Are you being paid fairly for your work? For millions of salaried professionals, the answer isn't just about the number on their paycheck—it's about whether they are legally entitled to overtime pay. This is determined by their classification as "exempt" or "non-exempt" from the Fair Labor Standards Act (FLSA), a status that hinges on both job duties and a minimum salary level known as the exempt salary threshold.

Navigating these regulations is crucial for both employees seeking fair compensation and employers ensuring legal compliance. While a federal standard exists, many states have implemented their own, more stringent requirements. This guide will break down the federal and state-level exempt salary thresholds for 2024, explain the key factors that determine them, and clarify what it all means for your career and finances.

What Does It Mean to Be an "Exempt" Employee?

Before diving into the numbers, it's essential to understand the terminology. The FLSA is a federal law that establishes minimum wage, overtime pay, recordkeeping, and youth employment standards. Employees are generally categorized in one of two ways:

- Non-Exempt: These employees are covered by the FLSA and are entitled to overtime pay (at a rate of at least 1.5 times their regular rate of pay) for any hours worked over 40 in a workweek.

- Exempt: These employees are not entitled to overtime pay. To qualify for exempt status, an employee must meet three specific tests:

1. Salary Basis Test: The employee must be paid a predetermined, fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed.

2. Salary Level Test: The employee's salary must meet a minimum specified amount. This is the "salary threshold" we are discussing.

3. Duties Test: The employee's primary job duties must involve executive, administrative, or professional (EAP) tasks as defined by the U.S. Department of Labor (DOL).

Crucially, an employee must meet *all three* tests to be classified as exempt. A high salary alone does not make an employee exempt if their job duties don't qualify.

Federal and State Exempt Salary Thresholds for 2024

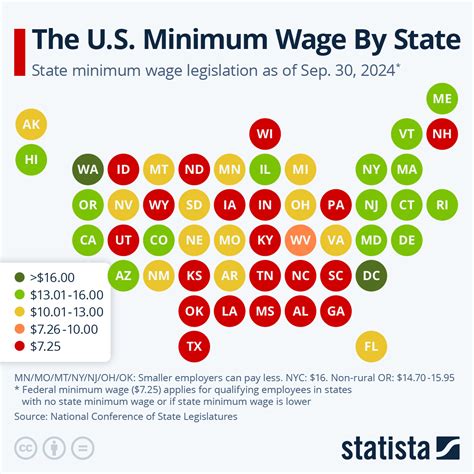

The rule of thumb is that employers must comply with whichever law—federal, state, or local—provides the greatest benefit to the employee. If a state's salary threshold is higher than the federal one, employers in that state must meet the higher state standard.

Federal Salary Threshold:

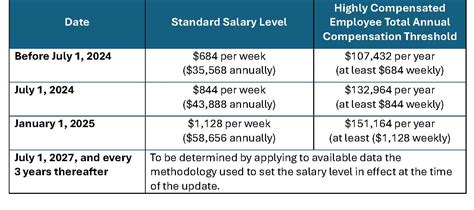

As of 2024, the federal salary threshold for the EAP exemption is $684 per week, which translates to $35,568 per year.

- Source: [U.S. Department of Labor (DOL)](https://www.dol.gov/agencies/whd/fact-sheets/17a-overtime)

Important Note: In late 2023, the DOL proposed a new rule to significantly increase this threshold to $1,059 per week ($55,068 per year). This rule is not yet final, but it signals a potential major shift in the near future.

States with Higher Salary Thresholds in 2024:

Several states have recognized that the federal threshold is insufficient for their economic conditions and have set their own higher minimums. Below are the states with exempt salary thresholds that surpass the federal level for 2024.

- Alaska: The threshold is set at two times the state's minimum wage for a 40-hour week. With a minimum wage of $11.73/hr in 2024, the exempt salary threshold is $46,920 per year ($938.40/week).

- *Source: Alaska Department of Labor and Workforce Development.*

- California: The threshold is two times the state's minimum wage. With a statewide minimum wage of $16.00/hr in 2024, the exempt salary threshold for employers of all sizes is $66,560 per year ($1,280/week).

- *Source: California Department of Industrial Relations.*

- Colorado: The 2024 threshold is $55,000 per year ($1,057.69/week), with a planned increase to $60,000 in 2025.

- *Source: Colorado Department of Labor and Employment.*

- Maine: The threshold is tied to the state's minimum wage. In 2024, with a minimum wage of $14.15/hr, the minimum salary for exempt status is $42,450 per year ($816.35/week).

- *Source: Maine Department of Labor.*

- New York: The thresholds vary by region for 2024.

- NYC, Long Island, and Westchester: $62,400 per year ($1,200/week).

- Rest of New York State: $58,500 per year ($1,125/week).

- *Source: New York State Department of Labor.*

- Washington: The threshold is a multiplier of the state minimum wage and varies by employer size. In 2024, the state minimum wage is $16.28/hr.

- All employers: The threshold is 2 times the state minimum wage, resulting in a minimum salary of $67,724.80 per year ($1,302.40/week).

- *Source: Washington State Department of Labor & Industries.*

Key Factors That Influence the Threshold and Your Status

Understanding the numbers is just the first step. Several dynamic factors can influence which threshold applies to you and whether you are correctly classified.

###

Geographic Location

As demonstrated above, geography is the single most significant factor. The cost of living and wage standards vary dramatically across the country, prompting states like California, Washington, and New York to set thresholds that are nearly double the federal minimum. Always check your specific state and, in some cases, city or county laws, as local ordinances can also play a role in wage standards.

###

Years of Experience

While experience level doesn't directly change the legal salary threshold, it heavily influences whether you meet it. An entry-level professional may be hired at a salary below their state's exempt threshold and be classified as non-exempt, making them eligible for overtime. As they gain experience and their salary increases past the threshold (assuming their duties also qualify), their employer may reclassify them as exempt. This is a common point of transition in a professional's career.

###

Area of Specialization (The Duties Test)

Your job title is less important than your actual job duties. To be exempt, your primary responsibilities must fall under one of the EAP categories.

- Executive: Primarily managing the enterprise, directing the work of at least two other employees, and having the authority to hire or fire.

- Administrative: Performing office or non-manual work directly related to the management or general business operations of the employer.

- Professional: Performing work requiring advanced knowledge in a field of science or learning (e.g., law, medicine, engineering) or work requiring invention, imagination, or talent in a recognized artistic or creative field.

If your salary is $100,000 but your primary duties are routine clerical tasks, you may still be legally non-exempt and owed overtime.

###

Proposed Federal Changes

The regulatory landscape is not static. The DOL's proposed rule to increase the federal threshold to over $55,000 would have a massive impact, making millions of additional American workers eligible for overtime pay. Professionals and employers should stay informed about these potential changes, as they could require significant adjustments to budgets and compensation structures.

Job Outlook: Why This Matters for Your Career Growth

Understanding exempt status is fundamental to professional development. As you advance in your career, you will likely cross this threshold. Knowing your rights ensures you are compensated fairly for all hours worked, especially in junior or mid-level roles.

For employers, proper classification is a cornerstone of risk management and talent retention. Misclassifying employees can lead to costly back-pay lawsuits and penalties. Furthermore, as reported by salary aggregators like Salary.com and Glassdoor, companies that are transparent and compliant with wage laws often have higher employee satisfaction and lower turnover rates.

The trend is clear: federal and state governments are increasingly focused on ensuring salary thresholds reflect modern economic realities. Professionals who understand this landscape are better equipped to negotiate salaries, understand their compensation packages, and advocate for themselves throughout their careers.

Conclusion

The "exempt salary threshold" is a critical number that defines a major right for every employee: the right to overtime pay. As you navigate your career path, keep these key takeaways in mind:

1. Three Tests Matter: Exemption depends on your salary basis, salary level, and job duties. All three must be met.

2. State Law Often Prevails: The federal threshold of $35,568 is the floor, not the ceiling. Always check your state's regulations, as they may be much higher.

3. The Landscape is Evolving: With a major federal increase proposed and states regularly updating their laws, this is a dynamic area of compliance and employee rights.

4. Knowledge is Power: Understanding your classification empowers you to ensure you're paid legally and fairly for the hard work you do.

Whether you are an employee evaluating a job offer or an employer building a compensation strategy, a firm grasp of these thresholds is not just good practice—it's essential for legal and financial success.