Introduction

"How much am I worth?" It's a question that echoes in the mind of every professional, from the recent graduate starting their first job to the seasoned executive negotiating a new role. The answer, frustratingly, is never a single number. Instead, it's a "salary range"—a concept that can feel opaque, arbitrary, and designed to confuse. But what if you could not only master this concept for your own benefit but also build a rewarding, high-impact career by defining these ranges for others? This guide is designed to do both. We will demystify the salary range, providing you with the knowledge to maximize your own earning potential. Simultaneously, we will pull back the curtain on the expert career path that sits at the very heart of this process: the Compensation Analyst.

A salary range is not a random guess; it's the carefully calculated financial spectrum a company is willing to pay for a specific role. For a Compensation Analyst, the median salary is approximately $74,530 per year, with top earners commanding well over $120,000 annually, according to the U.S. Bureau of Labor Statistics. This is a field built on data, strategy, and a deep understanding of market dynamics, offering a stable and intellectually stimulating career. I once mentored a young professional who, armed with a basic understanding of market data and salary ranges for her field, successfully negotiated a starting offer that was 25% higher than the initial proposal. She didn't just ask for more money; she presented a case built on the very principles a Compensation Analyst uses every day, demonstrating her value within the company's own logical framework. This power—the power of data-driven negotiation and strategic positioning—is accessible to everyone, and it's the core expertise of a compensation professional.

This ultimate guide will serve two purposes. First, it will be your definitive resource for understanding what a salary range is and the key factors that determine your place within it. Second, it will provide a comprehensive roadmap for those intrigued by the career path of a Compensation Analyst, the professional who architects these critical financial structures.

### Table of Contents

- [What Does a Compensation Analyst Do?](#what-does-a-compensation-analyst-do)

- [Average Compensation Analyst Salary: A Deep Dive](#average-compensation-analyst-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for Compensation Analysts](#job-outlook-and-career-growth)

- [How to Get Started in a Compensation Career](#how-to-get-started-in-this-career)

- [Conclusion: Taking Control of Your Financial Future](#conclusion)

What Does a Compensation Analyst Do?

Before we can fully appreciate the intricacies of a salary range, we must understand the role of the professional who creates it. A Compensation Analyst is a specialized Human Resources (HR) professional who acts as an organization's internal economist and strategist for all things pay-related. They are the architects of a company's compensation philosophy, ensuring that pay is not only competitive and fair but also legally compliant and aligned with the company's strategic goals.

Their work is a meticulous blend of art and science. The "science" involves rigorous data analysis, statistical modeling, and market research. The "art" lies in interpreting that data within the unique context of their company's culture, financial health, and talent strategy. They don't just pull numbers from a spreadsheet; they build the logic that helps a company attract, retain, and motivate its most valuable asset: its people.

Core Responsibilities and Typical Projects:

- Market Pricing and Benchmarking: Compensation Analysts spend a significant amount of time conducting research to see what other companies are paying for similar jobs. They purchase and analyze large salary survey datasets from firms like Radford, Willis Towers Watson, and Mercer to benchmark their organization's roles against the external market.

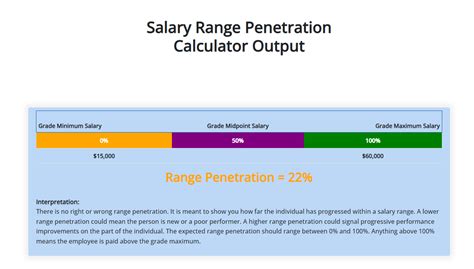

- Developing Salary Structures: This is their cornerstone task. They create the formal salary ranges (with a minimum, midpoint, and maximum) for every job or job family in the organization. This structure provides a consistent framework for all pay decisions.

- Job Evaluation: When a new role is created or an existing one changes significantly, the analyst evaluates it to determine its internal value and place it in the appropriate salary grade. This involves analyzing the job's duties, skills required, and level of responsibility.

- Pay Equity Analysis: A critical and growing responsibility is conducting audits to ensure fair pay across gender, race, and other demographics. They identify and recommend adjustments to close any inequitable pay gaps.

- Incentive Plan Design: They help design and administer short-term incentive plans (like annual bonuses) and long-term incentive plans (like stock options or restricted stock units), ensuring these programs drive the right behaviors and business outcomes.

- Compliance: They ensure all pay practices comply with federal, state, and local laws, such as the Fair Labor Standards Act (FLSA) and emerging pay transparency laws.

### A Day in the Life of a Mid-Career Compensation Analyst

To make this role more tangible, let's walk through a typical day.

- 9:00 AM - 9:45 AM: Market Data Review. The day begins with data. The analyst reviews a new salary survey report that just came in, looking for major market shifts for key roles, particularly in the competitive tech department. They flag several software engineer roles where the market midpoint has jumped 7% in the last quarter.

- 9:45 AM - 11:00 AM: Job Evaluation for a New Role. A hiring manager for the Marketing team has submitted a job description for a new "Digital Community Manager" position. The analyst reads the description, schedules a brief meeting with the manager to clarify the scope and impact of the role, and then uses the company's job evaluation tool to score its complexity and responsibility. They benchmark it against similar roles in their salary surveys to recommend a specific salary grade.

- 11:00 AM - 12:00 PM: Consultation with an HR Business Partner. An HR Business Partner (HRBP) reaches out with a pay issue. A high-performing employee has received a competitive offer from another company. The analyst quickly pulls the employee's compensation history and compares their current salary to the market range for their role and experience level. They provide the HRBP with data-backed options for a counteroffer that is both compelling for the employee and equitable within the internal team.

- 12:00 PM - 1:00 PM: Lunch.

- 1:00 PM - 3:00 PM: Quarterly Pay Equity Audit. This afternoon is dedicated to a major project. The analyst exports employee census data into an Excel or statistical analysis tool. They run regression analyses to check for any statistically significant pay disparities between demographic groups after controlling for legitimate factors like job level, tenure, and performance. They begin drafting a summary of their initial findings for the Director of HR.

- 3:00 PM - 4:30 PM: Preparing for the Annual Salary Review Cycle. The end-of-year compensation cycle is approaching. The analyst works on modeling different scenarios for the company's merit increase budget (e.g., a 3.5% vs. 4.0% budget) and its impact on the company's finances. They begin building the spreadsheets and training materials that will be used by managers to make individual pay raise decisions.

- 4:30 PM - 5:00 PM: Final Communications. The analyst drafts an email to the Marketing manager with their salary grade recommendation for the new role, including the corresponding salary range and market data to support it. They answer a few outstanding emails and plan their priorities for the next day.

This "day in the life" illustrates a role that is both analytical and collaborative, requiring a professional who is as comfortable in a spreadsheet as they are advising a senior leader on a critical talent decision.

Average Compensation Analyst Salary: A Deep Dive

For a role centered on determining the value of other jobs, it's only natural to be curious about its own earning potential. The career of a Compensation Analyst is financially sound and offers a clear path for income growth based on experience, skill development, and specialization.

The compensation for these professionals is typically broken down into base salary and variable pay (like an annual bonus), with a comprehensive benefits package.

### National Averages and Salary Ranges

To understand the typical earnings, we must look at data from multiple authoritative sources. It's important to remember that these numbers are statistical aggregates and will vary based on the factors we'll explore in the next section.

- U.S. Bureau of Labor Statistics (BLS): The BLS provides some of the most reliable data. In their Occupational Outlook Handbook, the category "Compensation, Benefits, and Job Analysis Specialists" reported a median annual wage of $74,530 in May 2023. The salary spectrum is wide: the lowest 10 percent earned less than $48,370, while the top 10 percent earned more than $132,960. This highlights a significant runway for growth.

- Salary.com: This site, which aggregates employer-reported data, often shows slightly higher figures due to its focus on corporate roles. As of late 2023, Salary.com reported the median salary for a mid-level Compensation Analyst (Analyst II) in the United States to be around $80,500, with a typical range falling between $72,500 and $89,300.

- Payscale: This aggregator, which uses a mix of employee- and employer-reported data, shows a similar average base salary of approximately $72,000. Their data is particularly useful for showing the progression of pay by experience.

Combining these sources, a reasonable expectation for a mid-career Compensation Analyst in the U.S. is a base salary in the $70,000 to $90,000 range, with significant upward potential.

### Salary Progression by Experience Level

A key determinant of salary is, unsurprisingly, experience. The role evolves from tactical execution to strategic leadership, and compensation reflects this evolution.

| Experience Level | Typical Title(s) | Typical Salary Range (Base) | Key Responsibilities & Focus |

| :--- | :--- | :--- | :--- |

| Entry-Level | Compensation Analyst I, HR Analyst (Comp Focus) | $58,000 - $75,000 | Assisting with salary surveys, data entry into HRIS, running basic reports, responding to first-level queries, learning the fundamentals of job evaluation. |

| Mid-Career | Compensation Analyst II, Senior Compensation Analyst | $75,000 - $98,000 | Managing the annual compensation review cycle for a business unit, conducting independent job evaluations, benchmarking jobs, performing basic pay equity analysis, mentoring junior analysts. |

| Senior/Lead | Senior/Lead Compensation Analyst, Principal Analyst | $95,000 - $125,000+ | Leading complex projects (e.g., redesigning salary structures), handling executive compensation analysis, managing international compensation, performing advanced statistical analysis, acting as a key advisor to HR and business leaders. |

| Management | Compensation Manager, Director of Compensation | $120,000 - $180,000+ | Managing a team of analysts, setting the overall compensation strategy, presenting to the executive leadership team, managing vendor relationships, responsible for the entire company's compensation budget. |

| Executive | VP of Total Rewards, Chief People Officer | $200,000 - $500,000+ | Responsible for all aspects of "total rewards" (compensation, benefits, equity, recognition), setting the global rewards philosophy, sitting on the executive leadership team, presenting to the Board of Directors' Compensation Committee. |

*(Salary data is an aggregation and estimate based on BLS, Salary.com, and Payscale data for major U.S. markets, updated for 2023/2024 trends. Actual salaries will vary significantly.)*

### Beyond the Base Salary: Understanding Total Compensation

A Compensation Analyst's pay isn't just their salary. As experts in "total rewards," they are often beneficiaries of the very programs they help design.

- Annual Bonus / Short-Term Incentive (STI): This is the most common form of variable pay. It's typically a percentage of base salary, paid out annually based on a combination of company performance and individual performance.

- Analyst Level: 5-10% of base salary target.

- Manager Level: 10-20% of base salary target.

- Director/VP Level: 20-50%+ of base salary target.

- Long-Term Incentives (LTI): While less common at the junior analyst level, LTI becomes a significant part of compensation at the senior and management levels, especially in publicly traded companies or high-growth startups.

- Restricted Stock Units (RSUs): A grant of company shares that vest over a period of time (e.g., 4 years).

- Stock Options: The right to buy company stock at a predetermined price in the future.

- Profit Sharing: A plan that distributes a portion of the company's profits to employees, often as a contribution to their retirement accounts.

- Comprehensive Benefits: This is a crucial, though non-cash, part of the package. Analysts are keenly aware of the value of these benefits, which include:

- Health Insurance: Medical, dental, and vision plans. The value of an employer's premium contribution can be worth thousands of dollars annually.

- Retirement Savings: 401(k) or 403(b) plans, often with a generous company match (e.g., 100% match up to 5% of salary). This is essentially free money and a core component of total rewards.

- Paid Time Off (PTO): Vacation, sick days, and company holidays.

- Other Perks: Can include wellness stipends, tuition reimbursement, commuter benefits, and parental leave, all of which have a tangible financial value.

When considering a role as a Compensation Analyst, or any role for that matter, it's essential to evaluate the entire "total compensation" package, not just the number on the paycheck. A lower base salary with an exceptional bonus structure, generous 401(k) match, and low-cost health insurance can often be more valuable than a higher base salary with minimal benefits.

Key Factors That Influence Salary

The "average" salary is a useful starting point, but your individual earning potential—whether as a Compensation Analyst or in any other profession—is determined by a confluence of specific, measurable factors. Understanding these levers is the key to navigating your career and maximizing your income. As an expert in this field, a Compensation Analyst masters these factors to build rational pay systems for an entire company. You can apply the same logic to your own career trajectory.

###

Level of Education and Professional Certifications

Your formal education and specialized credentials provide the foundation for your career and directly impact your starting salary and long-term growth potential.

- Bachelor's Degree: For a Compensation Analyst, a bachelor's degree is the standard entry requirement. The most relevant fields are Human Resources, Business Administration, Finance, Economics, or Mathematics/Statistics. A degree in a quantitative field can be particularly advantageous, signaling strong analytical capabilities. Holding a bachelor's degree is the baseline that gets you into the typical salary band for an entry-level professional.

- Master's Degree: An advanced degree, such as a Master of Business Administration (MBA), Master of Science in Human Resources (MSHR), or a master's in a quantitative field, can provide a significant advantage. It often allows a candidate to enter at a higher level (e.g., Analyst II instead of Analyst I) and can accelerate the path to management. According to Georgetown University's Center on Education and the Workforce, individuals with a graduate degree earn, on average, $17,000 more per year than those with only a bachelor's degree. This premium applies directly to fields like compensation.

- Professional Certifications: In the world of compensation, certifications are the gold standard. They signal a deep, specialized expertise that goes beyond a general HR degree and are often a prerequisite for senior and management-level roles. Earning a prestigious certification can lead to a salary increase of 5-15%, according to various industry surveys. The key certifying body is WorldatWork:

- Certified Compensation Professional (CCP®): This is the most recognized and respected certification in the field. It requires passing a series of exams on topics ranging from base pay administration and market pricing to variable pay and accounting for compensation. Holding a CCP is a clear indicator of a serious, knowledgeable professional.

- Global Remuneration Professional (GRP®): For those working in multinational corporations, the GRP demonstrates expertise in managing compensation across different countries, currencies, and legal systems.

- Advanced Certified Compensation Professional (ACCP™): A higher-level certification for strategic leaders in the field.

- Other Relevant Certifications: Credentials from the Society for Human Resource Management (SHRM), like the SHRM-CP or SHRM-SCP, are also valuable, though they are broader HR certifications rather than compensation-specific.

###

Years of Experience

Experience is arguably the single most powerful determinant of salary. As you progress in your career, you move from executing tasks to managing projects, then to setting strategy. Your compensation grows in lockstep with this increasing level of impact and responsibility.

- 0-2 Years (Analyst I): At this stage, you are learning the ropes. Your value is in your ability to learn quickly, execute tasks accurately, and support senior team members. Your salary is at the lower end of the professional spectrum, reflecting your trainee status.

- *Salary Impact:* You are likely to be paid between the minimum and the 25th percentile of the established salary range for the role.

- 3-7 Years (Analyst II / Senior Analyst): You are now a fully functional, independent contributor. You can manage the core compensation processes (like benchmarking and cycle support) with minimal supervision. You may start to specialize and mentor junior analysts. Your proven ability to deliver results makes you significantly more valuable.

- *Salary Impact:* You can expect to earn near the midpoint of the salary range, which represents the market rate for a fully proficient professional. In the U.S. market for a Compensation Analyst, this is typically in the $75,000 to $98,000 range.

- 8-15 Years (Lead/Principal Analyst or Manager): You are now a subject matter expert and/or a people leader. You are not just running processes; you are improving them. You lead complex, cross-functional projects, advise senior leadership, and may be responsible for the work of a team. Your impact is strategic and broad.

- *Salary Impact:* Your salary will be in the upper half of the range, likely between the midpoint and the 75th percentile or higher. For managers, base salaries often cross the $120,000 threshold, supplemented by a larger bonus.

- 15+ Years (Director / VP): At this executive level, you are setting the entire compensation philosophy for the organization. Your decisions impact thousands of employees and have a direct line to the company's financial performance and strategic goals.

- *Salary Impact:* You are paid at the top of the scale, with a compensation package heavily weighted towards variable pay and long-term incentives. Base salaries can reach $180,000 to $250,000+, with total compensation being significantly higher.

###

Geographic Location

Where you work has a massive impact on your paycheck. Companies adjust their salary ranges based on two primary geographic factors: the local cost of labor and the local cost of living. It's a common misconception that salaries are based purely on living costs; they are primarily driven by the supply and demand for talent in a specific labor market.

- High-Paying Metropolitan Areas: Major tech and finance hubs have highly competitive labor markets, which drives salaries up significantly. These are often Tier 1 cities.

- Examples: San Jose, CA; San Francisco, CA; New York, NY; Boston, MA; Seattle, WA.

- *Salary Impact:* A Compensation Analyst in San Francisco might earn 20-40% more than the national average. A $80,000 national median salary could easily become $110,000 or more in a high-cost-of-labor market.

- Average-Paying Areas: Most major cities and suburban areas fall into this category. Their salary structures are typically aligned with the national average.

- Examples: Chicago, IL; Atlanta, GA; Dallas, TX; Phoenix, AZ.

- *Salary Impact:* Salaries will hover close to the national median figures reported by the BLS and other aggregators.

- Lower-Paying Areas: Rural areas and smaller cities with less competitive labor markets will have lower salary ranges.

- Examples: Smaller cities in the Midwest and South.

- *Salary Impact:* Pay could be 10-20% below the national average.

- The Rise of Remote Work: The post-pandemic shift to remote work has complicated geographic pay. Companies have adopted different strategies:

- Geo-Neutral Pay: A small number of companies pay the same salary for a role regardless of where the employee lives (e.g., paying a San Francisco rate to someone in Idaho). This is rare.

- Geo-Differentiated Pay: Most companies adjust pay based on the employee's location, using geographic differentials or location-based salary ranges. An employee moving from a high-cost to a low-cost area may see their salary adjusted downwards. This is a complex area that Compensation Analysts are actively working to solve.

###

Company Type & Size

The type of organization you work for, its size, and its industry all create distinct compensation environments.

- Large, Publicly Traded Corporations (e.g., Fortune 500): These companies have the most structured and well-funded compensation departments.

- *Salary Impact:* They typically pay at or above the market average. They offer high base salaries, structured annual bonuses, excellent benefits, and, for senior levels, significant long-term incentives (RSUs). The career path is clear, but the environment can be more bureaucratic.

- High-Growth Tech Startups: The compensation philosophy here is different.

- *Salary Impact:* Base salaries may be at or slightly below the market average. The major draw is equity (stock options), which has the potential for a massive payout if the company is successful (but is also high-risk). The work is fast-paced, and roles are often broader.

- Private Companies & Small-to-Medium Businesses (SMBs): These can vary widely.

- *Salary Impact:* Pay can be less predictable. Some are highly profitable and pay very well, while others are more constrained. They are less likely to