The allure of real estate investing often lies in its potential for significant wealth creation and financial independence. But what does a "salary" truly look like for a real estate investor? The answer is complex, as this career path can range from a highly structured, salaried position at an investment firm to the entrepreneurial pursuit of a self-made property mogul.

While income can vary dramatically, many professionals in this field build highly lucrative careers. For salaried positions, it's common to see earnings well into the six figures, especially with experience. This guide will break down the data to give you a clear picture of your potential earnings as a real estate investor.

What Does a Real Estate Investor Do?

Before diving into the numbers, it's crucial to understand the role. A real estate investor's primary goal is to generate profit through property. This is achieved through two main avenues:

1. Direct/Entrepreneurial Investing: This is the path most people envision. These investors use their own capital (or capital from private lenders) to purchase properties. Their income comes from rental cash flow, appreciation (selling a property for more than it was purchased for), or "flipping" (buying, renovating, and quickly reselling a property). Their "salary" is their net profit.

2. Salaried Professional Investing: These investors work for a company, such as a Real Estate Investment Trust (REIT), a private equity firm, a bank, or a development company. They are often called Acquisitions Analysts, Asset Managers, or Real Estate Analysts. They use the company's capital to find, analyze, and acquire investment properties or manage a portfolio of assets. They earn a traditional salary plus performance-based bonuses.

This article will address the income potential for both paths, focusing on the more predictable data available for salaried roles while providing context for entrepreneurial earnings.

Average Real Estate Investor Salary

Defining a single "average salary" for a real estate investor is challenging due to the high number of self-employed professionals. However, by looking at data for salaried roles and self-reported income from entrepreneurs, we can establish a reliable benchmark.

According to recent data, the average salary for a professional in a real estate investment role in the United States typically falls between $95,000 and $125,000 per year.

- Salary.com reports the median salary for a Real Estate Acquisitions Analyst is around $93,500, with a typical range between $81,000 and $108,000.

- Glassdoor lists the average total pay (including base and additional compensation) for a "Real Estate Investor" at approximately $124,000 per year, based on self-reported data.

- Payscale notes a wide range, indicating an average base salary of around $100,000, with total pay potentially reaching over $200,000 when including bonuses and profit-sharing.

The full earnings spectrum is vast. An entry-level analyst at a small firm might start around $65,000, while a senior director at a major REIT or a successful independent investor could easily earn $250,000+ annually.

Key Factors That Influence Salary

Your specific income is determined by a combination of critical factors. Understanding these will help you strategize your career path for maximum earning potential.

###

Level of Education

While you can succeed as an entrepreneur in real estate without a formal degree, a bachelor's degree is typically a minimum requirement for salaried positions at investment firms. Degrees in Finance, Economics, Business Administration, or Real Estate are highly favored. An MBA with a concentration in finance or real estate can significantly boost earning potential and open doors to senior management and private equity roles, where compensation is highest. Professional certifications, like the Chartered Financial Analyst (CFA) or Certified Commercial Investment Member (CCIM), also add significant credibility and can lead to higher pay.

###

Years of Experience

Experience is arguably the most significant factor influencing a real estate investor's income.

- Entry-Level (0-3 years): Professionals typically start as Analysts. They perform financial modeling, conduct market research, and support senior team members in underwriting potential deals. Salaries often range from $65,000 to $90,000, plus a modest bonus.

- Mid-Career (4-8 years): After gaining experience, professionals move into Associate or Manager roles. They take on more responsibility, manage deals from start to finish, and may supervise junior analysts. Salaries can climb to $100,000 - $150,000, with substantially larger performance bonuses.

- Senior-Level (8+ years): At this stage, professionals hold titles like Vice President, Director, or Partner. They are responsible for setting investment strategy, sourcing major deals, and managing large portfolios. Base salaries often exceed $175,000, with bonuses and profit-sharing pushing total compensation well over $250,000. For entrepreneurs, experience translates to a better network, stronger negotiation skills, and a more intuitive understanding of market cycles, leading to more profitable investments.

###

Geographic Location

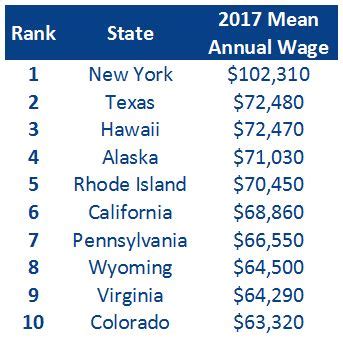

Real estate is inherently local, and location drastically impacts salary. Major metropolitan areas with high property values and significant deal flow command the highest salaries. For instance, an acquisitions professional in New York City, San Francisco, or Boston will earn significantly more than their counterpart in a smaller market like Kansas City or Cleveland. However, this is often balanced by a much higher cost of living.

According to Salary.com, a real estate analyst in New York, NY, can expect to earn about 20% more than the national average, while one in Dallas, TX, might earn closer to the average.

###

Company Type

For those on the salaried path, who you work for matters immensely.

- Large Private Equity Firms & REITs: These firms (e.g., Blackstone, Starwood Capital) manage billions in assets and engage in highly complex, large-scale deals. They pay top-tier salaries and offer lucrative bonus structures to attract the best talent.

- Real Estate Developers: Compensation can be high but may be more closely tied to the success and profitability of specific development projects.

- Boutique & Family-Owned Firms: These smaller firms may offer lower base salaries but can provide a better work-life balance and sometimes offer a direct stake (equity) in deals, which can be very valuable long-term.

- Corporate Real Estate Departments: Large corporations (like Google or Walmart) have internal real estate teams to manage their global property portfolios. These offer stable, competitive salaries and corporate benefits.

###

Area of Specialization

The type of property you invest in affects both the risk and the potential reward. Specializing in high-value or complex asset classes typically leads to higher compensation.

- Residential: This includes single-family homes, condos, and small multi-family properties (2-4 units). It's the most accessible entry point for entrepreneurs but generally offers lower per-deal profits than commercial.

- Commercial: This is a broad category including office buildings, retail centers, and large multi-family apartment complexes. Deals are larger and more complex, and professionals in this space (especially in salaried roles) tend to earn more.

- Industrial: Investing in warehouses, distribution centers, and manufacturing facilities has become extremely lucrative with the growth of e-commerce. It is a highly sought-after and well-compensated specialization.

- Land Development: This involves acquiring raw land and taking it through the entitlement and construction process. It carries high risk but also the potential for massive returns.

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) does not track "Real Estate Investors" as a distinct profession. However, we can look at related fields for a strong proxy.

The BLS projects that employment for Property, Real Estate, and Community Association Managers will grow by 3 percent from 2022 to 2032, which is about as fast as the average for all occupations. Similarly, the outlook for Real Estate Brokers and Sales Agents is projected to grow by 3 percent.

While these growth rates seem modest, the underlying demand is constant. People and businesses will always need places to live and work. The real estate market is a fundamental pillar of the economy, and savvy investors who can identify opportunities, manage risk, and adapt to market shifts will continue to find success and a demand for their skills.

Conclusion

Choosing a career in real estate investing offers a path filled with opportunity, whether you pursue it as an entrepreneur or as a salaried professional within a firm. Your income is not a fixed number but a dynamic figure influenced by your education, experience, location, and the strategic choices you make.

Key Takeaways:

- Dual Paths: You can be a self-employed investor earning profits or a salaried professional earning a base salary plus significant bonuses.

- Six-Figure Potential is Real: Average salaries for experienced professionals consistently cross the $100,000 mark, with top earners making well over $250,000.

- Experience is King: Your value and income grow directly with your track record of successful deals and portfolio management.

- Specialization Pays: Focusing on high-value sectors like commercial or industrial real estate can significantly increase your earning potential.

For those with a passion for the market, strong analytical skills, and a strategic mindset, a career in real estate investing can be both intellectually challenging and exceptionally rewarding.