com, Payscale, and industry compensation reports.)*

### Deconstructing the Compensation Package

A CEO's pay is a carefully constructed package with several key components:

- Base Salary: This is the fixed, guaranteed portion of cash compensation. It is often benchmarked against peer companies and is designed to provide a stable income. As seen with the Uber example, it's often a small fraction of the total package.

- Short-Term Incentives (STI) / Annual Bonus: This is a cash payment awarded for achieving specific, pre-defined goals over a one-year period. These goals are typically tied to financial metrics (e.g., revenue growth, profitability), operational targets (e.g., market share), and individual performance.

- Long-Term Incentives (LTI): This is the largest component for public company CEOs and is designed to align their interests with long-term shareholders. LTIs are typically awarded in the form of:

- Restricted Stock Units (RSUs): A promise to grant a specific number of company shares on a future date (vesting date).

- Stock Options: The right to buy a certain number of company shares at a pre-set price (the strike price) in the future. They only have value if the stock price rises above the strike price.

- Performance Share Units (PSUs): These are RSUs where the number of shares that ultimately vest depends on the company achieving specific long-term performance goals (e.g., total shareholder return relative to a peer index over three years).

- Benefits and Perquisites ("Perks"): This includes standard benefits like health insurance and a 401(k) plan, as well as executive-specific perks such as a car allowance, personal use of the company jet, financial planning services, and personal security, as seen in the Uber filing.

Understanding this structure is key. A CEO's wealth is not built from their salary; it's built from the equity they accumulate and the value they create for the company over many years.

Key Factors That Influence Salary

The vast range in CEO compensation isn't random. It's driven by a confluence of factors that the board of directors' compensation committee analyzes meticulously. For anyone aspiring to the C-suite, understanding these levers is critical, as they dictate not only potential earnings but also the very nature of the career path.

### 1. Level of Education

While there is no single educational requirement to become a CEO, a strong academic background is a near-universal trait among top executives.

- The Power of the MBA: The Master of Business Administration (MBA) remains the gold standard for aspiring C-suite executives. An MBA from a top-tier business school (e.g., Harvard, Stanford, Wharton, INSEAD) provides three key advantages:

1. Hard Skills: A rigorous curriculum in finance, strategy, marketing, and operations.

2. Soft Skills: Training in leadership, negotiation, and communication.

3. The Network: Unparalleled access to a global network of alumni who are leaders in every industry.

While it's possible to become a CEO without an MBA (many successful tech founders, for instance, are college dropouts), for those climbing the traditional corporate ladder, an MBA is often seen as a crucial accelerator. A study by Kittleman & Associates found that approximately 40% of Fortune 500 CEOs hold an MBA. The degree itself doesn't guarantee a higher salary, but it opens doors to the high-paying feeder roles (in investment banking, management consulting, or corporate strategy) that are common launching pads for future CEOs.

- Undergraduate and Other Advanced Degrees: A bachelor's degree is a foundational requirement. Degrees in business, finance, economics, or engineering are most common. For CEOs in specialized industries, other advanced degrees can be highly valuable. A CEO of a pharmaceutical company might have a Ph.D. in chemistry or an M.D. A CEO of a major law firm will be a lawyer with a J.D. In the tech world, a Master's or Ph.D. in Computer Science or Electrical Engineering can be the pathway to a CTO role, which is a common stepping stone to the CEO position.

### 2. Years of Experience

Experience is arguably the single most important factor. No one becomes the CEO of a major corporation without decades of proven success. The salary trajectory is a direct reflection of a growing track record of leadership and P&L (Profit & Loss) responsibility.

- 0-10 Years (The Foundation): In the first decade of a career, the focus is on becoming an expert in a specific function. A future CEO might spend this time as an investment banker analyzing deals, a software engineer building products, or a brand manager launching marketing campaigns. The goal is to build a reputation for excellence and deliver quantifiable results.

- 10-20 Years (The Ascent to Leadership): This is the period of transitioning from an individual contributor to a leader. It starts with managing a small team, then a department, and eventually an entire business unit with P&L responsibility. At this stage, compensation begins to include a more significant variable component (bonus) and potentially the first grants of equity. An executive who successfully turns around a struggling division or launches a highly profitable new product line will see their compensation and career prospects soar.

- 20+ Years (The C-Suite): To even be considered for a CEO role at a large company, a candidate typically needs to have served successfully in another C-suite position (COO, CFO, President of a major division) or have been a successful CEO at a smaller company. By this point, their reputation and track record are their primary currency. Their compensation is heavily weighted toward long-term incentives because their role is to deliver long-term value. A board is not just paying for future work; they are paying for 25+ years of accumulated wisdom, judgment, and a network of contacts.

### 3. Geographic Location

"Where you work" significantly impacts compensation, especially for roles below the top C-suite level of globally benchmarked public companies. For most executive roles, salary levels are adjusted for the local cost of labor and cost of living.

Major metropolitan hubs with a high concentration of corporate headquarters and a high cost of living command the highest salaries.

Comparison of Average Senior Executive Salaries by Major U.S. City

| City | Salary Index (vs. National Average) | Why it's a High-Paying Location |

| :--- | :--- | :--- |

| San Francisco, CA | +25% to +40% | Epicenter of the global tech industry, venture capital, and high-growth startups. Immense competition for talent. |

| New York, NY | +20% to +35% | Global center for finance, banking, media, and law. Home to a huge number of Fortune 500 headquarters. |

| Boston, MA | +10% to +20% | Major hub for biotechnology, pharmaceuticals, and asset management. |

| Seattle, WA | +10% to +18% | Headquarters for tech giants like Amazon and Microsoft, creating a high-wage ecosystem. |

| Chicago, IL | +5% to +10% | A major, diversified economic hub for the Midwest, strong in finance, consulting, and consumer goods. |

| Dallas, TX | +2% to +8% | A rapidly growing corporate center with a lower cost of living, attracting many company relocations. |

*(Source: Author's analysis based on data from Salary.com and other compensation surveys.)*

Conversely, executive roles in smaller cities or regions with a lower cost of living will typically pay less in absolute dollars, though the purchasing power may be comparable. However, for the CEO of a global public company like Uber, their compensation is benchmarked against a peer group of other global public companies, making local geography less of a factor than the company's overall size and industry.

### 4. Company Type & Size

This is one of the most significant differentiators in executive pay. The scale of responsibility is vastly different, and the compensation structure reflects that.

- Startups (Early-Stage): A startup CEO's compensation is heavily weighted towards equity. The cash salary may be relatively low (e.g., $150,000 - $250,000) to preserve cash. The real prize is their large equity stake (e.g., 5-15% of the company), which could be worth nothing if the company fails or hundreds of millions of dollars if the company becomes a unicorn and has a successful exit (IPO or acquisition).

- Small to Mid-Sized Businesses (SMBs) / Private Companies: For companies with, say, $10 million to $500 million in annual revenue, the CEO's total compensation might range from $300,000 to $2 million. It will typically consist of a solid base salary, a performance bonus tied to profitability, and potentially some form of equity or profit-sharing.

- Large Public Corporations (e.g., Fortune 500): This is the domain of eight-figure compensation packages. As discussed, these roles at companies with billions in revenue and tens of thousands of employees involve a global scale of complexity. The compensation is designed by specialized consultants and approved by the board to be competitive and to heavily incentivize stock performance. According to Equilar, the median pay for a CEO at an S&P 500 company in 2022 was $14.5 million.

- Non-Profit Organizations: A CEO of a large non-profit (e.g., a major university, hospital system, or foundation) can still earn a very high salary, often in the $500,000 to $1.5 million+ range. However, the compensation is driven by the organization's size, budget, and mission, not by shareholder value and stock price. The pay is typically lower than in the for-profit sector, and the motivation is often more mission-driven.

### 5. Area of Specialization (Path to CEO)

The functional background of a CEO can influence their leadership style and, in some cases, their path and pay. The most common "feeder roles" for the top job are:

- Chief Operating Officer (COO) / President: This is the most traditional path. The COO has already been responsible for the company's day-to-day operations and P&L, making them a natural successor. They have proven their ability to run the business.

- Chief Financial Officer (CFO): A background in finance is increasingly valued. CFOs are masters of capital allocation, M&A, and investor relations. In a market focused on profitability and financial discipline, a CFO can be an attractive candidate.

- Chief Technology Officer (CTO) / Head of Product: In the tech industry, it's common for the leader who drove the company's core technology or product innovation to ascend to the CEO role (e.g., Satya Nadella at Microsoft). They have a deep understanding of the product and the market.

- Head of Sales / Chief Revenue Officer (CRO): In companies where growth is paramount and the sales motion is complex, a leader with a background in driving revenue and managing large commercial teams can be a strong contender.

The specialization doesn't dictate salary directly, but a candidate with a background that perfectly matches the company's current strategic needs (e.g., a CFO for a financial turnaround, a CTO for a technology transformation) is in a stronger negotiating position.

### 6. In-Demand Skills

Beyond a proven track record, boards look for a specific set of high-value skills in a modern CEO. Cultivating these skills throughout a career is what separates top earners from the rest.

- Strategic & Digital Transformation: The ability to lead a company through fundamental changes in technology,