Table of Contents

- [Introduction](#introduction)

- [The Role of a Financial Journalist: What Does a Maria Bartiromo-Level Professional Do?](#what-does-a-financial-journalist-do)

- [Average Financial Journalist Salary: A Deep Dive](#average-financial-journalist-salary-a-deep-dive)

- [Key Factors That Influence a Financial Journalist's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for Financial Journalists](#job-outlook-and-career-growth)

- [How to Become a Financial Journalist: Your Step-by-Step Guide](#how-to-get-started-in-this-career)

- [Conclusion: Is a Career in Financial Journalism Right for You?](#conclusion)

---

Introduction

Have you ever watched a major news story break about the stock market and felt a jolt of adrenaline? Do you find yourself drawn to the fast-paced world of finance, technology, and global economics, and wonder how you could build a career at the intersection of information and influence? For many, the name Maria Bartiromo epitomizes this ambition. As a trailblazing journalist who was the first to report live from the floor of the New York Stock Exchange daily, she has built a brand synonymous with financial news expertise. This naturally leads to the question: what is the Maria Bartiromo salary, and what does it take to reach that level of success?

While specific salaries of high-profile media personalities are private, industry estimates place Maria Bartiromo's annual compensation, including her salary from Fox Business and Fox News, in the realm of $10 million or more. This figure represents the absolute pinnacle of a career in financial broadcast journalism, a reward for decades of brand-building, unparalleled access to sources, and a powerful on-air presence. However, this article is not just about one person's income. It's about deconstructing the career path that makes such a salary possible. We will use the "Maria Bartiromo salary" as a North Star to explore the entire profession of financial journalism—from the first job as a production assistant to the anchor's chair. We'll delve into average salaries, the factors that drive compensation, the long-term career outlook, and a concrete roadmap for how you can start your own journey.

I once mentored a young economics graduate who was brilliant with numbers but struggled to explain complex market trends to her non-expert colleagues. We worked on turning her dense analysis into compelling narratives. Months later, she emailed me after landing a role at a major financial publication, not because she "dumbed down" her work, but because she learned to make it resonate. That's the essence of this career: bridging the gap between complex data and human understanding, a skill that is more valuable than ever. This guide is designed to give you the blueprint to do just that, and in turn, build a lucrative and impactful career.

---

The Role of a Financial Journalist: What Does a Maria Bartiromo-Level Professional Do?

At its core, a financial journalist is a specialized reporter and storyteller whose beat is the world of money. They investigate, analyze, and communicate news and trends related to business, economics, and financial markets. Their work serves a diverse audience, from institutional investors and corporate executives to everyday consumers trying to understand their 401(k)s. While an anchor like Maria Bartiromo represents the most visible aspect of this profession, the role is multifaceted and encompasses a wide range of responsibilities that happen long before the camera light turns on.

The primary mission is to translate complexity into clarity. Financial journalists take raw data—earnings reports, Federal Reserve statements, market fluctuations, SEC filings—and weave it into a coherent narrative that explains *what* is happening, *why* it's happening, and *what it means* for their audience. This requires a unique blend of skills: the investigative rigor of a traditional journalist, the analytical mind of a financial analyst, and the communication prowess of a great teacher.

Breakdown of Daily Tasks and Typical Projects:

- Information Gathering & Research: The day often begins before the markets open. Journalists scan news wires (like Reuters and Bloomberg Terminal), read pre-market reports, check international market performance, and monitor social media for breaking news. They continuously research companies, industry sectors, and economic indicators.

- Source Development & Interviews: A journalist's value is directly tied to their sources. They spend significant time building relationships with CEOs, Wall Street analysts, economists, traders, and government officials. This involves conducting interviews, both on-the-record for broadcasts and off-the-record for background information.

- Content Creation: This is the execution phase. Depending on the medium, it can involve:

- Broadcast: Writing scripts for TV or radio segments, preparing questions for live interviews, and working with producers to create on-screen graphics that simplify data.

- Print/Digital: Writing articles, in-depth features, or quick market updates for websites, newspapers, or magazines. This includes fact-checking every detail meticulously.

- Multimedia: Creating content for podcasts, video clips for social media, or data visualizations for online articles.

- Analysis and Interpretation: This is what separates a great financial journalist from a simple reporter. They don't just state that a stock went up; they analyze the catalysts, compare it to competitors, and provide context on whether this is a short-term blip or a long-term trend.

- On-Air Presence & Reporting (for Broadcasters): For those in television or radio, a key part of the job is delivering information clearly and confidently on air. This includes anchoring shows, reporting live from locations like the NYSE or a company's headquarters, and moderating panel discussions.

### A "Day in the Life" of a Mid-Career Financial Journalist

Let's imagine a day for "Chloe," a 32-year-old financial journalist covering the tech sector for a major cable network.

- 5:30 AM: Wake up. First task: Check overnight market performance in Asia and Europe on her phone. Scan headlines from The Wall Street Journal, Financial Times, and key tech blogs. A major semiconductor company has just issued a surprise warning about its quarterly revenue.

- 6:30 AM: At the office. Chloe joins the morning editorial meeting. She pitches the semiconductor story as the day's lead, explaining its potential ripple effect on the entire tech sector. Her editor agrees.

- 7:00 AM - 9:00 AM: "Pre-production." Chloe dives deep into the company's press release and SEC filing. She calls two trusted analyst sources for their immediate take. Simultaneously, she works with a producer to build graphics showing the company's revenue sources and its stock performance. She quickly drafts an opening script for the 10 AM show.

- 9:30 AM: The U.S. markets open. She watches the company's stock plummet in early trading, gathering real-time data for her report.

- 10:05 AM: Chloe goes live on air, delivering a concise 2-minute report on the breaking news, incorporating the analyst commentary and on-screen graphics.

- 11:00 AM - 2:00 PM: Her team secures a live interview with the CEO of a rival semiconductor company for the afternoon show. Chloe spends the next few hours preparing. She researches the rival's market position, anticipates the CEO's talking points, and crafts sharp, insightful questions that go beyond the obvious.

- 2:30 PM: Chloe conducts the live 7-minute interview with the CEO, pressing for details on how their company will be impacted and if they see an opportunity.

- 3:30 PM - 5:00 PM: After the market closes, she writes a more detailed article for the network's website, synthesizing the day's events, her reporting, and the CEO interview. She also works with the digital team to create a short video clip for social media.

- 5:30 PM: Chloe connects with a long-term source—an executive at a different tech firm—for a "background" coffee meeting to discuss broader industry trends, nurturing a relationship for future stories. The work is rarely a simple 9-to-5.

---

Average Financial Journalist Salary: A Deep Dive

While the multi-million dollar salary of a star anchor like Maria Bartiromo is the dream, the reality for the vast majority of professionals in this field is more grounded, yet still quite competitive. A financial journalist's salary is not a single number but a wide spectrum influenced by the factors we'll explore in the next section. Here, we'll establish a baseline by examining national averages, typical ranges, and the different components of compensation.

It's important to note that the U.S. Bureau of Labor Statistics (BLS) groups financial journalists under broader categories like "News Analysts, Reporters, and Journalists." For this general group, the median annual wage was $57,500 in May 2023. However, this figure includes reporters in all fields and locations, from small-town newspapers to national outlets. Financial journalism is a highly specialized and lucrative niche within this category, and its compensation potential is significantly higher.

To get a more accurate picture, we must turn to industry-specific salary aggregators that account for the specialization.

National Average and Typical Salary Range

Based on an aggregation of data from platforms like Salary.com, Payscale, and Glassdoor, the salary landscape for a dedicated Financial Journalist or Financial Reporter in the United States looks like this:

- National Average Salary: Approximately $78,000 to $95,000 per year.

- Typical Salary Range: Most financial journalists will earn between $55,000 and $130,000.

- Top Earners: The top 10% of financial journalists, often senior correspondents or columnists at major publications, can earn $150,000 to $250,000+, not including the elite-tier TV anchors whose compensation enters a different stratosphere.

Salary by Experience Level

Experience is arguably the single most significant factor in salary growth. The journey from a novice reporter to a seasoned expert is reflected directly in your paycheck.

| Experience Level | Typical Years of Experience | Typical Annual Base Salary Range | Notes & Responsibilities |

| :--- | :--- | :--- | :--- |

| Entry-Level Financial Reporter | 0-2 Years | $45,000 - $65,000 | Often starts as a production assistant, research associate, or reporter in a smaller market. Focus on data gathering, fact-checking, and writing short news briefs. |

| Mid-Career Financial Journalist | 3-8 Years | $70,000 - $115,000 | Has developed a specific beat (e.g., tech, energy, M&A). Contributes original analysis, conducts interviews, and writes feature-length articles or handles regular broadcast segments. |

| Senior Financial Journalist / Correspondent | 8-15+ Years | $110,000 - $180,000+ | A recognized expert in their field with deep sources. Breaks exclusive stories, writes major columns, or holds a prominent on-air role. May have some editorial or mentoring duties. |

| Lead Anchor / Editor-in-Chief | 15+ Years | $250,000 - $1,000,000+ | The top of the profession. This tier includes well-known TV anchors, top columnists at world-renowned publications (like the WSJ), and editorial leaders. The "Maria Bartiromo salary" is in the upper echelon of this tier. |

*(Sources: Data synthesized from Payscale, Salary.com, and Glassdoor, accessed 2024. Ranges are illustrative and can vary significantly based on other factors.)*

Beyond the Base Salary: Understanding Total Compensation

For many financial journalists, especially those at larger media corporations, base salary is only one part of the picture. Total compensation can include several other valuable components.

- Annual Bonuses: This is a very common component, particularly in broadcast and at major digital media companies. Bonuses are often tied to individual performance (e.g., breaking a major story), the performance of your show or section, and the overall profitability of the company. These can range from 5% to 30% or more of the base salary.

- Profit Sharing: Some companies offer a profit-sharing plan, where a portion of the company's profits is distributed among employees. This incentivizes everyone to work towards the organization's success.

- Stock Options or Restricted Stock Units (RSUs): At publicly traded media companies (e.g., Fox Corp., Comcast, The New York Times Company), more senior employees are often granted stock options or RSUs. This can be a significant part of long-term compensation, aligning the journalist's financial interests with those of the shareholders.

- Standard Benefits: Like any professional role, this includes comprehensive health insurance (medical, dental, vision), retirement savings plans (401(k) with company match), paid time off, and parental leave.

- Perks and Allowances: For reporters who travel frequently, companies provide travel allowances and expense accounts. Some high-profile talent may also receive a wardrobe allowance or have access to professional coaching for on-air performance.

When evaluating a job offer in this field, it's crucial to look beyond the base salary and consider the full value of the total compensation package. A role with a slightly lower base salary but a generous bonus structure and excellent benefits could be more lucrative in the long run.

---

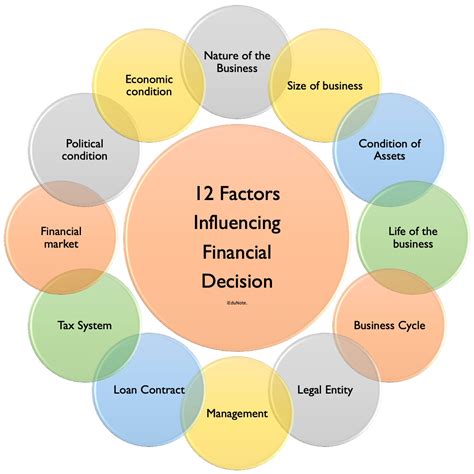

Key Factors That Influence a Financial Journalist's Salary

The path to a salary that approaches the stratosphere of a Maria Bartiromo is not linear. It's a complex equation with multiple variables. Understanding these factors is essential for anyone looking to maximize their earning potential in this competitive field. This section provides a granular breakdown of what truly drives compensation for a financial journalist.

###

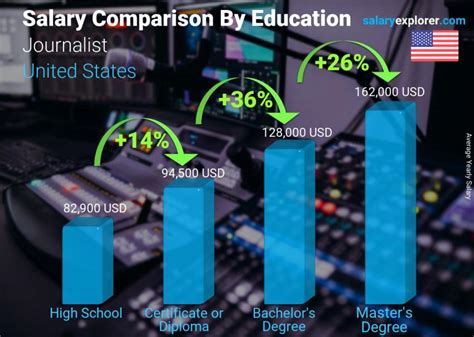

Level of Education

While journalism has historically been a field where experience could trump formal education, in the specialized realm of finance, your academic background plays a significant role in opening doors and commanding a higher starting salary.

- Bachelor's Degree (The Standard): A bachelor's degree is the minimum requirement for almost any reputable financial journalism role. The most common and effective majors are a blend of communication and analytical disciplines:

- Journalism/Communications: Provides the core skills of reporting, writing, ethics, and media law.

- Finance/Economics: Provides the subject matter expertise to understand market dynamics, read financial statements, and analyze economic data. A double major or a major/minor combination of these fields is often the ideal launching pad.

- Master's Degree (The Accelerator): An advanced degree can provide a significant advantage, both in initial hiring and long-term salary potential.

- Master's in Journalism: Programs at institutions like Columbia University Graduate School of Journalism (which has a business and economics concentration), Northwestern's Medill School of Journalism, or the Craig Newmark Graduate School of Journalism at CUNY are highly respected and can fast-track a career. They provide intense practical training and, crucially, access to a powerful alumni network.

- Master of Business Administration (MBA): While less common, an MBA is a powerful differentiator. It signals an extremely deep understanding of business strategy, corporate finance, and management. A journalist with an MBA is uniquely positioned to cover complex topics like mergers and acquisitions (M&A) or venture capital and can often transition into more senior, strategy-focused roles. Graduates with this credential can command a significant salary premium.

- Certifications (The Enhancer): While not required, professional certifications demonstrate a commitment to deep financial literacy and can boost credibility and pay.

- Chartered Financial Analyst (CFA): This is the gold standard for investment management professionals. While a full charter is rare and intensive for a journalist to pursue, even passing Level I of the CFA exam can be a massive resume booster, signaling a sophisticated understanding of financial analysis.

- Certificate in Business and Economics Journalism: Offered by some universities and professional organizations, these specialized certificates provide focused training and can be valuable for those transitioning from general news.

###

Years of Experience

As illustrated in the salary table, experience is the primary engine of salary growth. However, it's not just the *quantity* of years but the *quality* of experience that matters. The salary trajectory is a story of accumulating skills, a portfolio of impactful work, and a network of high-level sources.

- Stage 1: The Foundation (0-2 Years | ~$45k - $65k): In these early years, you're paying your dues. You might be a "news associate" or "production assistant" at a network like CNBC or Bloomberg, a "data journalist" pulling numbers for senior reporters, or a general business reporter at a local paper or trade publication. The focus is on learning the craft, understanding workflow, and proving your reliability.

- Stage 2: The Specialization (3-8 Years | ~$70k - $115k): This is where career and salary acceleration happens. You've proven your basics and now you carve out a niche. You become the "go-to" reporter for software, or renewable energy, or retail. You begin breaking smaller, original stories and are trusted to conduct interviews with mid-level executives. You have a portfolio of work that demonstrates your analytical skills.

- Stage 3: The Authority (8-15+ Years | ~$110k - $180k+): At this stage, you are no longer just reporting the news; you are a recognized authority who helps shape the conversation. You have a "Rolodex" (digital, of course) of CEO and C-suite contacts who take your calls. You break major, market-moving stories. Your byline or on-air presence carries significant weight. You might be a Senior Correspondent, a featured columnist, or a segment host.

- Stage 4: The Brand (15+ Years | ~$250k and beyond): This is the tier where Maria Bartiromo, Andrew Ross Sorkin, and other household names reside. At this point, the journalist *is* the brand. Their name alone draws viewers or readers. Compensation is no longer just a salary; it's a complex negotiation based on ratings, brand value, and influence. This level is achieved by a very small fraction of professionals and is the result of exceptional skill, branding, and career-long dedication.

###

Geographic Location

In financial journalism, geography is destiny. The industry is heavily concentrated in a few key financial and media hubs. Working in one of these cities is almost a prerequisite for reaching the upper echelons of the profession and its associated salaries.

- Tier 1: New York City (The Epicenter): NYC is the undisputed global capital of financial news. It's home to Wall Street, the NYSE, Nasdaq, and the headquarters of nearly every major financial media outlet: Bloomberg, The Wall Street Journal, Reuters, Fox Business, CNBC, and more. Salaries here are the highest in the country to compensate for the extreme cost of living and the concentration of top-tier talent. A mid-career financial journalist in NYC can expect to earn 20-40% more than their counterpart in a smaller city.

- Tier 2: Major Media & Tech Hubs (e.g., Washington D.C., San Francisco, Los Angeles):

- Washington D.C.: The center for news related to economic policy, the Federal Reserve, the Treasury Department, and regulation. Reporters here specialize in the intersection of politics and finance.

- San Francisco Bay Area: The hub for covering the technology industry and venture capital. Journalists here need deep expertise in tech companies, startups, and innovation.

- Los Angeles: A hub for covering the media, entertainment, and studio business.

Salaries in these cities are also very high, though perhaps slightly below NYC's peak.

- Tier 3: Regional Financial Centers (e.g., Chicago, Boston, Charlotte): These cities have significant financial industries (commodities in Chicago, asset management in Boston, banking in Charlotte) and support robust business journalism communities. Salaries are competitive but generally a step below the Tier 1 and 2 cities.

- Tier 4: All Other Markets: Business reporters at local newspapers or TV stations in smaller cities will earn salaries closer to the general BLS median for journalists. The path to a six-figure salary often involves starting in a smaller market to gain experience and then moving to a larger, more competitive hub.

###

Company Type & Size

The type of organization you work for has a profound impact on your salary, work culture, and career trajectory.

- Major Broadcast Networks (e.g., Fox Business, CNBC, Bloomberg TV): These are at the top of the pay scale, especially for on-air talent. The combination of high viewership, advertising revenue, and the need for recognized "stars" drives compensation up. The work is high-pressure and performance-driven.

- Global News Wires & Publications (e.g., The Wall Street Journal, Financial Times, Reuters, Associated Press): These legacy institutions are known for deep, investigative journalism and global reach. They pay very competitive salaries, particularly for experienced reporters with exclusive sources. Compensation here is often more focused on base salary and strong benefits rather than the massive on-air talent bonuses of TV.

- Digital-Native Publications (e.g., Business Insider, Axios, The Information): These newer media companies are often more nimble and innovative. Compensation can be highly variable. Some well-funded startups can pay competitively to attract top talent, and may offer equity as part of the package. Others may have lower base salaries but offer a faster path to responsibility.

- Trade Publications & Niche Sites: These outlets focus on a specific industry (e.g., advertising, a specific type of manufacturing, or healthcare finance). They offer a fantastic opportunity to develop deep subject-matter expertise. Salaries are typically more modest than at major national outlets but can still be solid, especially for editors and senior writers.

- Local Newspapers and TV Stations: These are the entry points for many journalists. The pay is the lowest in the industry, but they provide invaluable hands-on experience in reporting, writing on a deadline, and building a portfolio.

###

Area of Specialization

Within the broad field of financial journalism, developing a deep and in-demand specialization is a key strategy for increasing your value and salary. Generalists are a commodity; experts are an asset.

- High-Value Beats:

- Mergers & Acquisitions (M&A): A highly complex and secretive world. Reporters who can break news on major deals are extremely valuable.

- Venture Capital & Private Equity: Covering the flow of "smart money" into new technologies and companies requires a strong network and understanding of deal structures.

- Hedge Funds & Asset Management: Reporting on the strategies and performance of the world's largest investors.

- Energy & Commodities: A specialized field that requires understanding geopolitics, supply chains, and futures markets.

- Technology (Enterprise & AI): Covering the largest and most influential companies in the world (Apple, Microsoft, Google, Nvidia) and emerging trends like artificial intelligence is a consistently high-paying beat.

- Standard Beats: These include covering public stock markets, personal finance, retail, and general economic news. They are essential and can be lucrative, but may have more competition.

###

In-Demand Skills

Beyond your degree and experience, a specific set of tangible skills can directly translate into a higher salary. Modern financial journalists are multimedia powerhouses.

- Data Analysis & Visualization: The ability to not just read a spreadsheet but to use tools like Excel, SQL, or even Python to analyze large datasets and create compelling charts (using tools like Tableau or Flourish) is a massive advantage. This allows you to find original stories within the data.

- On-Camera Presence & Public Speaking: For broadcast roles, this is non-negotiable. The ability to communicate complex topics calmly and confidently on live television is a rare skill that commands a premium. Even for print reporters, this skill is valuable for appearing as a guest on TV/podcasts, which builds your brand.

- Multimedia Production: Skills in video shooting/editing (Adobe Premiere), audio editing for podcasts (Audition), and graphic design are increasingly expected. The "one-man-band" journalist who can write, shoot, and edit their own stories is highly efficient and valuable to an organization.

- Financial Modeling Literacy: You don't need to be an investment banker, but understanding the basics of a DCF, comps, or a P&L statement allows you to ask smarter questions and dissect corporate spin more effectively.

- SEO and Social Media Strategy: Understanding how to write headlines that perform well on search engines and how to use platforms like X (formerly Twitter) and LinkedIn to break news, engage with an audience, and build a personal brand is critical in the digital age.

---

Job Outlook and Career Growth for Financial Journalists

Navigating a career in financial journalism requires a realistic understanding of the industry's landscape. While the potential for high earnings and significant influence is real, the profession is undergoing a profound transformation. The outlook is a tale of two trends: a decline in traditional media roles coupled with a surge of opportunity in new digital formats.

The Statistical Outlook: A Sobering View

The U.S. Bureau of Labor Statistics (BLS) projects employment for "News Analysts, Reporters, and Journalists" to decline by 3% from 2022 to 2032 (Source: BLS, updated September 2023). This projection reflects the ongoing challenges facing the traditional news industry, including:

- Consolidation of Media Companies: Mergers and acquisitions often lead to layoffs as companies seek to eliminate redundant roles.

- Decline in Print Advertising Revenue: The shift of advertising dollars from print newspapers and magazines to online platforms has squeezed budgets, particularly at local and regional publications.

- Automation and AI: Artificial intelligence is beginning to be used for tasks like writing basic earnings reports or summarizing market data, which could displace some entry-level data-gathering roles.

However, it is absolutely critical to interpret this data with nuance. The decline is not uniform across the industry. While jobs for general assignment reporters at small local papers are indeed shrinking, the demand for highly skilled, specialized financial journalists who can provide expert analysis remains strong and is arguably growing. Audiences are flooded with raw information and are willing to pay a premium—through subscriptions or by giving their attention—to trusted experts who can help them make sense of it all. The future belongs to the specialist, not the generalist.

Emerging Trends and Future Opportunities

The successful financial journalist of the next decade will be one who embraces change and capitalizes on emerging trends.

1.