Understanding the 2025 Washington State Minimum Salary for Exempt Employees

For employers and salaried professionals in Washington, understanding employee classification is a critical component of career management and legal compliance. One of the most important figures in this conversation is the state's minimum salary threshold for exempt employees. This figure, which is set to increase again in 2025, dictates the minimum annual pay an employee must receive to be considered "exempt" from overtime rules.

Navigating this topic is essential. For employees, it determines eligibility for overtime pay. For employers, misclassification can lead to significant legal and financial penalties. This article provides a data-driven guide to the 2025 Washington State minimum salary for exempt employees, how it's calculated, and what it means for your career or business.

What Does "Exempt Employee" Mean in Washington State?

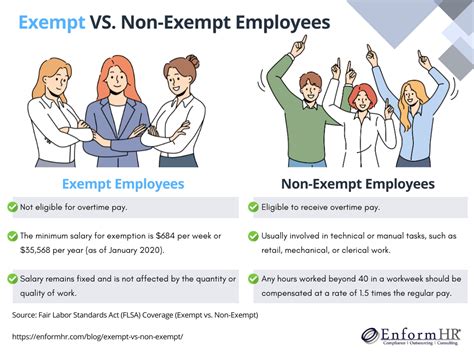

Before diving into the numbers, it's crucial to understand the terminology. In Washington, as under federal law, employees are classified as either "non-exempt" or "exempt."

- Non-Exempt Employees: These employees are protected by the Minimum Wage Act. They are entitled to receive at least the state minimum wage for all hours worked and must be paid overtime (1.5 times their regular rate of pay) for any hours worked over 40 in a single workweek.

- Exempt Employees: These employees are "exempt" from overtime protections because they meet specific criteria related to their job duties and are paid a fixed salary that doesn't change based on the hours they work.

To be legally classified as exempt in Washington, an employee must meet both of the following conditions:

1. The Salary Basis Test: The employee must be paid a predetermined, fixed salary that is at or above the state's minimum salary threshold.

2. The Duties Test: The employee's primary job responsibilities must fall under the specific definitions of an Executive, Administrative, Professional (EAP), Computer Professional, or Outside Salesperson role.

Simply paying an employee a salary does not make them exempt. Their job duties must genuinely align with the state's definitions.

The 2025 Washington State Minimum Salary for Exempt Employees

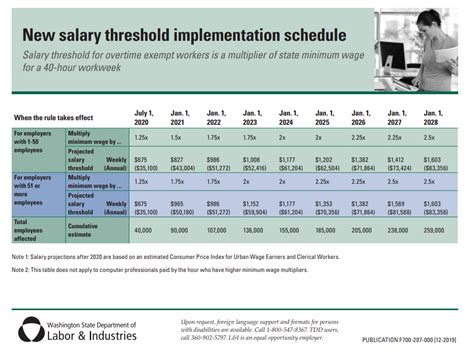

Washington State's exempt salary threshold is calculated as a multiplier of the state's minimum wage. This multiplier has been gradually increasing and will continue to do so until it reaches 2.5 times the minimum wage in 2028.

For 2025, the multiplier is set at 2 times the state minimum wage for employers of all sizes.

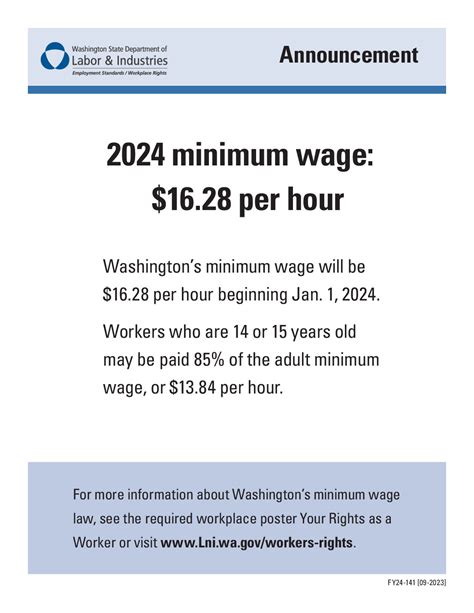

The final, official 2025 threshold depends on the state's 2025 minimum wage, which the Department of Labor & Industries (L&I) will announce on September 30, 2024, based on the Consumer Price Index.

However, we can create a reliable projection. Using Washington's 2024 minimum wage of $16.28 per hour as a baseline, we can estimate the 2025 threshold.

Projected 2025 Calculation:

- Step 1: Determine the minimum weekly salary.

- (State Minimum Wage x 2) x 40 hours = Weekly Salary Threshold

- ($16.28 x 2) x 40 = $1,302.40 per week

- Step 2: Determine the minimum annual salary.

- Weekly Salary Threshold x 52 weeks = Annual Salary Threshold

- $1,302.40 x 52 = $67,724.80 per year

Disclaimer: This figure is an estimate based on the 2024 minimum wage. The official 2025 threshold announced by the Washington State Department of Labor & Industries will almost certainly be higher due to inflation. Employers and employees should refer to the L&I website for the final, official figure in late 2024.

Key Factors That Influence Exemption Status

While the salary threshold is a hard number, several other factors determine if a position can be classified as exempt.

### The Duties Test

This is the most critical factor after salary. An employee earning over the threshold is still eligible for overtime unless their primary job responsibilities fit the state’s definitions.

- Executive: Must primarily manage the enterprise or a department, direct the work of at least two other full-time employees, and have the authority to hire or fire.

- Administrative: Primary duty is non-manual work directly related to the management or general business operations of the employer or its customers. This role must include the exercise of discretion and independent judgment on significant matters.

- Professional: Primary duty involves work requiring advanced knowledge in a field of science or learning (e.g., law, medicine, accounting) or work that is original and creative in a recognized artistic field (e.g., music, writing).

### Geographic Location

While the salary threshold is a statewide mandate, market salaries for specific jobs vary significantly across Washington. According to data from Salary.com (2024), an Operations Manager in Seattle has a median salary of approximately $120,000, well above the exempt threshold. However, a similar role in a more rural area like Yakima may have a median salary closer to $95,000. For roles with salaries hovering near the state threshold (e.g., $65,000 - $75,000), the new 2025 rule will have a much greater impact, potentially forcing employers in lower-cost-of-living areas to either increase salaries or reclassify positions.

### Company Type and Size

As of 2025, the salary multiplier (2.0x) is the same for all companies regardless of size. However, the practical impact can differ.

- Large Corporations: Tech giants and large corporations in the Puget Sound area often have salary bands that already far exceed the state minimum for their professional roles. For them, this change is less likely to affect a large number of employees.

- Small Businesses and Non-Profits: These organizations often operate on tighter budgets. According to Payscale (2024), the average salary for a Non-Profit Program Manager is around $62,000. The 2025 threshold will require these organizations to either raise salaries above the new minimum (projected at ~$68,000+) or reclassify these managers as non-exempt and budget for potential overtime.

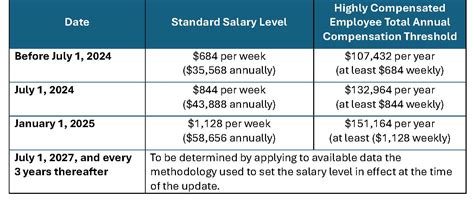

### Federal vs. State Law

Employers must comply with both federal and state wage laws and follow the rule that is most beneficial to the employee. The federal salary threshold for exempt employees is currently $35,568 per year (though a new rule to increase it is under review). As Washington's threshold is significantly higher, employers in the state must adhere to the Washington rule.

Implications for Your Career

This is not just a compliance issue for businesses; it is a significant career and financial topic for professionals.

- For Job Seekers: If you are applying for a salaried "manager" or "professional" role in Washington with a salary offer below the 2025 threshold (projected near $68,000), you should be classified as non-exempt and are legally entitled to overtime pay. This is a crucial point to clarify during salary negotiations.

- For Current Employees: If your salary is currently between the old threshold and the new 2025 threshold, your employer has a decision to make. They may give you a raise to keep you exempt, or they may reclassify your position to non-exempt. If reclassified, you will need to start tracking your hours accurately to ensure you are paid for any overtime you work.

The U.S. Bureau of Labor Statistics (BLS) does not track growth for "exempt employees" as a category, but it does project strong growth for many of the roles typically classified as exempt, such as Management Occupations (projected 8% growth from 2022-2032) and Computer and Mathematical Occupations (projected 15% growth). The rising salary threshold ensures that compensation for these roles in Washington keeps pace with the cost of living.

Conclusion

The "washington state minimum salary exempt 2025" is not a job title but a critical legal and financial benchmark that shapes the professional landscape.

Key Takeaways:

- The 2025 Threshold: Will be 2 times the 2025 Washington State minimum wage, projected to be around $68,000 per year but likely higher.

- It's More Than Salary: Exemption requires passing both the salary basis test and the duties test (Executive, Administrative, or Professional).

- Action is Required: Employers must audit their payrolls to ensure compliance, and employees should be aware of their rights regarding classification and overtime.

- A Positive Trend: These scheduled increases are designed to protect workers and ensure that salaried professionals are compensated fairly for their expertise and time.

Staying informed about these regulations is a proactive step in managing your career in Washington State, ensuring you are valued and paid in accordance with the law. For the most accurate and final numbers, always consult the official Washington State Department of Labor & Industries website in late 2024.