Table of Contents

- [Introduction: Your Path to a Rewarding Career](#introduction)

- [What Does a Progressive Claims Adjuster Trainee Actually Do?](#what-does-a-trainee-do)

- [Progressive Claims Adjuster Trainee Salary: A Deep Dive](#salary-deep-dive)

- [The Key Factors That Influence Your Salary](#key-factors)

- [Job Outlook and Career Growth for Claims Adjusters](#job-outlook)

- [How to Become a Claims Adjuster Trainee: A Step-by-Step Guide](#how-to-get-started)

- [Conclusion: Is This Career the Right Fit for You?](#conclusion)

Introduction: Your Path to a Rewarding Career

Have you ever considered a career where you are the calm in someone’s storm? A role where your analytical skills and empathy directly help people piece their lives back together after an unexpected event? This is the world of a claims adjuster. And for those looking to enter this dynamic and stable field, the Progressive Claims Adjuster Trainee program is one of the most respected and sought-after entry points in the entire insurance industry. It’s more than just a job; it’s an apprenticeship in a profession that offers remarkable stability, a clear path for advancement, and a surprisingly competitive starting salary.

Many people enter this field expecting a standard office job, but they quickly discover it’s a career built on investigation, negotiation, and human connection. The financial rewards are significant. While trainee salaries vary based on location and specific role, you can expect a starting base salary in the range of $50,000 to $65,000 per year, with many positions offering additional compensation through bonuses and company-wide gainsharing programs. This robust starting package, combined with comprehensive paid training, makes it an incredibly attractive option for recent graduates and career-changers alike.

I remember years ago when a close friend’s apartment suffered major water damage from a burst pipe in the unit above. The chaos and stress were overwhelming, but the claims adjuster who handled their case was a beacon of professionalism and expertise. He didn't just process a claim; he guided them through the entire ordeal, explained every step, and ensured they had the resources to recover. Witnessing that process firsthand, I realized that a great claims adjuster isn't just a financial professional; they are a first responder for life's unexpected crises.

This comprehensive guide is designed to be your ultimate resource. We will dissect every aspect of the Progressive Claims Adjuster Trainee role, from the day-to-day responsibilities to the long-term career trajectory. We will perform a deep dive into salary data, explore the critical factors that can increase your earning potential, and provide a clear, step-by-step roadmap to help you land the job. Whether you're just starting your research or are ready to apply, consider this your blueprint for success.

What Does a Progressive Claims Adjuster Trainee Actually Do?

At its core, a Claims Adjuster Trainee at a company like Progressive is an apprentice learning the art and science of insurance claim investigation and settlement. You are not thrown into the deep end; instead, you enter a highly structured, immersive training program designed to build your skills from the ground up. This is a critical distinction—you are paid a full salary *while you learn*.

The fundamental purpose of the role is to determine coverage (does the insurance policy apply to this specific event?), liability (who is at fault?), and damages (what is the monetary value of the loss?). The trainee program methodically teaches you how to answer these three questions for various types of claims, most commonly in the auto or property sectors.

### Breakdown of Daily Tasks and Responsibilities

While in the training program, your days will be a blend of structured learning and hands-on, mentored case work. Here’s what that typically looks like:

- Classroom & Virtual Learning: The initial phase of your training is often classroom-based (either in-person at a Progressive campus or virtual). Here, you’ll learn the fundamentals: insurance theory, how to read and interpret complex policy documents, state-specific regulations and laws, and how to use Progressive's proprietary claims management software (like their Advanced Claims Management System).

- Mentored Claim Handling: After the initial learning phase, you will be assigned a mentor—an experienced claims adjuster. You will start by "shadowing" them, listening in on calls and observing their process. Gradually, you will be assigned your own caseload of less complex claims, but every step you take will be reviewed and guided by your mentor.

- First Notice of Loss (FNOL) Calls: You will learn to make the initial contact with customers who have just filed a claim. This is a crucial, high-empathy touchpoint where you introduce yourself, explain the claims process, and gather preliminary information about the incident.

- Investigation: This is the detective work. You will interview the insured, claimants, and any witnesses. You might review police reports, gather photos and videos of damage, and consult with experts like auto body shops or building contractors.

- Damage Evaluation: For auto claims, you'll learn to write repair estimates using industry-standard software. For property claims, you may work with field adjusters or contractors to assess the cost of repairs. The goal is to arrive at a fair and accurate valuation of the loss.

- Reporting and Documentation: Every action, every conversation, and every decision must be meticulously documented in the claim file. This creates a clear and defensible record of how the claim was handled.

### A "Day in the Life" of a Claims Adjuster Trainee

To make this more concrete, let's walk through a hypothetical day for a trainee in an auto damage claims role, about three months into the program:

- 8:00 AM: Log in. Check emails and review your assigned claim queue. Your mentor has assigned you two new, low-complexity claims overnight. You also have a follow-up scheduled with a body shop.

- 8:30 AM: Team Huddle. A brief virtual meeting with your team and supervisor to discuss any urgent issues, share successes, and get updates on company or department goals.

- 9:00 AM: First Customer Contact. You call the insured on your first new claim. It’s a simple rear-end collision. You use your training to ask structured questions, express empathy for their situation, verify their policy information, and explain the next steps for getting their vehicle inspected.

- 10:00 AM: Investigation. You review the police report for the accident and call the other party involved (the claimant) to get their version of events. You document both conversations thoroughly in the claim file.

- 11:00 AM: Estimate Review. You receive an estimate from an auto body shop for a different claim. You meticulously review it line by line, comparing it against photos of the damage to ensure the repairs are related to the accident and the costs are reasonable. You flag a questionable charge for a "pre-scan" and schedule a call with the shop to discuss it.

- 12:00 PM: Lunch.

- 1:00 PM: Mentor Check-in. You have a scheduled one-on-one with your mentor. You discuss the two new claims you’re handling, and they provide feedback on your customer call. They also give you a tip on negotiating the "pre-scan" charge with the body shop.

- 2:00 PM: Writing an Estimate. For another claim, you use photos provided by the customer via Progressive's app to write your own estimate of damages using specialized software. This is a key skill you're developing.

- 3:30 PM: Settling a Claim. One of your first claims is ready to be closed. You’ve determined liability, and the repair estimate is approved. You call the customer to explain the settlement, authorize payment to the body shop, and officially close the claim in the system.

- 4:30 PM: Documentation & Planning. You spend the last 30 minutes of your day ensuring all your claim files are updated with your notes and actions. You plan your to-do list for tomorrow.

This structured environment ensures that by the time you "graduate" from the trainee program (typically after 6-12 months), you are a competent, confident adjuster ready to manage your own full caseload.

Progressive Claims Adjuster Trainee Salary: A Deep Dive

Understanding the compensation structure is a primary concern for anyone considering a new career path. The good news is that the role of a claims adjuster trainee at a major carrier like Progressive is well-compensated from day one, reflecting the company's investment in attracting and retaining top talent. Let's break down the numbers from multiple authoritative sources.

It's important to note that a "trainee" salary is a specific entry-level figure. Once you complete the training program, you are promoted to a full Claims Adjuster, which comes with a significant salary increase.

### National Averages and Typical Ranges

Based on the most recent data available (as of late 2023/early 2024), here is a consolidated view of the salary landscape:

- Progressive-Specific Data: According to salary data reported directly by employees on Glassdoor, the estimated total pay for a Claims Adjuster Trainee at Progressive is approximately $63,550 per year. This total pay figure includes an estimated base salary of around $58,100 and additional pay (bonuses, profit sharing) of roughly $5,450. Job postings directly from Progressive often advertise a range of $55,000 to $62,000 for trainee roles, depending heavily on the location.

- Broader Industry Data: Salary.com places the average salary for a Claims Adjuster I (the level just after trainee) in the United States at $63,161, with a typical range falling between $56,715 and $70,147. This aligns closely with the post-training salary expectations at a company like Progressive.

- Payscale.com reports the average entry-level Claims Adjuster salary at around $52,000, but this figure includes smaller insurance companies and independent firms which may pay less than industry leaders like Progressive.

Key Takeaway: For a *Progressive Claims Adjuster Trainee* position, a realistic base salary expectation upon receiving an offer is between $55,000 and $65,000, with your exact number depending heavily on the factors we'll discuss in the next section.

### Salary Progression by Experience Level

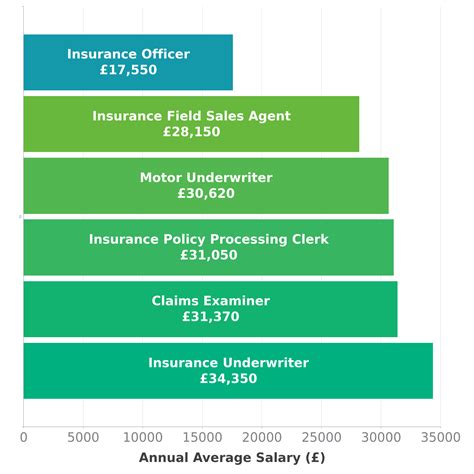

The salary growth in a claims career is clear and predictable. Your earnings increase significantly as you move from trainee to a seasoned, expert adjuster.

| Career Stage | Years of Experience | Typical Annual Base Salary Range | Key Responsibilities & Titles |

| :--- | :--- | :--- | :--- |

| Trainee | 0 - 1 year | $55,000 - $65,000 | Learning policies, software, and regulations under mentorship. (Claims Adjuster Trainee) |

| Junior Adjuster | 1 - 3 years | $65,000 - $78,000 | Managing a full, independent caseload of low-to-moderate complexity claims. (Claims Adjuster, Claims Representative II) |

| Mid-Career Adjuster| 4 - 8 years | $75,000 - $90,000 | Handling more complex and higher-value claims; may begin to specialize. (Senior Claims Adjuster, Claims Specialist) |

| Senior/Expert Adjuster| 8 - 15 years | $85,000 - $110,000+ | Subject matter expert in a specific area (e.g., litigation, total loss, commercial); may mentor junior staff. (Lead Claims Representative, Claims Examiner) |

| Management/Leadership| 10+ years | $100,000 - $150,000+ | Supervising a team of adjusters, managing department operations, setting strategy. (Claims Supervisor, Claims Manager, Claims Director) |

*(Source: Aggregated data from Glassdoor, Salary.com, and industry job postings as of November 2023.)*

### A Closer Look at Total Compensation

Your base salary is only one piece of the puzzle. Large insurers like Progressive are known for their comprehensive benefits packages, which significantly increase your total compensation.

- Gainsharing/Profit Sharing: This is a major benefit at Progressive. It's an annual bonus program where the company shares its profits with eligible employees. The amount varies each year depending on the company's performance, but it can add a significant percentage (often 5-15%) to your annual earnings.

- Performance Bonuses: Many claims roles, especially once you are out of the trainee phase, are eligible for individual or team-based performance bonuses. These are tied to specific metrics like customer satisfaction scores (NPS), claim closure speed (cycle time), and financial accuracy.

- 401(k) with Company Match: This is a standard but powerful wealth-building tool. Progressive offers a robust 401(k) plan with a generous company match (e.g., dollar-for-dollar up to 6% of your salary), which is essentially free money for your retirement.

- Health and Wellness Benefits: Comprehensive medical, dental, and vision insurance is a given. Progressive is also known for its wellness programs, offering gym membership reimbursements and mental health support services.

- Paid Time Off (PTO): Trainees start with a competitive amount of PTO, which increases with tenure at the company.

- Tuition Assistance & Professional Development: Companies like Progressive will often pay for you to pursue advanced industry designations (like the AIC or CPCU, discussed later) and may offer tuition assistance for relevant degree programs.

- Company Vehicle (for Field Roles): If you are training for a field adjuster role that requires you to inspect damaged property or vehicles in person, you will typically be provided with a company car, a fleet vehicle allowance, and a gas card. This is a massive financial benefit that eliminates commuting and work-related travel costs.

When you evaluate an offer for a Progressive Claims Adjuster Trainee position, it is crucial to look beyond the base salary and calculate the value of this entire compensation package. The "hidden" value in bonuses, retirement matching, and benefits can easily add another $10,000 to $20,000 or more to your annual compensation.

The Key Factors That Influence Your Salary

While we've established a solid baseline salary for a trainee, your specific offer and long-term earning potential are not set in stone. They are influenced by a combination of your background, where you work, and the skills you develop. Understanding these factors is the key to maximizing your income throughout your career.

###

1. Level of Education and Professional Certifications

While a bachelor's degree is not always a strict requirement to become a claims adjuster trainee, it is highly preferred by top-tier employers like Progressive and can directly impact your starting salary and career ceiling.

- Minimum Requirement: A high school diploma or GED is the absolute minimum. However, candidates with only this level of education may face tougher competition and potentially start at the lower end of the salary band. They will need to compensate with significant, relevant work experience (e.g., in customer service or the auto body industry).

- The Bachelor's Degree Advantage: A four-year degree is the standard for most trainee programs at major carriers. While any major is acceptable, degrees in Business Administration, Finance, Communications, Criminal Justice, or Risk Management are seen as particularly relevant. A candidate with a relevant bachelor's degree can often command a starting salary that is $5,000 to $7,000 higher than a candidate without one.

- The Power of Certifications: This is where you can truly differentiate yourself and boost your salary *after* you've started. The insurance industry runs on professional designations. Your employer, especially Progressive, will not only encourage but often pay for you to get these.

- Associate in Claims (AIC): Offered by The Institutes, the AIC is the foundational designation for claims professionals. Earning your AIC demonstrates a comprehensive understanding of the claims process, from investigation and evaluation to negotiation and settlement. Holding an AIC can lead to a 3-5% salary increase and is often a prerequisite for promotion to a senior adjuster role.

- Chartered Property Casualty Underwriter (CPCU): This is the gold standard in the property-casualty insurance industry, often called the "PhD of insurance." It is a rigorous series of exams covering topics like risk management, insurance operations, law, and finance. Earning your CPCU is a significant achievement that signals elite expertise. It can lead to a 10-15% salary increase and opens doors to the highest levels of claims handling (complex litigation, management) and other areas of the insurance business.

- State-Specific Adjuster Licenses: Many states require claims adjusters to be licensed. The licensing process typically involves a pre-licensing course and passing a state-administered exam. While this is a requirement for the job, having already obtained your "designated home state" license (e.g., a Texas or Florida license, which has reciprocity with many other states) before applying can make you a more attractive candidate.

###

2. Years of Experience and Career Trajectory

Nowhere is the impact on salary more direct than with experience. The claims profession has a very clear and rewarding career ladder.

- The Trainee-to-Adjuster Jump (Year 1-2): The single biggest salary jump occurs when you complete your training program (typically 6-12 months). Upon promotion from "Trainee" to "Claims Adjuster," you can expect a salary increase of 10-20%. If you started at $60,000 as a trainee, you could easily be making $68,000 to $72,000 in your second year.

- The Mid-Career Growth (Years 3-8): During this phase, you are an established, productive member of the team. You'll receive consistent annual merit increases (typically 2-4%) and will be eligible for promotion to more senior roles. Moving from a Claims Adjuster II to a Senior Claims Specialist, for example, could net another 10-15% raise. Your salary will likely climb into the $75,000 - $90,000 range as you take on more complex files.

- The Senior/Expert Level (Years 8+): Seasoned adjusters with deep expertise are highly valuable. At this stage, your salary growth is tied to the complexity of your work. A senior bodily injury adjuster handling multi-million dollar liability claims will earn significantly more than a senior adjuster handling standard auto physical damage. Salaries can easily cross the $100,000 threshold, especially with specialization and strong performance bonuses.

###

3. Geographic Location

Your paycheck is heavily influenced by your zip code. Salaries for the exact same trainee role can vary by as much as 25% or more across the United States. This is driven by two main factors: cost of living and the regional demand for adjusters (often tied to population density and weather patterns).

Here is a breakdown of how location impacts salary, with examples:

High-Paying States and Metropolitan Areas:

These locations typically have a high cost of living and/or a high volume of claims.

- California: Los Angeles, San Francisco, San Diego ($65,000 - $75,000+ starting range)

- New York: New York City, Long Island ($64,000 - $72,000+ starting range)

- Massachusetts: Boston ($63,000 - $70,000+ starting range)

- Washington: Seattle ($62,000 - $70,000+ starting range)

- Texas: Houston, Dallas (High volume of claims due to weather and population) ($60,000 - $68,000+ starting range)

- Florida: Miami, Tampa, Orlando (High volume of weather and auto claims) ($58,000 - $67,000+ starting range)

Average-Paying States and Regions:

These locations generally have a more moderate cost of living.

- Midwest: Chicago (IL), Columbus (OH), Indianapolis (IN) ($57,000 - $64,000 starting range)

- Southeast (excluding Florida): Atlanta (GA), Charlotte (NC) ($56,000 - $63,000 starting range)

- Southwest: Phoenix (AZ), Denver (CO) ($58,000 - $65,000 starting range)

Lower-Paying States and Regions:

These areas typically have the lowest cost of living.

- Rural South: Mississippi, Arkansas, Alabama ($50,000 - $58,000 starting range)

- Rural Midwest: The Dakotas, Nebraska ($52,000 - $60,000 starting range)

*(Salary estimates are based on aggregated job posting data and cost-of-living calculators.)*

When evaluating a job offer, it's essential to use a cost-of-living calculator to understand how far your salary will actually go in that specific location. A $60,000 salary in Cleveland, Ohio, provides a much higher standard of living than a $68,000 salary in San Jose, California.

###

4. Company Type & Size

While our focus is on Progressive, a Fortune 100 company, it's useful to understand how they fit into the broader industry landscape, as this context affects compensation benchmarks.

- Large National Carriers (e.g., Progressive, GEICO, State Farm, Allstate): These companies are the industry leaders. They typically offer the highest starting salaries for trainees and the most comprehensive benefits packages (like the Gainsharing program at Progressive). They invest heavily in structured training because they need to build a massive, consistent talent pipeline.

- Mid-Sized and Regional Carriers (e.g., Erie Insurance, The Hartford, Liberty Mutual): These are still excellent companies that offer competitive compensation, often very close to the national carriers. They may offer a different company culture, perhaps with more of a regional focus. Their bonus structures might be different, but their base salaries for trainees are generally in the same ballpark.

- Third-Party Administrators (TPAs) (e.g., Sedgwick, Gallagher Bassett): TPAs don't issue insurance policies themselves; they are hired by large corporations, self-insured entities, or insurance companies to manage their claims. Salaries at top TPAs are very competitive with national carriers.

- Independent Adjusting (IA) Firms: IA firms are contractors hired by insurance companies on a per-claim basis, often during catastrophes or when the insurer's staff is overloaded. Working as an independent adjuster can be highly lucrative, but it's not an entry-level path. You typically need 3-5 years of experience as a staff adjuster before making the switch. Independent adjusters often earn more on an annual basis, but they are independent contractors responsible for their own taxes, health insurance, and retirement, and their income can be less stable.

###

5. Area of Specialization

As you progress in your career, the type of claim you handle becomes one of the most significant drivers of your salary. While a trainee at Progressive will likely start in a general auto or property role, they can later specialize.

- Auto Physical Damage (APD): This is the most common entry point. You handle claims for damage to vehicles—fender benders, hail damage, thefts. It's foundational and provides excellent experience. Salary Potential: Standard.

- Property (Homeowners/Commercial): This involves claims for damage to structures from events like fire, water, wind, or theft. These claims are often more complex and involve larger monetary values than auto claims. Property adjusters, especially those with expertise in using estimation software like Xactimate, often earn more than their auto counterparts. Salary Potential: Above Average.

- Bodily Injury (BI) / Casualty: This is a highly specialized and demanding field. BI adjusters handle the "people" side of an accident—injuries, medical treatments, lost wages, and pain and suffering. These claims can involve complex medical records, litigation, and large payouts. Due to the high stakes and required expertise, experienced BI adjusters are among the highest-paid non-management claims professionals. Salary Potential: High.

- Catastrophe (CAT) Adjusting: CAT adjusters are deployed to areas hit by major disasters like hurricanes, tornadoes, or wildfires. They work long hours under intense pressure for weeks or months at a time. The pay structure is often different, with significant overtime and special bonuses. A CAT adjuster can earn in a few months what a staff adjuster earns in a year, but the lifestyle is demanding and requires constant travel. Salary Potential: Very High (but variable).

- Specialty/Commercial Lines: This includes adjusting claims for things like trucking accidents (cargo liability), professional liability (errors & omissions), or cybersecurity breaches. These are niche, highly complex areas that require deep subject matter expertise and command premium salaries. Salary Potential: Very High.

###

6. In-Demand Skills

Beyond your formal qualifications, a specific set of hard and soft skills can make you a more effective adjuster and, therefore, a more valuable and higher-paid employee.

High-Value Hard Skills:

- Software Proficiency: Mastery of claims management systems is a given. For property adjusters, advanced proficiency in Xactimate is non-negotiable and a major salary booster. For auto adjusters, experience with estimating platforms like CCC ONE or Mitchell is key.

- Data Analytics: The ability to analyze claims data to spot trends, identify potential fraud, and improve efficiency is a skill of the future. Adjusters who are comfortable with data will be invaluable.

- Bilingualism: In many parts of the country, being fluent in a second language (especially Spanish) is a massive advantage. It allows you to communicate directly with a wider range of customers, making the process smoother and more efficient. Being bilingual can often come with a **salary differential or