New York City stands as the undisputed financial capital of the world, making it a premier destination for ambitious accounting professionals. If you're considering launching or advancing your accounting career in the Big Apple, you're likely drawn by the immense opportunity and earning potential. But what can you realistically expect to make?

An accounting career in NYC is not just about crunching numbers; it's about being at the heart of the global economy. The demand for skilled accountants is robust, and the compensation reflects that. While salaries can vary widely, the average accountant salary in NYC often surpasses six figures, with top earners commanding significantly more. This guide breaks down everything you need to know about your potential earnings and the factors that drive them.

What Does an Accountant in NYC Do?

At its core, an accountant's role is to prepare, analyze, and maintain financial records. However, in a dynamic market like New York City, the responsibilities are far more diverse and strategic. Depending on their role, an accountant in NYC is a crucial business advisor who handles tasks such as:

- Financial Reporting: Preparing financial statements like balance sheets and income statements for stakeholders, investors, and regulatory bodies.

- Tax Compliance and Strategy: Ensuring individuals and corporations comply with complex city, state, and federal tax laws, while also advising on tax-saving strategies.

- Auditing: Reviewing a company’s financial records to ensure accuracy and compliance with laws and regulations. This is a massive field in NYC, home to the "Big Four" accounting firms.

- Budgeting and Forecasting: Helping organizations plan for the future by analyzing financial data to project revenue and expenses.

- Advisory Services: Providing strategic advice on mergers and acquisitions, risk management, and forensic accounting.

In a city that hosts Wall Street, thousands of startups, and global corporate headquarters, an accountant's work is essential to operational integrity and growth.

Average Accountant Salary in NYC

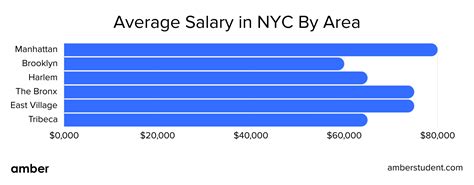

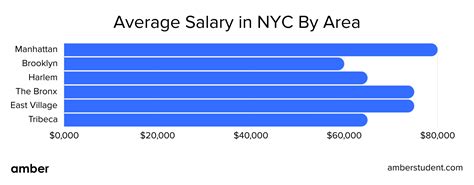

New York City is one of the highest-paying metropolitan areas for accountants in the United States. The salary range is broad, reflecting the diversity of roles from entry-level staff positions to senior financial controllers.

According to the U.S. Bureau of Labor Statistics (BLS), the annual mean wage for "Accountants and Auditors" in the New York-Newark-Jersey City metropolitan area was $111,960 as of May 2023.

This average provides a strong benchmark, but it's helpful to look at the full salary spectrum to understand potential earnings at different career stages:

- 10th Percentile (Entry-Level): $62,130

- 25th Percentile: $77,320

- 50th Percentile (Median): $99,570

- 75th Percentile (Experienced): $132,180

- 90th Percentile (Top Earners/Specialists): $179,830

Data from leading salary aggregators reinforces this, often including additional compensation like bonuses and profit-sharing:

- Salary.com reports the average Staff Accountant salary in New York, NY, is around $78,211, but a Senior Accountant averages $108,187 (as of late 2023).

- Glassdoor places the average total pay (including base salary and additional compensation) for an Accountant in New York, NY, at approximately $98,000 per year.

- Payscale notes a similar range, with the average accountant salary in NYC falling around $82,500, with significant increases based on experience and certifications.

The key takeaway is that while an entry-level position may start in the $65,000 to $80,000 range, a mid-career accountant can comfortably earn over $100,000, and senior specialists can reach $180,000 or more.

Key Factors That Influence Salary

Your exact salary will depend on a combination of factors. Understanding these variables is key to maximizing your earning potential throughout your career.

###

Level of Education

A bachelor's degree in accounting or a related field is the standard entry requirement. However, advanced credentials are a powerful lever for higher pay.

- Master's Degree: A Master of Accountancy (MAcc) or an MBA with a concentration in accounting can lead to higher starting salaries and faster promotions.

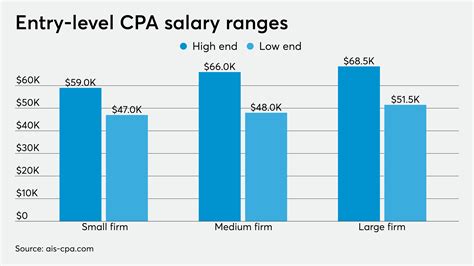

- CPA License: The Certified Public Accountant (CPA) license is the gold standard in the accounting industry. Earning your CPA demonstrates a high level of expertise and is often a prerequisite for senior and management-level roles. Professionals with a CPA license consistently earn a 5% to 15% salary premium over their non-certified peers.

###

Years of Experience

Experience is arguably the most significant driver of salary growth in accounting. A typical career progression and its impact on salary look like this:

- Entry-Level (0-2 years): As a Staff Accountant or Junior Auditor, you'll focus on foundational tasks. Salaries typically fall in the $65,000 to $85,000 range.

- Mid-Level (3-5 years): As a Senior Accountant, you'll take on more complex projects and may supervise junior staff. Salaries often rise to the $90,000 to $120,000 range.

- Senior/Management (5+ years): Roles like Accounting Manager, Controller, or Director involve strategic oversight and team leadership. At this level, salaries can range from $125,000 to $200,000+, especially with a CPA and specialized skills.

###

Company Type

The type of organization you work for has a profound impact on your compensation and work environment.

- Public Accounting (The "Big Four"): Firms like Deloitte, PwC, EY, and KPMG are headquartered in NYC and offer some of the highest starting salaries. While the hours can be demanding, the training and experience are unparalleled and serve as a launchpad for lucrative roles in private industry.

- Corporate/Private Industry: Working in-house for a Fortune 500 company in finance (e.g., Goldman Sachs), media (e.g., Warner Bros. Discovery), or tech can offer competitive salaries with better work-life balance compared to public accounting.

- Government: Accountants working for federal, state, or city agencies (like the IRS or the NYC Department of Finance) enjoy excellent job security and benefits, though salaries may be slightly lower than in the top-tier private sector.

- Non-Profit: These roles are mission-driven and can be incredibly rewarding. Compensation is typically lower than in for-profit sectors but can still be competitive for experienced professionals.

###

Area of Specialization

General accounting is always in demand, but specializing in a high-growth, complex area can dramatically increase your value. In NYC, top-paying specializations include:

- Forensic Accounting: Investigating financial discrepancies and fraud.

- International Tax: Navigating the complex tax laws of multiple countries for multinational corporations.

- IT Audit & Risk Assurance: Blending accounting with technology to assess cybersecurity and data integrity risks.

- Transaction Advisory / M&A: Providing financial due diligence and valuation services for mergers and acquisitions.

These specialized roles often require additional certifications and command premium salaries due to their complexity and direct impact on a company's bottom line.

Job Outlook

The future for accountants and auditors is bright. According to the U.S. Bureau of Labor Statistics (BLS), employment in this field is projected to grow 4 percent from 2022 to 2032, about as fast as the average for all occupations.

This steady growth is driven by factors like increasing globalization, a complex tax and regulatory environment, and a greater need for financial accountability to prevent fraud. As technology automates routine tasks, accountants who can provide strategic analysis, risk assessment, and advisory services will be in particularly high demand.

Conclusion

For aspiring and current accounting professionals, New York City offers a career landscape filled with opportunity and significant financial rewards. While an average salary well over $100,000 is a strong draw, your journey to becoming a top earner is within your control.

To maximize your salary potential, focus on a clear path: invest in your education, prioritize earning your CPA license, gain diverse experience, and consider developing a valuable specialization. By doing so, you can build a stable, challenging, and highly lucrative career in the financial center of the world.