Introduction

Have you ever found yourself typing "salary tax calculator Washington" into a search bar, trying to demystify your paycheck or understand your true earning potential in the Evergreen State? That search is the first step on a journey toward financial clarity—a journey that, for a select few, becomes a rewarding and lucrative career. While "Salary Tax Calculator" isn't an official job title, the professionals who perform these critical functions—Tax Accountants, Payroll Specialists, and Certified Public Accountants (CPAs)—are the human engines behind the numbers. They are the experts who ensure every dollar is accounted for, every tax law is followed, and every employee is paid accurately.

This is a career path built on precision, integrity, and expertise, offering remarkable stability and significant financial rewards. In a state with a unique tax landscape like Washington, which boasts no personal income tax but has a complex web of other business, sales, and local taxes, these professionals are more valuable than ever. The national average salary for an experienced accountant hovers around $80,000 to $90,000, with senior professionals and specialists in high-demand areas like Seattle easily commanding well over $120,000 to $150,000+ annually. For those who achieve elite status as a Tax Partner or Director, compensation can soar even higher.

I once sat down with a friend, a brilliant software engineer who had just moved to Seattle for a job at a major tech firm. He was staring at his first pay stub with a look of utter confusion. "Where's the state income tax?" he asked, "And what is this WA PFML deduction? My take-home pay is nothing like the online calculator said!" In that moment, the immense value of a financial professional became crystal clear. They don't just run the numbers; they provide the context, the strategy, and the peace of mind that no automated tool can fully replicate.

This comprehensive guide is designed to take you beyond the search query and into the heart of this dynamic profession. We will explore everything you need to know about building a career as a tax or payroll expert in Washington and beyond.

### Table of Contents

- [What Does a Tax and Payroll Professional Do?](#what-does-a-tax-and-payroll-professional-do)

- [Average Tax and Payroll Professional Salary: A Deep Dive](#average-tax-and-payroll-professional-salary-a-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-your-salary)

- [Job Outlook and Career Growth for Tax and Payroll Experts](#job-outlook-and-career-growth-for-tax-and-payroll-experts)

- [How to Get Started in This Career: A Step-by-Step Guide](#how-to-get-started-in-this-career-a-step-by-step-guide)

- [Conclusion: Is This the Right Career for You?](#conclusion-is-this-the-right-career-for-you)

What Does a Tax and Payroll Professional Do?

At its core, a career in tax or payroll is about managing the financial lifeblood of individuals and organizations. These professionals ensure that money flows correctly and compliantly between employers, employees, and government agencies. While their domains sometimes overlap, their primary functions are distinct yet complementary. They are the guardians of financial accuracy, translating complex regulations into tangible, real-world numbers.

The Tax Professional (Tax Accountant, Enrolled Agent, CPA)

A tax professional is a strategist and a compliance expert. Their primary role is to interpret and apply the labyrinthine codes of federal, state, and local tax laws to minimize tax liability while ensuring 100% compliance. They work with individuals (from salaried employees to high-net-worth investors) and businesses (from small local shops to multinational corporations). Their work is cyclical, with an intense peak during "tax season" (typically January to April), but tax planning, auditing, and consulting are year-round activities.

Core Responsibilities Include:

- Tax Preparation: Preparing and filing accurate tax returns for individuals, corporations, partnerships, and non-profits.

- Tax Planning: Strategizing with clients throughout the year to make financial decisions that optimize their tax outcomes. This could involve advising on retirement contributions, investment strategies, or business expense deductions.

- Compliance and Research: Staying relentlessly up-to-date on ever-changing tax legislation. A single new law can have massive implications for clients.

- Audit Representation: Representing clients before the IRS or state tax authorities (like the Washington State Department of Revenue) during an audit.

- Entity Structuring: Advising businesses on the most tax-advantageous way to structure their company (e.g., S-Corp vs. LLC).

The Payroll Professional (Payroll Clerk, Specialist, Manager)

A payroll professional is the master of compensation. They are responsible for the critical, time-sensitive process of paying an organization's employees. This goes far beyond simply cutting a check. It involves a meticulous series of calculations for every single employee on every single pay cycle. Their work ensures that the company's greatest asset—its people—are compensated accurately and on time, maintaining morale and trust.

Core Responsibilities Include:

- Payroll Processing: Collecting employee time data, calculating gross pay, and processing payroll runs through software like ADP, Workday, or Paychex.

- Calculating Withholdings and Deductions: This is the "salary tax calculator" function in action. They calculate and withhold federal taxes (income, Social Security, Medicare), state-specific items (like Washington's Paid Family and Medical Leave - WA PFML), and employee-elected deductions (health insurance premiums, 401(k) contributions, etc.).

- Compliance: Ensuring compliance with federal wage and hour laws (like the Fair Labor Standards Act) and state-specific labor laws.

- Reporting and Remittance: Preparing payroll reports for management and ensuring that all withheld taxes are remitted to the correct government agencies on time.

- Employee Support: Answering employee questions about paychecks, deductions, and tax forms like the W-4.

### A Day in the Life: Two Sides of the Same Coin

7:00 AM (Tax Accountant - Peak Season): The day starts early with a strong coffee and a review of overnight emails from clients. A client has a question about the tax implications of selling cryptocurrency. Flag for research later.

9:00 AM (Payroll Specialist - Payday): The final payroll preview report is ready. It's time for a meticulous, line-by-line audit. Check for new hires, terminations, and any last-minute changes to salary or deductions. One employee's 401(k) loan repayment was entered incorrectly—catch it and fix it.

11:00 AM (Tax Accountant): Deep focus mode. Working on a complex S-Corporation tax return for a construction company. This involves reconciling books, calculating depreciation on heavy equipment, and ensuring compliance with Washington's Business & Occupation (B&O) tax—a nuance out-of-state accountants often miss.

1:00 PM (Payroll Specialist): The payroll audit is complete and approved. Hit the "Submit" button. It's a moment of both relief and immense responsibility. Now, generate the direct deposit file to send to the bank and the 401(k) contribution file for the plan administrator.

3:00 PM (Tax Accountant): Meeting with a high-net-worth individual to discuss Q1 estimated tax payments. They recently exercised a large number of stock options, and the goal is to create a payment strategy that avoids an underpayment penalty at year-end.

4:30 PM (Payroll Specialist): Answering employee inquiries. One new hire doesn't understand their WA PFML deduction. Pull up the official state guidelines and draft a clear, simple email explaining how the premium is calculated and what the benefit provides.

6:00 PM (Tax Accountant): The office is still buzzing. Time to circle back to that cryptocurrency question from the morning. Researching the latest IRS guidance on digital assets to provide an accurate, defensible answer for the client tomorrow. It's a long day, but solving these complex puzzles is what makes the job challenging and rewarding.

Average Tax and Payroll Professional Salary: A Deep Dive

Understanding compensation is central to evaluating any career path. For tax and payroll professionals, salary is a reflection of expertise, responsibility, and market demand. While a simple online calculator can give you a snapshot, a true understanding requires a deeper dive into national averages, experience-based ranges, and the various components that make up a total compensation package.

It's important to note that salary data is compiled under broad categories by government sources. The U.S. Bureau of Labor Statistics (BLS) is the gold standard for occupational data. For our analysis, we will look primarily at the "Accountants and Auditors" category for tax professionals and the "Payroll and Timekeeping Clerks" category for payroll professionals. We will supplement this with more specific, real-time data from reputable aggregators like Salary.com, Glassdoor, and Payscale, which often provide data for titles like "Tax Accountant" and "Payroll Specialist."

### National Salary Benchmarks

According to the U.S. Bureau of Labor Statistics' Occupational Outlook Handbook (updated May 2023), the national landscape looks like this:

- Accountants and Auditors: The median annual wage was $78,000 in May 2022. The lowest 10 percent earned less than $48,560, and the highest 10 percent earned more than $132,690.

- Payroll and Timekeeping Clerks: The median annual wage was $49,640 in May 2022. The lowest 10 percent earned less than $35,270, and the highest 10 percent earned more than $73,260.

These BLS figures provide a solid baseline, but they blend all experience levels and specializations. Payroll "Clerk" is a more junior title than "Payroll Specialist" or "Payroll Manager," which explains the lower median wage. For a more granular view, let's turn to salary aggregators that differentiate by job title and experience.

### Salary Progression by Experience Level

Your earning potential grows significantly as you accumulate experience, develop specialized skills, and earn professional certifications. Here’s a typical salary trajectory for both tax and payroll careers, based on a synthesis of data from Payscale, Salary.com, and Glassdoor (as of late 2023/early 2024).

| Career Stage | Typical Experience | Tax Accountant Salary Range (National) | Payroll Specialist Salary Range (National) | Key Responsibilities & Milestones |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | 0-2 Years | $55,000 - $72,000 | $45,000 - $58,000 | Learning core processes, data entry, preparing simple tax returns, assisting with payroll runs, basic reconciliation. Focus on accuracy and learning. |

| Mid-Career | 3-8 Years | $70,000 - $95,000 | $57,000 - $75,000 | Handling complex returns, managing client relationships, implementing payroll systems, ensuring multi-state compliance. Often pursuing or has obtained CPA or CPP certification. |

| Senior | 8-15 Years | $90,000 - $125,000 | $72,000 - $90,000 | Managing a team of accountants/specialists, strategic tax planning, reviewing complex work, representing clients in audits, leading payroll operations. |

| Manager/Director | 15+ Years | $120,000 - $180,000+ | $85,000 - $130,000+ | Department leadership, setting firm-wide tax strategy, business development, managing vendor relationships, ultimate responsibility for compliance. Partners in public accounting firms can earn significantly more. |

*Note:* *These are national averages. As we'll explore in the next section, salaries in high cost-of-living areas, particularly major tech hubs like Seattle, can be 15-30% higher than these ranges.*

### Beyond the Base Salary: Understanding Total Compensation

Your base salary is only one piece of the puzzle. Total compensation for tax and payroll professionals often includes a variety of valuable components that significantly increase overall earnings.

- Bonuses: This is a major factor, especially in public accounting. Tax professionals often receive substantial bonuses after the successful completion of tax season, which can range from 5% to 20% (or more) of their base salary, depending on firm profitability and individual performance. Payroll managers may also receive performance-based bonuses tied to departmental goals like accuracy rates and successful system upgrades.

- Profit Sharing: Many accounting firms, particularly those structured as partnerships, offer profit sharing plans. This allows employees to receive a portion of the firm's profits, directly linking their compensation to the company's success.

- Overtime Pay: While senior accountants are often salaried and exempt from overtime, junior staff accountants in public accounting may be eligible for paid overtime. Given the long hours required during busy season, this can be a significant addition to their income.

- Benefits Package: A strong benefits package is a crucial part of compensation. This includes:

- Health Insurance: Medical, dental, and vision insurance.

- Retirement Savings: 401(k) or 403(b) plans, often with a generous company match (e.g., matching 50% of your contributions up to 6% of your salary).

- Paid Time Off (PTO): Vacation days, sick leave, and holidays.

- Professional Development: Many firms will pay for CPA review courses, exam fees, and the continuing professional education (CPE) required to maintain certifications. This is a highly valuable, non-taxable benefit that directly invests in your career growth.

- Stock Options/Equity: In corporate roles, especially at publicly traded companies or tech startups, compensation may include Restricted Stock Units (RSUs) or stock options, which can be extremely lucrative. A senior tax or payroll manager at a company like Amazon or Microsoft in Washington would see a large portion of their compensation come from equity.

When evaluating a job offer, it's essential to look beyond the base salary and calculate the value of the entire compensation package. A job with a slightly lower base salary but an incredible 401(k) match and a history of large annual bonuses might be the more financially advantageous choice in the long run.

Key Factors That Influence Your Salary

While national averages provide a useful benchmark, your individual earning potential is determined by a combination of personal and market-driven factors. Mastering these elements is the key to maximizing your income throughout your career. This is where you move from being a passive job-taker to an active career strategist. For professionals in Washington state, understanding these nuances is particularly important due to the state's unique economic and regulatory environment.

###

Level of Education and Professional Certifications

Your educational foundation and professional credentials are the most powerful levers you can pull to increase your salary, especially early in your career. They act as a signal to employers, signifying a verified standard of knowledge and commitment to the profession.

Educational Foundation:

- Bachelor's Degree: A bachelor's degree in Accounting is the universal standard and a non-negotiable requirement for virtually all professional tax and accounting roles. A degree in Finance, Business Administration, or a related field can also be a starting point, but an Accounting degree is preferred as it provides the most direct path to CPA eligibility.

- Master's Degree: A Master of Science in Taxation (MST), a Master of Accountancy (M.Acc), or a Master of Business Administration (MBA) with an accounting concentration can provide a significant salary advantage. Employers view a master's degree as a sign of specialized expertise. According to a 2021 report by the Association of International Certified Professional Accountants (AICPA), professionals with a master's degree can earn a premium of $10,000 to $20,000 annually compared to those with only a bachelor's. It also helps meet the 150-credit-hour requirement for the CPA license in most states.

The "Alphabet Soup": Game-Changing Certifications

Certifications are the great accelerators of an accounting or payroll career. They are difficult to earn, which is precisely why they are so valuable.

- CPA (Certified Public Accountant): This is the undisputed gold standard in the accounting world. Earning a CPA license requires passing a rigorous four-part exam, meeting strict educational requirements (the 150-hour rule), and satisfying a professional experience requirement. The payoff is immense. Robert Half's 2024 Salary Guide notes that CPAs can earn 5% to 15% more than their non-certified peers. In senior and management roles, this premium is often much higher, and many top-level positions (like Controller, CFO, or Partner) are exclusively available to CPAs. It grants you legal authority to sign audit reports and is a mark of elite expertise recognized globally.

- EA (Enrolled Agent): An EA is a tax professional licensed directly by the IRS. They have demonstrated special competence in tax matters and have unlimited rights to represent taxpayers before the IRS. While a CPA's expertise is broad, an EA's is deep and hyper-focused on taxation. For a professional who wants to specialize exclusively in tax preparation and representation without pursuing the broader accounting topics on the CPA exam, the EA is a fantastic and highly respected credential that boosts earning potential.

- CPP (Certified Payroll Professional): This is the premier certification for payroll professionals, administered by the American Payroll Association (APA). It validates expertise in payroll administration, from core calculations and compliance to payroll systems and management. Payscale.com data shows that a Payroll Manager with a CPP can earn nearly $10,000 more per year on average than one without. For anyone serious about a long-term career in payroll, the CPP is an essential milestone.

###

Years of Experience

Experience is the currency of career progression. In a field governed by complex, ever-changing rules, there is no substitute for the wisdom gained by navigating multiple tax seasons, implementing payroll for a growing company, or handling a difficult IRS inquiry.

- Entry-Level (0-2 years): Salary: $55k - $72k. At this stage, you are building your fundamental skills. Your value is in your ability to learn quickly, your attention to detail on routine tasks, and your positive attitude. Focus on absorbing everything you can from senior mentors.

- Mid-Career (3-8 years): Salary: $70k - $95k. You are now a reliable and productive member of the team. You can handle complex client accounts or payroll scenarios with minimal supervision. Your salary growth is driven by taking on more responsibility, perhaps specializing in a specific industry or tax area, and beginning to mentor junior staff. Obtaining your CPA or CPP during this phase is a major catalyst for jumping to the next salary band.

- Senior/Manager (8+ years): Salary: $90k - $180k+. You have transitioned from a "doer" to a "manager and strategist." Your value lies in your ability to review the work of others, manage client relationships at a high level, provide strategic tax or payroll advice, and contribute to the growth of the business. Your salary is now highly dependent on the scope of your management responsibilities and the value you bring to the firm or company. A Senior Tax Manager at a Big Four firm in Seattle is a high-six-figure role.

###

Geographic Location: The Washington State Advantage

Location is one of the most significant drivers of salary. A Tax Accountant in Seattle, Washington will earn substantially more than one in a low-cost-of-living area like Jackson, Mississippi. This is driven by the cost of living, demand for talent, and the concentration of large, high-paying employers.

Washington state presents a particularly interesting case study. The absence of a state income tax is a major draw for high-earning professionals, but it creates complexity on the business side that increases demand for expert tax and payroll advice. Businesses must navigate:

- Business & Occupation (B&O) Tax: A gross receipts tax that is unique and complex.

- State and Local Sales Taxes: Varying rates and rules across different cities and counties.

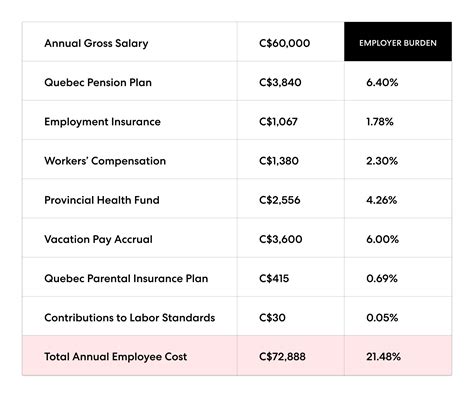

- WA Paid Family and Medical Leave (PFML): A state-mandated program funded by premiums paid by both employers and employees, which must be accurately calculated and withheld by payroll departments.

- Seattle's "JumpStart" Payroll Expense Tax: A local tax on large employers that adds another layer of compliance.

This complex environment means that companies in Washington are willing to pay a premium for professionals who understand the local landscape.

Salary Comparison: Major Washington Cities (Tax Accountant, 5 years experience)

| City | Average Salary | Cost of Living Index (vs. National Avg of 100) | Notes |

| :--- | :--- | :--- | :--- |

| Seattle | $98,500 | 168.3 | Epicenter of tech (Amazon, Microsoft HQs nearby), biotech, and global trade. Highest salaries and highest demand. |

| Bellevue | $97,800 | 188.7 | Often considered part of the Seattle metro, home to many tech and finance HQs. Very high cost of living drives high salaries. |

| Tacoma | $88,200 | 119.5 | A more affordable alternative to Seattle but still a major economic hub with a busy port and growing industries. |

| Spokane | $82,400 | 106.6 | The largest city in Eastern Washington, with a growing healthcare and logistics sector. Salaries are lower than the Puget Sound area but so is the cost of living. |

| Vancouver | $89,100 | 114.3 | Unique location in the Portland, OR metro area. Professionals may live in WA (no income tax) and work in OR (has income tax), creating complex tax situations that require expert help. |

*Salary data is an estimate derived from Salary.com's location-based calculator for a "Tax Accountant II" as of early 2024. Cost of living data is from Payscale.*

###

Company Type & Size

Where you work matters just as much as what you do. The culture, work-life balance, and compensation structure can vary dramatically between different types of organizations.

- Public Accounting (e.g., Deloitte, PwC, Moss Adams): This is the traditional boot camp for accountants. The "Big Four" (Deloitte, PwC, EY, KPMG) and large national/regional firms offer the highest starting salaries,